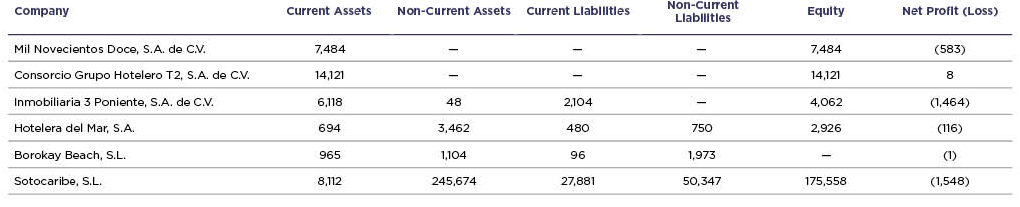

The associated companies in the year and the amount recognised on the books (in thousands of euros) are listed below:

The impact recorded on the consolidated comprehensive profit and loss statement for the financial year due to consolidation of these holdings was losses of 7,468 thousand euros (22 thousand euros in 2019), recorded under the heading “Gain/(Loss) from entities valued using the equity method”. In addition, these holdings were reduced in 2020 by 2,575 thousand euros due to the effect of the exchange differences (they increased by 714 thousand euros in 2019) and increased by other contributions of 108 thousand euros.

Specifically, a loss of 6,926 thousand euros was recorded due to the integration of the results of Sotocaribe, S.L. previously classified as available for sale (Note 16).

On the other hand, as a result of analysis of the fair value of these holdings, a reversal for impairment was recorded on the investment in Sotocaribe, S.L. for 6,926 thousand euros under the heading “Impairment on financial investments”.

The Group’s policy on holdings in associated companies consists of ceasing to book losses in these companies if the associated company’s consolidated losses attributable to the Group are equivalent to or exceed the cost of its holding in them, provided there are no additional contingencies or guarantees connected with existing losses. The holding in Kensington Hotel Value Added I, Ltd is in this situation.

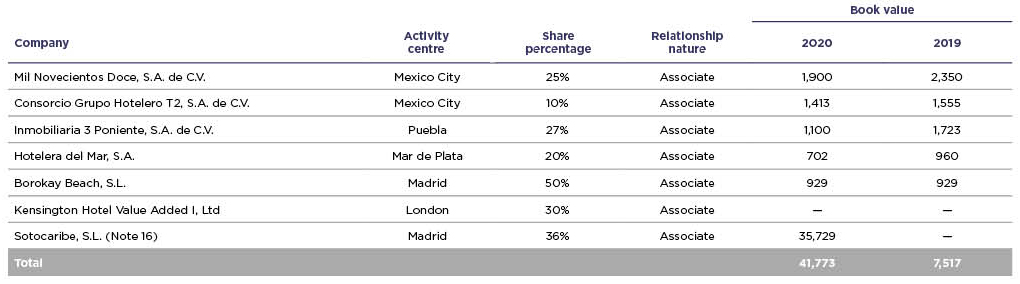

The balance sheet of these key companies accounted for using the equity method at year-end is as follows (in thousands of euros):