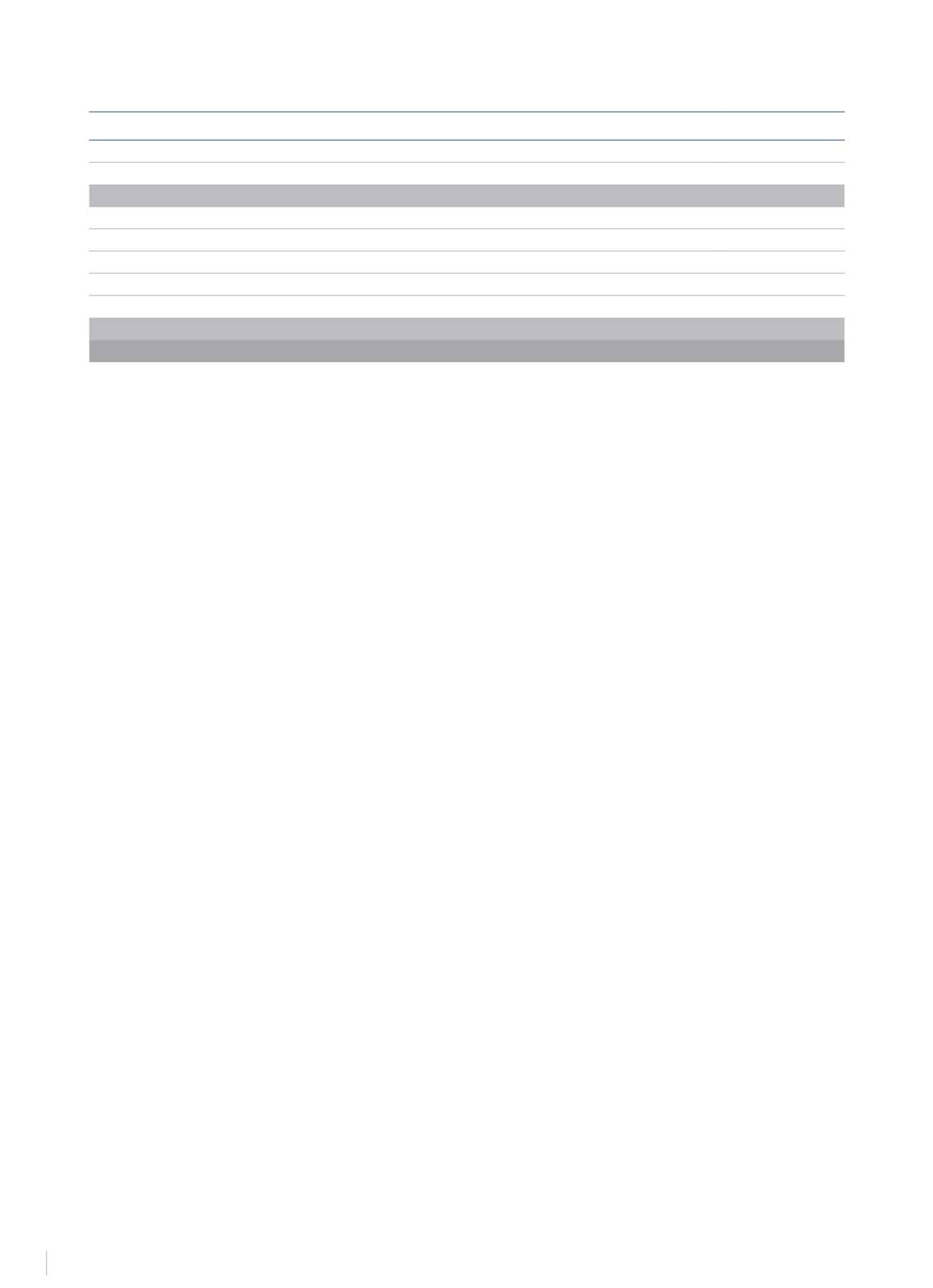

CONSOLIDATED MANAGEMENT REPORT

12

12 M 2014

(Millions of euros)

Income from the hotel business

1,265.1

Non-recurring activity

29.8

TOTAL INCOME

1,294.9

Staff costs

(460.0)

Direct management costs

(413.2)

Other non-recurring costs

(24.4)

Leases and property tax (excl. Revers. of prov. for onerous contracts and other)

(281.7)

Financial expenses

(49.9)

TOTAL COSTS

(1,229.3)

TOTAL OPERATING CASH FLOW

65.6

Reduced cash outflow related to expenses compared with the previous year (€1,252.8 million) and an increase in revenues of €12.5 million compared

with 2013 are the main components of the greater generation of cash flow from operating activities of NH Hotel Group.

OVERVIEW OF NH RISK POLICY

NH’s operations are mainly focused on the hotel industry and particularly on urban hotels, which are characterised by a relatively high level of operating

leverage that may require high levels of investment in fixed assets, especially real estate. These have a long economic cycle, which makes it necessary to

finance investments mainly through financial borrowing. The Group’s policy has always been to maintain financial orthodoxy by ensuring that solvency

ratios always remain high.

The management of the risks to which NH Hotel Group is exposed in the course of its operations is one of the basic pillars of its actions. Risk

management is aimed at preserving the value of assets and consequently the investment of the Company’s shareholders. Minimising risks and

optimising management of such risks by analysing the corresponding risk maps are among the objectives of the Group’s Management.

Financial risk management is centralised at the Corporate Finance Division. The necessary procedures have been set to monitor exposure to interest

and exchange rate variations and credit and liquidity risks on the basis of the Group’s financial position and structure and economic environment

variables.

The size of NH Hotel Group and its excellent penetration and brand recognition provide the Group with access to many expansion opportunities,

although these are selected more on the basis of rate of return and less on the need for investment, always attempting to minimise the risk inherent in

the industry in which the Group operates. The industry is characterised by economic cycles, and is therefore exposed to fluctuating prices, which the

Group has always managed to offset with occupancy.

The Group’s credit risk can mainly be attributed to commercial debts. The amounts are shown net of any provisions for insolvencies and the risk is

very low since the customer portfolio is spread among a large number of agencies and companies. Furthermore, part of the accounts receivable are

guaranteed through insurance policies, surety, guarantees and advance payments made by tour operators.

Concerning interest rate risks, the Group is exposed to fluctuations in the interest rates of its financial assets and liabilities, which may have an adverse

effect on its results and cash flows. In order to mitigate this risk, the Group has established policies and has refinanced its debt at fixed interest rates

through the issuance of convertible bonds and guaranteed convertible senior notes. At 31 December 2014, approximately 65% of the gross borrowings

was tied to fixed interest rates.

The Group has subsidiaries in several countries with operating currencies other than the euro, the Group’s currency of reference. The operating results

and financial position of these subsidiaries (mainly located in Mexico and Argentina) are recognised in their corresponding currencies and converted

later at the applicable exchange rate for their inclusion in the financial statements of NH Hotel Group. In 2014 the euro fluctuated against other major

currencies and this affected sales, equity and cash flows. In order to ensure that such risks are mitigated as much as possible, the Group takes out debt

in the same currency as the investment, always considering that the income generated in geographic areas with currencies other than the euro remains

below 7% of total income.

Regarding liquidity risks, NH Group has a suitable debt maturity calendar, which is set out in Note 16 of the Consolidated Annual Report for 2014.

The level of consolidated net financial debt at 31 December 2014, in accordance with the definition of the syndicated loan, was €807 million, representing

a decrease of €64 million in the Group’s level of borrowing compared with the previous year-end. The Group continuously evaluates the possibility of

refinancing part or all of its existing financial debt.

Maintaining the operational sources of cash flow depends on adapting the NH Hotel Group business model to the evolution of the hotel business, and

also on the sale of non-strategic assets. These variables depend on the overall economic cycle and on the markets’ short-term supply and demand

situation. The Group’s business units have the capacity to generate regular and significant cash flow from their operations. Likewise, the Group regularly

makes cash and bank forecasts, which allow it to assess its liquidity needs and fulfil the payment obligations it has undertaken without the need to

obtain funds under onerous terms and conditions.

The Group estimates that the average payment period to suppliers of operational and financial services is approximately 68 days for NH Hotel Group,

S.A. If we include all the Spanish companies of the Group the period decrease to 57 days.

INCOME STATEMENT EXCLUDING ELEMENTS THAT DO NOT REPRESENT CASH OUTFLOWS OR INFLOWS

Note: This Consolidated Statement of Cash Position was prepared using hotel management criteria that do not necessarily coincide with the accounting.