103

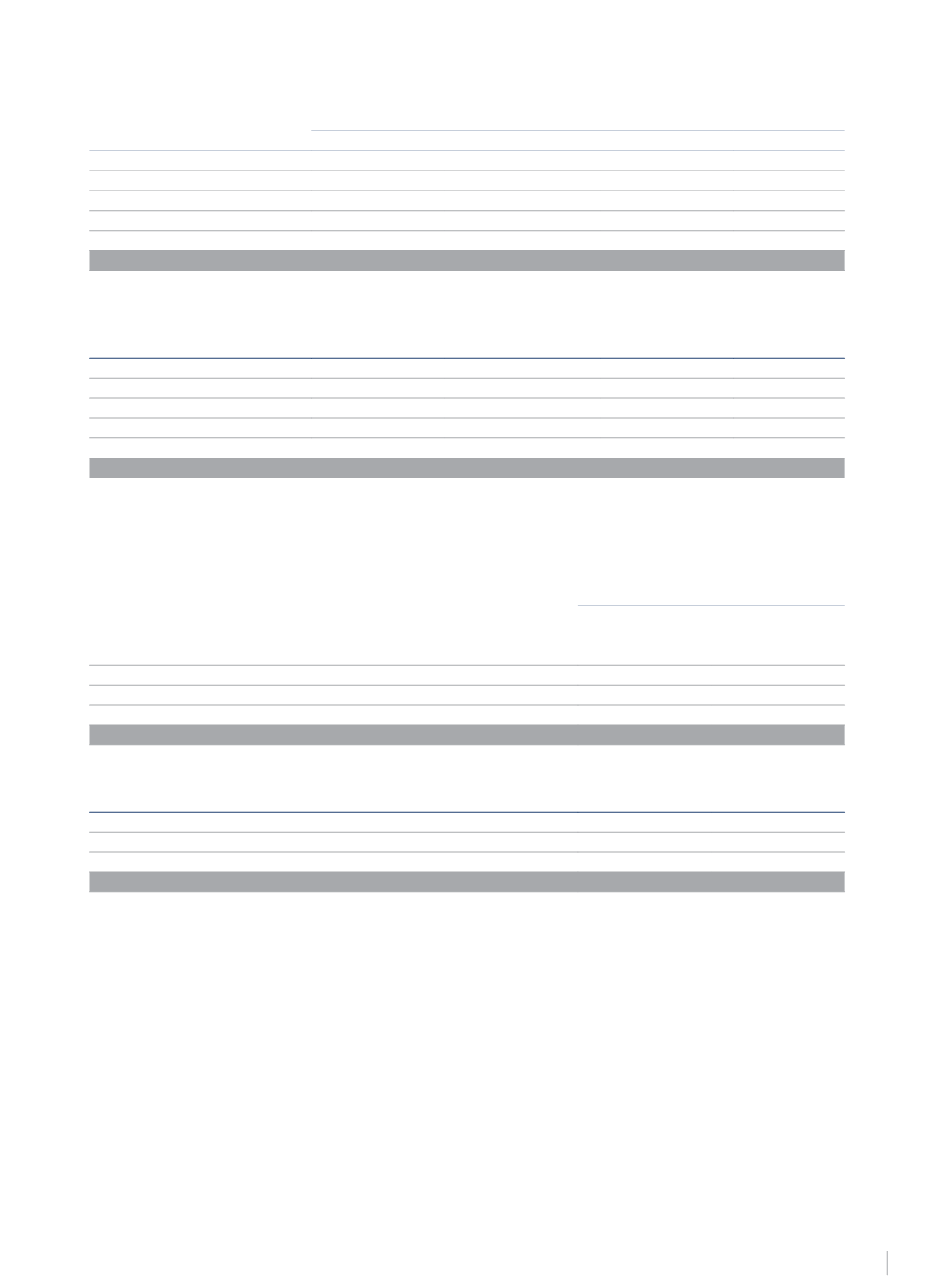

The breakdown, by business units, of the current value of the rental payments at 31 December 2014 is as follows:

Less than one year

Between two and five years

More than five years

Total

Spain

80,742

317,450

159,043

557,235

Germany and Central Europe

109,344

414,517

305,619

829,480

Italy

40,692

129,258

59,275

229,225

Benelux

44,678

187,027

297,347

529,052

Latin America

3,219

5,572

2,765

11,556

Total

278,675

1,053,824

824,049

2,156,548

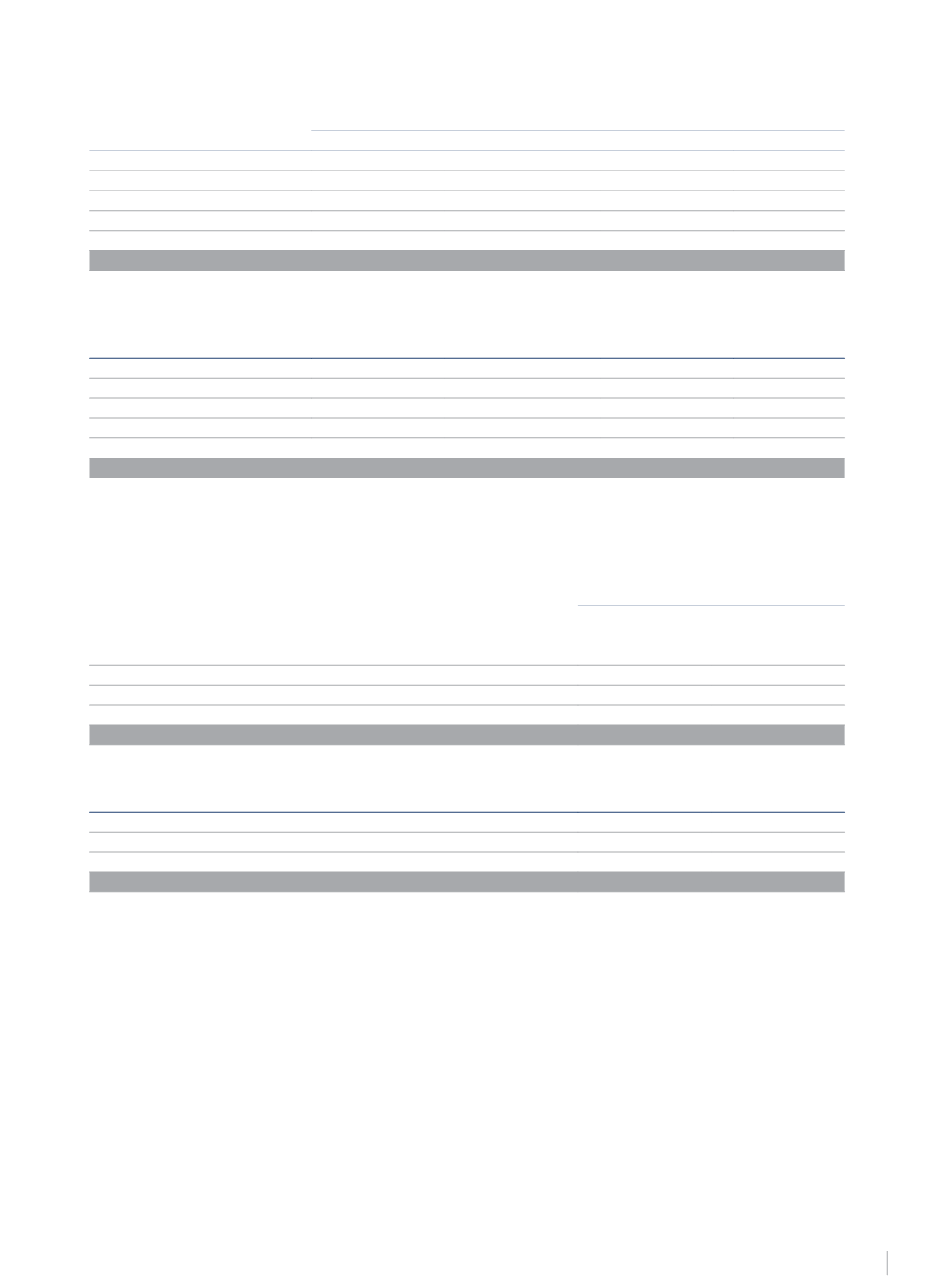

The breakdown, by business units, of the current value of the rental payments at 31 December 2013 is as follows:

Less than one year

Between two and five years

More than five years

Total

Spain

85,046

334,745

234,601

654,392

Germany and Central Europe

108,551

404,856

282,473

795,880

Italy

41,014

141,144

63,706

245,864

Benelux

40,447

157,350

212,911

410,708

Latin America

2,936

4,586

7,522

Total

277,994

1,042,681

793,691

2,114,366

25.6 Financial Expenses and Changes in Fair Value of Financial Instruments

The detailed balance of this chapter of the consolidated statement of comprehensive income for 2014 and 2013 is as follows:

€Thousand

2014

2013

Expenses for interest

53,488

54,462

Financial expenses for means of payment

10,354

10,489

Cancellation of interest rate derivatives

-

5,880

Other financial expenses

1,531

1,496

Financial effect relating to updating of provisions (Note 19)

3,456

4,019

Total financial expenses

68,829

76,346

€Thousand

2014

2013

Interest rate derivatives (Note 4.7.3)

(2,786)

-

Put option for Donnafugata Resort, S.r.l.

770

-

Share-based remuneration scheme 2007-2013 (Note 18)

-

(9,511)

Total change in fair value of financial instruments

(2,016)

(9,511)

26.- RELATED-PARTY TRANSACTIONS

In addition to its subsidiaries, associates and joint ventures, the Group’s “related parties” are considered to be the “key management personnel” of

the Parent Company (Board Members and Directors, along with their immediate relatives), as well as organisations over which key management

personnel may exert significant influence or control.

Transactions carried out by the Group with its related parties during 2014 are stated below, distinguishing between major shareholders, members

of the Board of Directors and Directors of the Parent Company and other related parties. The conditions of the related-party transactions are

equivalent to those of transactions carried out under market conditions:

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS