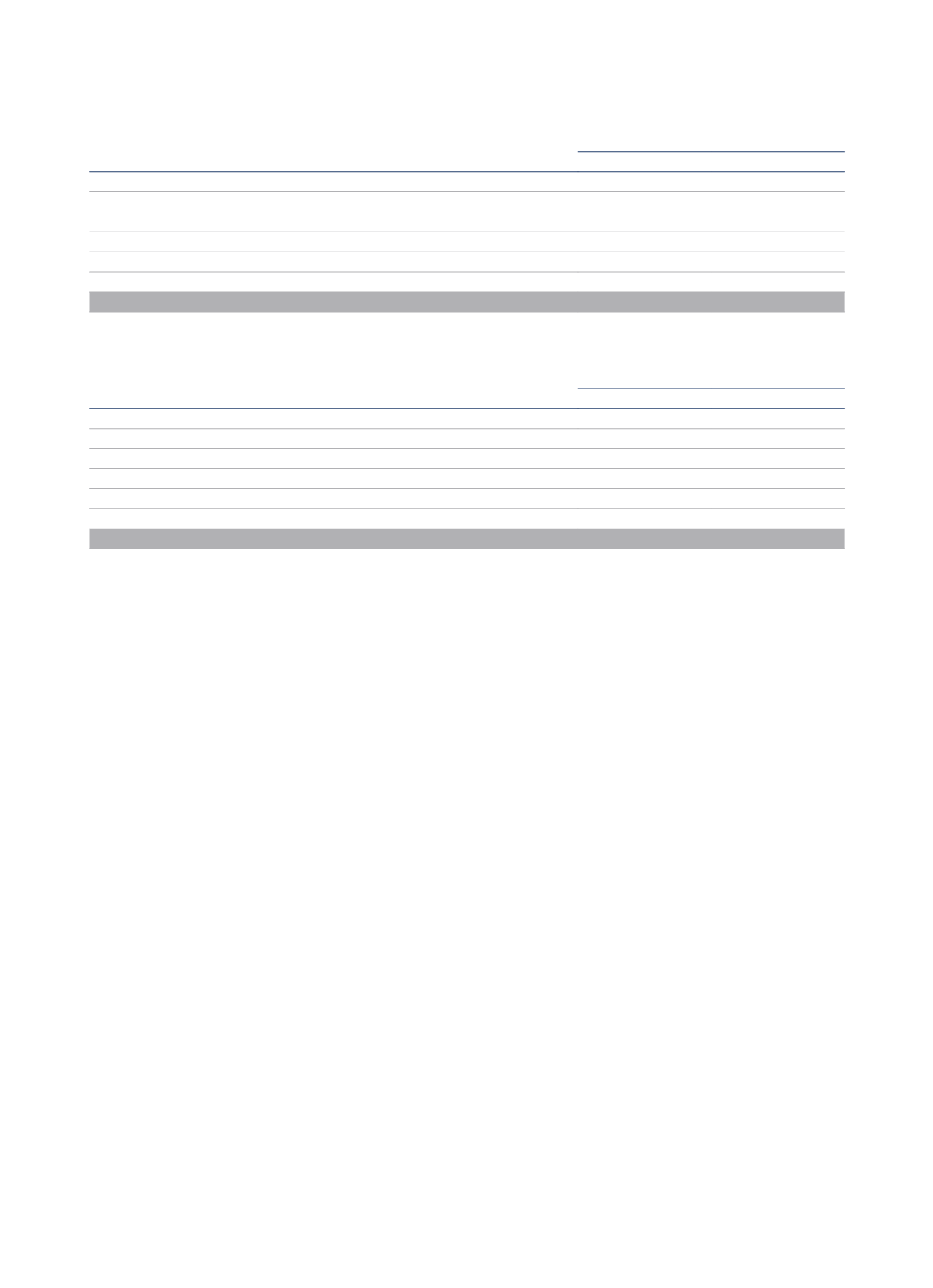

122

During the fiscal years 2015 and 2014, the remunerations perveived for audit services and other services rendered by the Deloitte SL to the

consolidades group, as well as remunerations perceived by related companies have been the follwoing:

Thousand Euros

2015

2014

Audit services

472

464

Other verification services

263

241

Total audit and related services

735

705

Tax advise services

471

246

Other services

398

666

Total other services

869

912

Total profesional services

1,604

1,617

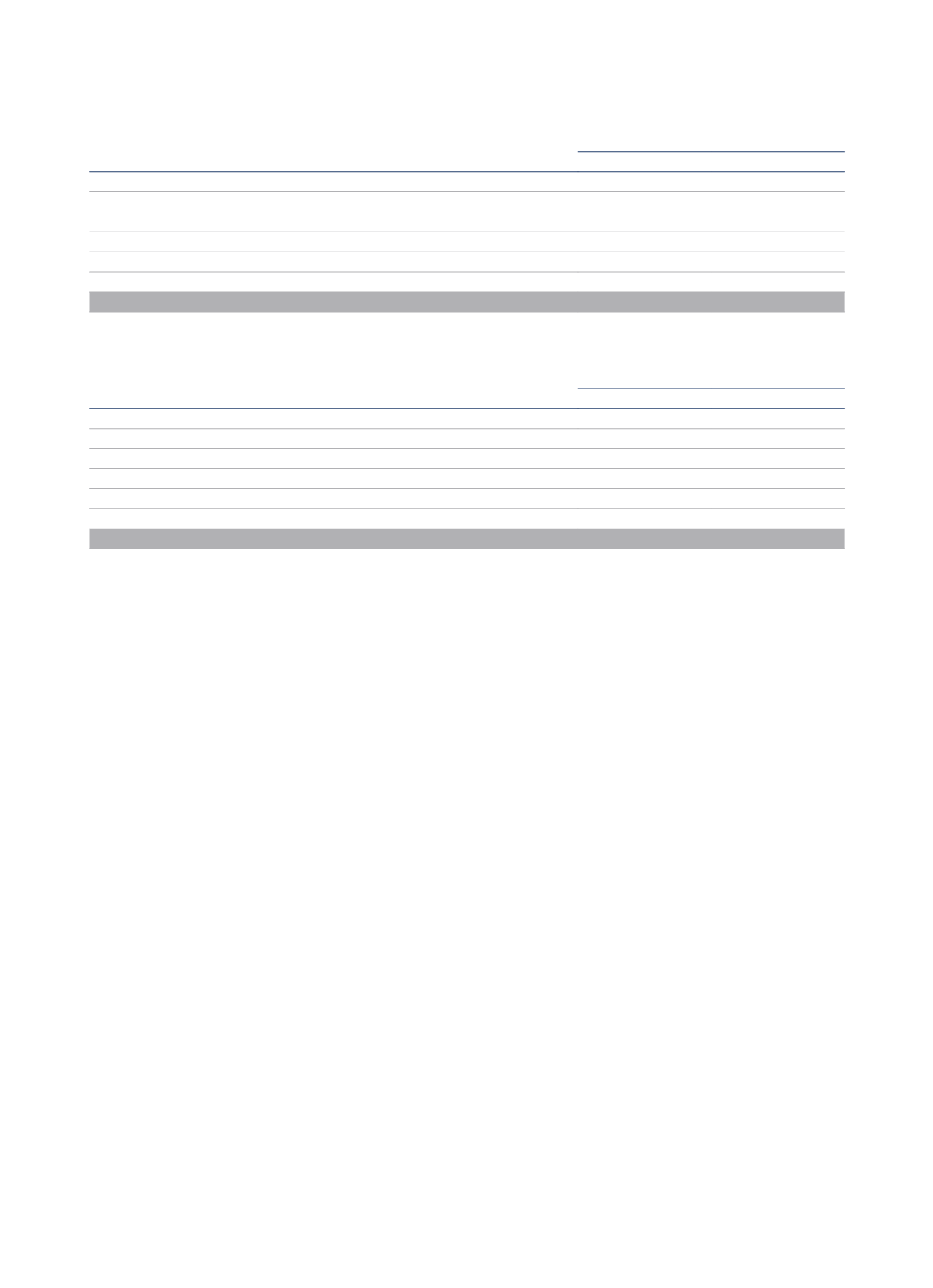

In addition, related companies of Deloittes´international alliances have invoiced the group the following services:

Miles de Euros

2015

2014

Audit services

1.208

890

Other verification services

20

35

Total audit and related services

1,228

925

Tax advise services

131

133

Other services

3

42

Total other services

134

175

Total

1,362

1,100

During fiscal year 2015, other companies to Deloitte, S.L. have rendered audit services to NH group companies. The remuneration have amounted

to 107 thousand Euros (57 thousand euros in 2014). The remuneration accrued during fiscal year 2015 for said tax advise have amounted to 221

thousand euros (232 thousand euros in 2014) and other services 372 thousand euros (399 thousand euros in 2014).

The Audit Committee has received information on matters that could endanger the auditors’ independence and after carefully reviewing such

information, has issued a Report expressing its opinion on their independence, as well as on the provision of additional non-audit services.

4) Content and results of the work of the Audit Committee

The Audit Committee held 7 meetings during 2015 at which it dealt with the following matters:

a) Analysis and evaluation, together with the external auditors, of the Financial Statements and Annual Report corresponding to the year

2014, checking that their audit opinion had been issued under conditions of absolute independence.

b) Review of information on matters that could endanger the auditors’ independence. Issue of the Report on the auditors’ independence.

c) Review of periodic public financial information for 2015 prior to its analysis and approval by the Board of Directors to ensure that it is

reliable, transparent and prepared by applying uniform accounting principles and policies.

d) Approval of the External Auditor’s fees for the 2015 audit.

e) Supervision of the Internal Audit strategic plan.

f) Monitoring of the Internal Audit Plan for 2015, examining its conclusions and implementing, as the case may be, the necessary corrective

measures.

g) Approval of the new Code of Conduct of NH Hotel Group.

h) Supervision of the tasks carried out by the Compliance Committee.

i) Monitoring of the most significant projects carried out by the Internal Audit team.

j) Supervision of the Update of the Group’s Risk Map and monitoring of the Risk Map.

k) Supervision of the risks related to the Financial Information Control System.

l) Examination of the Annual Corporate Governance Report, prior to sending it to the Board of Directors for its study and approval, with

special emphasis on the analysis of the register of situations of Directors and executives (charges in other companies, related transactions,

legal proceedings).

m) Analyse of the tax organisation of the company and determination of the tax policy.

ANNUAL REPORT OF THE AUDIT AND CONTROL COMMITTEE OF NH HOTEL GROUP, S.A.