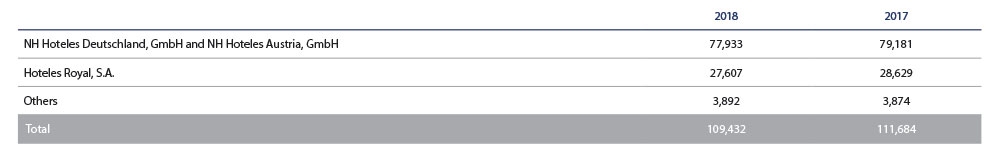

The balance included under this item corresponds to the net goodwill arising from the acquisition of certain companies, and breaks down as follows (thousand euros):

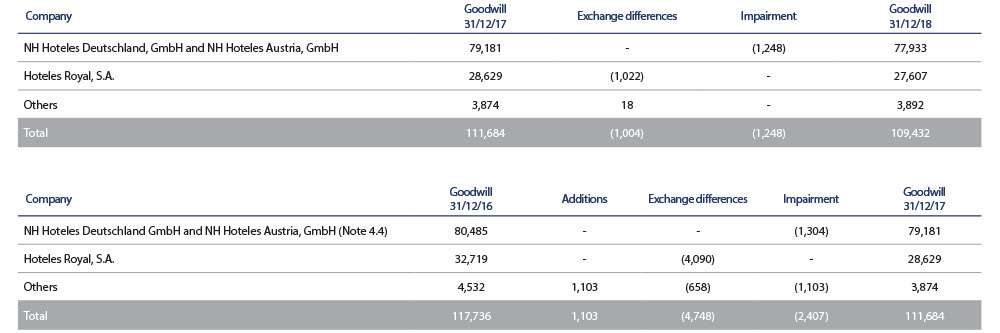

The movements in this heading of the consolidated balance sheet in 2018 and 2017 were as follows (in thousand euros):

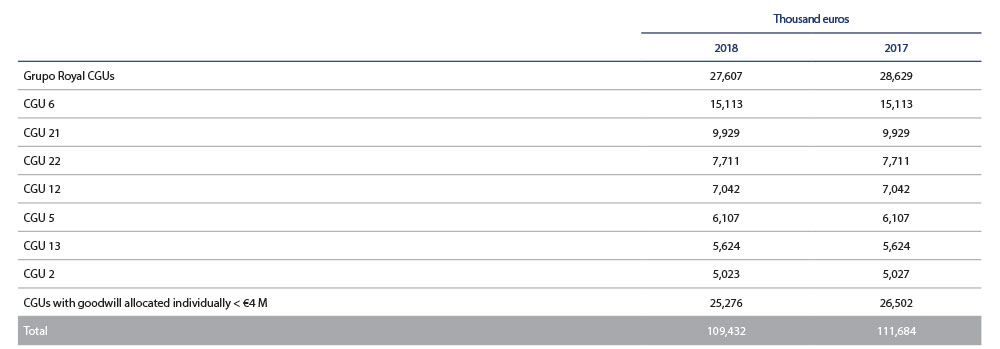

Details of the cash-generating units to which such goodwill arising on consolidation has been allocated is shown below:

At 31 December 2018, Goodwill was subject to an impairment test which showed 1,248 thousand euros of impairment.

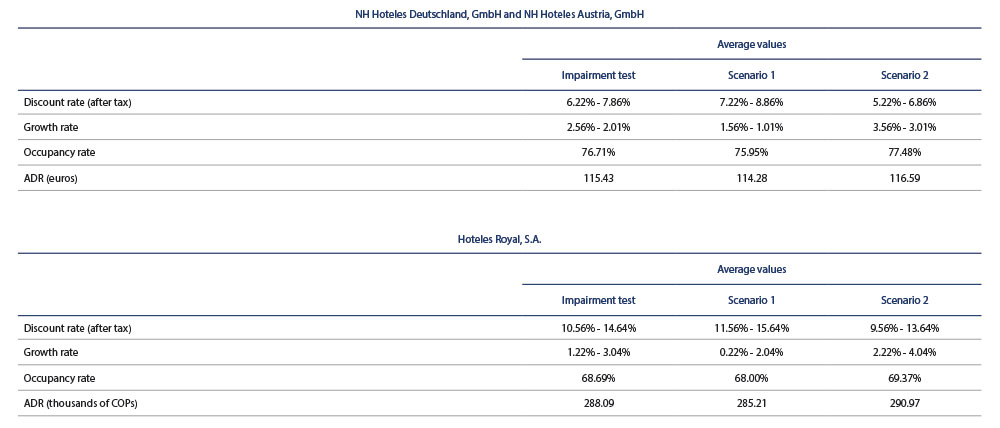

The basic assumptions used to estimate future cash flows of the CGUs mentioned above are detailed below:

- After-tax discount rate: 6.22% and 7.86% (5.55% and 6.93% respectively in 2017) for CGUs subject to the same risks (German and Austrian market); and for Grupo Royal CGUs, rates of 14.64% (Colombian and Ecuadorian markets) and 10.56% (Chilean market) (12.40% and 9.61% respectively in 2017).

- Terminal value growth rate (g): 2.01% and 2.56% (2.67% and 2.25% in 2017) for Germany and Austria and 1.22% and 3.04% (3% in 2017) for Grupo Royal CGUs.

Additionally, and considering the assumption implied in the preceding paragraph, the Group has conducted a sensitivity analysis of the result of the impairment test of goodwill to changes in the following situations:

“Average Daily Rate” (ADR): is the quotient of total room revenue for a specific period divided by the rooms sold in that specific period. This indicator is used to compare with companies in the sector the average prices per room of the hotels.

Scenario 1 is a negative one where the discount rate is raised 1 bp above the rate used in the test and a growth rate lower by 1 bp , i.e. with minimum growth, and falls in occupancy and ADR of 1% which would lead to an additional impairment to that registered in 2018 for an amount of 3 million euros with respect to the goodwill of NH Hotels Deutschland, Gmbh and NH Hoteles Austria, Gmbh, and 17.2 million euros with respect to the goodwill of Hoteles Royal, S.A.

In the case of scenario 2, an impairment had been recorded for 99 thousand euros less than that recorded at 31 December 2018 with respect to the goodwill of NH Hotels Deutschland, Gmbh and NH Hoteles Austria, Gmbh, and no impairment in regard to the goodwill of Hoteles Royal, S.A. was registered.