13

SHARES AND SHAREHOLDERS

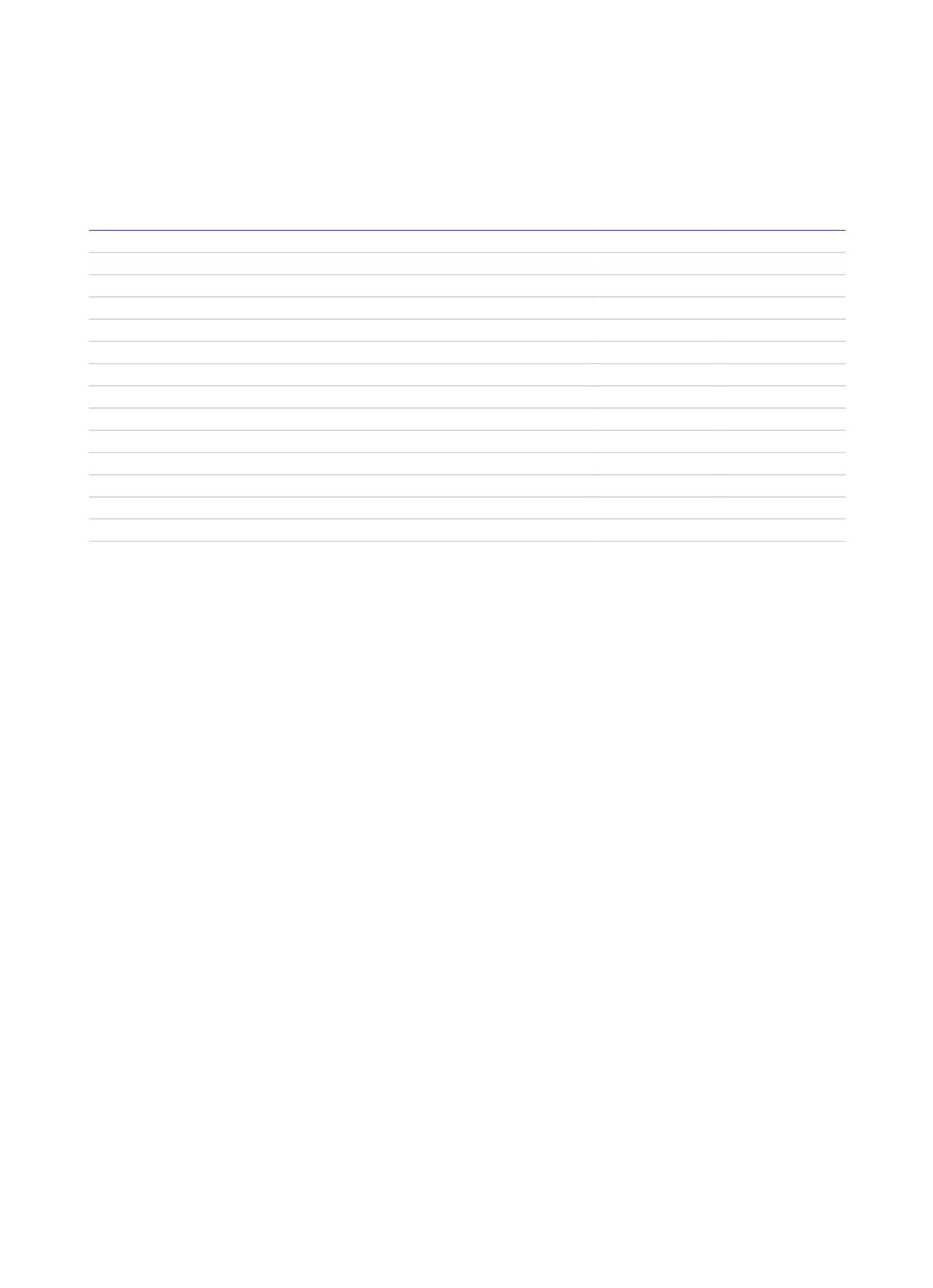

NH Hotel Group, S.A. share capital at the end of 2015 comprised 350,271,788 fully subscribed and paid up bearer shares with a par value of 2 euros each.

All these shares carry identical voting and economic rights and are traded on the Continuous Market of the Spanish Stock Exchanges.

According to the latest notifications received by the Group and the notices given to the Spanish Securities Market Commission before the end of every

financial year, the most significant shareholdings at 31 December 2015 and 2014 were as follows:

2015

2014

HNA Group Co Limited

29.50%

29.50%

Grupo Inversor Hesperia, S.A.

9.10%

9.10%

Banco Santander, S.A.

-

8.57%

Intesa Sanpaolo, S.p.A

-

7.64%

Oceanwood Capital Management LLP

7.58%

-

Henderson Global Investors LTD

4.19%

-

Schroder PLC

2.95%

-

Taube Hodson Stonex Partners LLP

2.64%

3.89%

Blackrock Inc.

2.30%

2.31%

Fidelity International Limited

0.96%

0.96%

Invesco LTD

0.66%

-

UBS Group AG

0.22%

2.01%

Treasury Share

2.57%

2.67%

Shares owned by NH employees

0.05%

0.07%

In January 2015, Intesa San Paolo through UBS Limited transferred 100% of its shares in NH Hotel Group, S.A. to a Group of accredited investors, and

therefore at the date of drafting these Annual Accounts Intesa San Paolo is no longer a Group shareholder.

The average share price of NH Hotel Group, S.A. in 2015 was 5 euros per share (4.28 euros in 2014). The lowest share price of 3.73 euros per share (3.06

euros in October 2014) was recorded in January and the highest share price of 5.97 euros per share in July (5.26 euros in March 2014). The market

capitalisation of the group at the close of 2015 stood at 1,765.37 million (1,392.33 million at the close of 2014).

At year-end, NH Hotel Group held 9,000,000 treasury shares representing 2.57% of its share capital at a total cost of EUR 37,589 thousand. On 4

November 2013, the Spanish National Securities Market Commission (CNMV) was notified of the loan of 9,000,000 of shares to the three financial

institutions involved in the placement of the bonds convertible or exchangeable for shares of NH Hotel Group, S.A. amounting to EUR 250 million. The

purpose of this loan was to allow said financial entities to offer the shares to subscribers to the bonds requesting them.

CONSOLIDATED MANAGEMENT REPORT