111

Exchange rate risk

The Group is exposed to exchange rate fluctuations that may affect its sales, results, equity and cash flows. These mainly arise from:

- Investments in foreign countries (essentially Mexico, Argentina, the Dominican Republic, Colombia, Panama and the United States).

- Transactions made by Group companies operating in countries whose currency is other than the euro (essentially Mexico, Argentina, the

Dominican Republic, Venezuela and the United States).

The NH Group endeavours to align its borrowings with the cash flows in the different currencies and follows the criteria of using financial derivatives

(ERS) in order to reduce the impact of the exchange rate differences.

A sensitivity analysis was performed in relation to the possible fluctuations in the exchange rates that might arise in the markets in which it

operates. For this analysis, the Group has taken into consideration fluctuations in the main currencies with which it operates other than its functional

currency (the US dollar, the Argentine peso, the Mexican peso and the Colombian peso). On the basis of this analysis, the Group considers that a 5%

depreciation in the corresponding currencies would have the following impact on equity:

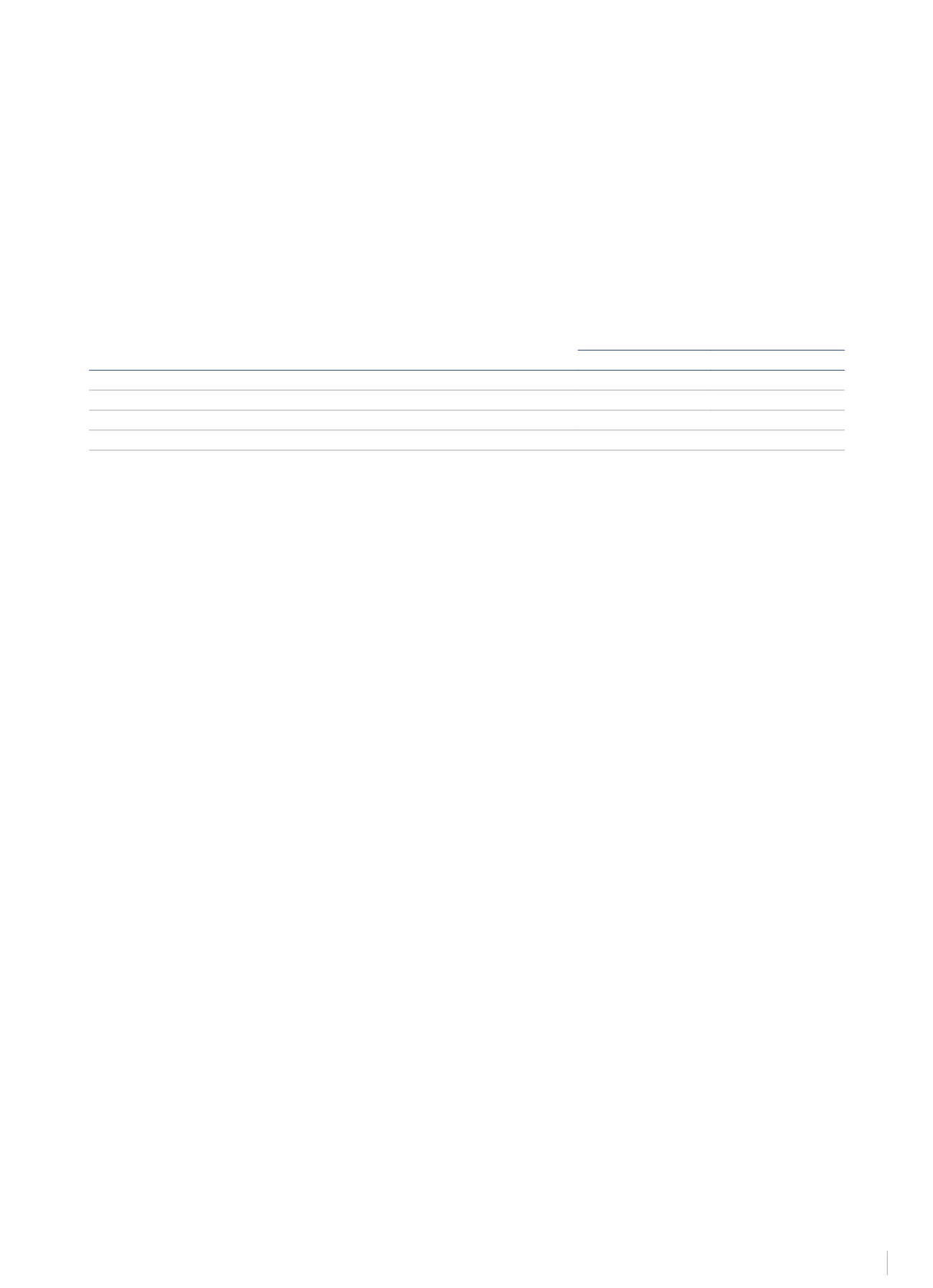

€Thousand

Equity

Profit (Loss)

US dollar

(824)

(15)

Argentine peso

(2,298)

(96)

Mexican peso

(4,681)

(217)

Colombian peso

(875)

(38)

Liquidity risk

Exposure to adverse situations in debt or capital markets could hinder or prevent the Group from meeting the financial needs required for its

operations and for implementing its Strategic Plan.

Management of this risk is focused on thoroughly monitoring the maturity schedule of the Group’s financial debt, as well as on proactive management

and maintaining credit lines that allow forecast cash needs to be met.

The Group’s liquidity position in 2014 is based on the following points:

- The group had cash and cash equivalents amounting to €200,103 thousand at 31 December 2014.

- Available undrawn credit facilities amounting to €65.6 thousand at 31 December 2014.

- The Group’s business units have the capacity to generate cash flow from their operations in a recurrent and significant manner. Cash flow from

operations in 2014 amounted to €110,100 thousand.

- The Group’s capacity to increase its financial borrowing; given that the financial leverage ratio stood at 0.53 at 31 December 2014 (see Note 15).

On 14 November 2014, the date of the sale of its stake in Sotogrande, S.A., NH Hotels Group, S.A. terminated its agreement with Banco Bilbao Vizcaya

Argentaria, S.A., signed in 2010 to increase the market liquidity and distribution of subsidiary company Sotogrande, S.A.’s shares.

Lastly, the Group makes cash flow forecasts on a systematic basis for each business unit and geographical area in order to assess their needs. This

Group liquidity policy ensures payment undertakings are fulfilled without having to request funds at onerous conditions and allows its liquidity

position to be monitored on a continuous basis.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS