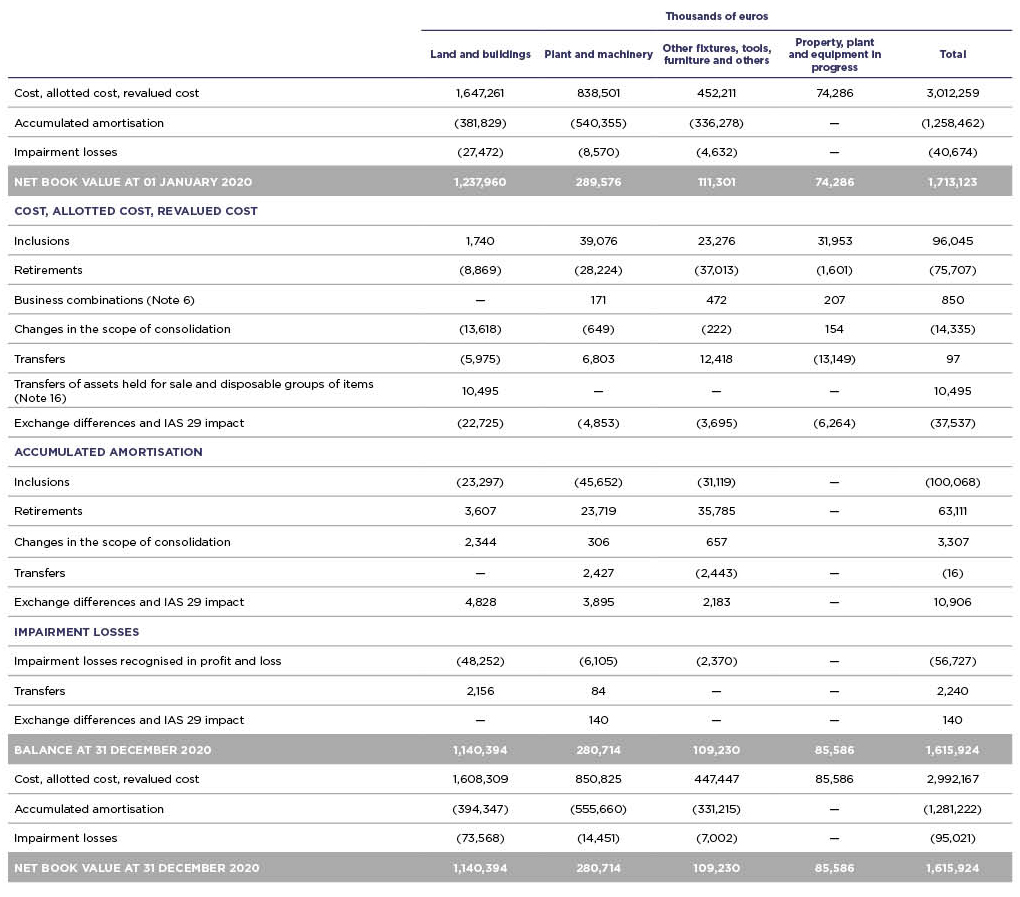

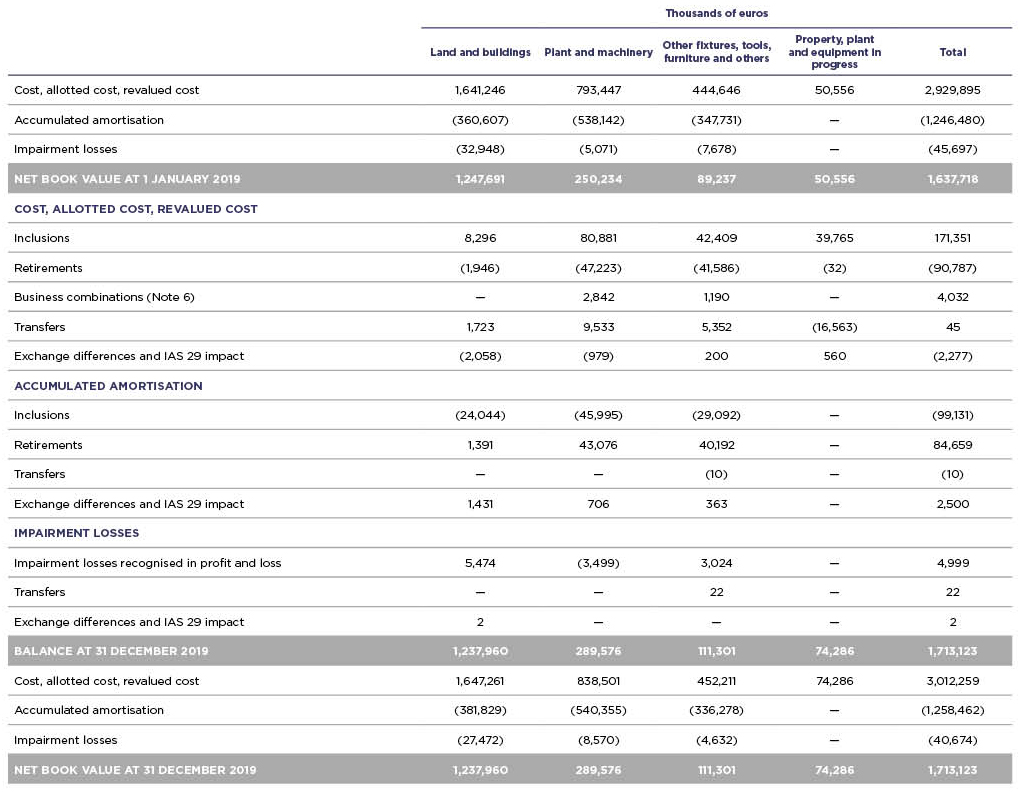

The breakdown and movements in the year were as follows (in thousands of euros):

The main additions occurring during the 2020 financial year relate to hotel refurbishment and opening new hotels. Of note is the refurbishment on the NH Sants Barcelona and NH Plaza de Armas in Spain, the renovations of the NH Napoli Panorama, NH Palermo, NH Trieste, NHC Roma Vittorio Veneto and NH Milano Touring in Italy, the refurbishment on the NH Heidelberg, NH Munchen Airport, NH Frankfurt Airport and NH Salzburg City in Central Europe, the refurbishment on the NH Conference Center Leeuwenhorst NH Amsterdam Caransa, NH Brussels Airport, NH Brussels Bloom and NH Luxembourg hotels in Benelux, and in Latin America the refurbihments of NHC Monterrey San Pedro and NH Ciudad de Santiago hotels. Finally, in New York, refurbishment of the NH New York Jolly Madison Towers.

The effect on the profit and loss account of assets de-recognised, replaced or disposed of to third parties outside the Group was a loss of 1,668 thousand euros (a loss of 4,627 thousand euros in 2019), recognised under “Profit/(loss) on the disposal of non-current assets” in the 2020 consolidated comprehensive profit and loss statement.

The net entries for the year included in the “Business combination” and “Changes in the scope of consolidation” rows come, on the one hand, from the sales of the companies Onroerend Goed Beheer Maatschappij Maas Best, B.V., owner of the NH Best hotel, and Onroerend Goed Beheer Maatschappij Bogardeind Geldrop, B.V., owner of the NH Geldrop hotel, both in Holland (Note 2.9.5), and the acquisition of the Boscolo Hotels Group comes under business combinations (Note 6).

At 31 December 2020, there were tangible fixed asset elements with a net book value of 208 million euros (232 million euros in 2019) to guarantee several mortgage loans (Note 18).

The Group has taken out insurance policies to cover any possible risks to which the different elements of its tangible fixed assets are subject, and to cover any possible claims that may be filed against it in the course of its activities. It is understood that such policies sufficiently cover the risks to which the Group is exposed.

At 31 December 2020, firm purchase undertakings amounted to 17.3 million euros. These investments will be made between 2021 and 2022 (37.8 million euros in 2019).