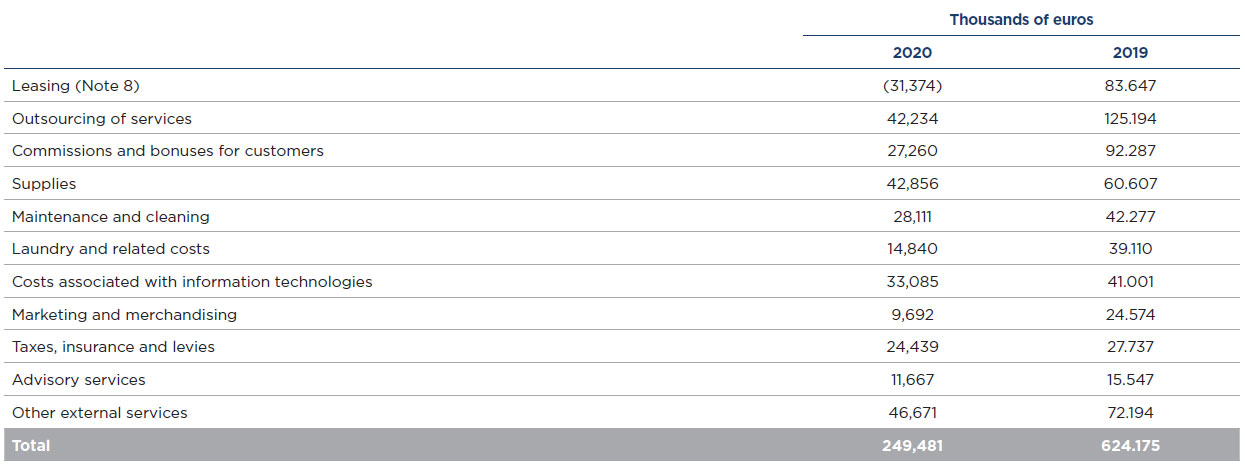

The composition of this consolidated comprehensive income heading is as follows:

The Group experienced a decrease in the level of activity of its hotel business in 2020 as a result of Covid-19. At the start of the pandemic, the Group implemented a contingency plan that includes a severe reduction in fixed and variable costs directly related to the activity level.

The high degree of uncertainty required the fixed cost structure to be minimised and operations adapted. The enormous effort in efficiency and cost control has practically covered operating costs before rentals.

The “Taxes, insurance and levies” heading includes property tax allowances or rebates received from some City Councils to offset the temporary closure of some hotels. The total amount was approximately 1,684 thousand euros.

On the other hand, during 2020, the Group managed to reach agreements with the vast majority of landlords, which has made it possible to obtain rent concessions to significantly mitigate the impact of the pandemic. In this sense, as a result of applying the IFRS 16 amendment published on 28 May 2020, the Group recorded savings of 46,195 thousand euros relating to rent concessions achieved in the aforementioned negotiations carried out as a result of Covid-19 (Note 2.2). In addition, as a result of the drop in business and renegotiations and write-offs, expenses for variable rents, as well as those which are not subject to IFRS 16, were reduced.

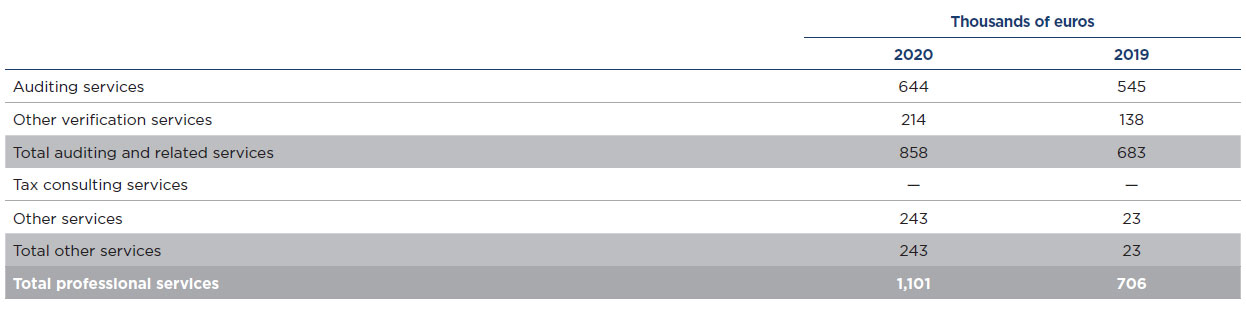

During 2020 and 2019, the fees for account auditing and other services provided by the auditor of the Group’s consolidated annual accounts and the fees for services invoiced by the entities related to it by control, shared ownership or management, were as follows:

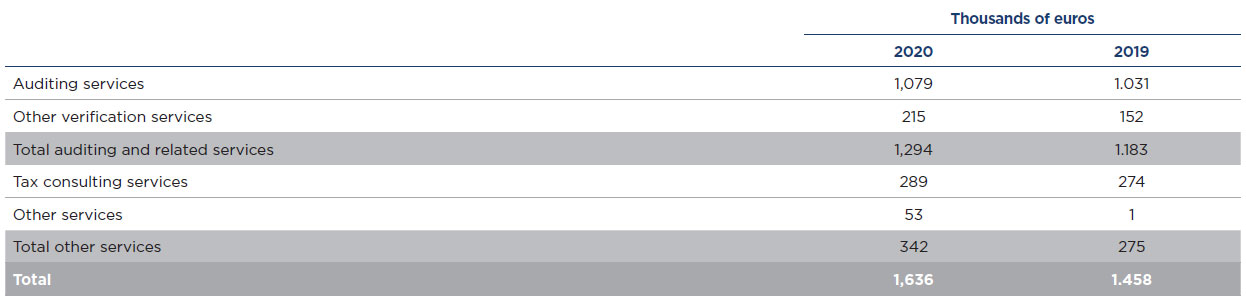

Additionally, entities associated with the international network of the consolidated annual accounts auditor have invoiced the Group for the following services:

During 2020, other auditing firms apart from the auditor of the consolidated annual accounts or entities associated with this company by control, shared ownership or management, have provided account auditing services to the companies making up the Group, for fees totalling 46 thousand euros (50 thousand euros in 2019). The fees accrued in 2020 by these firms for tax advice services were 366 thousand euros (244 thousand euros in 2019) and for other services, 54 thousand euros (80 thousand euros in 2019).