Group financial risk management is centralized in the Corporate Finance Division in accordance with the policies approved by the Board of Directors. This Division has put the necessary measures in place to control exposure to changes in interest and exchange rates on the basis of the Group’s structure and financial position, as well as credit and liquidity risks. If necessary, hedges are made on a case-by-case basis. The main financial risks faced by the Group’s policies are described below:

Credit risk

The Group main financial assets include cash and cash equivalents (Note 15), as well as trade and other accounts receivable (Note 14). In general terms, the Group holds its cash and cash equivalents in entities with a high credit rating and part of its trade and other accounts receivable are guaranteed by deposits, bank guarantees and advance payments by tour operators.

The Group has no significant concentration of third-party credit risk due to the diversification of its financial investments as well as to the distribution of trade risks with short collection periods among a large number of customers.

The Group has formal procedures for detecting objective evidence of impairment in trade receivables for the provision of services. As a result of these, significant delays in payment terms and the methods to be followed in estimating the impairment loss based on individual analyses are identified. Impairment of trade receivables from customers for the provision of services at 31 December 2020 amounted to 9,025 thousand euros (7,100 thousand euros at 31 December 2019) (Note 14) and customer balances not included in this provision have sufficient credit quality and, therefore, with this provision, the credit risk of these trade receivable is considered covered.

Interest rate risk

The Group’s financial assets and liabilities are exposed to fluctuations in interest rates, which may have an adverse effect on its results and cash flows. In order to mitigate this risk, the Group has established policies and has part of its debt at fixed interest rates through the issue of guaranteed convertible senior bonds. At 31 December 2020, approximately 39% of the gross borrowings was tied to fixed interest rates (excluding leasing liabilities).

In accordance with reporting requirements set forth in IFRS 7, the Group has conducted a sensitivity analysis on possible interest-rate fluctuations in the markets in which it operates, based on these requirements.

Through the sensitivity analysis, taking as a reference the outstanding amount of that financing that has variable interest, we estimated the increase in the interest that would arise in the event of a rise in the reference interest rates.

-

- If the increase in interest rates were 25 bp, the financial expense would increase by 1,544 thousand euros plus interest.

- If the increase in interest rates were 50 bp, the financial expense would increase by 3,088 thousand euros plus interest.

- If the increase in interest rates were 100 bp, the financial expense would increase by 6,176 thousand euros plus interest.

The results in equity would be similar to those recorded in the income statement but taking into account their tax effect, if any. Lastly, the long-term financial assets set out in Note 13 of this annual report are also subject to interest-rate risks.

Exchange rate risk

The Group is exposed to exchange-rate fluctuations that may affect its sales, results, equity and cash flows. These mainly arise from:

– Investments in foreign countries (essentially Mexico, Argentina, Uruguay, Colombia, Chile, Ecuador, the Dominican Republic, Brazil, Panama and the United States).

– Transactions made by Group companies operating in countries whose currency is other than the euro (essentially Mexico, Argentina, Uruguay, Colombia, Chile, Ecuador, the Dominican Republic, Venezuela, Brazil, the United States and the United Kingdom).

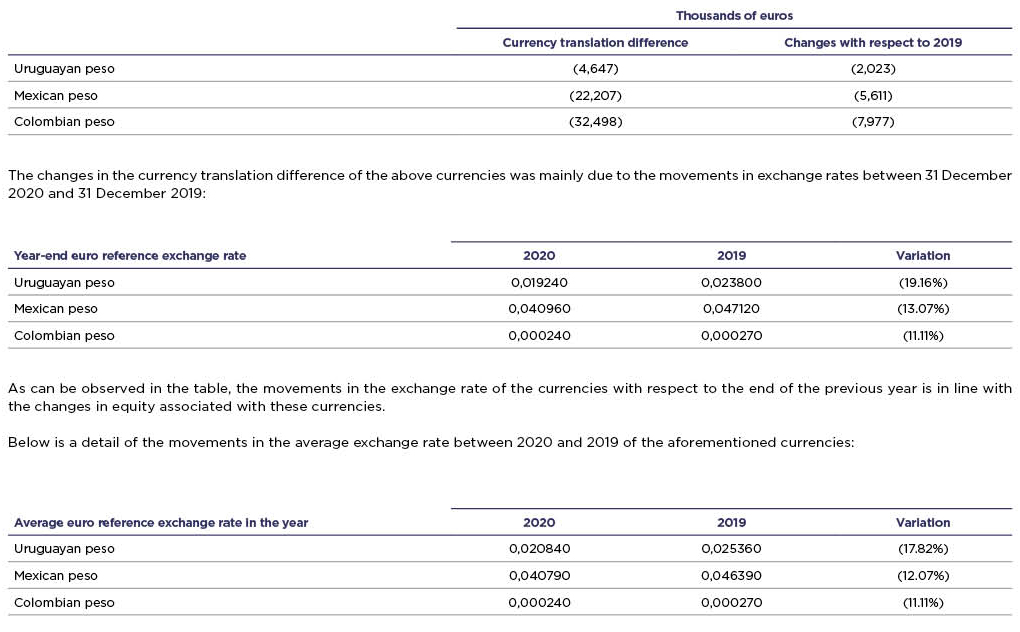

In this respect, the detail of the effect on the currency translation difference of the main currencies in 2020 was as follows: