On 5 June and 13 June 2018 deeds were registered for the conversion of convertible bonds (see Note 15) and capital increase in which a total of 41,908,455 new ordinary shares were issued, each with a nominal value of 2 euros, in the context of the conversion of bonds convertible to NH Hotel Group, S.A. shares, which were issued on 31 October 2013.

Due to this bond conversion and capital increase, the share capital of NH Hotel Group, S.A. came to 784,360,486 euros, divided into 392,180,243 ordinary shares of the same category and series, each with a face value of 2 euros and fully subscribed and paid up. All these shares carry identical voting and economic rights and are traded on the Continuous Market of the Spanish Stock Exchanges.

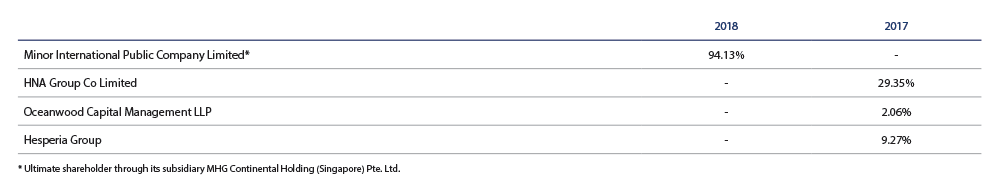

According to the latest notifications received by the Parent Company and the notices given to the National Securities Market Commission before the end of every financial year, the shareholders with shareholdings above 3% at 31 December 2018 and 2017 are as follows:

Changes in the shareholder structure and control of the Group:

Between the months of May and September 2018, various purchase and sale contracts were entered into by Minor International Public Company Limited (“MINT”), as buyer, and the HNA Group and with funds managed by Oceanwood, all of which as sellers. As a result of these transactions, MINT acquired all the sellers’ interests in NH Hotel Group, S.A. In addition to these transactions, MINT acquired several non-significant shareholdings, as a result of which on 30 September 2018 MINT owned 179,772,214 shares in NH Hotel Group, S.A., representing 45.84% of its share capital.

In parallel, on 11th June 2018, MHG International Holding (Singapore) Pte. Ltd. (a company wholly owned by MINT) made a takeover bid (“OPA”) for 100% of the shares that formed part of the share capital of NH Hotel Group, S.A., which, once approved by the Spanish regulatory body, the “CNMV” (Spain’s National Securities Market Commission), and the acceptance period was opened, was accepted, among others, by the hitherto shareholder Grupo Hesperia.

As a consequence of the takeover bid, the result of which was notified by the CNMV through a significant event on 26th October 2018, and of the purchase and sale transactions described above, (i) the funds managed by Oceanwood, the HNA Group and the Hesperia Group lost their status as significant shareholders of NH Hotel Group, S.A.; and (ii) MINT acquired, through its wholly-owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd., shares representing 94.13% of the share capital of NH Hotel Group, S.A.

The three proprietary directors representing the majority shareholder “Minor International PCL” do not hold a personal interest in the parent company. By virtue of the foregoing, at 2018 year-end, the different members of the Board of Directors owned or represented (by virtue of their status as proprietary) 94.16% of the share capital of NH Hotel Group, S.A. At 31st December 2017, this percentage was 21.38%.

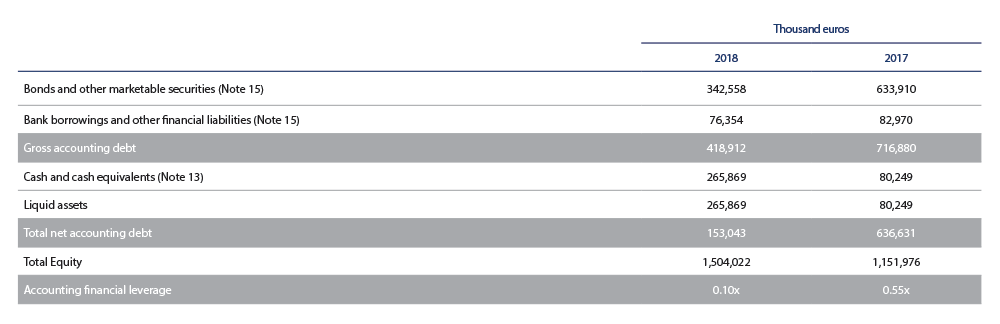

The main aims of the Group’s capital management are to ensure short-term and long-term financial stability and suitable funding for investments and indebtedness. All the above is geared towards ensuring that the Group maintains its financial strength and the strength of its financial ratios, enabling it to maintain its businesses and maximise value for its shareholders.

During recent years, the evolution of the business has allowed to reduce the ratio of accounting financial leverage from 0.55x to 0.10x. The ratios of accounting financial leverage at 31 December 2018 and 2017 are the following:

On 21 June 2018, the General Shareholders’ Meeting approved the distribution of a dividend at 10 cents gross per outstanding share, charged to 2017 profits and also to reserves. The total amount of dividends paid in 2018 amounted to 39 million euros.