During the year, new accounting standards came into force and were therefore taken into account when preparing the accompanying consolidated financial statements, but which did not give rise to a change in the Group’s accounting policies:

English

English Spanish

Spanish English

English Spanish

SpanishDuring the year, new accounting standards came into force and were therefore taken into account when preparing the accompanying consolidated financial statements, but which did not give rise to a change in the Group’s accounting policies:

These regulations and amendments have been applied to these consolidated financial statements with no significant impacts on either the reported figures or the presentation and breakdown of the information, except for the application of the amendment to IFRS 16. See breakdown of impacts in the following section.

On 1 January 2019, the Group began to apply IFRS 16 to all contracts that were identified as leases in accordance with IAS 17 and IFRIC 4, except for the exceptions recognised by the standard.

The Group decided to apply the modified retrospective method as the transition method to IFRS 16, calculating the asset at the commencement date of each identified contract and the liability at the transition date, using for the calculation of both the incremental interest rate at the transition date and recognising the difference between the two items as an adjustment to the opening balance of the consolidated reserves

The impact of IFRS 16 on the Group’s financial statements is significant due to the lease contract portfolio.

This impact at 1 January 2019 was mainly greater right-of-use net assets for 1.747 billion euros, a greater liability for operating leases of 2.099 billion euros (1.839 billion euros of non-current liabilities and 260 million euros of current liabilities), lower early payments assets of 3 million euros, lower lease linearisation assets of 16 million euros (13 million euros in non-current assets, 3 million euros in current assets), lower lease linearisation liabilities of 19 million euros (17 million euros in other non-current liabilities, 2 million euros in other current liabilities), greater deferred tax assets of 88 million euros and lower equity of 256 million euros. It also entailed the reclassification of certain balance sheet items that were associated with lease contracts under the Right-of-use assets heading. Specifically, a liability for risk provisions and expenses on onerous contracts of 7 million euros, a liability for grants of 22 million euros and net intangible assets of 22 million euros.

The calculation of these impacts has been performed as if IFRS 16 had been applied from the inception of each contract or from the date of initial consolidation of the lessee of the contract. The calculation was made by discounting the lease flows by recalculating the asset and liability for each material modification to the lease and using an incremental interest rate calculated for each of the contracts at the transition date without taking into account the tax effect.

On the other hand, an amendment to IFRS 16 was approved by the IASB on 28 May 2020 to help accounting for changes in leases resulting from the pandemic caused by Covid-19. The amendment establishes an exemption in which rental concessions caused by Covid-19 may not be recorded as amendments to the lease. This practical solution is applicable if certain conditions are fulfilled:

Therefore, the standard provides that the Group can, if the above requirements are met, choose to account for the contractual changes, not by recalculation of the rent but instead account for it as a change that is not considered to be an amendment by IFRS 16.

The Group has chosen to use the practical solution, by which rental concessions that comply with that set out above have generated less expenditure on rent of 46,195 thousand euros (Note 26.4).

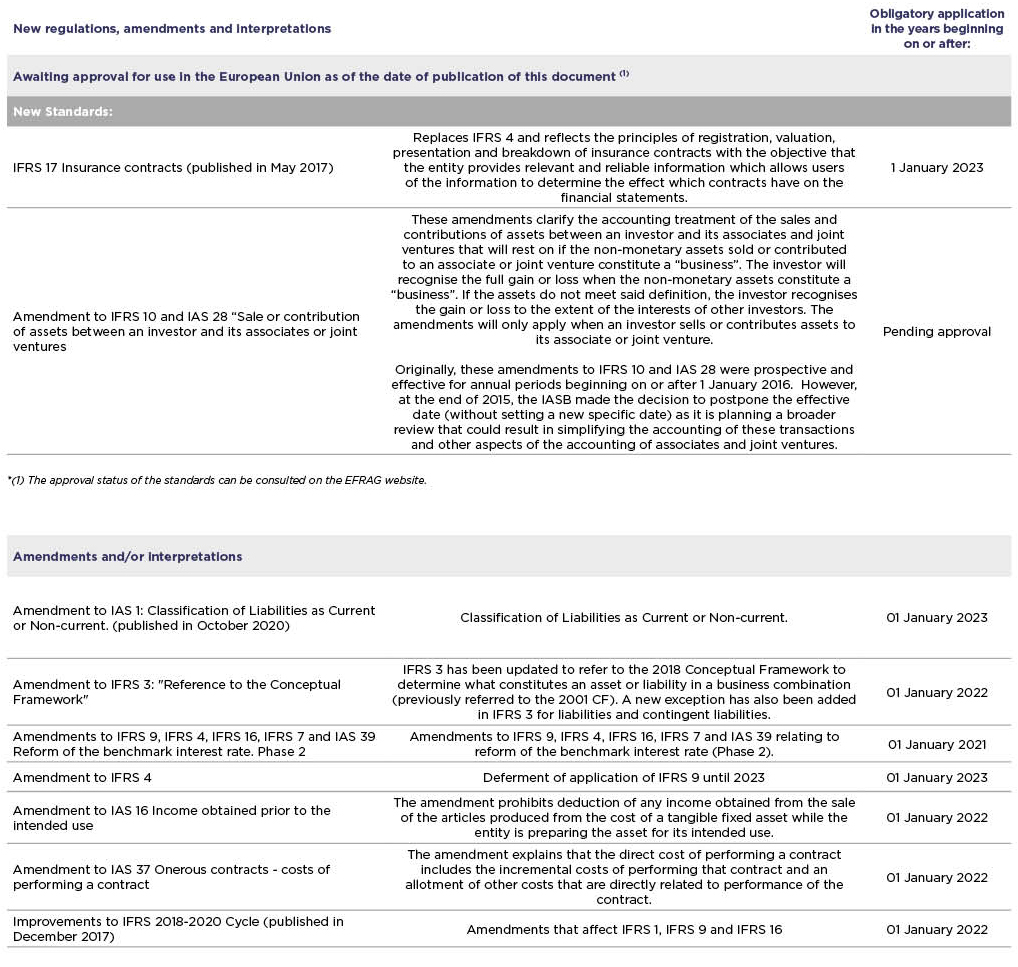

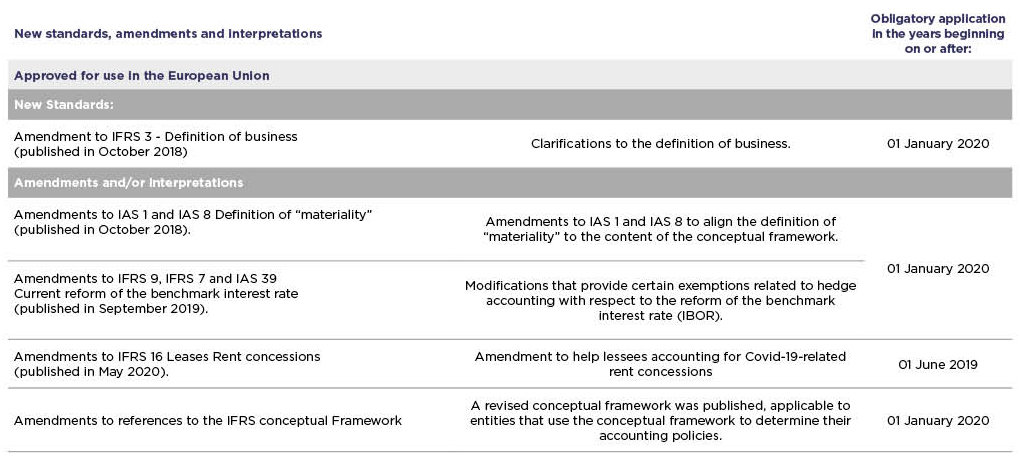

The following standards and interpretations had been published by the IASB on the date the consolidated financial statements were drawn up but had not yet entered into force, either because the date of their entry into force was subsequent to the date of these consolidated financial statements or because they had not yet been adopted by the European Union