On 25 June 2013, the Company’s General Shareholders Meeting approved a long-term share-based incentive plan (“the plan”) for the NH Hotel Group SA’s executives and employees, as follows:

The plan consisted of the grant of ordinary shares of NH Hotel Group, S.A. to the beneficiaries calculated as a percentage of the fixed salary, according to their level of responsibility. The number of shares to be granted was subject to the degree of fulfilment of the following objectives:

- TSR (total shareholder return) at the end of each of the plan cycles, comparing the performance of NH Hotel Group, SA shares with the following indices:

- IBEX Medium Cap

- Dow Jones Euro Stoxx Travel & Leisure

- EBITDA, discounting the amount corresponding to rentals compared annually with the forecasts of the Company’s strategic plan.

If the minimum degree of fulfilment established in the aforementioned objectives were not achieved, the plan’s beneficiaries will not be entitled to shares under said plan.

The plan was aimed at a maximum of 100 beneficiaries. The Board of Directors, at the proposal of the CEO, may include new members in the plan.

The plan had a total duration of five years, divided into three three-year cycles.

In 2019, the third and final cycle of the first plan was settled with the delivery of 226,067 net shares at a fair value per unit of 4.55 euros. The settlement of the plan was made net of taxes.

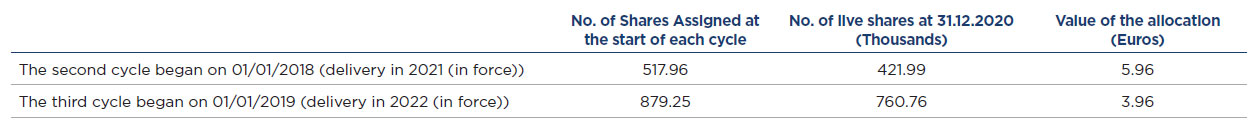

On the other hand, the 2017 Shareholders’ Meeting approved the launch of a new Long-Term Incentive Plan. This plan has a duration of five years, divided into three three-year cycles. The current cycles at 31 December 2020 are: