On 7 September 2020, the Group acquired 100% of the shares of the Boscolo Hotels Group, which runs eight luxury hotels in prime areas of Rome. Florence, Venice, Prague, Nice and Budapest. The Group operates through the following companies:

-

- Hungarian Opco New York Palace K.F.T.

- Italian OpCo Roco Hospitality Group, S.R.L.

- Czech Opco AGAGA, s.r.o.

The hotels are run under the variable rent with a guaranteed minimum system.

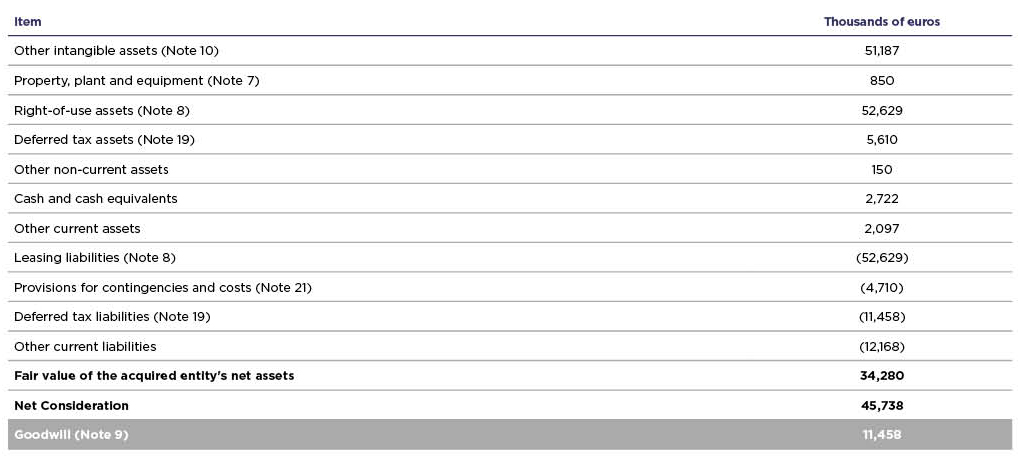

The amount of the initial consideration for the acquisition of the Boscolo Hotels Group was 50,491 thousand euros, to which 2,147 million euros was added relating to the net working capital position at the integration date. Both amounts were wholly paid up at the time of acquisition. After a subsequent review of the net working capital position and an additional agreement with the vendor, the Group recorded an account receivable with the vendor of 6,900 thousand euros, recorded under the “Other non-trade debtors” heading.

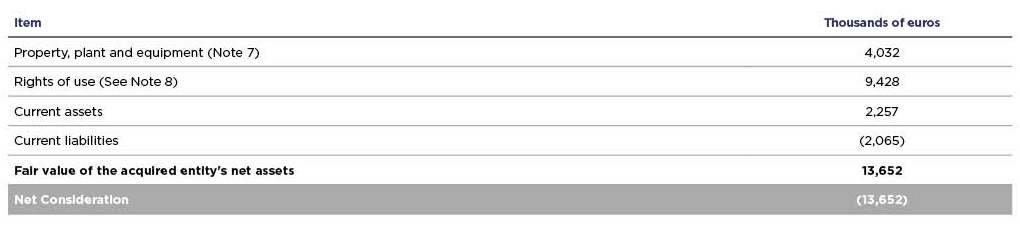

The consideration, the final fair values of the assets and liabilities identified at the time of acquisition and the final goodwill are set out below: