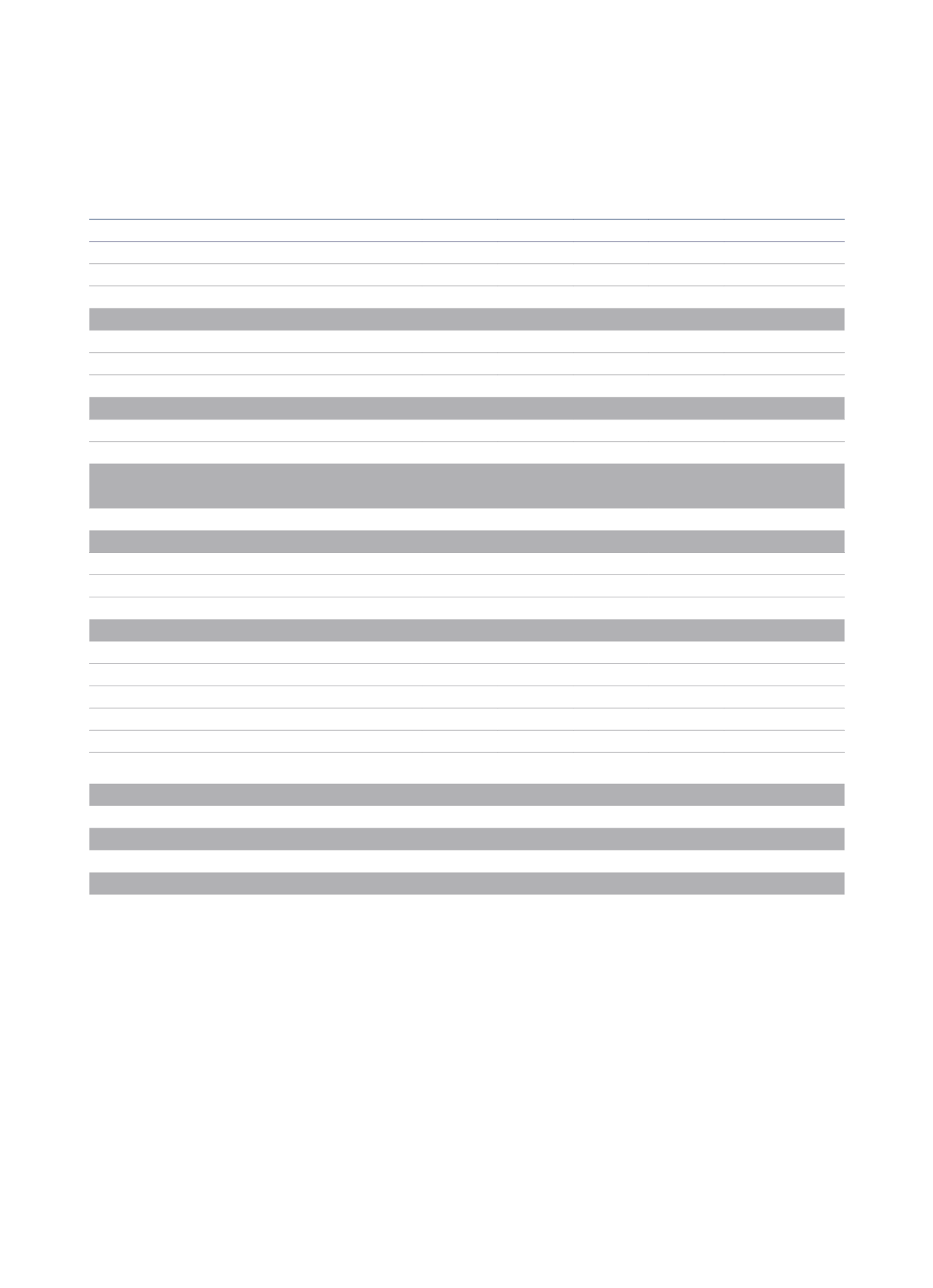

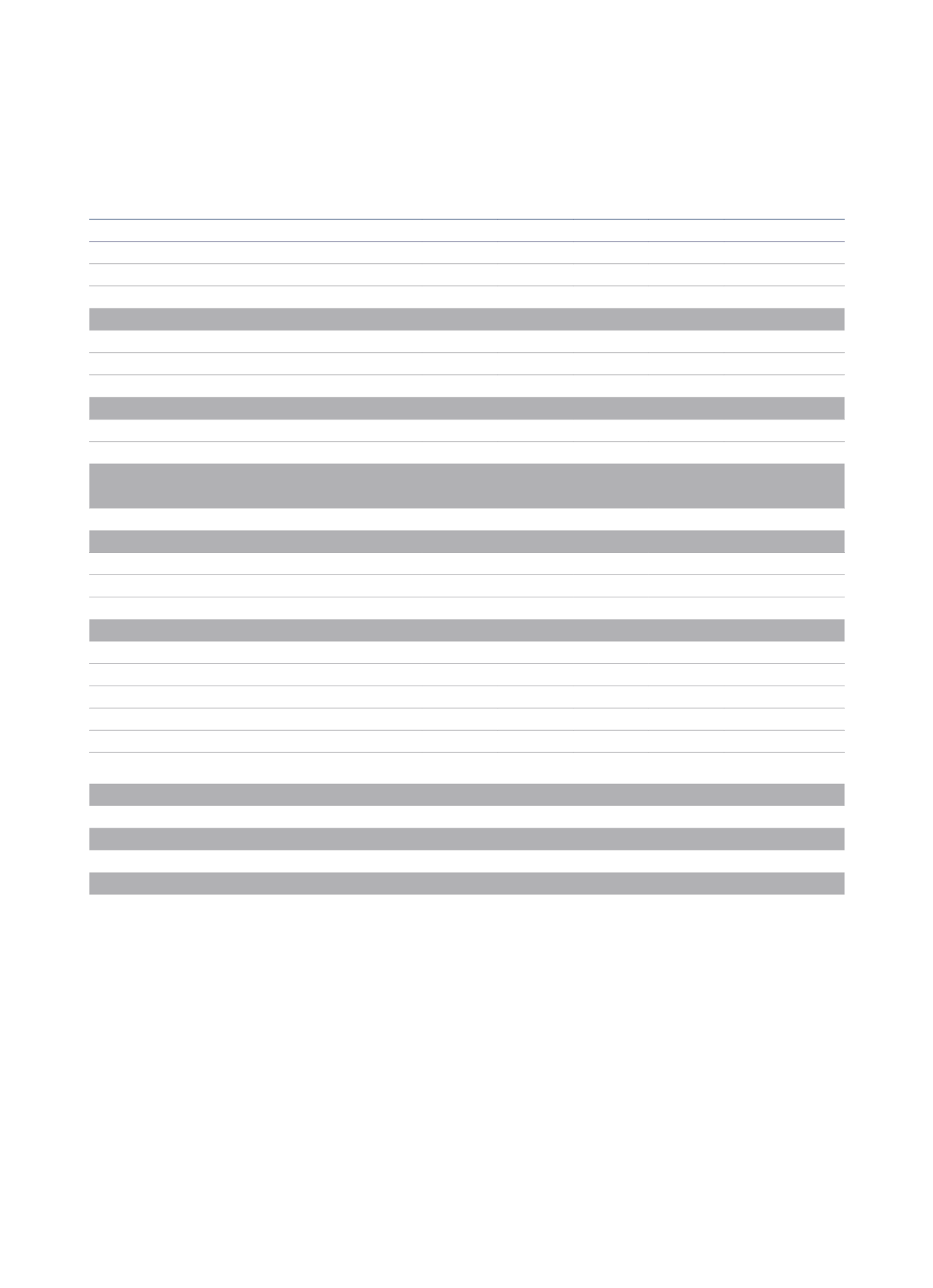

CONSOLIDATED PROFIT AND LOSS ACCOUNT (€ millions)

The Management Accounts shown below reflect the evolution of the Group’s activity based on hotel management criteria, so the groupings may not

coincide with the accounting criteria applied in the Group’s consolidated annual accounts.

It includes results for Hoteles Royal from March 2015.

NH HOTELS, S.A. INCOME STATEMENT AT 31 DECEMBER 2015

2015

2014

2015/2014

M EUR.

%

M EUR.

%

VAR. %

Recurring income

1.395.5

99.0%

1.265.1

97.7%

10.3%

Non-recurring income

14.3

1.0%

29.8

2.3%

(52.0%)

TOTAL INCOME

1.409.8

100.0%

1.294.9

100.0%

8.9%

Staff costs

(496.4)

(35.2%)

(460.0)

(35.5%)

7.9%

Direct management costs

(457.0)

(32.4%)

(413.2)

(31.9%)

10.6%

Non-recurring costs

(27.8)

(2.0%)

(24.4)

(1.9%)

13.8%

OPERATING PROFIT

428.6

30.4%

397.2

30.7%

7.9%

Leases and property tax

(292.6)

(20.8%)

(281.7)

(21.8%)

3.9%

Non-recurring leases and property tax

(4.4)

(0.3%)

(2.4)

(0.2%)

N/A

Recurring EBITDA

149.5

10.6%

110.1

8.5%

35.8%

Non Recurring EBITDA

(17.9)

(1.3%)

3.0

0.2%

(704.7%)

Reversal of provision for onerous contracts and other

10.0

0.7%

16.1

1.2%

(38.0%)

Recurring EBITDA after onerous

159.5

11.3%

126.2

9.7%

26.4%

Provision for impaired assets

31.6

2.2%

5.2

0.4%

507.1%

Depreciation

(94.8)

(6.7%)

(89.1)

(6.9%)

6.4%

Non-recurring depreciation

(21.2)

(1.5%)

(12.3)

(0.9%)

72.5%

EBIT

57.2

4.1%

32.9

2.5%

73.7%

Financial expenses

(46.6)

(3.3%)

(49.9)

(3.9%)

(6.6%)

Non-recurring finance costs

(3.5)

(0.2%)

(1.0)

N/A

258.8%

Change in fair value of financial instruments

4.7

0.3%

0.0

0.0%

-

Results of entities accounted for using the equity method

(1.1)

(0.1%)

(2.0)

(0.2%)

(46.8%)

Non-recurring results of entities accounted for using the equity

method

0.0

0.0%

(1.6)

N/A

(100.0%)

Profit (loss) for the year from discontinued operations net of tax

5.6

0.4%

33.8

2.6%

(83.4%)

EBT

16.4

1.2%

12.2

0.9%

33.9%

Corporation Tax

(13.1)

(0.9%)

(22.7)

(1.8%)

(42.4%)

PROFIT before minority interests

3.3

0.2%

(10.4)

(0.8%)

131.9%

Minority interests

(2.4)

(0.2%)

0.9

0.1%

(371.6%)

NET PROFIT

0.9

0.1%

(9.6)

(0.7%)

109.8%

10 CONSOLIDATED MANAGEMENT REPORT