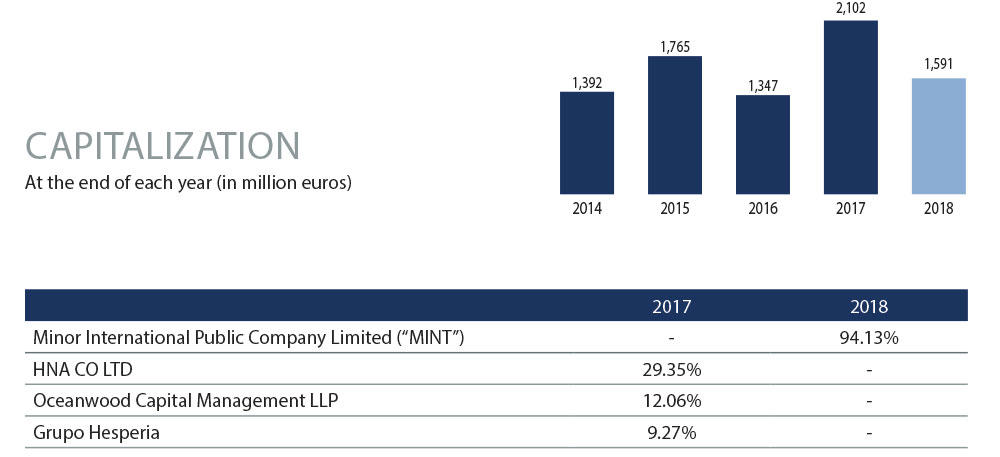

SHAREHOLDER STRUCTURE

At the end of 2018, the share capital of NH Hotel Group, S.A. was represented by 392,180,243 bearer shares with a par value of 2€ each, fully subscribed and paid up.

According to the latest notifications received by the Company and the communications sent to the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores – CNMV) before the year end, the most significant shareholders at December 31st, 2018 were as follows:

Between the months of May and September 2018, a number of different sale/purchase agreements formalized by Minor International Public Company Limited (“MINT”) as Purchaser with the HNA Group and with funds managed by Oceanwood, as Sellers, were executed. As a result of these operations, MINT acquired the Sellers’ entire shareholding in NH Hotel Group, S.A. In addition to these operations, MINT also acquired several non-significant shareholding packages, as result of which on September 30th, 2018 MINT was the holder of 179,772,214 shares in NH Hotel Group, S.A., representing 45.84% of its share capital.

Meanwhile, on June 11th, 2018, MHG International Holding (Singapore) Pte. Ltd (a company wholly owned by MINT) made a public takeover bid for 100% of the shares in NH Hotel Group, S.A., which, once it had been approved and the acceptance period initiated, was accepted by, among others, the Hesperia Group.

Following the takeover bid, the result of which was reported by the CNMV through a relevant event notice on October 26th, 2018, and following the purchase operations described above, (i) the funds managed by Oceanwood, the HNA Group and the Hesperia Group ceased to be significant shareholders of NH Hotel Group, S.A.; and (ii) MINT, through its wholly owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd, acquired shares representing 94.13% of the share capital of NH Hotel Group, S.A.

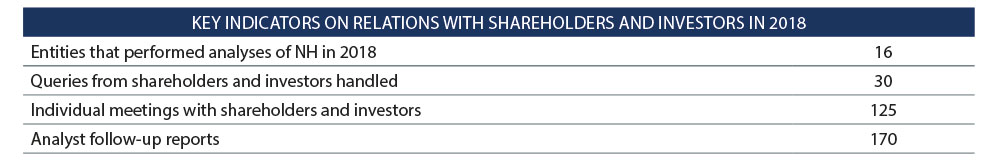

Relations with shareholders and investors

Throughout 2018 NH Hotel Group has been in permanent contact with the Company’s analysts and investors in order to meet their demands in relation to the Group’s general evolution. This contact with the market takes place through individual meetings, attendance to investors’ conferences organized by various financial institutions and individual call requests.

The Company produces consistent and transparent financial information with the aim of permitting monitoring for the analysis and valuation of the Group.

The Company produces consistent and transparent financial information with the aim of permitting monitoring for the analysis and valuation of the Group.

As a listed company, NH Hotel Group publishes quarterly results for the market. On the occasion of these quarterly publications, a conference call with the market is also carried out, attended on average by 40 participants between investors and analysts who cover the Group.

The quarterly result publications detail the following:

• KPIs and drivers of results

• Evolution by geography

• Evolution of costs

• Breakdown of cash flow and financial debt position

CORPORATE GOVERNANCE

The Corporate Governance system of NH Hotel Group is made up of the By-Laws, the Board of Directors’ Regulations, the General Shareholders’ Meeting Regulations and the Internal Regulations for Conduct on Securities Markets, as well as the other rules, codes, internal procedures and corporate policies approved by the competent bodies of the Company.

This system has been formalized in compliance with the highest standards of compliance with good practice in corporate governance, determined among others by the Good Governance Code for listed companies (the “Good Governance Code”), approved by a Resolution of the Board of the CNMV on February 18th, 2015, and which is aligned with the recommendations on good governance of international markets.

No modifications to the internal regulations of NH Hotel Group, S.A. have been approved in 2018.

Board of Directors of

NH Hotel Group

The Board of Directors is the Company’s senior management and representation body. It is empowered, within the scope of the corporate object defined in the By-Laws, to carry out any acts of administration or disposal, under any legal title, except those reserved by law or by the Company’s By-Laws to the exclusive competence of the General Shareholders’ Meeting.

Consequently, the Board of Directors is conceived basically as a supervisory and control body, while the ordinary management of the Company’s business is entrusted to the executive bodies and the management team.

However, the faculties reserved by law or by the Company’s By-Laws exclusively to the Board and other faculties necessary to exercise responsibly the Board’s basic supervision and control function may not be delegated. Thus, there are certain non-delegable powers that may not be delegated under any circumstances, such as the approval of the strategic plan, the determination of the control and risk management policy, the determination of the Company’s corporate governance policy, the approval of the financial information the Company is required to publish periodically, and the preparation of annual accounts and any other kind of report the administrative body is required by law to issue.

In relation to the companies that make up the Group, the Board of Directors of NH will establish the bases, within the legal limits, of adequate and efficient coordination between the Company and the companies that make up the Group, respecting at all times the decision-making autonomy of their management bodies and executives, according to the Company’s own corporate interest and that of each of the group companies.

For these purposes and within the limits mentioned above, the Board of Directors will implement the necessary instruments to establish adequate coordination relations based on mutual interest and, therefore, with due regard to their respective corporate interests.

The Board of Directors will discharge its duties in line with the corporate interest, which is understood to be the Company’s interest; and in this regard it will act to safeguard the Company’s long-term viability and to maximize its value, also weighing the many legitimate public or private interests involved in relation to any business activity.

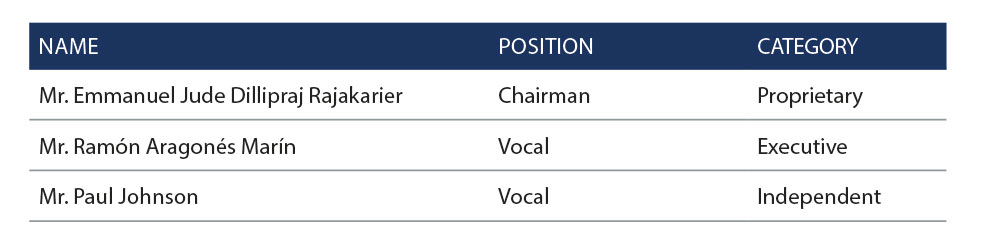

Board control commissions and committees

During 2018 the Board of Directors of NH had the following control commissions and committees:

• Delegated Commission. With general decision-making capacity and, therefore, expressly delegated to exercise all the faculties that correspond to the Board of Directors except those which, by virtue of the law or the Company’s By-Laws, may not be delegated, as well as those expressly established in the Board Regulations.

• Audit and Control Committee. Focused mainly, among other matters, on the supervision and effectiveness of the Company’s internal control, and of the process of preparing and presenting regulated financial information, ensuring the independence and effectiveness of the internal audit functions and of the

external auditor.

• Nominations, Remuneration and Corporate Governance Committee. Focused mainly on proposing the appointment of Independent Directors or reporting on the suitability of the other Directors to be appointed, as well as analyzing and evaluating everything related to matters of remuneration, both of Board members and of Senior Management, drawing up the corresponding policies. It is also responsible for supervising and controlling compliance with corporate governance rules and the corporate social responsibility policy and plan, proposing the necessary Reports to the Board.

Certain changes in the composition of the Board occurred in 2018, caused in part by the takeover bid presented on June 11th, 2018 by MHG International Holding (Singapore) Pte (a wholly owned subsidiary of Minor IPC) on 100% of the shares in NH Hotel Group, S.A. which, once it had been approved and the acceptance period initiated, was accepted by, among others, the Hesperia Group. Following the takeover bid, the result of which was reported by the CNMV through a relevant event notice on October 26th, 2018, and following the purchase operations described above, (i) the funds managed by Oceanwood, HNA Group and Hesperia Group ceased to be significant shareholders of NH Hotel Group, S.A.; and (ii) Minor IPC, through its wholly owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd, acquired shares representing 94.13% of the share capital of NH Hotel Group, S.A.

As a result of the above, Mr. Chojnacki, Mr. Heinecke and Mr. Rajakarier had access to the Board as proprietary Directors, and the Directors who represented the shareholder Grupo Inversor Hesperia, S.A., namely Mr. José Antonio Castro and Mr. Jordi Ferrer Graupera left the Board as a result of having sold in full their stake in NH.

The Board of Directors of NH Hotel Group, at its meeting held on April 10th, 2019, and following favourable Report of the Appointments, Remuneration and Corporate Governance Committee, has approved the appointment per cooptation of Ms. Beatriz Puente, current NH Executive Managing Director of Finance & Administration as Executive Director and Mr Kosin Chantikul, current Senior Vicepresident of Investment & Acquisitions at Minor Hotels as Proprietary Director representing Minor International Public Company Ltd. Both members will be ratified as Directors in the next Shareholders meeting that has been called by the Board during its meeting held the April 10th, taking place presumably on May 13th, 2019 on first call. The new Board members have been appointed covering the vacancies following the resignations of Ms Maria Grecna, Mr Paul Johnson and Mr. José María Sagardoy.

Additionally during the Board´s meeting held on April 10th, 2019 the following agreements have been approved regarding changes in the Board´s Committee:

− Audit and Control Committee: Appointment of Mr. José María Cantero de Montes-Jovellar as member of this Committee, following the resignation of Ms. María Grecna.

− Nominating, Remuneration and Corporate Governance Committee: Appointment of Mr. Alfredo Fernández Agras as member of this Committee , following the resignation of Mr. José María Sagardoy. Furthermore the members of this Committee have designated Mr. José María Cantero de Montes-Jovellar as Chairman of the Nominating, Remuneration and Corporate Governance Committee.

Composition of the Delegated Commission at December 31st, 2018:

Notwithstanding the above, at its meeting held on February 7th, 2019, the Board of Directors decided to take on the inherent duties of the Board that had been delegated to the Delegated Commission and render the aforesaid Commission inactive, all of its members having tendered their respective resignations.

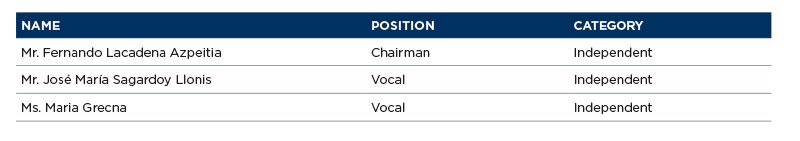

Composition of the Audit and Control Committee at December 31st, 2018:

On February 7th, 2019 the Board of Directors of NH took note of the resignation tendered by Mr. José María Sagardoy, having appointed Mr. Stephen Andrew Chojnacki as a new member of this Committee.

Composition of the Nominations, Remuneration and Corporate Governance Committee at December 31st, 2018:

In relation to the Nominations, Remuneration and Corporate Governance Committee, at December 31st, 2019 it was made up of just two members, namely Mr. José Maria Sagardoy (Chairman) and Mr. José Maria Cantero de Montes-Jovellar, following the departure of the Director Grupo Inversor Hesperia, S.A. as a member of the Committee, as a result of the takeover bid described above.

On February 7th, 2019 the Board appointed Mr. Stephen Andrew Chojnacki as a new member of the Nominations, Remuneration and Corporate Governance Committee.

Selection Policy for Director Candidates

Objective and Candidate Selection Process

On February 25th, 2016, following a favorable report issued by the Nominations, Remuneration and Corporate Governance Committee, the Board of Directors approved a Director Selection Policy which ensures that proposed appointments of Directors of the Company are based on a prior analysis of the Board’s needs. To evaluate the candidates who participate in the selection process, the procedure takes into account the skills, experience, professionalism, suitability, gender, independence, knowledge, qualities, capacities and availability of members of the Board of Directors in each moment. The Nominations, Remuneration and Corporate Governance Committee plays a relevant role in this process.

This Policy seeks to avoid discrimination and ensure that meritocracy is the governing selection principle in finding the best candidates for the Company.

Conditions that candidates must fulfill

Candidates to the post of Director of the Company must meet requisites of qualification and professional and personal honorability. In particular, they must be suitable and prestigious individuals, of recognized professional capability, competence and experience, with sufficient qualifications, training and availability for the position. Candidates must show a commitment to their role, with a personal and professional history of respect for the law and commercial good practice, and they must comply with the obligations established by law at all times in order to be part of the Board of Directors. Furthermore, they must be professionals of integrity, whose conduct and career are aligned with the ethical principles and duties established in the Company’s internal regulations, and they must share the vision and values of NH Hotel Group.

Promotion of Diversity

NH Hotel Group is convinced that diversity in all its facets, at all levels of its professional team, is an essential factor to ensure the Company’s competitiveness and a key element of its corporate governance strategy. In the candidate selection process, discrimination is avoided, and meritocracy is the principal selection criterion, in the corporate interest, with the process designed to seek the most qualified candidates.

However, and notwithstanding the above, every time a vacancy arises on the Board of Directors, and the corresponding selection process starts, at least one woman must participate as a candidate, until the target of 30% by the year 2020 is achieved.

To attain this objective, the Nominations, Remuneration and Corporate Governance Committee will ensure that the selection process does not suffer from any implicit bias that impedes the selection of female Directors and that the potential candidates include women who meet the professional profile being sought.

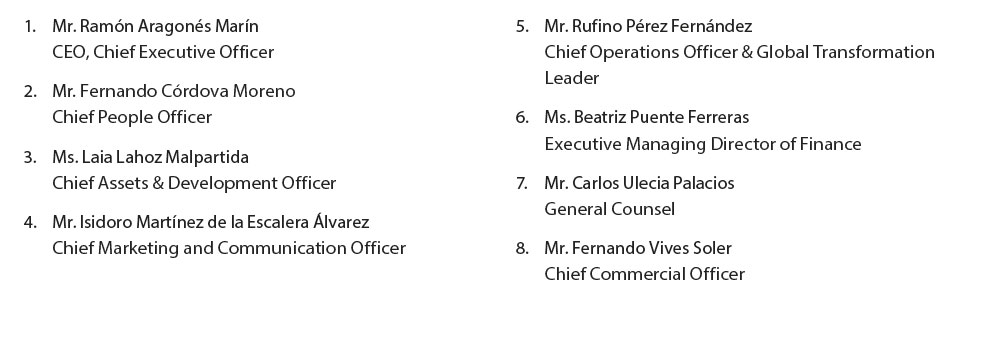

Management Committee

The NH Hotel Group Management Committee is conceived as a body that guarantees the viability of the business, seeking growth and establishing the Company’s strategic framework, developing talent and leadership.

The Management Committee meets on a weekly basis and is made up of the Chief Executive Officers and Executive Managing Directors of the different areas:

Composition of the Management Committee at December 31st, 2018

COMPLIANCE

SYSTEM

Since 2014, NH Hotel Group has promoted the Compliance function covering the following key areas:

• Code of Conduct

It determines the principles, values and rules that are to govern the conduct and behavior of each of the professionals and executives of the Group, as well as members of the governing bodies of Group companies and stakeholders working with NH Hotel Group.

• Criminal Risk Prevention Model. It describes the principles applicable to the management and prevention of crimes within NH Hotel Group and defines the structure and operation of the control and oversight bodies established within the Company, systematizing existing controls for the purpose of preventing and mitigating the risk of crime in the different areas of the Company.

• Internal Rules of Conduct. These establish the minimum standards that apply to the purchase and sale of securities, as well as to privileged and confidential information, and how such information must be handled.

• Procedure for Conflicts of Interest. It establishes the rules to be followed in situations in which the interest of the Company or of any of the Group companies come into conflict with the direct or indirect personal interest of the Directors or of any person subject to rules governing conflicts of interest.

Compliance Committee

Established in 2014, the Compliance Committee is made up of members of the Management Committee and Senior Management. It is responsible for overseeing compliance with the key areas of the Compliance System: the Internal Rules of Conduct, the Procedure for Conflicts of Interest, the Code of Conduct and the Criminal Risk Prevention Model.

The Compliance Committee oversees the management activity carried out by the Compliance Office and submits detailed reports on its activities to the Audit and Control Committee. Furthermore, it can take disciplinary measures against employees in relation to matters falling within its scope of competence.

Six meetings of the Compliance Committee were held in 2018.

Compliance Office

The Compliance Office, led by the Head of Compliance, reports directly to the Compliance Committee and is responsible for spreading awareness of and monitoring compliance with the Code of Conduct and for preparing the Criminal Risk Prevention Model, as well as handling queries regarding the Code of Conduct.

In turn, the Head of Audit is responsible for managing the confidential Whistleblowing Channel, which guarantees confidentiality in all the phases involved, as well as the absence of reprisals. The procedure is specified in detail in the Code of Conduct.

In 2018, there have been 54 reports of alleged breach of the Code of Conduct and the pertinent disciplinary measures have been imposed. Also, all 61 queries received have been answered.

Throughout 2018, the Compliance Office has completed the rationalization of the Criminal Risk Matrix for 7 countries, with the aim of providing the Company with a more efficient model. Furthermore, in 2018 implementation of a computer tool in Spain that will help with the management and audit of the Criminal Risk Prevention Model was completed.

ETHICS AND CONDUCT

The framework for ethics in NH Hotel Group is based on its Code of Conduct. Responsibility for approving the Code of Conduct lies with the Board of Directors. The most recent update of the Code was in 2015.

The Code affects all the people who work at NH Hotel Group, and is applicable not only to employees and members of the Board of Directors, but also, in certain cases, to other stakeholders such as customers, suppliers, competitors or shareholders, as well to the communities where NH operates its hotels.

The Code of Conduct summarizes the professional conduct that is expected of NH Hotel Group employees, who are committed to acting with integrity, honesty, respect and professionalism in carrying out their activities.

The NH Group is committed to complying with laws and regulations in the countries and jurisdictions where it does business. This includes, among other matters, laws and regulations on health and safety, discrimination, tax, data privacy, competition, anti-corruption, prevention of money laundering and environmental commitment. The key areas covered by the Code include:

• Commitment to people

• Commitment to customers

• Commitment by suppliers

• Commitment to competitors

• Commitment to shareholders

• Commitment to communities and society

• Commitment to the group’s assets, knowledge and resources

• Obligations in relation to fraudulent or unethical practices

• Commitment in relation to the securities market

The Code of Conduct is published in 6 different languages on the official website of NH Hotel Group, and is available to all stakeholders. Furthermore, with effect from 2017, NH employees can access the code of conduct from their mobile devices using the “My NH” app. Employees at workplaces operating under NH Hotel Group brands have also been provided with a practical Guide and a FAQ document.

Awareness of and training on the Code of Conduct

In collaboration with NH University, the Compliance Office oversees on a quarterly basis the degree of completion of courses on the Code of Conduct. Online training sessions on the Code of Conduct have continued in 2018, in an effort to ensure that all Group employees are familiar with it. Out of a total workforce of 14,411 (excluding extra labor and outside labor) at December 31st 2018, 66% of the Company’s employees have signed the Code and done the training. This figure includes the employees listed in the NH Talent tool (NH employees).

Training on the Criminal Risk Prevention Model

In addition, the Criminal Risk Prevention Model is in place in Spain. In 2018, specific training courses on criminal risk prevention have been given, also under the supervision of the Compliance Office. Taking into account that the Criminal Risk Prevention Training is intended for Top Management, Middle Management and Central Services staff (1,260 in total at December 31st 2018), 80% of the employees of work centers operating under the NH Hotel Group brands completed the training in Criminal Risk Prevention in Spain.

In Italy, 87% of employees have received training.

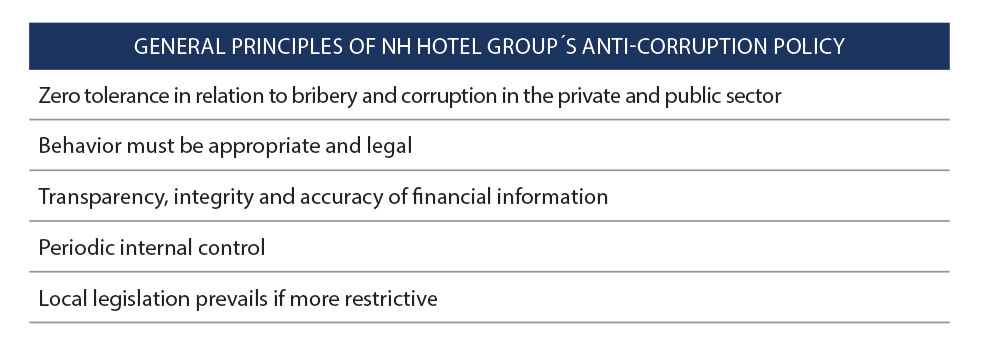

Group Anti-Corruption Policy

NH Hotel Group undertakes to work against all forms of corruption through policies and mechanisms that ensure the prevention of possible cases of corruption, bribery and money laundering within the organization.

The Company has an Anti-Corruption Policy, approved in January 2018 by the Board of Directors, the purpose of which is to protect the Company and all its representatives from criminal liability in the event that a criminal offense of corruption is committed within the Group. It is an additional element to the Criminal Risk Prevention Model as part of the Code of Conduct.

In December 2018 the Compliance Committee updated the policy to include specifically the principles of the fight against fraud. The new document will be submitted to the Board of Directors for approval during the first half

In December 2018 the Compliance Committee updated the policy to include specifically the principles of the fight against fraud. The new document will be submitted to the Board of Directors for approval during the first half

of 2019.

Fight against money laundering

The NH Hotel Group Code of Conduct reflects a commitment to respect applicable legislation on the prevention of money laundering, paying special attention to supplier evaluation and selection processes and to cash payments made and received.

The Group is also reinforcing the application of the policies approved in relation to the fight against corruption and money laundering through compulsory training courses for employees. In the first quarter of 2019, two online courses on the prevention of money laundering and on the fight against fraud will be available in 6 languages on the Company’s e-learning platform.

At the Compliance Committee meeting held in December 2018, a policy was approved that will reinforce NH Hotel Group’s commitment to the prevention of money laundering and the financing of terrorism. The aim of this measure is to prevent the Company and Group companies from being used in money laundering or terrorism financing operations.

The Policy will be submitted to the Board of Directors for approval during the first half of 2019. Once it has been approved, it will be communicated to employees and specific training on its contents will be offered.

Relations with Governments

The Company manages its business in accordance with its corporate values and its ethical and conduct framework. It also ensures strict compliance with ruling legislation in each country. At the local level, the Company always acts independently of any political party, ensuring transparency in its dealings with public and administrative institutions.

In 2018 the Company received a total of 132,088 euros in public grants, of which 89% corresponds to grants received for employee training.

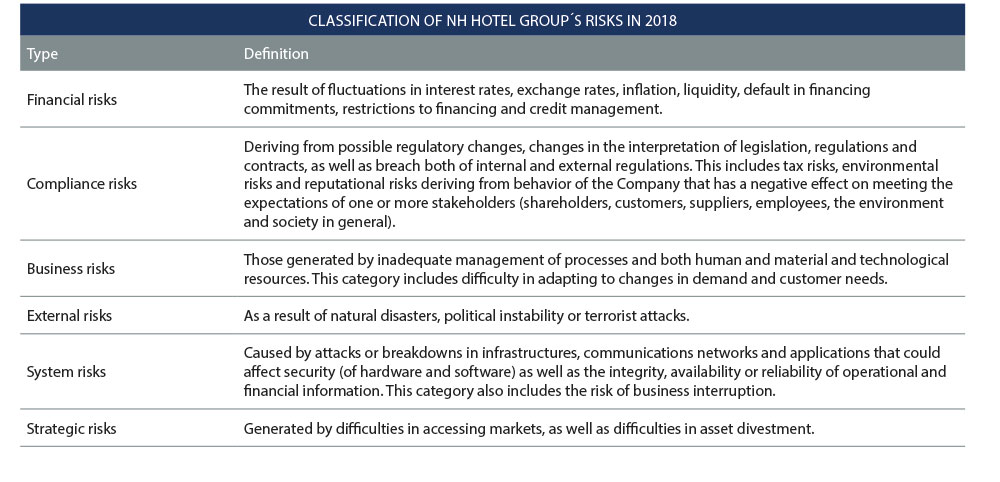

RISK MANAGEMENT

Risk management is part of the culture of NH Hotel Group and is integrated across all of the Company’s operations.

Risk Policy and Risk Map

The Company’s Risk Management and Control Policy is defined by the Board of Directors, which is also responsible for overseeing the Risk Management and Control System, through the Audit and Control Committee.

This policy was approved in 2015 by the Board of Directors, with the aim of defining the basic principles and the general framework of action for the identification and control of risks that could affect the companies over which NH Hotel Group has effective control.

In 2018 the Company updated its Risk Map through a process in which 33 senior executives defined the main risks to which the Company is exposed. This update has been validated by the Audit and Control Committee and will be submitted to the Board of Directors for approval in the first quarter of 2019.

The risks to which NH Hotel Group is exposed may be classified in the following categories:

Action plans to mitigate the impact of risks

Action plans have been implemented in 2018 to mitigate the potential impact of risks, and indicators have been established to monitor the evolution of risks periodically. For the first time, the SAP GRC risk management and compliance tool has been used, which makes it possible to reduce the time dedicated to risk planning and assessment and to collect information relating to Risk Management from the entire Company at global level.

Each of the main risks identified on the map is assigned a risk owner, who is a member of the Management Committee. Each risk owner attends meetings of the Audit Committee on a regular basis to present the measures in place or in progress to mitigate his or her risks, the implementation status of action plans and measurement of key indicators.

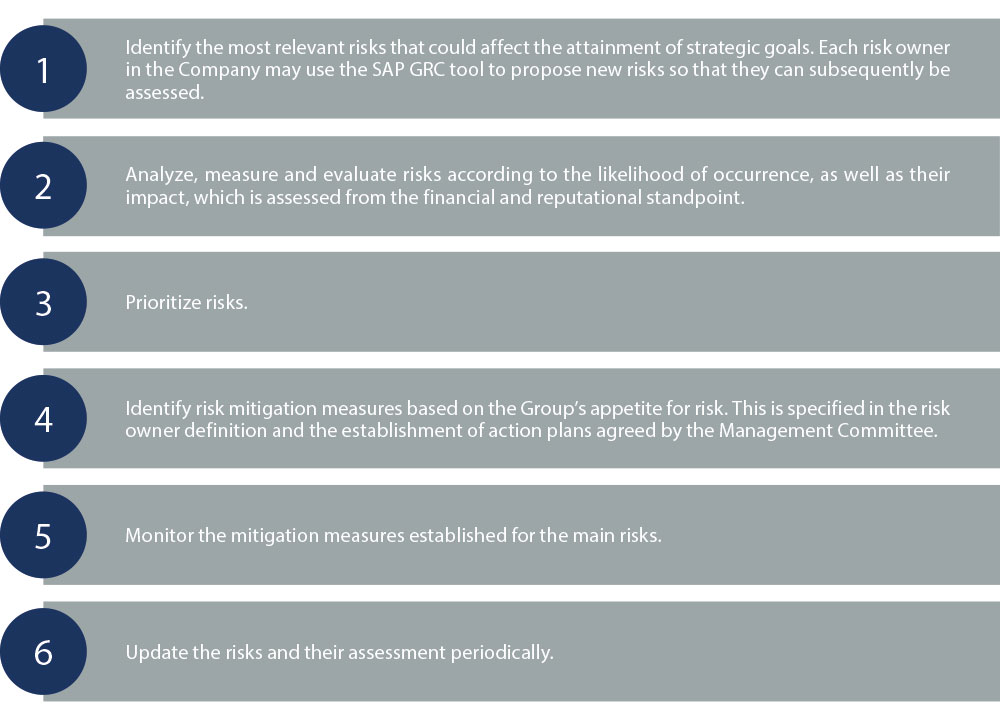

Risk Management Model

The NH Hotel Group risk management model permits the identification of events that could have a negative impact on the attainment of goals of the Company’s Strategic Plan, with the aim of obtaining the highest possible assurance for shareholders and stakeholders, while protecting the Group’s revenues and reputation.

This model is based on ERM (Enterprise Risk Management) methodologies and envisages a set of methodologies, procedures and tools that make it possible to:

The Company also has an Executive Risk Committee to support the regular monitoring of risks, the development of new initiatives and activities related to the implementation of action plans, and to create a risk culture in the Company. This Committee met twice in 2018.

DATA PROTECTION

On the occasion of the entry into effect, in May 2018, of the new data protection legislation, NH Hotel Group has carried out an analysis of the different types of personal data processing it carries out, with the aim of specifying the aspects indicated in the legislation and, where necessary, align processing with the new legal requirements. Efforts have also been made to make data processing by NH more transparent and to allow data subjects to know about it.

Thus, the different privacy policies have been updated, as well as the data protection sections of the legal notices on both websites and the documents provided to customers. NH has also implemented a series of measures that will make these privacy policies and legal notices accessible to customers at all times.

In the context of these actions, the Company has implemented an additional information system which is available to customers, so that they can know each of the types of processing carried out by NH Hotel Group.

Similarly, the position of Data Protection Officer has been created, not just to comply with the requirements of the new legislation, but also to ensure, among other functions, that customers’ rights with regard to data protection are always treated in accordance with the principles established in the new legislation.

Finally, NH has decided to continue in 2019 with its project for improvement in relation to the quality of data within the organization.