For listed public limited companies

Identification details of the issuer

End date of 12-month period of reference: 31/12/2018

Tax id code (CIF): A28027944

Company name: NH Hotel Group, S.A.

Registered office: Santa Engracia, 120 – 7ª planta, Madrid.

ANNUAL CORPORATE GOVERNANCE REPORT

FOR LISTED PUBLIC LIMITED COMPANIES

A – OWNERSHIP STRUCTURE

A.1 Fill in the following table regarding the share capital of the Company:

Indicate whether there are different share classes with different associated rights:

NO

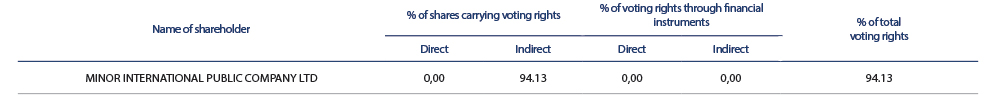

A.2 Please provide details of the company’s significant direct and indirect shareholders at year end, excluding any directors.

Breakdown of the indirect holding:

Indicate the most significant movements in the shareholding structure of the company during the year:

Most significant movements

Between May and September 2018, various purchase agreements signed by Minor International Public Company Limited (“Minor IPC”) as Purchaser were executed with the HNA Group and with funds managed by Oceanwood, all of them as Sellers. As a result of said operations, Minor IPC acquired the full shareholding of the Sellers in NH. In addition to these operations, Minor IPC acquired various non-significant shareholding packages which meant that, on 30 September 2018, Minor IPC held 179,772,214 shares in NH Hotel Group, S.A., representing 45.84% of its share capital.

At the same time, on 11 June 2018, MHG International Holding (Singapore) Pte (a company wholly owned by Minor IPC) launched a takeover bid for 100% of the shares in NH Hotel Group, S.A., which , once approved and the acceptance period opened, it was accepted, amongst others, by Grupo Hesperia.

In the wake of the takeover bid, whose result was reported by the CNMV by means of a relevant fact on 26 October 2018, and of the aforementioned purchase operations, (i) the funds managed by Oceanwood, Grupo HNA and Grupo Hesperia lost the status of significant shareholders in NH Hotel Group, S.A.; and (ii) Minor IPC acquired, through its wholly-owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd, shares representing 94.13% of the share capital in NH Hotel Group, S.A.For listed public limited companiesIdentification details of the issuerEnd date of 12-month period of reference: 31/12/2018Tax id code (CIF): A28027944Company name: NH Hotel Group, S.A.Registered office: Santa Engracia, 120 – 7ª planta, Madrid.

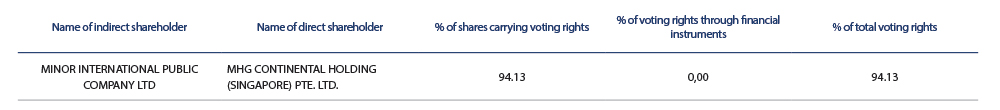

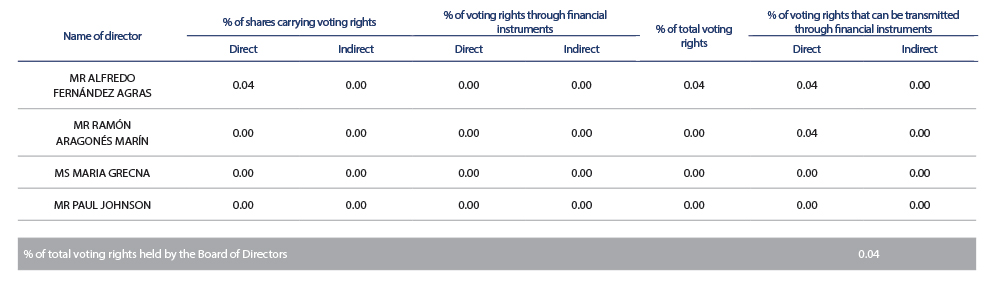

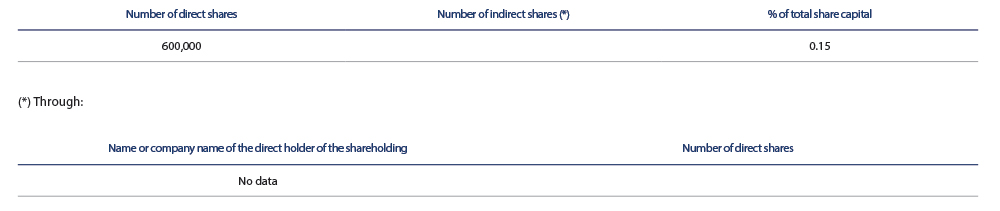

A.3 In the following tables, list the members of the Board of Directors (hereinafter “directors”) with voting rights in the company:

Breakdown of the indirect holding:

A.4 If applicable, state any family, commercial, contractual or corporate relationships that exist among significant shareholders to the extent that they are known to the company, unless they are significant or arise in the ordinary course of business, except those that are reported in Section A.6:

A.5 Indicate, where applicable, the commercial, contractual or corporate relationships existing between major shareholders, and the company and/or its group, unless they have little relevance or arise from normal trading activities:

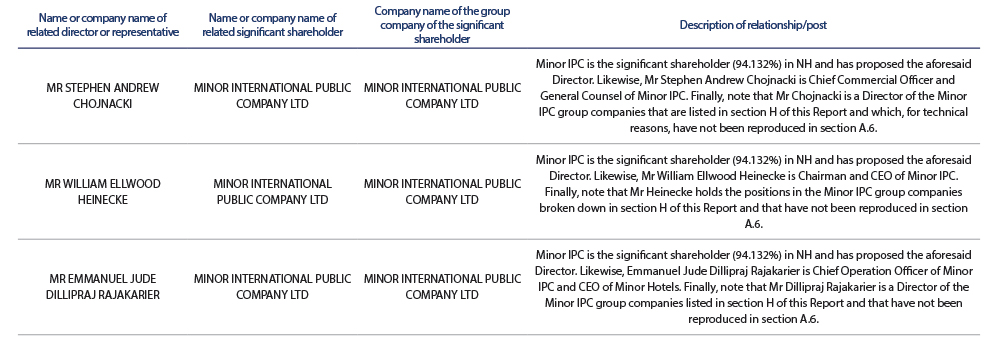

A.6 Describe the relationships, unless significant for the two parties, that exist between significant shareholders or shareholders represented on the Board and directors, or their representatives in the case of proprietary directors.

Explain, as the case may be, how the significant shareholders are represented. Explain, as the case may be, how the significant shareholders are appointed. Specifically, state those directors appointed to represent significant shareholders, those whose appointment was proposed by significant shareholders and/or companies in its group, specifying the nature of such relationships or ties. In particular, mention the existence, identity and post of directors, or their representatives, as the case may be, of the listed company, who are, in turn, members of the Board of Directors or their representatives of companies that hold significant shareholdings in the listed company or in group companies of these significant shareholders.

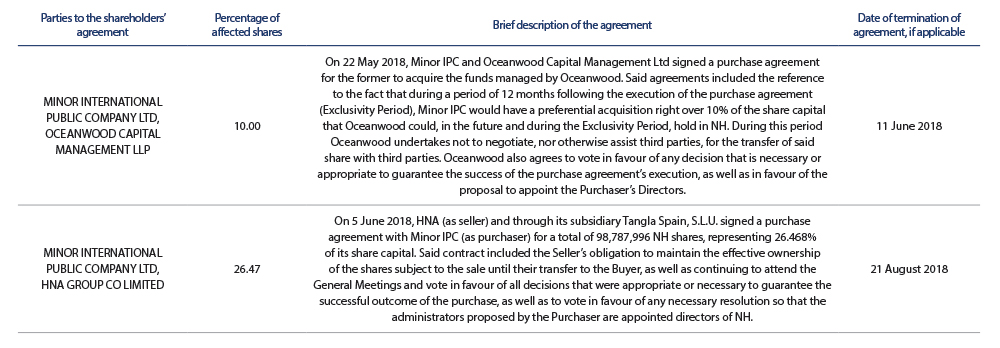

A.7 Indicate whether the company has been informed of shareholders’ agreements which affect it, as established in Articles 530 and 531 of the Capital Companies Act. If so, describe these agreements and list the party shareholders:

Indicate if the company is aware of the existence of concerted actions among its shareholders. If so, give a brief description:

NO

In the event of any modification or termination of these pacts, agreements or agreed actions during the year, please specify it:

On 5 June 2018, via a Relevant Fact, Minor IPC communicated the modification of the shareholders’ agreement contained in the purchase agreement signed between Minor IPC and Oceanwood on 22 March 2018, under which Oceanwood grants Minor IPC an exclusive right to acquire another 14,000,000 shares. Oceanwood mantains and reiterates the commitments regarding these shares that have already been assumed by Oceanwood under the original shareholders’ agreement.

On 11 June 2018, Minor IPC and Oceanwood, by virtue of the corresponding Relevant Fact, published that the agreements contained in the aforementioned purchase agreement formalised on 22 May 2018 and amended on 5 June 2018 were rendered null and void.

Likewise, on 21 August 2018, through a Relevant Fact, HNA communicated the execution of the purchase signed with Minor IPC and duly informed the CNMV through Relevant Facts on 5 and 15 June 2018, meaning that the aforementioned purchase is exhausted and, with that, the shareholders’ agreement broken.

A.8 Indicate whether any individual person or legal entity exercises, or could exercise, control over the Company in accordance with Article 5 of the Stock Market Act. If so, give details here:

YES

A.9 Fill in the following tables regarding the Company’s treasury stock:

At year end:

Explain any significant changes during the year:

Explain the significant changes

At the end of the year, NH Hotel Group, S.A. had 600,000 treasury shares on its balance sheet, compared with 9,416,368 treasury shares at 31 December 2017. The reduction in treasury shares over the period can be explained by the following movements:

- In June 2018, the Group delivered 8,569,262 own shares to bond-holders for the early conversion of convertible bonds worth 250 million euros.These include 1,384,473 shares held by one of the entities participating in the loan of 9,000,000 shares associated with the issue, which has been definitively settled.

- In in first half of 2018, the second cycle of the long-term incentive plan was settled (see Note 23). This second cycle was settled by the delivery of 247,106 shares valued at 1,029 thousand euros.

A.10 Describe the conditions and the term of the current mandate of the Board of Directors to issue, repurchase or transmit treasury stock, as conferred by the General Shareholders’ Meeting.

The General Shareholders’ Meeting held on 29 June 2017 authorised the Board of Directors of the Company to repurchase treasury stock under the terms indicated below:

a) The acquisition can be made by any title accepted in Law, once or more times, provided that the acquired shares, added to those the Company already owns, do not exceed 10% of the Company’s share capital, together with those owned by other companies in the group, if applicable.

b) The acquisition, including the shares which the Company, or a person acting in their own name but on behalf of the Company, may have acquired beforehand and have in its portfolio, can be made as long as this does not lead to net equity being below the amount of share capital plus the reserves made unavailable by law or the Company’s articles of association. For these purposes, net assets shall be considered to be the amount identified as such in accordance with the criteria for preparing annual accounts, less the profits directly attributable to it, and plus the uncalled share capital, as well as the amount of the principal and the share premium that are registered in the accounts as liabilities.

c) The shares must be fully paid up.

d) The authorisation will be valid for 5 years from the day this agreement comes into force.

e) The minimum purchase price will be 95% and the maximum price will be 105% of the listed market value at the close of Spain’s continuous market the day before the transaction, and the purchase transactions will adhere to security market regulations and customs.

The shares acquired due to the authorisation can be disposed of or amortised, or used in the payment systems set out in Article 146.a) 3 of the Capital Companies Act.

A.11 Estimated floating capital:

A.12 State whether there are any restrictions (article of associations, legislative or of any other nature) placed on the transfer of shares and/or any restrictions on voting rights. In particular, state the existence of any type of restriction that may inhibit a takeover attempt of the company through acquisition of its shares on the market, and those regimes for the prior authorisation or notification that may be applicable, under sector regulations, to acquisitions or transfers of the company’s financial instruments.

NO

A.13 State whether the General Shareholders’ Meeting has agreed to adopt neutralisation measures against take-over bids, pursuant to Law 6/2007.

NO

If so, please explain the measures approved and the terms under which such limitations would cease to apply.

A.14 State if the company has issued shares that are not traded on a regulated EU market.

NO

If so, please list each type of share and the rights and obligations conferred on each.

B – GENERAL SHAREHOLDERS’ MEETING

B.1 Indicate whether differences exist between the minimum quorum established in the Spanish Capital Companies Act (LSC) and the quorum of the General Shareholder’s Meeting. If so, explain these differences.

NO

B.2 Indicate, and if applicable, specify any differences from the system established in the Capital Companies Act (LSC) for adopting company agreements:

NO

B.3 Indicate the regulations applicable to modification of the company articles of association. In particular, note the majorities required for changes to the articles of association and, if any, the regulations governing the protection of shareholders’ rights when making changes to the articles of association.

Title VIII, covering Articles 285 – 345, of Royal Legislative Decree 1/2010 of 2 July, approving the Revised Text of the Capital Companies Act (hereunder, LSC), and Articles 158 – 164 of Royal Decree 1784/1996, of 19 July, approving the Regulation of the Mercantile Register (hereunder, RRM), establish the legal system applicable to the modification of articles of association. The text of the articles of association of NH Hotel Group faithfully reflects these legal regulations, with no higher quorum or majority required than is set out therein.

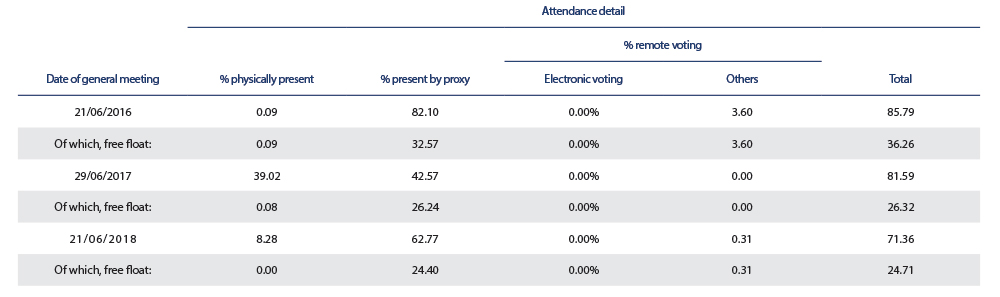

B.4 Give details of attendance at General Shareholders’ Meetings held during the year of this report and the previous year:

B.5 State whether any point on the agenda of the General Shareholders’ Meetings during the year has not been approved by the shareholders for any reason.

NO

B.6 State if the Articles of Association contain any restrictions requiring a minimum number of shares to attend General Shareholders’ Meetings, or on distance voting:

NO

B.7 State whether it has been established that certain decisions other than those established by law exist that entail an acquisition, disposal or contribution to another company of essential assets or other similar corporate transactions that must be subject to the approval of the General Shareholders’ Meeting.

NO

B.8 Indicate the address and access on the Company website to information on corporate governance and other information on general shareholders’ meetings which must be available to shareholders on the Company website.

All information of relevance to shareholders, including information on corporate governance and other information on general shareholders’ meetings is available at all times on the NH Hotel Group website, www.nh-hotels.es, in the section “Shareholders and Investors”.

C – COMPANY MANAGEMENT STRUCTURE

C.1 Board of Directors

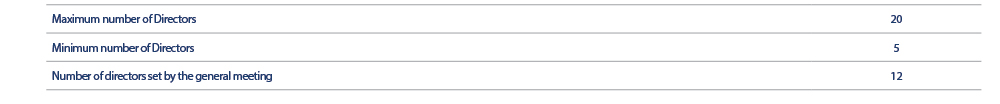

C.1.1 Maximum and minimum number of directors established in the Articles of Association and the number set by the general meeting:

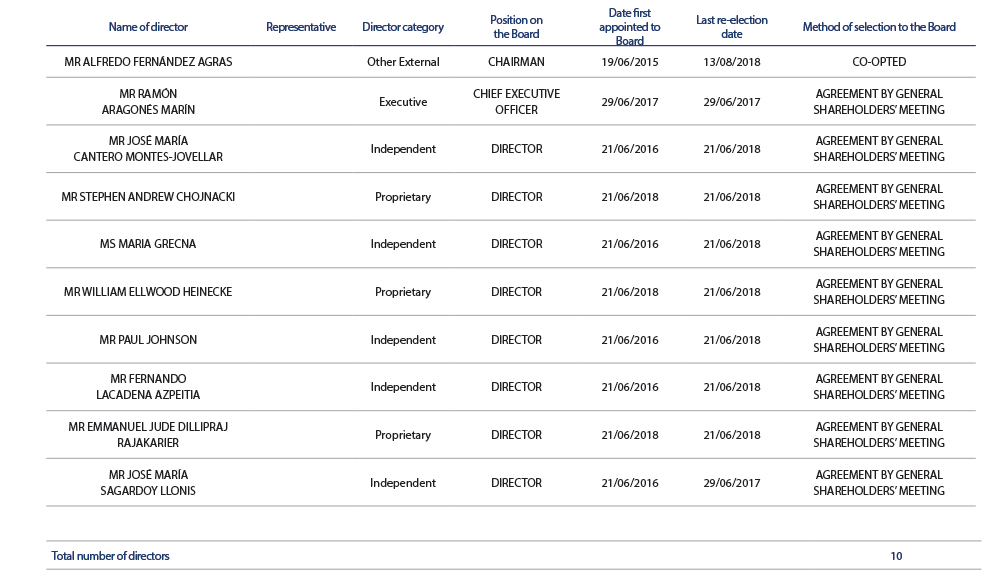

C.1.2 Complete the following table with the members of the Board:

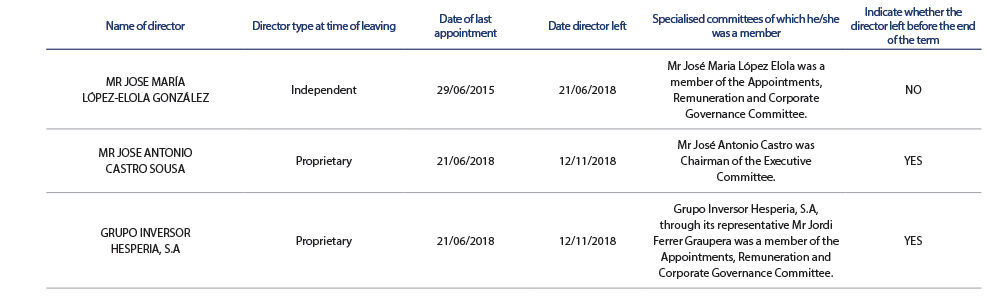

State if any directors, whether through resignation, dismissal or any other reason, have left the Board during the period subject to this report:

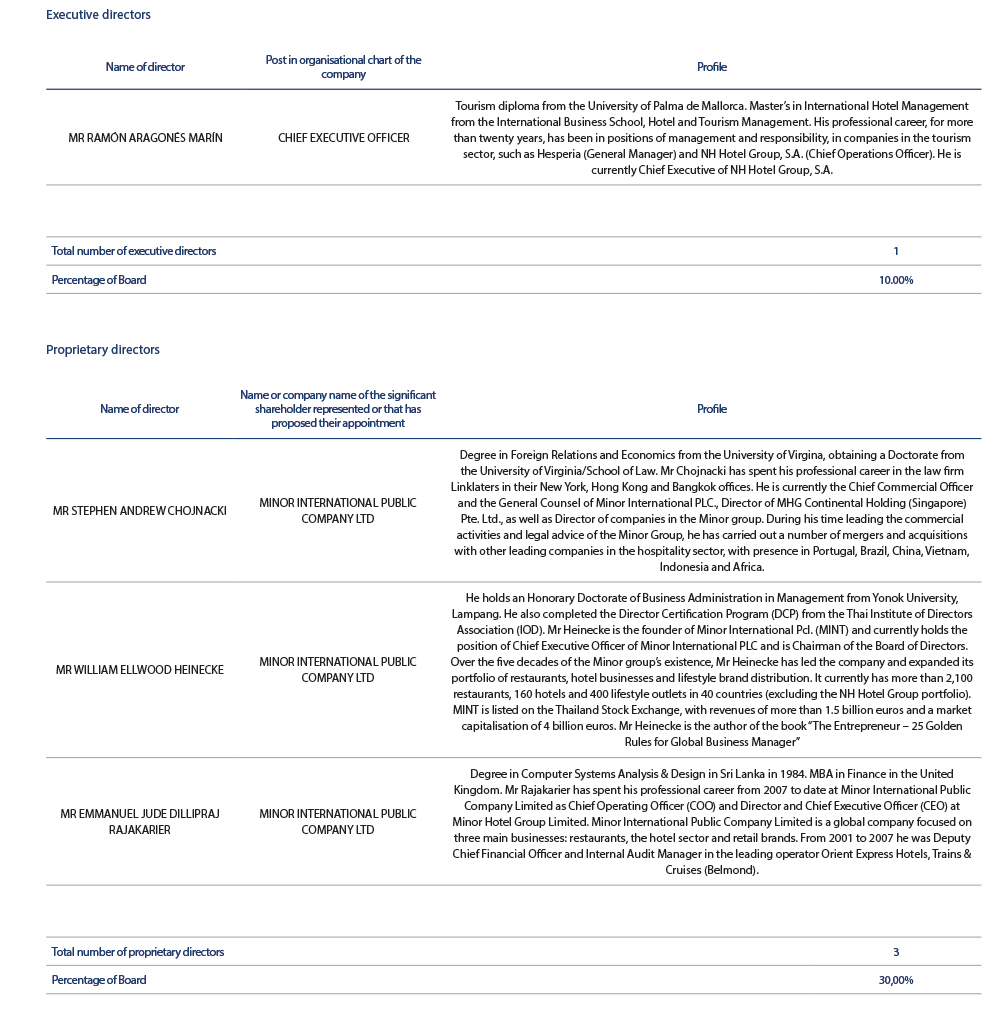

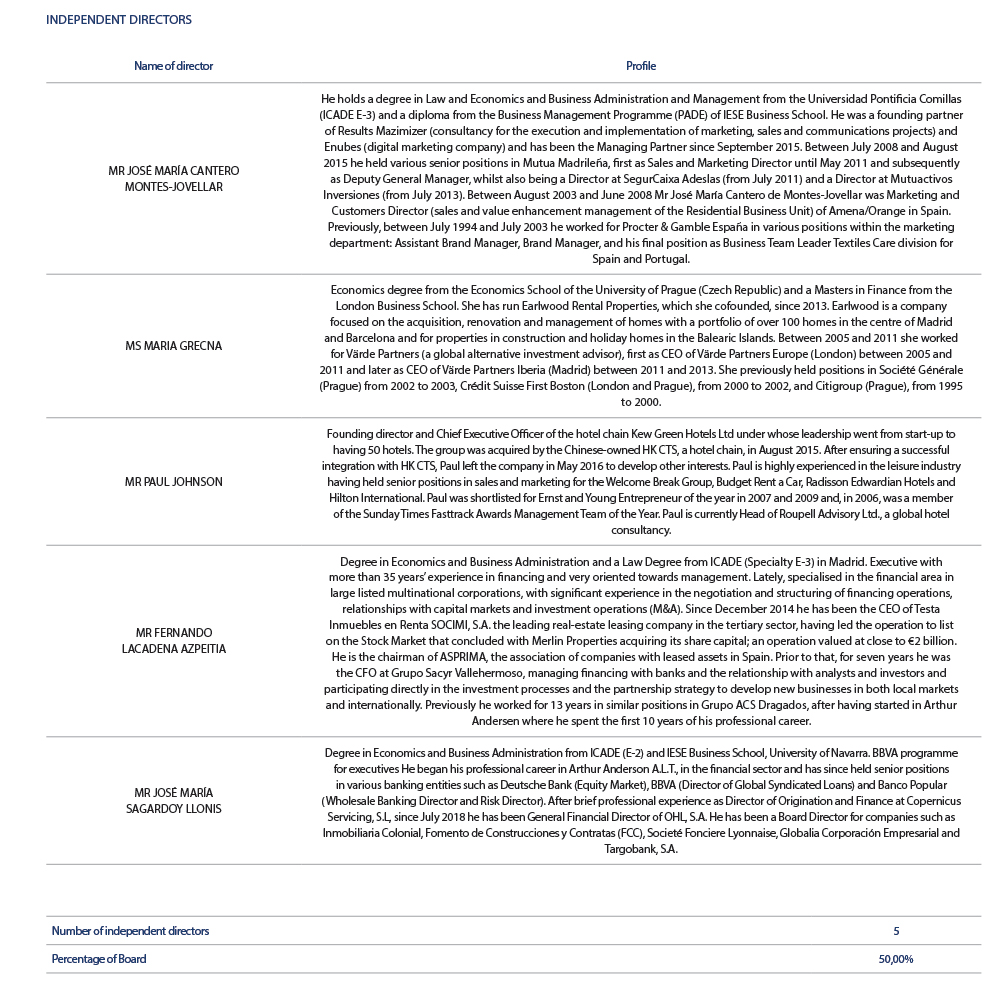

C.1.3 Fill in the following tables about the Board members and their corresponding categories:

State whether any independent director receives from the company or any company m the group any amount or benefit other than compensation as a director, or has or has had a business relationship with the company or any company m the group during the past year, whether in his or her own name or as a significant shareholder, director or senior executive of a company that has or has had such a relationship.

In this case, include a statement by the Board explaining why it believes that the director in question can perform his or her duties as an independent director.

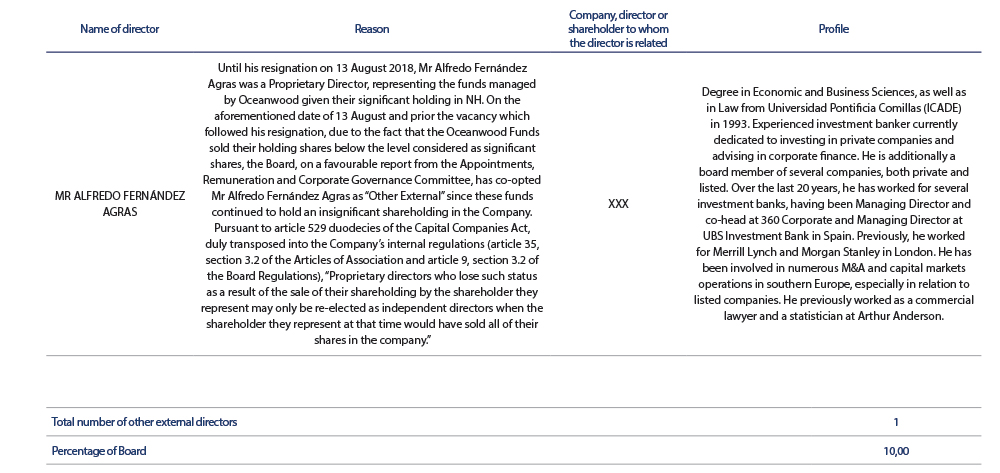

Other External Directors

Identify the other external directors and state the reasons why these directors are considered neither proprietary nor independent, and detail their ties with the company or its management or shareholders:

State any changes in status that has occurred during the period for each director:

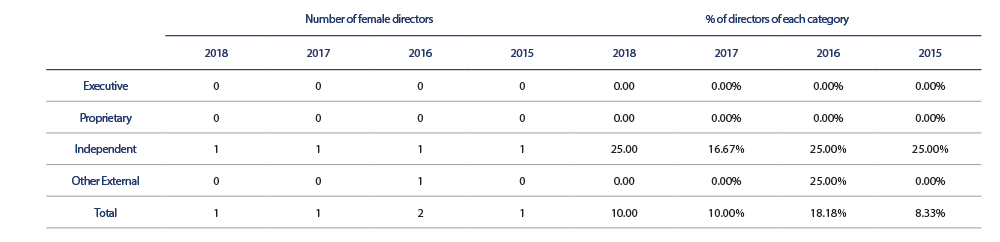

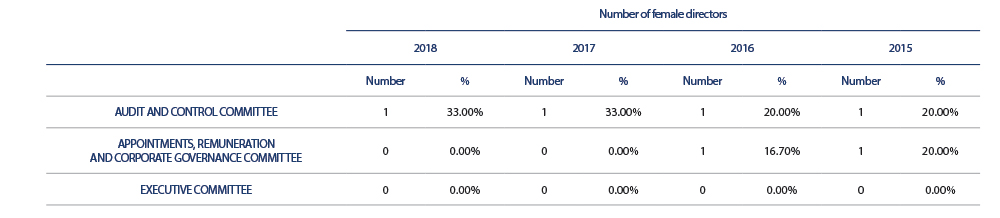

C.1.4 Complete the following table with information relating to the number of female directors at the close of the past 4 years, as well as the category of each.

C.1.5 Indicate whether the company has diversity policies in relation to the Board of Directors of the company with regard to issues such as age, gender, disability, or professional training and experience. Small and medium-sized companies, in accordance with the definition established in the Accounts Auditing Law, will at least have to report the policy they have established in relation to gender diversity.

PARTIAL POLICIES

Should this be the case, describe these diversity policies, their objectives, the measures and way in which they have been applied and their results over the year. Also state the specific measures adopted by the Board of Directors and the appointments and remuneration committee to achieve a balanced and diverse presence of directors.

In the event that the company does not apply a diversity policy, explain the reasons why.

Description of policies, objectives, measures and how they have been implemented, including results achieved

On 25 February 2016, following a favourable report from the Appointments, Remuneration and Corporate Governance Committee, the Board of Directors approved a Selection Policy for Directors. Said policy seeks to prevent discrimination, with meritocracy as the criterion guiding the selection process to identify the best candidates for the Company. However, and notwithstanding the foregoing, each time that there is a vacancy on the Board of Directors, and the corresponding selection process begins, at least one woman must be considered as a candidate until the 30% target is met.

In order to fulfil the aforementioned goal, the Appointments, Remuneration and Corporate Governance Committee shall ensure that the selection procedure does not suffer from any implicit bias that may hamper the selection of female directors and that women that fulfil the professional profile sought are included among the potential candidates.

C.1.6 Explain the measures agreed, if any, by the Appointments Committee to ensure that the selection process is not implicitly biased against selecting female Directors, and so that the company deliberately seeks to include women who meet the desired professional profile among potential candidates:

Explanation of the means

The Appointments, Remuneration and Corporate Governance Committee ensures that each time a vacancy occurs in the Board of Directors and the corresponding selection process begins, at least one woman is a candidate.

In the event that there are few or no female directors in spite of any measures adopted, please explain the reasons that justifyn such a situation:

Explanation of the means

So far, no women have been found who fit the professional profile sought.

C.1.7 Explain the conclusions of the appointments committee regarding the verification of compliance with the policy on director selection. In particular, as it relates to the goal of ensuring that the number of female directors represents at least 30% of the total membership of the Board of Director s by the year 2020.

The Appointments, Remuneration and Corporate Governance Committee has concluded that, despite women having taken part in the selection process for Directors women, to date none have meet the required profile.

C.1.8 Explain, if applicable, the reasons why proprietary directors have been appointed at the request of shareholders whose holdings are below 3% of share capital:

Indicate whether formal requests for representation on the Board from shareholders whose shareholding is equal to or greater than other shareholders at whose request proprietary directors have been appointed, have not been acted upon. If this is the case, please explain why the aforementioned requests were not met:

NO

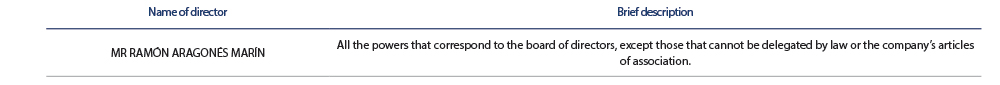

C.1.9 State the powers delegated by the Board of Directors, as the case may be, to directors or Board committees.

C.1.10 Identify any members of the Board who are also directors or officers m other companies in the group of which the listed company is a member:

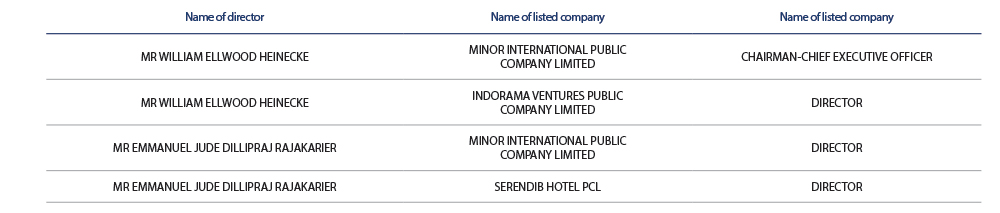

C.1.11 List any legal-person directors of your company who are members of the Board of Directors of other companies listed on official securities markets other than group companies, and have communicated that status to the Company:

D. William Ellwood Heinecke is also Chairman of the Appointments, Remuneration and Corporate Governance Committee of the company Indorama Ventures Public Company Limited.

Mr Stephen Andrew Chojnacki is Chief Commercial Officer and General Counsel of the company listed in Thailand, Minor IPC.

C.1.12 State whether the company has established rules on the number of boards on which its directors may hold seats, providing details if applicable, identifying, where appropriate, where this is regulated:

YES

Explanation of the roles and identification of the document where this is regulated

Article 29 of the Board Regulations expressly establishes that directors must dedicate the necessary time and effort to performing their duties, and must notify the Appointments, Remuneration and Corporate Governance Committee of any circumstances that may interfere with the required dedication. Similarly, directors may not belong to more than 10 boards of directors, excluding the Board of NH Hotel Group, S.A. and the boards of holding companies and family companies, without the express authorisation of the Appointments, Remuneration and Corporate Governance Committee based on the individual circumstances in each case.

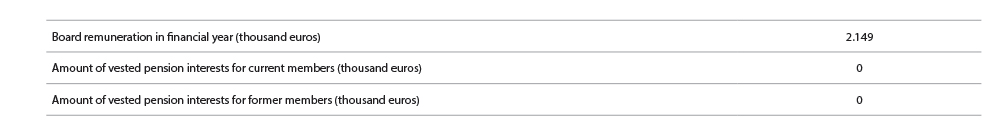

C.1.13 State total remuneration received by the Board of Directors:

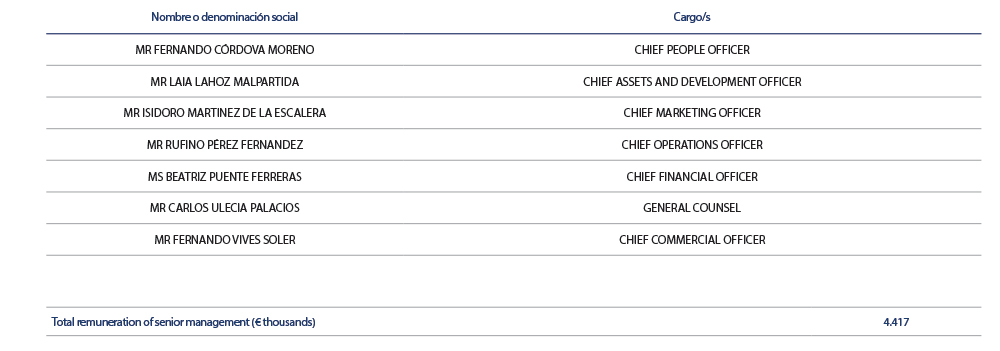

C.1.14 Identify members of senior management who are not also Executive Directors, and indicate their total remuneration for the year:

C.1.15 State whether there has been any change to the regulations of the Board during the year:

NO

C.1.16 Specify the procedures for selection, appointment, re-election and removal of directors: the competent bodies, steps to follow and criteria applied in each procedure.

The directors are appointed by the General Shareholders’ Meeting, or provisionally by the Board of Directors in accordance with the provisions contained in the Capital Companies Act and the company’s articles of association.

Proposals for appointments or the re-election of members of the Board of Directors is the responsibility of the Appointments, Remuneration and Corporate Governance Committee in the case of independent directors and is the responsibility of the Board itself for all other cases. Proposals should always be accompanied by a report from the Board assessing the proposed candidate’s competence, experience and merits, which will be attached to the minutes of the General Shareholders’ Meeting or that of the Board.

Proposals for appointing or re-electing any non-independent Director must also be preceded by a report from the Appointments, Remuneration and Corporate Governance Committee.

The Board of Directors must ensure that the selection process for its members favours diversity in terms of gender, experience and knowledge and does not suffer from implicit biases that may lead to any type of discrimination and, particularly, that it facilitates the selection of female directors.

In terms of appointing external directors, the Board of Directors and the Appointments, Remuneration and Corporate Governance Committee have a duty to ensure, within the scope of their respective competencies, that the election of candidates falls on people with a solid reputation, proven skills and experience, and who are prepared to dedicate a sufficient part of their time to the Company, taking the utmost care in choosing people who may be selected to be independent directors.

The Board of Directors will propose or designate people who meet the requirements set out in article 9.3.2 of the Regulation of the Board of Directors to cover the position of independent directors.

In any event, those subject to any incapacity, disqualification, prohibition or conflict of interests set forth in current legislation may not be proposed for appointment as Board members. All those directly or indirectly holding interests of any type or that have an employment, professional or mercantile relationship, or relations of any other type with competitor companies, shall be considered as incompatible for the position of director, except when the Board of Directors, with a favourable vote of at least 70% of its members, agrees to set aside this condition. The above is without prejudice to any other waiver that, in compliance with current legislation, the General Shareholders’ Meeting had to provide.

C.1.17 Explain how far the annual assessment of the board has led to important changes in its internal organisation, and on the procedures applicable to its activities:

Description of amendment

Following the annual evaluation of the Board of Directors that has been conducted in December 2017, the Company has build up an action plan in order to improve certain areas of opportunity that have been detected.

• The training of the Board has been improved, as well as the Incorporation Plan of new Directors.

• The information available to the Directors regarding the perception of relevant third parties has increased.

Notwithstanding the aforementioned there is still pending an improvement margin regarding the execution of the defined Working Plan, especially with regard to the areas linked to the strategic plan of the Company and the duration of the Audit and Control Committee.

Describe the evaluation process and the areas evaluated by the Board of Directors with the help, if any, of external advisors, regarding the function and composition of the board and its committees and any other area or aspect that has been evaluated.

Description of the evaluation process and evaluated areas

The evaluation process of the Board of Directors of NH is carrying out annually with the purpose of identifying the awareness of the Directors with regard to certain performances of the Board and its Committees related to the composition, its functioning, the sessions and the performances of its duties.

The evaluation process, especially with regard to the collecting and treatment of the formulars from the Directors, as well as presentation of the results and the build up of the action plan has been carried out with the advice of KPMG, as independent advisor and specialised in this matter.

The evaluation of 2018 has been answered by all the members of the Board that have been members during all fiscal period during 2018.

The Directors have state their opinions over a variety of areas, such as functioning of the Board and their government Committees, strategic plan, operational and financing supervision, communication of stakes, etc.

C.1.18 Describe, in those years in which the external advisor has participated, the business relationships that the external advisor or any group company maintains with the company or any company in its group.

The external advisor, KPMG has not being involved in other matters that have been presented to the Appointments, Remuneration and Corporate Governance Committee

C.1.19 Indicate cases in which Directors are compelled to resign.

Directors shall step down when the period for which they were appointed comes to an end or when agreed by the General Shareholders’ Meeting based on the powers legally attributed to it.

Article 14.2 of the Regulations of the Board of Directors also stipulates that Directors shall place their office at the disposal of the Board of Directors and tender their resignation in any of the following circumstances:

a) When they are removed from the executive offices with which their appointment as a Director was associated or where the reasons for which they have been appointed are no longer valid. Such a circumstance shall be understood to apply to Proprietary Directors when the entity or business group they represent ceases to hold a significant shareholding in the Company’s share capital or when, in the case of independent Directors, they become an executive of the Company or of any of its subsidiaries.

b) Where they are subject to any incapacity, disqualification, prohibition or conflict of interests established in current legal provisions.

c) Where they are seriously reprimanded by the Appointments, Remuneration and Corporate Governance Committee for failing to comply with any of their obligations as Directors.

d) When their continued presence on the Board may affect the good standing or reputation that the Company enjoys in the market, or put its interests at risk in any other way. In this case, the Director must immediately inform the Board of the facts or procedural difficulties that affect said reputation or risk.

C.1.20 Are reinforced majorities other than those applicable by law required for any type of decision?:

YES

If so, please describe the differences.

Description of the differences

For the appointment of Directors with direct or indirect interests of any type in, or an employment, professional, commercial or any other relationship with competitor companies, a vote in favour by 70% of the Board members is required (Article 11.3 of the Board regulations).

C.1.21 Explain if there are any specific requirements, other than those relating to Directors, to be appointed Chairman of the Board of Directors.

NO

C.1.22 Indicate whether the Articles of Association or the Board Regulations establish any age limit for Directors:

NO

C.123 State whether the Articles of Association or the Board Rules establish any term limits for independent directors other than those required by law.

NO

C.1.24 State whether the Articles of Association or Board Rules establish specific proxy rules for votes at Board meetings, how they are to be delegated and, in particular, the maximum number of delegations that a director may have, as well as if any limit regarding the category of director to whom votes may be delegated and whether a director is required to delegate to a director of the same category. If so, please briefly describe the rules.

Article 40 of the Articles of Association sets the rules around delegating votes, stating that “Directors shall personally attend Board meetings and, when they are unable to do so in exceptional circumstances, shall ensure that the proxy granted to another member of the Board shall include the relevant instructions insofar as possible.”

Similarly, Article 22 of the Board Regulations in implementing said article adds that “Non-executive directors can only delegate their vote to another nonexecutive director.”

The Board of Directors has not governed the maximum number of times a Director may delegate their vote.

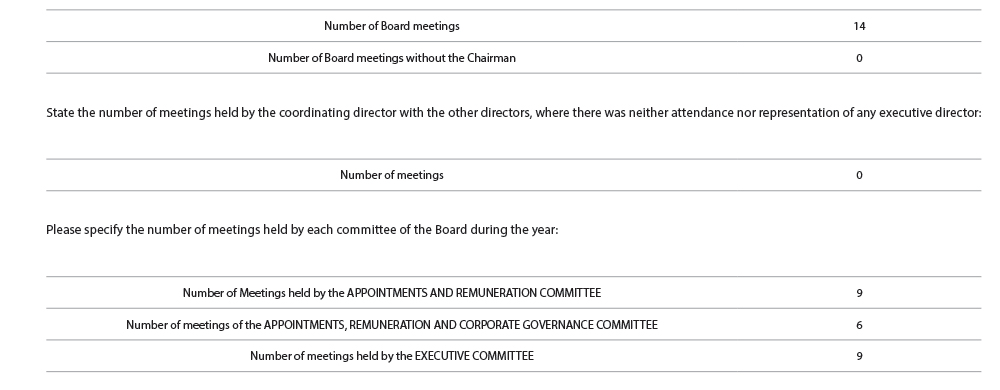

C.1.25 Indicate the number of meetings that the Board of Directors has held over the year. Also indicate, as applicable, the number of times that the Board has met without its Chairman attending. Meetings where the chairman sent specific proxy instructions are to be counted as attended.

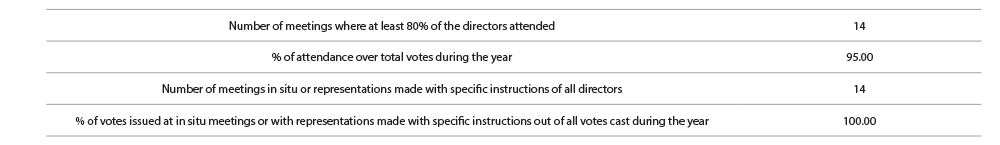

C.1.26 State the number of meetings held by the Board of Directors during the year in which all of its directors were present. For the purposes of this section, proxies given with specific instructions should be considered as attendance

C.127 State if the individual and consolidated financial statements submitted to the Board for preparation were previously certified:

NO

Identify, if applicable, the person/s who certified the individual and consolidated financial statements of the company for preparation by the Board:

C.1.28 Explain, if applicable, the mechanisms established by the Board of Directors to prevent the individual and consolidated annual accounts it draws up from being submitted to the General Meeting of Shareholders with qualifications in the auditors’ report.

Article 41.2 of the Regulations of the Board establishes that the Board of Directors shall ensure the financial statements are drawn up definitively so that there is no need for auditor qualifications. Nevertheless, when the Board considers that its criteria should remain unchanged, it shall publicly explain the content and scope of the discrepancies.

C.1.29 Is the Secretary of the Board a Director?

NO

If the secretary is not a director, please complete the following table.

C.1.30 State, if any, the concrete measures established by the entity to ensure the independence of its external auditors, financial analysts, investment banks, and rating agencies, including how legal provisions have been implemented in practice.

The Board of Directors has established a stable and professional relationship with the Company’s external accounts auditor through the Audit and Control Committee, strictly respecting its independence. By way of an example, the Audit and Control Committee holds regular meetings with the external auditor without the executive team being present. In this sense, article 25. b) of the Regulations of the Board of Directors expressly establishes that one of its responsibilities is to pass along to the Board of Directors proposals for selecting, appointing, re-electing and substituting external auditors, as well as conditions for their contracting and regularly collecting information from them on the audit plan and its execution, in addition to preserving its independence in exercising its functions.

Furthermore, the Audit and Control Committee is responsible for establishing suitable relationships with auditors or audit firms in order to receive information regarding any issues that may jeopardise their independence, so that these can be examined by the committee, and any other matters related with the process of conducting financial audits, as well as any other communications stipulated in the financial auditing legislation and audit regulations. In any event, it must receive written confirmation on an annual basis from the auditors or auditing firms of their independence from the Company or entities related to it either directly or indirectly, as well as information on any additional service of any kind provided to such entities and the corresponding fees received by the aforementioned auditors or by persons related to them in accordance with the provisions set forth in legislation regarding auditing.

Likewise, every year, prior to issuing the audit report, the Audit and Control Committee must also issue a report in which it gives its opinion on the independence of the auditors or auditing firms. This report must always contain an assessment of the additional services referenced in the above paragraph, considered individually and together, that are separate from the legal audit and with regard to their independence and to audit regulations.

C.1.31 State whether the Company has changed its external auditor during the year. If so, please identify the incoming and outgoing auditor:

NO

If there were any disagreements with the outgoing auditor, please provide an explanation:

NO

C.1.32 State whether the audit firm carries out other work for the company and/or its group other than audit work and if so, state the total fees paid for such work and the percentage this represents of the fees billed to the company and/or its business group:

YES

C.1.33 State whether the audit report of the financial statements for the previous year included qualifications or reservations. If so, please explain the reasons given by the chairman of the audit committee to explain the content and extent of the aforementioned qualified opinion or reservations.

NO

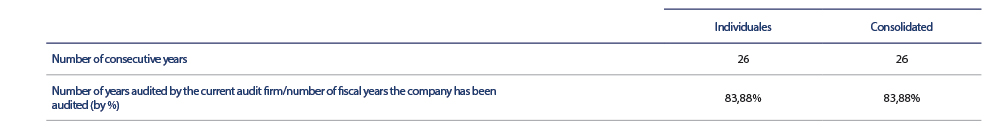

C.1.34 State the number of consecutive years the current audit firm has been auditing the financial statements of the company and/or group. Furthermore, state the number of years audited by the current audit firm as a percentage of the total number of years that the financial statements have been audited:

C.1.35 Indicate and, if applicable, provide details of whether there is a procedure whereby Directors can have the information necessary to prepare for meetings of the management bodies with sufficient time:

YES

Explanation of procedure

According to article 21 of the Regulations of the Board, the announcement of the meeting, which will be published at least three days before the date of the meeting, will include a preview of the likely agenda for the meeting and will be accompanied by the necessary written information that is available.

Furthermore, article 27 of the aforementioned Regulations indicates that Directors must diligently inform themselves of the Company’s progress, and to that end, collect any necessary or pertinent information in order to correctly perform their duty. To this end, the Board has been assigned the broadest possible powers to gain information about any aspect of the Company; to examine its books, registers and documents and any other information concerning its operations. Said right to information is also extended to the various subsidiary companies that are included in the consolidated group, insofar as it is necessary for the Director to correctly perform their functions as referred to in article 6 of said Regulations.

With the aim of not disturbing the Company’s normal management, the exercise of the right to information will be channelled through the Chairman or Secretary of the Board of Directors, who will respond to requests from Directors by directly providing him/her the information or putting them in touch with the appropriate people in the suitable level of the organisation. With the aim of being assisted in the exercise of their functions, the Directors may obtain the necessary consulting from the Company to perform their functions. In special circumstances, they may even request that the Company hire legal, accounting or financial consultants or other experts. Such help must relate to specifically defined and complex problems that arise in the course of their work. The decision to employ such services must be communicated to the Chairman of the Company and implemented through the Secretary of the Board, unless the Board of Directors considers that such services are not necessary or appropriate.

C.1.36 State and, if applicable, provide details on whether the company has established rules that require directors to report and, as applicable, resign in those cases where the company’s credibility and reputation may be harmed.

YES

Explanation of procedure

The Regulations of the Board includes a mechanism to oblige the Directors to provide immediate notification of all legal proceedings in which they may be adversely affected. In this way, article 14.2.d) of the Regulations of the Board of Directors of NH Hotel Group, S.A., expressly establishes that Directors shall place their office at the disposal of the Board of Directors and tender their resignation when their continued presence on the Board may affect the good standing or reputation that the Company enjoys in the market, or put its interests at risk in any other way. In this case, the Director must immediately inform the Board of the facts or procedural difficulties that affect said reputation or risk.

It also establishes that in all events, those subject to any incapacity, disqualification, prohibition or conflict of interests set forth in current legislation may not be proposed for appointment as Board members.

C.1.37 State whether any member of the Board of Directors has notified the Company that they have been prosecuted or issued with a summons for oral proceedings in relation to the offences indicated in Article 213 of the Spanish Capital Companies Act:

NO

C.1.38 List the significant agreements signed by the company and that come into force, are modified or are terminated in the case of a change in control of the company resulting from a take-over bid, and their effects.

The NH Group has signed several financing contracts that contain a clause establishing their early maturity in the event of circumstances that give rise to a change in control of the NH, among others, the the sindicated credit line for an amount up to 250 millions euro, with maturity 2021. In addition, NH issued guaranteed senior bonds with maturity 2023, which include certain consequences should control of the Issuer change, such as the possibility of NH being required to repurchase the senior bonds. As a consequence of the teakeover bid over NH, the Company got the unanimous waiver of the banks regarding the sindicated credit line, maintaining the maturity 2021. In addition and as a consequence of the change of control the Company has offered to the bond holders the purchase. The amount of the purchase only amounted 3,2 millions of the total nominal value.

Finally, the change of control following a public takeover bid could have different effects on other leasing and hotel management agreements signed by the Company.

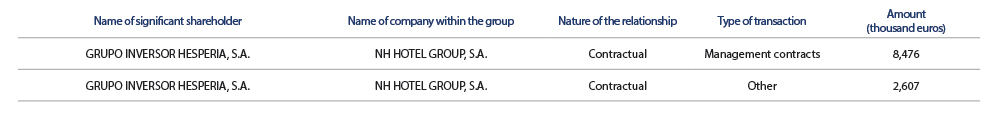

During 2018 and resulting from the takeover bid of shares prepared by the Minor IPC Group, the Framework Contract for Global Hotel Transaction and Management signed between NH Hotel Group and Grupo Inversor Hesperia on 5 December 2016 was resolved, as reported though a Relevant Fact on 30 November 2018.

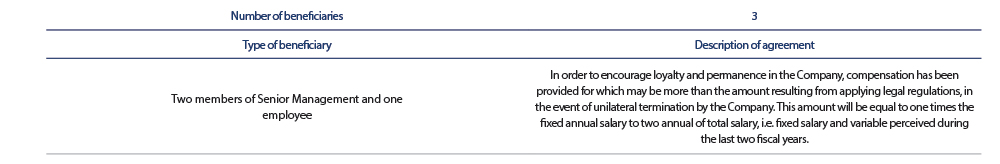

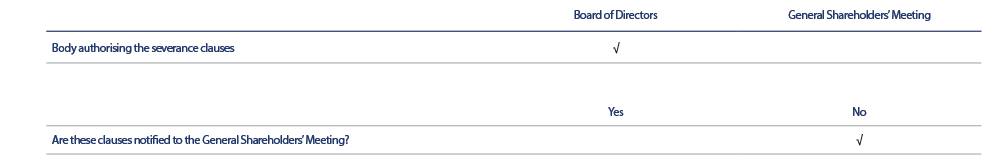

C.1.39 Identify individually for director, and generally in other cases, and provide detail of any agreements made between the company and its directors, executives or employees containing indemnity or golden parachute clauses in the event of resignation or dismissal or termination of employment without cause following a takeover bid or any other type of transaction.

State if these contracts have been communicated to and/or approved by management bodies of the company or of the Group. If they have, specify the procedures, events and nature of the bodies responsible for their approval or for communicating this:

C.2 Committees of the Board of Directors

C.2.1 List all the committees of the Board of Directors, their members and the proportion of Executive, Proprietary, Independent and other external Directors thereon:

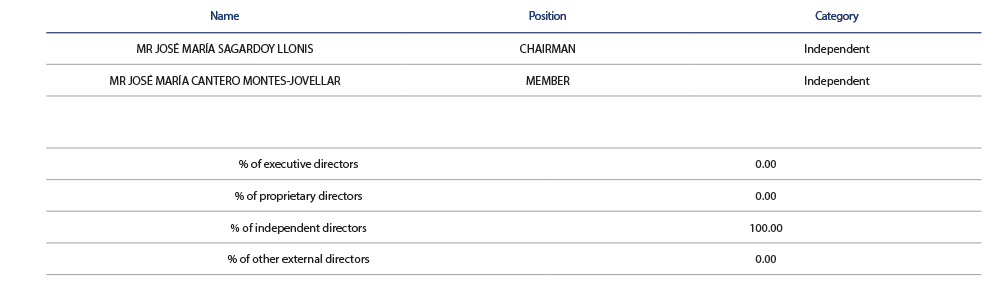

AUDIT AND CONTROL COMMITTEE

Explain the duties exercised by this committee, describe the rules and procedures it follows for its organisation and function. For each one of these functions, briefly describe its most important actions during the year and how it has exercise in practice each of the functions attributed thereto by law, in the Articles of Association or other corporate resolutions.

The Audit and Control Committee shall comprise a minimum of three and a maximum of six directors, appointed by the Board of Directors. All members sitting on said Committee shall be External Directors, the majority of whom, at least, must be independent directors, and one of whom must be designated by taking into consideration their knowledge and experience in accounting, auditing, or both. The Chairman of the Audit Committee must be appointed from among its independent members. The Chairman must also be replaced every four years; previous chairmen may be re-elected one year after their previous mandate has ended.

The Audit Committee will have at least the following responsibilities:

- Report to the General Meeting of Shareholders on any matters broached within the sphere of its competence.

- Supervise the effectiveness of the company’s internal control, internal auditing, where applicable, and risk-management (including tax risk) systems, as well as discussing with auditors or audit companies any significant weaknesses in the internal control system identified during audits.

- Oversee the process of drawing up and submitting regulated financial reporting.

- Pass along to the Board of Directors proposals for selecting, appointing, re-electing and substituting external auditors, as well as conditions for their contracting and regularly collecting information from them on the audit plan and its execution, in addition to preserving its independence in exercising its functions.

- Establish suitable relationships with auditors or audit firms in order to receive information regarding any issues that may jeopardise their independence, so that these can be examined by the committee, and any other matters related with the process of conducting financial audits, as well as any other communications stipulated in the financial auditing legislation and audit regulations. In any event, it must receive written confirmation on an annual basis from the auditors or auditing firms of their independence from the Company or entities related to it either directly or indirectly, as well as information on any additional service of any kind provided to such entities and the corresponding fees received by the aforementioned auditors or by persons related to them in accordance with the provisions set forth in legislation regarding auditing.

- Issue, once a year and prior to the release of the auditor’s report on the financial statements, a report expressing an opinion on the independence of the auditors or audit firms. This report must always contain an assessment of the additional services referenced in the above paragraph, considered individually and together, that are separate from the legal audit and with regard to their independence and to audit regulations.

- Provide previous information for the Board of Directors on all matters established by law, the articles of association and in the Regulation of the Board, and, in particular on:

- The financial information which the company must periodically publish;

- The creation or acquisition of any equity investments in special purpose vehicles and companies registered in tax havens; and

- Related party operations.

- Safeguard the independence and effectiveness of the internal audit area; propose the selection, appointment, re-election and removal of the manager of the internal audit service; propose the budget for this service; receive periodic information about its activities; and verify that senior management takes into account the conclusions and recommendations of its reports.

- Set up and oversee a mechanism that allows employees confidentially and anonymously to report any breaches of the Code of Conduct.

- Supervise compliance and internal codes of conduct, as well as the rules of corporate governance.

The Audit and Control Committee will meet at least once every quarter and as many times as may be necessary, after being called by the Chairperson on their own initiative or upon the request of two of the Committee or the Board of Directors.

The Audit and Control Committee may require any of the Company’s employees or managers, including the Company’s Accounts Auditor, to attend its meetings. Through its Chairman, the Audit and Control Committee will give the board an account of its activities and work done, either at the meetings scheduled for the purpose or at the very next meeting when the Chairman of the Audit and Control Committee deems it necessary. The minutes of its meetings will be available to any member of the board that requests them.

Non-member Directors may attend Audit and Control Committee meetings on a one-off basis, when invited by the Chairman of the Committee.

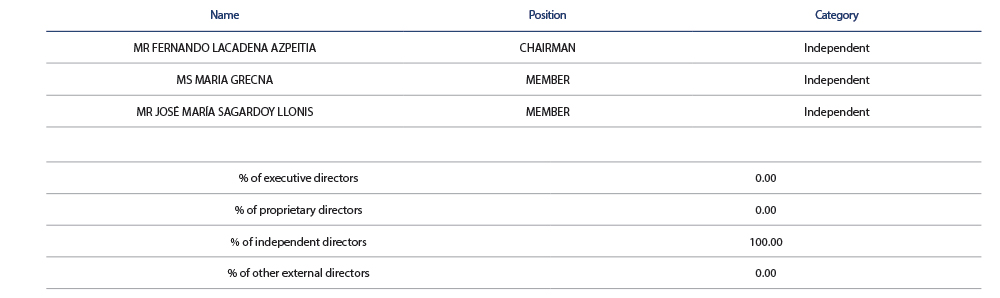

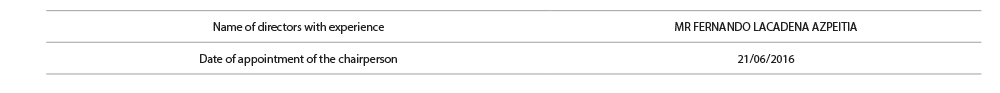

Identify the directors who are member of the audit committee and have been appointed taking into account their knowledge and experience in accounting or audit matters, or both, and state the date that the Chairperson of this committee was appointed.

APPOINTMENTS, REMUNERATION AND CORPORATE GOVERNANCE COMMITTEE

Explain the duties exercised by this committee, describe the rules and procedures it follows for its organisation and function. For each one of these functions, briefly describe its most important actions during the year and how it has exercise in practice each of the functions attributed thereto by law, in the Articles of Association or other corporate resolutions.

The Appointments, Remuneration and Corporate Governance Committee shall comprise a minimum of three and maximum of six Directors and shall be exclusively non-executive directors appointed by the Board of Directors, two of whom, at least, must be Independent Directors. The Chairman of the Committee shall be chosen by the Independent Directors that comprise it. The Appointments, Remuneration and Corporate Governance Committee will have at least the following responsibilities:

- Evaluate the competences, knowledge and experience necessary on the Board of Directors. For these purposes, it shall define the abilities and functions required by candidates to cover each vacancy, and assess the time and dedication required to correctly carry out their functions.

- Establish a representation goal for the less represented sex on the Board of Directors and create guidelines for how to achieve said goal.

- Pass along to the Board of Directors proposals for appointments of Independent Directors for their designation by co-opting or for their submission to the decision of the General Shareholders’ Meeting, as well as proposals for the re-election or removal of said Directors by the General Shareholders’ Meeting.

- Inform the Board of proposals for appointments of remaining Directors for their designation by co-opting or for their submission to the decision of the General Shareholders’ Meeting, as well as proposals for their re-election or removal by the General Shareholders’ Meeting.

- Provide notification of proposals for appointing or removing senior management and the basic conditions of their contracts.

- Examine or organise the Chairman of the Board’s and the chief executive’s succession and, if appropriate, bring proposals before the Board so that such successions are effected in an orderly fashion.

- Propose to the Board of Directors the remuneration policy for the directors and general managers or for those who perform functions of upper management directly reporting to the Board, Executive Committee or Chief Executives, as well as the individual remuneration and other contractual conditions for the Chief Executives, ensuring compliance therewith.

- Supervise and monitor compliance with corporate governance rules and with the corporate social responsibility policy and plan, proposing any necessary Reports to the Board.

- Periodically evaluate the suitability of the corporate governance system, with the aim of ensuring that it fulfils its mission of promoting the company’s interests.

The Board of Directors shall be informed of all the tasks carried out by the Appointments, Remuneration and Corporate Governance Committee during its first meeting, and in all events the corresponding documentation shall be made available to the Board so that it can take these actions into consideration when performing its duties.

The Appointments, Remuneration and Corporate Governance Committee shall meet as often as considered necessary by its Chairman, or when requested by two of its members or the Board of Directors. Furthermore, non-member Directors may attend Appointments, Remuneration and Corporate Governance Committee meetings on a one-off basis, when invited by the Chairman of the Committee.

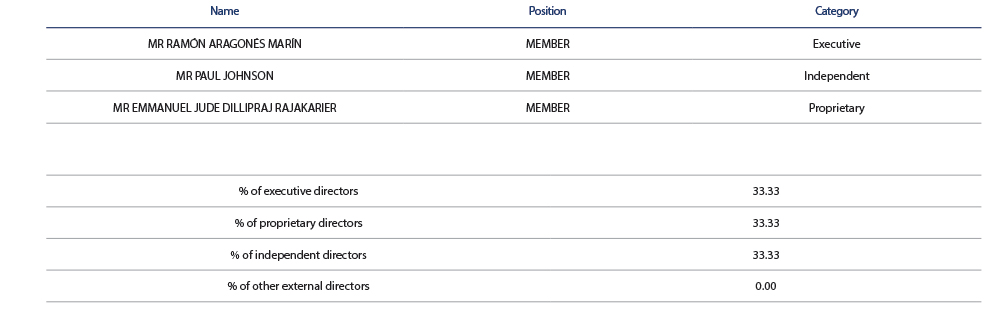

EXECUTIVE COMMITTEE

Explain the duties exercised by this committee, describe the rules and procedures it follows for its organisation and function. For each one of these functions, briefly describe its most important actions during the year and how it has exercise in practice each of the functions attributed thereto by law, in the Articles of Association or other corporate resolutions.

The Executive Committee shall comprise at least three but no more than nine directors, appointed by the Board of Directors.

In terms of the qualitative composition of the Executive Committee, the Board shall ensure that the different types of director represented will be similar to that of the main Board and its secretary will be the secretary of the Board. The Chairman of the Executive Committee shall be chosen by the body itself from the Directors that comprise it. The Chairman of the Executive Committee may be a director other than the Chairman of the Board of Directors. The Chairman of the Executive Committee shall alternate turns presiding the General Shareholders’ Meeting with the Chairman of the Board of Directors.

In all events, the valid appointment or re-election of members of the Executive Committee shall require the favourable vote of at least two thirds of the members of the Board of Directors. Given its delegated powers, the Executive Committee will resolve all those issues not reserved for the exclusive competency of the plenary Board of Directors by law or the Articles of Association, reporting to the Board. The Executive Committee will provide prior examination of those issues submitted to the plenary Board of Directors which have not been previously examined or proposed by the Appointments, Remuneration and Corporate Governance Committee or the Audit and Control Committee

The Executive Committee has the mission of providing perspective and a broad vision both to the Board of Directors and the executive team, providing their experience in the preparation of relevant materials, training and guidance on matters that are key to the Company’s future, thereby facilitating the Board of Directors’ decision-making process in the matters of their competence.

The Executive Committee may apply said function to matters such as:

1. Investments and financing

2. Strategy for acquisitions and identifying possible objectives

3. Business model

4. Cost structure

5. Long-term vision in asset management; and

6. Group structure

The Executive Committee will meet as many times as it is convened by its Chairman, and its Secretary and Deputy Secretary will be those who perform the identical positions on the Board of Directors. The Executive Committee shall be validly convened when half plus one of its members with a right to vote are present or represented at the meeting. Resolutions shall be passed by a majority of the directors at the meeting with the right to vote (in person or by proxy), with the Chairman holding the casting vote in the event of a tie. Furthermore, non-member Directors may attend Executive Committee meetings on a one-off basis, when invited by the Chairman of the Committee. The Executive Committee shall notify the Board of Directors of the matters discussed and the decisions made at its meetings.

C.2.2 Complete the following table with information regarding the number of female directors who were members of Board committees at the close of the past four years:

C.2.3 Indicate, as applicable, the existence of regulations governing the committees attached to the Board, where they are available for consultation and any amendments that have been made to them during the year. Also state whether any annual reports on the activities of each committee have been voluntarily prepared.

The Company Articles of Association (Articles 45 – 48), and the Regulations of the Board of Directors (Articles 23 – 26) comprehensively cover all regulations relating to the Board’s Committees. The aforementioned internal regulations of the Company are available on the company website (www.nh-hotels.es), in the section “Shareholders and Investors” – “Corporate Governance”. Said website also includes all information regarding the composition of each Committee. The Audit and Control Committee and the Appointments, Remuneration and Corporate Governance Committee annually issue a report on the activities they have carried out during the financial year.

D – RELATED AND IN-GROUP TRANSACTIONS

D.1 Describe, if applicable, the procedure for approval of related-party and intragroup transactions.

Articles 33.1.c) of the Articles of Association and 5.5.c) of the Board Regulations assign the Board of Directors the duty of approving related party transactions, understood to be transactions between the Company and Directors, significant shareholders or bodies represented on the Board, or people associated with them, as defined in the LSC. This approval will follow a report by the Audit and Control Committee (Article 48.4 of the Articles of Association and 25 b) of the Board Regulations).

Authorisation of the Board shall not be required however, for related party transactions that simultaneously meet the following three conditions:

1. That are carried out under agreements with standardised conditions and are applied in a general way to numerous clients;

2. That are carried out at generally established rates or prices, set by the supplier of the good or service; and

3. Operations with a quantity that does not exceed 1% of the company’s annual revenues.

Additionally, on 26 March 2014 the Board of Directors approved a Procedure on Conflicts of Interest and Related Party Transactions, available on the Company’s website, which includes the approval of such transactions in greater detail. In this way, the aforementioned Procedure implements the provisions of the Regulations of the Board of Directors and the Internal Code of Conduct on the Securities Market of the NH Hotel Group, S.A., and aims to detail the rules to be followed in those transactions the Group performs with Directors, with people subject to rules of conflict of interest, or with major shareholders. Said Procedure establishes in detail everything relative to i) the written communication that must be submitted by shareholders or Directors regarding transactions to be performed by them or their respective Related Parties to the Secretary of the Board of Directors, who will send it to the Audit and Control Committee periodically for its review and, if necessary, to be passed along to the Board, provided that it does not fall within the pre-established criteria of cases that do not have to be submitted to the Board; and ii) the obligation of maintaining a registry of said transactions.

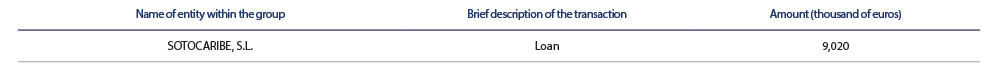

D.2 List transactions which are significant for their amount or relevant due to their subject, between the company or entities in its group, and significant shareholders of the company:

D.3 List transactions which are significant for their amount or relevant due to their subject, between the company or entities in its group, and the managers or directors of the company:

D.4 Report on the significant transactions carried out by the company with other entities belonging to the same group, provided they are not eliminated in the process of drafting the consolidated financial statements and do not form part of the Company’s normal business in relation to its purpose and conditions.

In any event, note any intragroup transaction conducted with entities established in countries or territories which are considered tax havens:

D.5 State the amount of any transactions conducted with other related parties that have not been reported m the previous sections.

D.6 Describe the mechanisms established to detect, determine and resolve possible conflicts of interest between the Company and/or its Group, and their directors, managers or major shareholders.

Article 32 of the Regulations of the Board establishes the duty of loyalty and the duty to prevent situations of conflict of interest that the Directors must comply with. Thus, the aforementioned article states that Directors must perform their duties with the loyalty of a faithful representative, operating under good faith and in the Company’s best interest. In particular, the duty of loyalty obliges Directors to:

a) Not exercise their powers for purposes other than those for which they have been conceded.

b) Keep the information, data, reports or background that they have had access to in the performance of their duty confidential, even when they have left the position, except for cases where allowed or required by the law.

c) Abstain from participating in the deliberation and voting for agreements and decisions in which they or an associate have a direct or indirect conflict of interests. Those agreements or decisions that affect their position as a Director shall be excluded from the above requirement to abstain, such as their selection or removal for positions in the administration body or others of similar significance.

d) Perform their duties under the principle of personal responsibility with freedom of criteria or judgement and independence with regard to instructions from and connections to third parties.

e) Adopt the necessary measures for avoiding situations in which his/her interests may enter into conflict with the company’s interests and with his/her responsibilities to the company.

In particular, avoiding the situations of conflict of interest referred to in the above letter e), obliges the Director to abstain from:

i) Carrying out transactions with the Company, except where they were ordinary transactions carried out under standard conditions for clients and of little importance, with these being understood to be those whose information is not necessary to express the true image of the equity, financial situation and profit and loss of the company.

ii) Using the Company name or their position as director to unduly influence the completion of private transactions.

iii) Making use of company assets, including confidential Company information, for private purposes.

iv) Exploiting the Company’s business opportunities.

v) Receiving benefits or remuneration from third parties other than the Company and its Group of associate companies while carrying out my duties, except where these were mere acts of courtesy.

vi) Carrying out activities on their own account, or for third parties, which would entail either actual or potential effective competition with the Company or which, in any other way, would place them in permanent conflict with the Company’s interests.

The above provisions shall also be applicable in the case that the beneficiary of the prohibited acts or activities is an associate of the Director, in accordance with the definition provided in article 231 LSC.

The Company may waive the prohibitions set out in this article, as established in article 230 LSC.

In any event, directors must notify the Board of Directors of any direct or indirect situation of conflict of interest that they or their associates may have with the Company. Situations of conflict of interest involving Directors will be subject to inclusion in the Annual Report.

For the purposes of the provisions of this Regulation, associates are defined as those persons referred to in Article 231 of the Revised Text of the LSC.

Additionally, on 26 March 2014 the Board of Directors approved a Procedure on Conflicts of Interest and Related Party Transactions, available on the Company’s website, which includes the approval of such transactions in greater detail. In this way, the aforementioned Procedure implements the provisions of the Regulations of the Board of Directors and the Internal Code of Conduct on the Securities Market of the NH Hotel Group, S.A., and aims to detail the rules to be followed when the Company’s interests or those of any of its Group’s companies directly or indirectly clash with a Director’s personal interests. Said Procedure establishes in detail everything relative to i) the obligation of communicating possible situations of conflict of interest to the Secretary of the Board, who will send them to the Audit and Control Committee periodically; ii) the obligation of the affected Director to abstain from attending and intervening in the phases of deliberation and voting regarding those matters in which they are involved in a conflict of interest, both in meetings of the Board of Directors as well as before any other company body, committee or board that participates in the corresponding transaction or decision, and iii) the obligation of keeping a registry of said transactions.

D.7 Is more than one company in the Group listed in Spain?

NO

E – RISK CONTROL AND MANAGEMENT SYSTEMS

E.1 Explain the scope of the company´s Risk Management System, including tax risks.

The NH Hotel Group (hereinafter Grupo NH) risk management system is applicable to all the companies over which NH has effective control.

NH’s risk management system aims to identify events that may negatively affect achievement of the objectives of the company’s strategic plan, providing the maximum level of assurance to shareholders and stakeholders and protecting the group’s revenue and reputation.

The model set up to manage risks is based on the ERM (Enterprise Risk Management) methodology and includes a set of methodologies, procedures and support tools which enable NH to:

1. Identify the most significant risks that could affect achievement of strategic objectives.

2. Analyse, measure and assess such risks depending on their probability of occurrence along with their impact, which is assessed from a financial and reputational point of view.

3. Prioritise such risks.

4. Identify measures to mitigate such risks based on the group’s risk appetite. This is firmed up by defining risk managers and setting up action plans agreed by the Management Committee.

5. Monitor mitigation measures set up for the main risks.

6. Periodically update risks and their assessment.

Such methodologies and procedures are also used in relation to tax risk management. NH Group has a Corporate Tax Strategy that forms part of the Group’s Corporate Governance System, the objective of which is to establish the values, principles and rules that must govern the Group’s activities in terms of tax, with a Tax Risk Management and Control Procedure.

E.2 Identify the company bodies responsible for creating and implementing the Risk Management System, including tax risks.

Board of Directors

The entity’s Board of Directors is responsible for overseeing the risk management system, in line with the provisions of Article 5 of the Regulation of the Board of Directors, including tax risks.

Audit and Control Committee

As regulated by paragraph 3 of article 25 b) of the Regulation of the company’s Board of Directors, the Audit and Control Committee supports the Board of Directors in supervising the effectiveness of the Company’s internal control, internal audit, if appropriate, and the risk management systems, including tax risks, in addition to discussing significant weaknesses in the internal control system detected during audit with the auditors of accounts or audit firms.

Executive Committee on Risks

NH Hotel Group set up the Executive Committee on Risks in 2017, comprising members of the Management Committee and Senior Management. Its main responsibilities are: support the periodic monitoring of risks (monitoring of action plans and KRIs – Key Risk Indicators), support initiatives and activities related to the implementation of action plans, as well as creating a culture of risks in the company. This Committee met twice in 2018.

Management Committee

The Management Committee meets weekly and is made up of the Chief Officers or heads of general management for each area. The Management Committee’s duties include, amongst others, risk management and control based on the risk appetite. Tax risk control falls to the Finance department.

Furthermore, NH has the following committees:

– Revenue Committee: In charge of monitoring revenue and defining such action plans as needed to achieve objectives based on the forecast of future demand.

– Assets Committee: Reviews the optimisation of hotel spaces, rent renegotiations and the exit plan from NH’s portfolio.

– Expansion Committee: In charge of scrutinising investment opportunities and managing risks associated with investment portfolio management.

– Investment Committee: In charge of monitoring and controlling risks related to hotel refurbishment and re-branding projects.

– Experience and Innovation Committee: In charge of monitoring the implementation of experience improvement initiatives, their results and proposing new projects.

– Pricing Committee: In charge of monitoring the implementation of pricing and revenue management strategy, its results and proposing improvements.

– Results Committee: Response for monitoring the income statement, detecting deviances and implementing measures to resolve them.

– Operating Model Committee: In charge of monitoring the implementation of the new operating model, in addition to ensuring efficiency in terms of inherent costs.

– Transformation Committee: In charge of monitoring the implementation of the Group’s transformation plan, which encompasses organisational changes to processes and systems. In charge of new projects that require systems developments.

Finance Department

The Finance Department is the department responsible for establishing the design, implementation and comprehensive monitoring of the Group’s internal Financial Reporting control system. The Corporate Tax Department forms part of the Finance Department and is responsible for designing, implementing and monitoring the Group’s Tax Risk Management.

Strategic Planning Department

The Strategic Planning Department is in charge of coordinating the definition and overseeing all strategic initiatives using Key Performance Indicators (KPIs).

Risk Function

The Risk function, which is part of the Internal Audit department, is in charge of drawing up the Corporate Risk Map, monitoring the KRI results monthly as well as the implementation status of the action plans agreed with each risk manager and their association with strategic objectives.

The risk map was updated in 2018; this was approved by the Audit and Control Committee at its meeting on 18 December 2018 and will be submitted to the Board of Directors for approval in the first quarter of 2019. In addition, action plans were defined to mitigate the main risks, as well as KRIs to carry out periodic monitoring on them, setting suitable tolerance levels for this.

Compliance Function

Since 1 January 2018, the Compliance function has been Internal Audit’s second line of independent defence. This function is responsible for disseminating and monitoring compliance with the Code of Conduct and drafting and monitoring the Criminal Risk Prevention Model, which is implemented in Spain (Business and Corporate Unit) and Italy.

E.3 State the primary risks, including tax compliance risks, and those deriving from corruption (with the scope of these risks as set out in Royal Decree Law 18/2017), to the extent that these are significant, which may affect the achievement of business objectives.

a) Financial Risks, such as fluctuation of interest rates, exchange rates, inflation, liquidity, non-compliance with financing undertakings, restrictions on financing and credit management.

b) Compliance Risks, arising from possible regulatory changes, interpretation of legislation, regulations and contracts, and non-compliance with internal and external regulations. This section would include tax, environmental, and fraud and corruption risks. It also covers Reputational Risks, arising from the company’s behaviour which negatively affects fulfilment of the expectations of one or more of its stakeholders (shareholders, customers, suppliers, employees, the environment and society in general).

c) Business Risks generated by inadequate management of procedures and resources, whether human, material or technological. This category includes the difficulty of adapting to changes in customer demands and requirements, including those resulting from External Risks caused by natural disasters, political instability or terrorist attacks.

d) Systems Risks, produced by attacks or faults in infrastructures, communications networks and applications that may affect security (physical and logical) and the integrity, availability or reliability of operational and financial information. This heading also includes business interruption risk.

e) Strategic Risks, produced by difficulty accessing markets and difficulties in asset disinvestment.

E.4 State whether the entity has risk tolerance levels, including for tax risk:

The NH Group has defined 68 KRIs for its 15 main risks which are measured monthly through a specialised risk management computer tool. Tolerance levels have been defined for each of the main KRIs. When the KRI exceeds an acceptable level of tolerance, the Risk Owner is asked to define mitigation measures to bring the level of risk back to the desired tolerance level.

For tax matters, the Group acts in line with its Corporate Tax Strategy and the Tax Risk Management and Control Procedure. On 11 November 2015, the Group approved its adherence to the Good Tax Practices Code which was approved on 20 July 2010 in the plenary session of the Large Companies Forum.

E.5 State which risks, including tax risks, have had an impact over the year.

In relation to risks which have materialised and had a negative effect on the company in 2018, the fact that a significant exposure to geopolitical risks exists must be noted. However, the company carried out a dollarisation strategy of the main contracts in local currency as well as repatriating local currency excesses that greatly contributed to mitigating the impact of the aforementioned risk. Additionally, political instability in Catalonia continued to negatively affect the company’s operations.

With the exception of those previously mentioned, no other risk materialised which had a negative impact. In any event, the Company’s risk management system has managed to identify, analyse and adequately deal with those risks which threaten compliance of the Organisation’s objectives.

E.6 Explain the response and monitoring plans for all major risks, including tax compliance risks, of the company, as well as the procedures followed by the company in order to ensure that the board of directors responds to any new challenges that arise.

The design of the response to risk takes into account the cost/benefit analysis between the impact of risk and the actions to be taken to manage it, the appetite and tolerance for risk and the strategic goals of the NH Group.

The NH Group follows an extensive coverage policy by taking out insurance policies for the risks to which it is exposed. It also has a policy of continuously reviewing this coverage.

The Strategic Planning Department oversees the achievement of strategic goals by continuously monitoring strategic initiatives and detection of new risks.

The Internal Audit Department, in carrying out its Risks function, advises the risk managers in defining response plans to mitigate the main risks and supervises their implementation.

In each of the Risk Committee’s meetings since its creation in May 2017, it has monitored the evolution of the KRIs, the degree of implementation of the risk map’s action plans as well as new risks and challenges that could affect the company and industry in the short, medium and long term.

Since November 2017, the company has had a tool to automate the identification, assessment and monitoring of risks. This tool significantly reduces the time involved in the planning and assessment of risks and controls, ensures traceability of the analysis and is the only point of information at a global level for risk management.

The Audit and Control Committee regularly carries out the following supervisory and control functions, as specified in Article 25 b) of the Regulation of the Board of Directors:

The Tax Department oversees the Group’s tax risk management. The Group has approved a Tax Risk Management and Control Procedure in order to identify and, as far as possible, mitigate any tax risk that may arise in Spain or in the countries in which the Group operates.

During the periodic risk supervision and monitoring process, as well as during the annual risk identification and assessment process, the company has the appropriate mechanisms to ensure that new risks and challenges are taken into consideration and given an appropriate response. The final result of this analysis is reflected in the corporate risk map that is submitted annually to the board of directors for approval.

F – INTERNAL RISK CONTROL AND MANAGEMENT SYSTEMS IN RELATION TO THE FINANCIAL REPORTING PROCESS (SCIIF)

Describe the mechanisms comprising the System of Internal Control over Financial Reporting (ICFR) of your company.

F.1 The company’s control environment

Report on at least the following, describing their principal features:

F.1.1 What bodies and/or areas are responsible for: (i) the existence and maintenance of an appropriate and effective financial reporting system; (ii) its implementation; (iii) its supervision.

Amongst others, the Board of Directors has the powers to determine the risk management and control policy as well as the internal information and control systems as stated in section 3 of article 5 of its governing rules. Likewise, the Board of Directors is responsible for a suitable and effective Internal Control System regarding the Group’s Financial Information which aims to provide the Group with a reasonable assurance as to the reliability of the financial information produced and published on the financial markets.

The Group’s Finance Management is responsible for the design, implementation and proper working of the SCIIF. 2018 was the first full year that the three lines of defence model has been present and operating in order to reasonably guarantee the reporting of complete and accurate financial information.

The Audit and Control Committee is responsible for monitoring the effectiveness of internal control in accordance with section b) of article 25 of the Board of Directors’ governing rules. This responsibility is in turn delegated to Internal Audit.

F.1.2 State whether the following are present, especially if they relate to the creation of financial information:

• Departments and/or mechanisms responsible for: (i) design and review of corporate structure; (ii) clear definition of lines of responsibility and authority with an adequate distribution of tasks and functions; and (iii) assurance that adequate procedures exist for proper communication throughout the entity.

Defining and reviewing the organisational structure of the Group is the responsibility of the Management Committee.

Significant changes to the organisation chart, i.e., those affecting Senior Management, are approved by the Board of Directors, after being proposed by the Appointments and Remuneration Committee. The organisation chart is available to all employees on both the Group’s intranet and its website.

Both the hierarchical and functional lines of responsibility are duly communicated to all Group employees. The internal communication channels are used for this, amongst which we highlight the intranet, executive meetings and information boards in each hotel.

In order to fulfil the objectives and responsibilities relating to maintenance and supervision of the Financial Reporting Control process, specific functions have been defined which apply to those responsible for each process involved with Financial Reporting, in order to ensure compliance with the implemented controls, analyse how well they function, and report any changes or incidents that may occur.

On an ascending scale of responsibility, this structure includes the supervisors of each process in the area of control, the directors of each business unit and the directors of each corporate area directly concerned with the processes related to the internal Financial Reporting Control System.

Within Finance Management, the Internal Control Department is entrusted with receiving information from the different individuals responsible for the process and is also responsible for ensuring correct operation of the Internal Control System.

• Code of conduct, the approval body, the degree of dissemination and instruction, included principles and values (indicating if there are specific mentions of the transactions register and the generation of financial reports), the body in charge of analysing breaches and proposing corrective actions and penalties:

The NH Group has had a Code of Conduct since 2006, whose last review was approved in June 2015. Responsibility for approving the Code of Conduct rests with the NH Group’s Board of Directors. This document affects all NH Group employees, and applies not only to employees, managers and members of the Board of Directors, but also, in certain cases, to other stakeholders, such as customers, suppliers, competitors, shareholders and the communities in which NH runs its hotels.