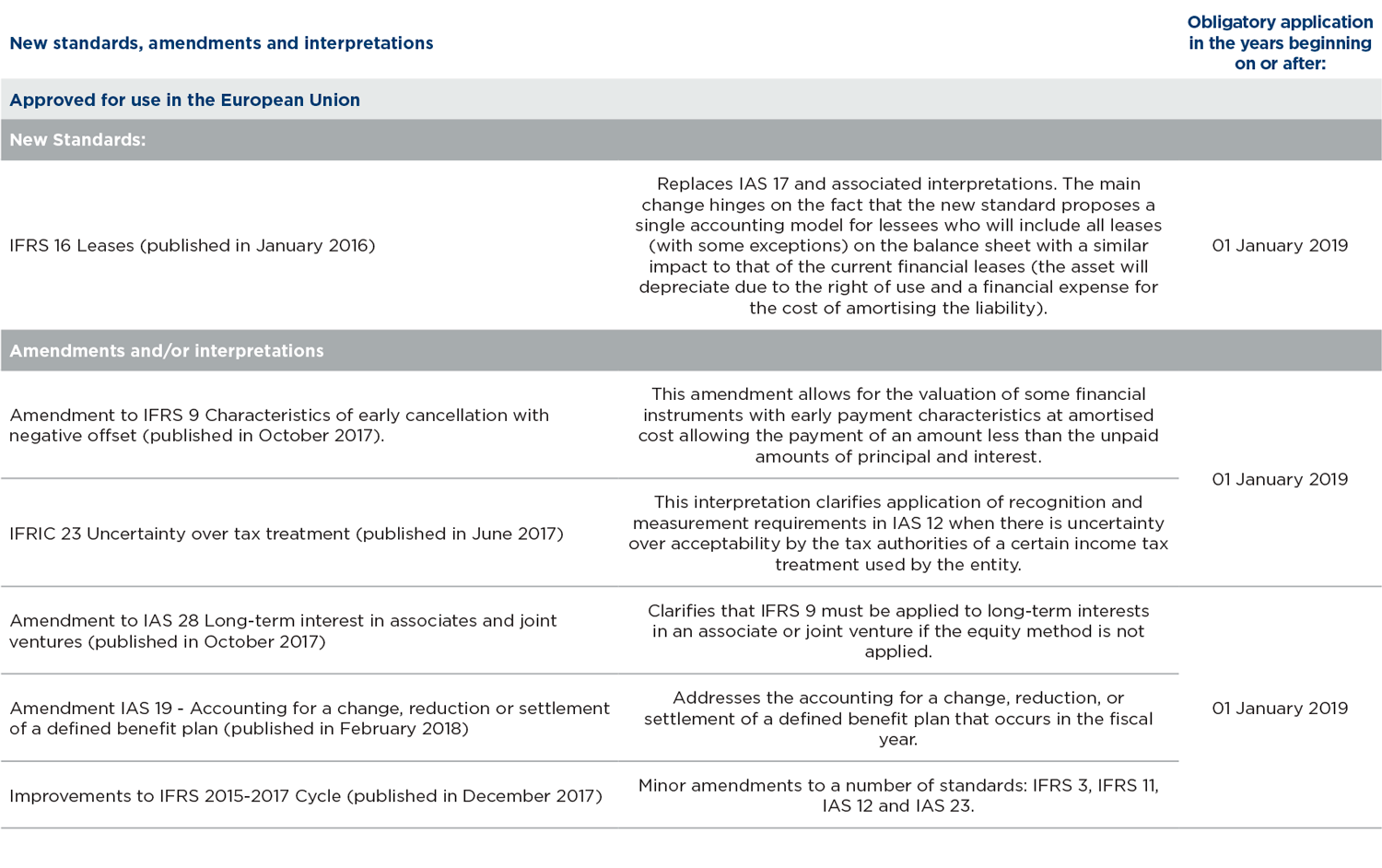

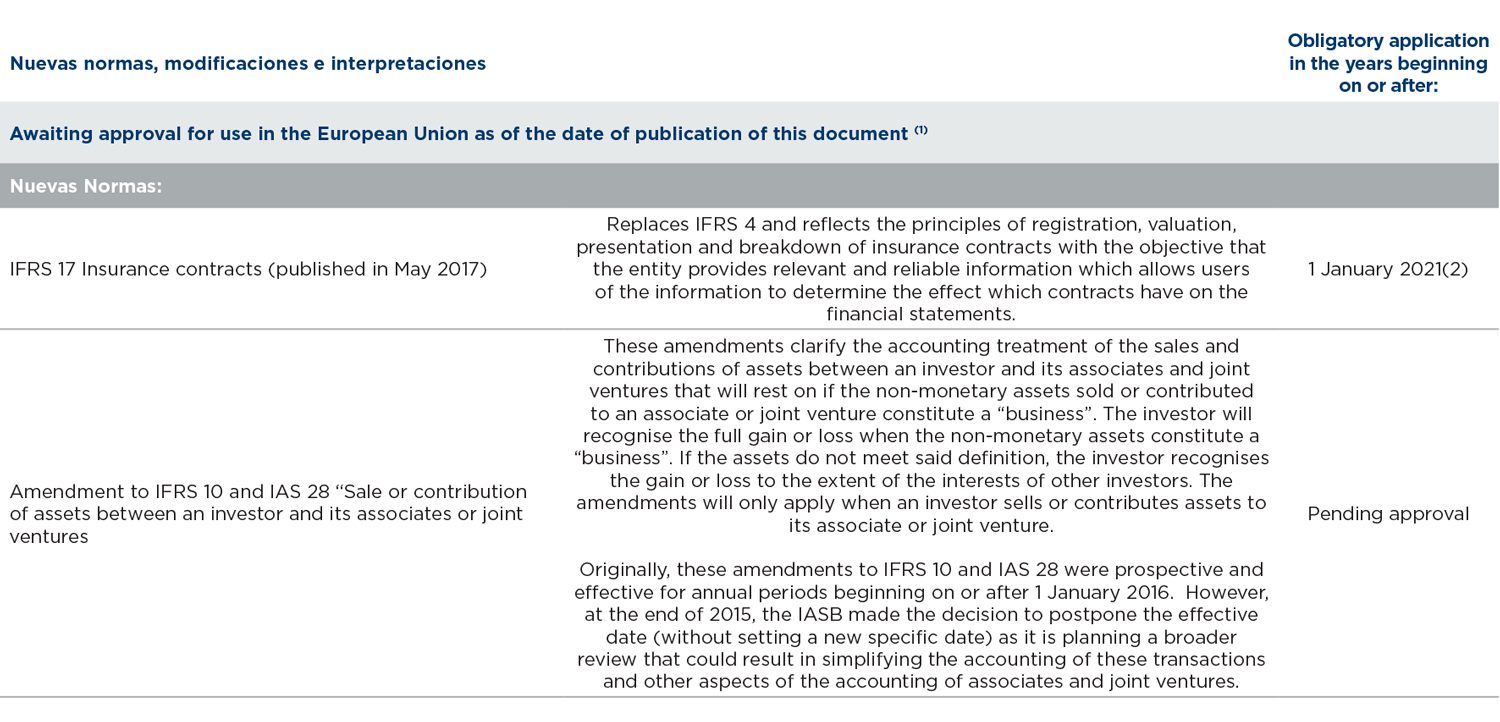

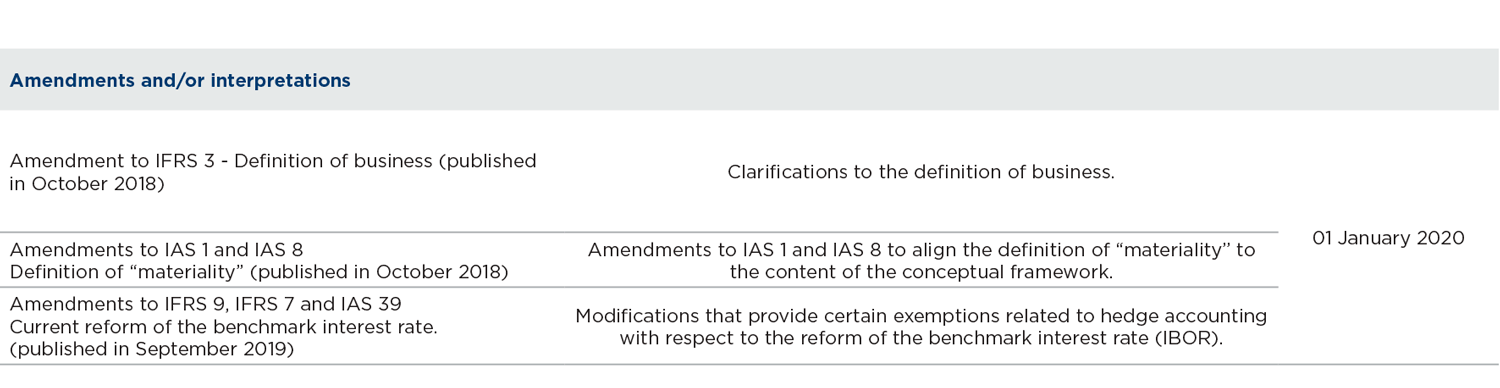

These regulations and amendments have been applied to these consolidated financial statements with no significant impacts on either the reported figures or the presentation and breakdown of the information, except for the application of IFRS 16; see breakdown of impacts in the following section:

B) Analysis of IFRS 16 first application

IFRS 16 replaces IAS 17, IFRIC 4, SIC-15 and SIC-17 and establishes the principles for the recognition, measurement, presentation and disaggregation of leases and requires lessees to account for all leases under a balance sheet recognition model similar to the accounting for finance leases under IAS 17. IFRS 16 came into force on 1 January 2019 and the Group decided not to apply it early.

The standard provides that at the inception of the lease, the lessee must record a liability equal to the present value of the lease payments. Such a liability includes fixed lease payments and those that are substantially fixed, as well as variable lease payments that depend on an index or interest rate. An asset that represents the right to use the underlying asset during the lease term (the right of use) is recognised. In the case of Grupo NH, the right of use is linked to “Buildings and Constructions”. Lessees are required to record separately the interest expense of the lease liability from the amortisation expense of the right of use.

Lessees are also required to recalculate the lease liability in certain circumstances (for example, a change in the term of the lease or a change in lease payments due to a change in the index or rate used to determine those payments). The lessee shall recognise the difference from the recalculation of the liability as an adjustment to the value of the right of use.

The lessor’s accounting under IFRS 16 is substantially the same as under IAS 17. The lessor shall continue to classify leases using the same criteria as under IAS 17 and distinguish between operating and finance leases.

Transition to IFRS 16

The Group has begun applying the standard to all contracts that were identified as leases in accordance with IAS 17 and IFRIC 4, except for the exceptions recognised by the standard. These exceptions are as follows: leases of low-value assets (e.g. computers) and short-term leases (leases for periods of less than 12 months). Also, the Group analysed the subleases signed at the transition date and, due to their amount and the applicable market conditions, were not considered relevant for the application of the standard.

The Group decided to apply the modified retrospective method as the transition method to IFRS 16, calculating the asset at the commencement date of each identified contract and the liability at the transition date, using for the calculation of both the incremental interest rate at the transition date and recognising the difference between the two items as an adjustment to the opening balance of the consolidated reserves.

In order to determine the term of the lease contracts, the Group has taken as non-cancellable the initial term of each contract, taking the possible unilateral extensions at the option of the Group only in those cases in which it has been reasonably considered certain that they will be exercised, and only the cancellation options whose exercise has been reasonably considered certain have been taken into account.

The incremental interest rate is the interest rate that the lessee would incur at the commencement of the lease if it borrowed, over a period of time, with similar guarantees and in a similar economic environment. The interest was calculated as a combination of the following elements:

- CDS curve of the economic environment

- Euribor Swap Rate Curve.

- Synthetic NH CDS curve.

These elements were combined to obtain an interest rate curve for each contract based on its geoeconomic specificities and from which the calculation process consists of bringing each of the discounted flows to the present value at the interest rate corresponding to each maturity within said curve and calculating which single equivalent rate would be used to discount said flows. The simple average rate of all the Group’s leasing contracts affected by IFRS 16 is 4.3%

The impact of IFRS 16 on the Group’s financial statements is significant due to the lease contracts portfolio.

This impact at 1 January 2019 was mainly greater right-of-use net assets for 1.747 billion euros, a greater liability for operating leases of 2.099 billion euros (1.839 billion euros of non-current liabilities and 260 million euros of current liabilities), lower early payments assets of 3 million euros, lower lease linearisation assets of 16 million euros (13 million euros in non-current assets, 3 million euros in current assets), lower lease linearisation liabilities of 19 million euros (17 million euros in other non-current liabilities, 2 million euros in other current liabilities), greater deferred tax assets of 88 million euros and lower equity of 256 million euros. It also entailed the reclassification of certain balance sheet items that were associated with lease contracts under the Right-of-use assets heading. Specifically, a liability for risk provisions and expenses on onerous contracts of 7 million euros, a liability for grants of 22 million euros and net intangible assets of 22 million euros.

The calculation of these impacts has been performed as if IFRS 16 had been applied from the inception of each contract or from the date of initial consolidation of the lessee of the contract. The calculation was made by discounting the lease flows by recalculating the asset and liability for each material modification to the lease and using an incremental interest rate calculated for each of the contracts at the transition date without taking into account the tax effect.

In order to reconcile operating lease commitments at 31 December 2018 in accordance with IAS 17 (see Note 24.5 of the 2018 consolidated annual accounts) with operating lease liabilities in accordance with IFRS 16, it would be necessary to add the commitments discounted by operating leases in accordance with IAS 17 of approximately 2 billion euros (3.581 billion euros of pre-discounted nominal value commitments), the impact of applying different discount rates (approximately 274 million euros, and subtract the impact of contracts signed but not in force at the transition date (approximately -175 million euros), thereby achieving an operating lease liability of 2.099 billion euros (1.839 billion euros of non-current liabilities and 260 million euros of current liabilities).

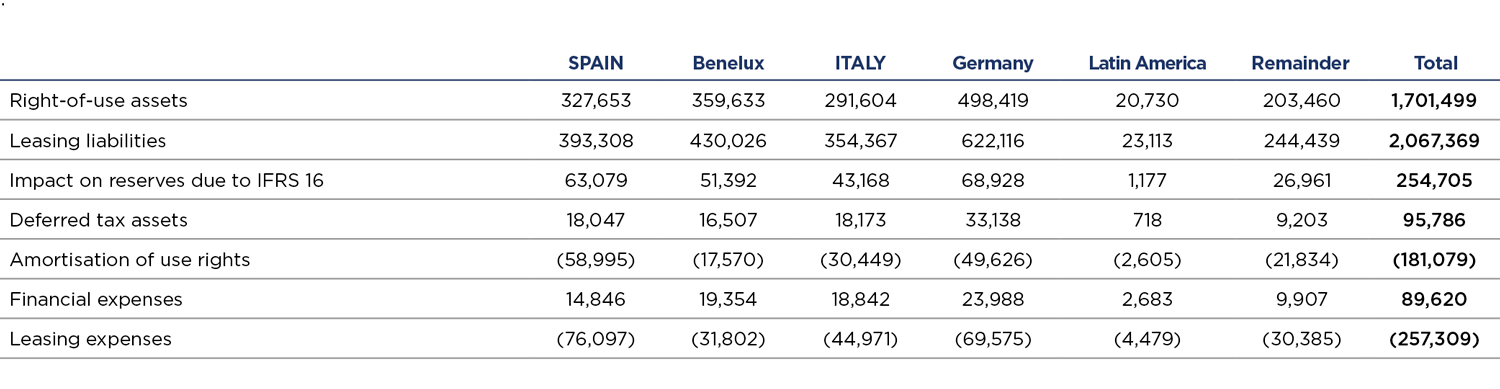

The main impacts on the Group’s consolidation, according to the source of the contracts in the hotel sector distributed by geographical segment of IFRS 16 at 31 December 2019 are as follows (thousands of euros):