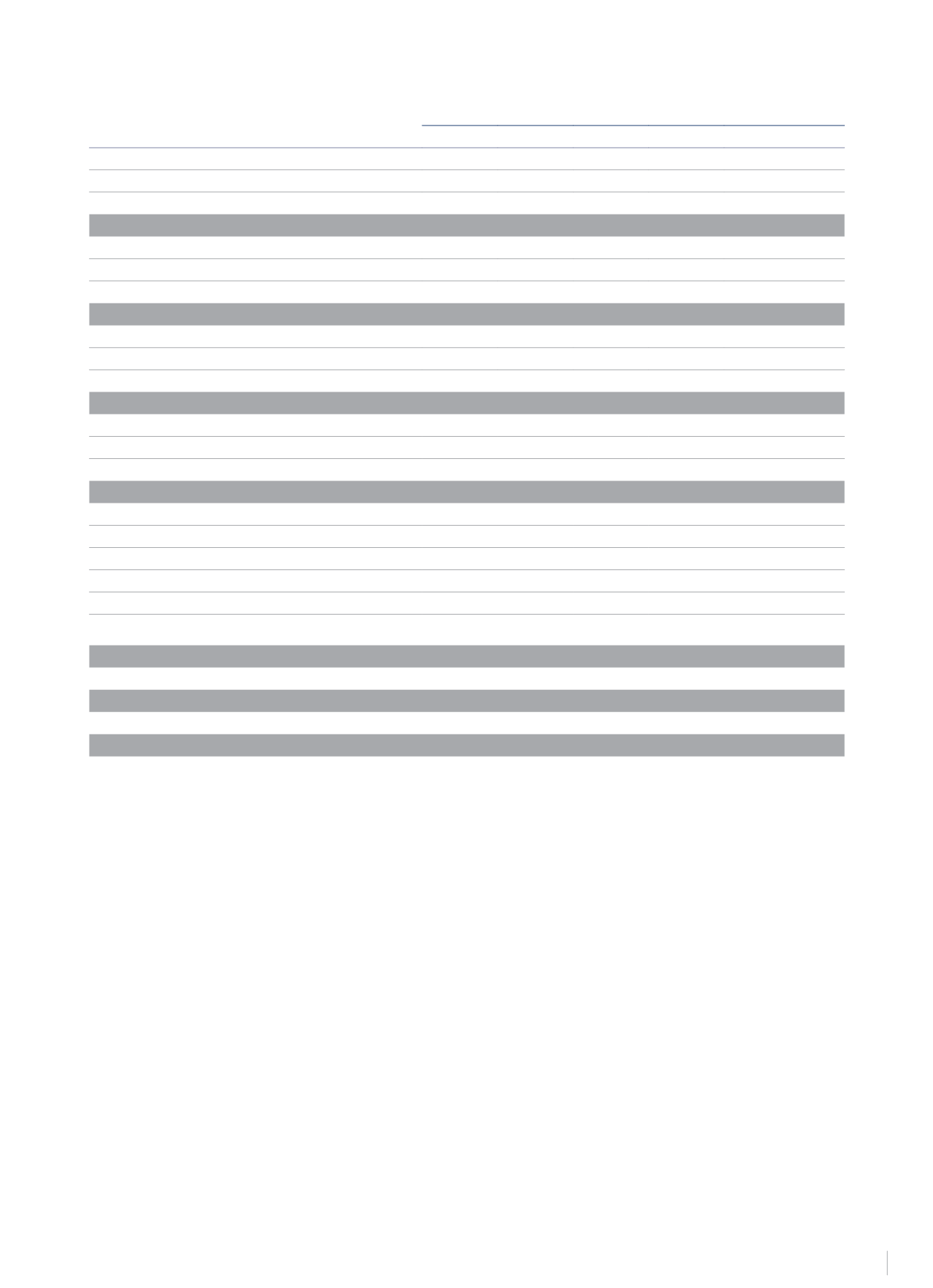

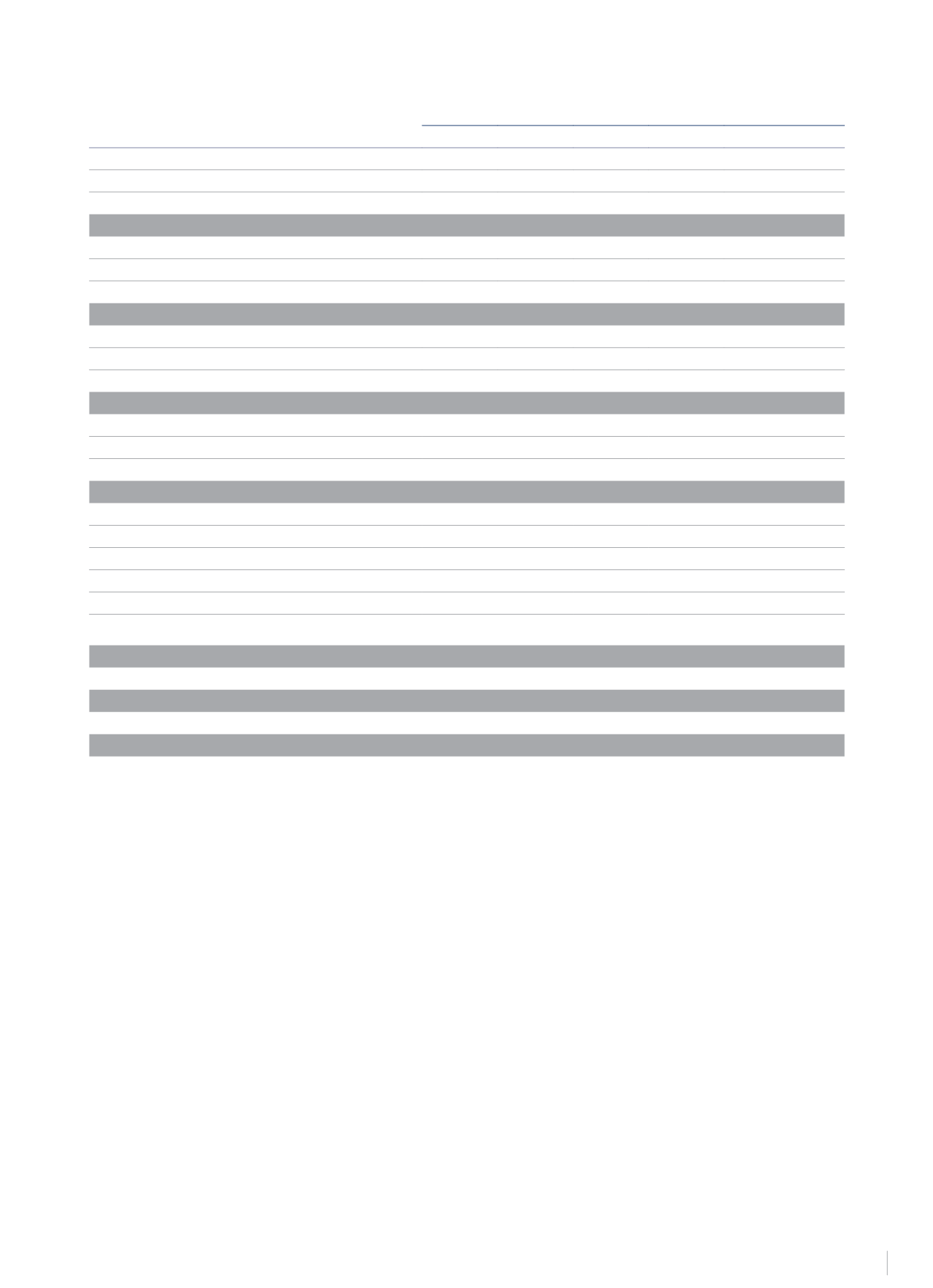

CONSOLIDATED MANAGEMENT REPORT 11

CONSOLIDATED PROFIT AND LOSS ACCOUNT (€ millions)

2014

2013*

2014/2013

€ Millions

%

€ Millions

%

VAR. %

Income from the hotel business

1,265.1

97.7%

1,252.6

96.5%

1.0%

Non-recurring income

29.8

2.3%

45.0

3.5%

(33.7%)

TOTAL INCOME

1,294.9

100.0%

1,297.6

100.0%

(0.2%)

Staff costs

(460.0)

(35.5%)

(450.0)

(34.7%)

2.2%

Direct management costs

(413.2)

(31.9%)

(404.1)

(31.1%)

2.3%

Non-recurring costs

(24.4)

(1.9%)

(22.6)

(1.7%)

8.1%

OPERATING PROFIT

397.2

30.7%

420.9

32.4%

(5.6%)

Reversal of provision for onerous contracts and other

16.1

1.2%

12.4

1.0%

30.0%

Leases and property tax

(281.7)

(21.8%)

(287.7)

(22.2%)

(2.1%)

Non-recurring leases and property tax

(2.4)

(0.2%)

(3.4)

(0.3%)

(27.9%)

EBITDA

129.1

10.0%

142.1

11.0%

(9.1%)

Provision for impaired assets

5.2

0.4%

(3.8)

(0.3%)

(236.4%)

Depreciation

(89.1)

(6.9%)

(88.9)

(6.8%)

0.3%

Non-recurring depreciation

(12.3)

(0.9%)

(11.7)

(0.9%)

4.8%

EBIT

32.9

2.5%

37.7

2.9%

(12.6%)

Financial expenses

(49.9)

(3.9%)

(57.9)

(4.5%)

(13.9%)

Non-recurring finance costs

(1.0)

(0.1%)

(11.1)

(0.9%)

(91.3%)

Non-recurring exchange differences

0.0

0.0%

7.6

0.6%

(100.0%)

Change in fair value of financial instruments

(2.0)

(0.2%)

1.9

0.1%

(207.4%)

Results of entities accounted for using the equity method

(1.6)

(0.1%)

(1.8)

(0.1%)

(12.5%)

Non-recurring results of entities accounted for using the equity

method

33.8

2.6%

(6.7)

(0.5%)

(604.3%)

EBT

12.2

0.9%

(30.4)

(2.3%)

(140.3%)

Corporation Tax

(22.7)

(1.8%)

(9.6)

(0.7%)

136.7%

PROFIT before minority interests

(10.4)

(0.8%)

(40.0)

(3.1%)

(73.9%)

Minority interests

0.9

0.1%

(1.5)

(0.1%)

(157.9%)

NET PROFIT

(9.6)

(0.7%)

(41.5)

(3.2%)

(77.0%)

Note: This consolidated income statement, on which the accounting aggregates of this Director’s Report are based, was prepared using hotel management grouping criteria that do not necessarily

coincide with the accounting principles and rules applied in the preparation of the consolidated financial statements of the NH Hotel Group. Further, the balances relating to 2014 are shown without

the retrospective application of the changes in legislation.

In 2014, NH Hotel Group obtained annual revenues amounting to €1,265.1 million, up by 1% on the previous year, representing an increase of €12.5 million.

It should be noted that this improvement is more significant when we take into account the loss of contributions from the hotels which left the scope

of consolidation last year, and the unfavourable exchange rate. If we discount these effects, revenue would have grown by 4.0% and EBITDA by 10.1%.

Operating costs increased slightly, in line with the Group’s increased activity, basic salary increases for unionised personnel in Central Europe, and the

costs associated with implementing the Strategic Plan and reinforcing operational, sales, website, revenue management and marketing personnel.

The Company was able to reduce total lease expenses by -2.1% in the twelve months of 2014 due to renegotiating agreements, mainly in Spain and

Italy, abandoning agreements with negative contributions, and offsetting increases resulting from negotiations in previous years and CPI revisions. In

the twelve months of 2014, 61 actions were carried out on leased hotels, achieving the cancellation of five leases, worth €0.7 million. These actions led

to annual savings of €10.7 million, of which approximately €6 million long-term. In the fourth quarter annualised savings of €0.8 million were achieved.

In 2014 the Group’s net interest expense was €49.9 million, a reduction of -13.9% compared to the previous year. This was largely due to the downward

trend of the Euribor, the reference interest rate for most of the Group’s variable interest rate debt, and the reduction of debt and margins due to the

refinancing of much of the Group’s debt, which was formalised in November 2013.

The change in Corporate Income Tax expense compared to 2013 corresponds to the approval of tax reform in Spain, where the tax rates applicable to

resident companies will be 28% in 2015 and 25% in 2016 and following years. Due to this regulation, the company has updated its tax credits.

In 2014, the negative result before tax of NH Hotel Group amounted to €10.4 million which, after applying corporation tax of €22.7 million, and non-

controlling interests, €0.9 million, produced net loss of €9.6 million.