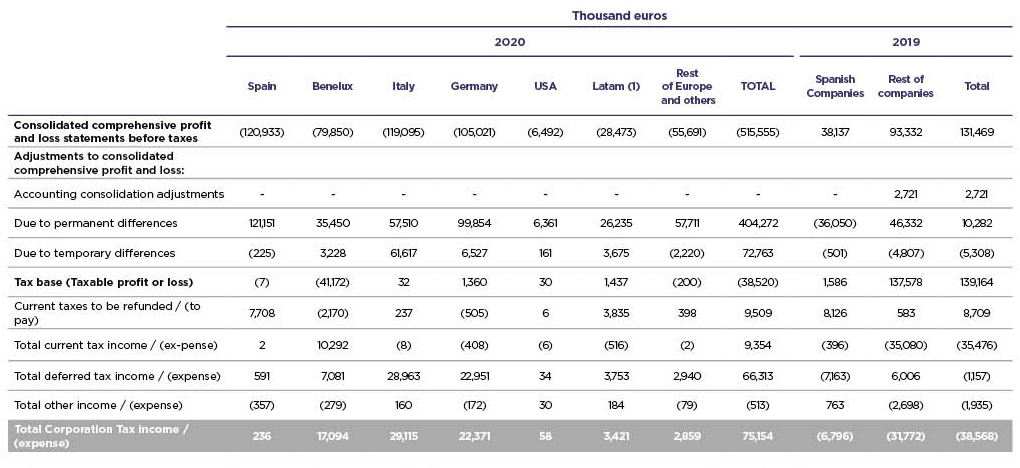

All these impacts have had an effect on the consolidated comprehensive profit and loss statements, apart from the change due to the entry into the scope of consolidation arising from the agreement reached with Boscolo Hotels to integrate eight hotels in Italy, Hungary, the Czech Republic and France into the NH Group, and some insignificant impacts that involved change to the consolidated statements of changes in equity.

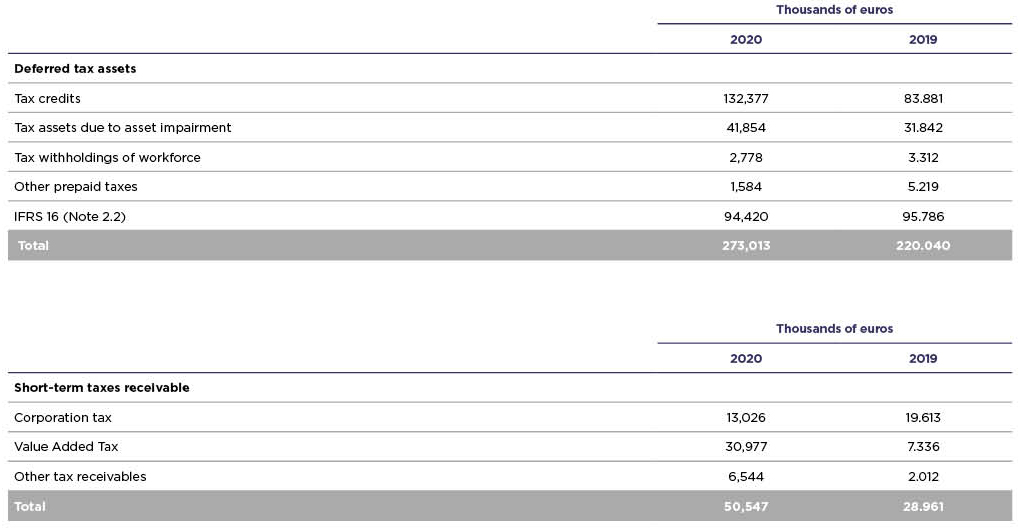

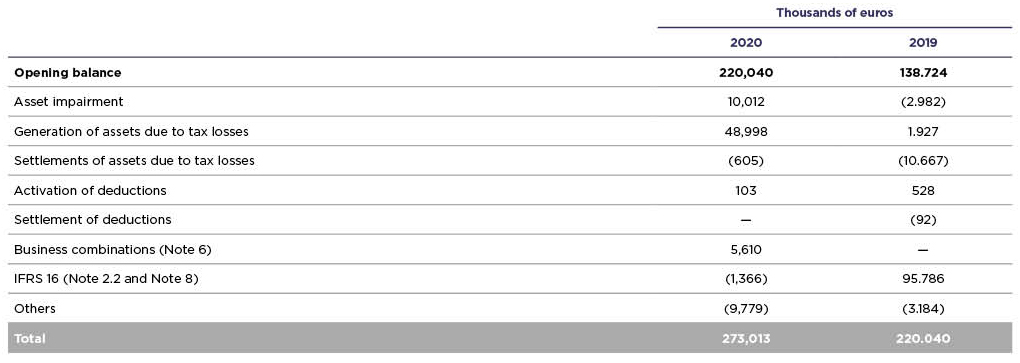

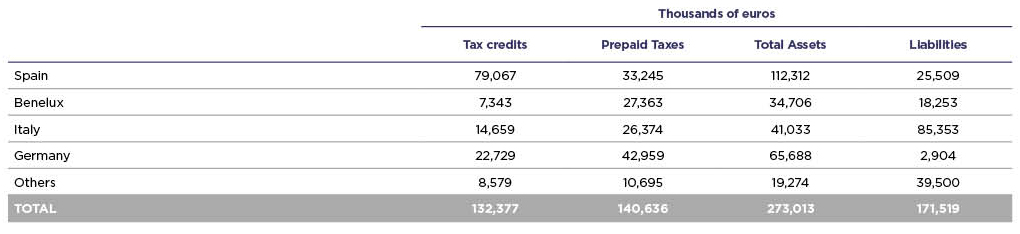

The increase in deferred tax assets is mainly due to the generation of assets due to tax losses as a result of the losses in 2020 caused by the slump in the sector due to the impact of the worldwide health crisis.

At 31 December 2020, the Group had assets resulting from tax losses and deductions amounting to 132,377 thousand euros (83,881 thousand euros in 2019). Out of the total tax credits, 79,067 thousand euros relates to credits activated in Spain. In accordance with the above, no tax credits were generated due to the loss generated in 2020 in the Spanish tax group.

In the 2020 financial year, the movement of tax credit assets was 48,496 thousand euros. The increase in tax credits was due to the activation of the loss for the financial year, mainly in Germany (20,872 thousand euros), Italy (14,659 thousand euros), Benelux (4,599 thousand euros), Portugal (3,759 thousand euros) and Latin America (3,526 thousand euros). To activate these credits, the relevant plans for tax credit recovery were prepared to support their activation. There was no additional activation of credits for tax losses in the Spanish tax group.

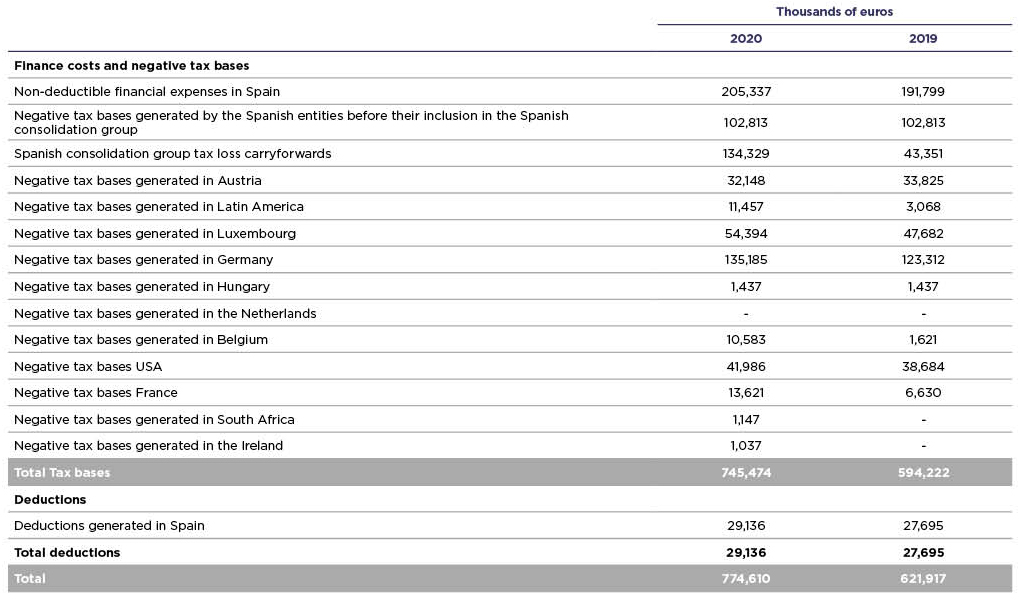

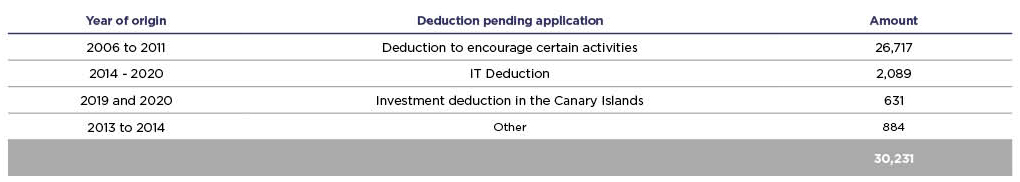

At 31 December 2020, the Group had tax loss carryforwards worth 745,474 thousand euros (594,222 thousand euros at 31 December 2019) and deductions amounting to 29,136 thousand euros (27,695 thousand euros in 2019) that had not been entered in the accompanying consolidated balance sheet because the Directors considered they did not meet accounting standard requirements. These assets are grouped as follows (base amount):