95

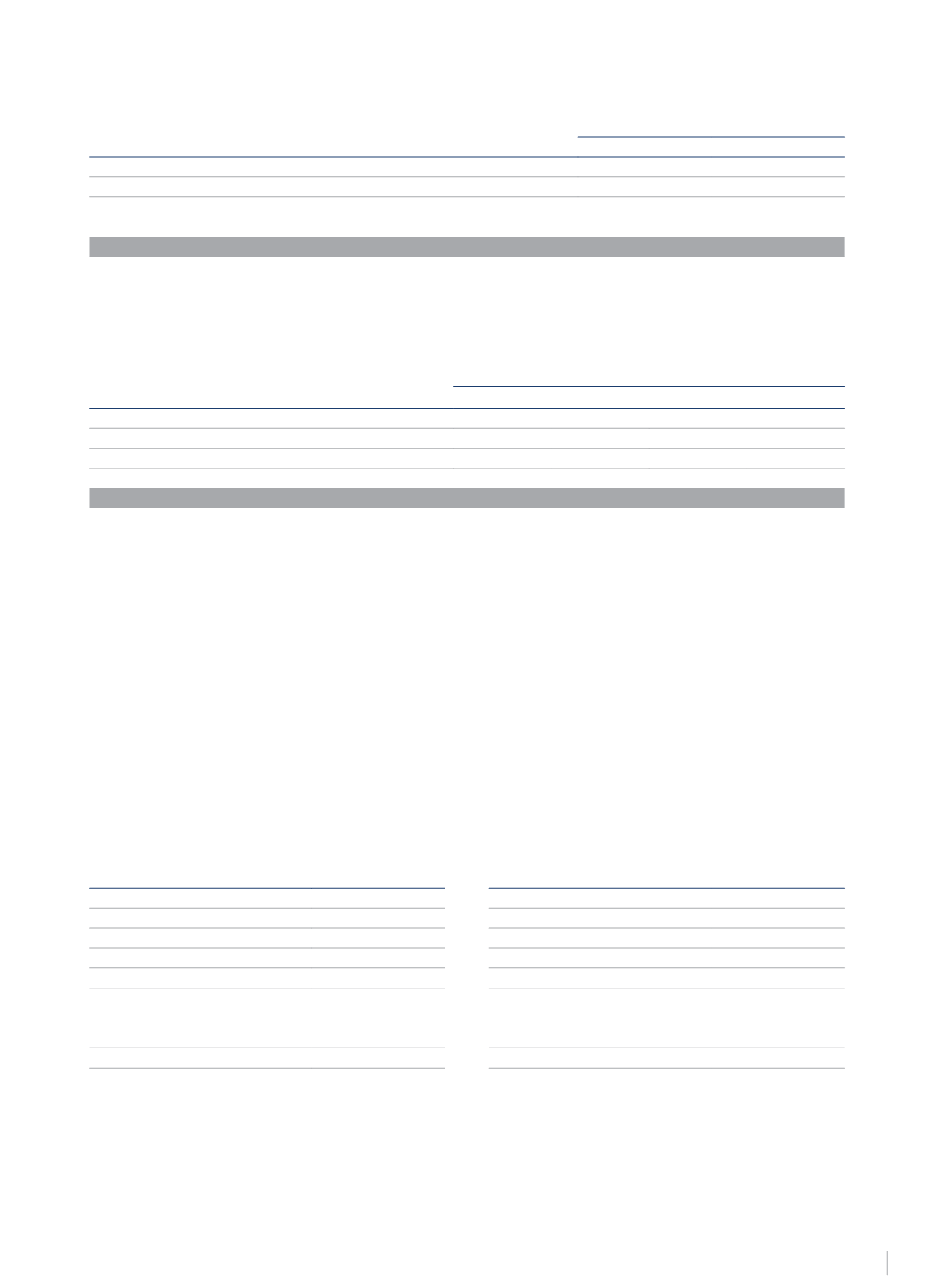

The movements in deferred tax liabilities during 2014 are as follows:

€Thousand

2014

2013

Opening balance

201,225

233,939

Cancellation of liabilities due to change in tax rate

(6,510)

-

Cancellation of liabilities due to changes in scope (Note 9)

(9,461)

(8,915)

Others

(5,524)

(23,799)

Closing balance

179,730

201,225

The derecognitions in 2013 relate mainly to Sotogrande S.A. and its subsidiaries leaving the group, and the adaptation of tax liabilities associated

with accounting revaluations at the expected effective tax rate.

The detail, by country and item, of these deferred taxes is as follows:

€Thousand

Tax credits

Prepaid Taxes

Total Assets

Liabilities

Spain

99,436

36,390

135,826

50,640

Italy

5,277

6,947

12,224

119,022

Germany

-

3,229

3,229

673

Others

736

5,843

6,579

9,395

TOTAL

105,449

52,409

157,858

179,730

Corporate Income Tax expense

The Group operates in many countries and is therefore subject to the regulations of different tax jurisdictions regarding taxation and corporate

income tax.

NH Hotel Group, S.A. and the companies with tax domicile in Spain in which it held a direct or indirect stake of at least 75% during the 2014 tax

period are subject to the tax consolidation scheme governed by Title VII, Chapter VII of the Consolidated Text of the Corporate Tax Act, approved

by Royal Legislative Decree 4/2004 of 5 March.

The companies belonging to the tax group have signed an agreement to share the tax burden. Hence, the Parent Company settles any credits and

debts which arise with subsidiary companies due to the negative and positive tax bases these contribute to the tax group.

During 2014, Sotogrande, S.A., Resco Sotogrande, S.L. and Club Deportivo Sotogrande, S.A. were excluded from the Spanish tax consolidation group.

Coperama Spain, S.L. was included in the group.

Corporation tax is calculated on the financial or accounting profit or loss resulting from the application of generally accepted accounted standards

in each country, and does not necessarily coincide with the tax result, this being construed as the tax base.

In 2014, Spanish companies pay taxes at the general tax rate of 30% irrespective of whether they apply the consolidated or separate taxation

schemes. Following the approval of tax reform in Spain, the tax rates applicable to resident entities will be 28% in 2015 and 25% in 2016 and the

following years. The foreign companies are subject to the prevailing tax rate in the countries where they are domiciled. In addition, taxes are

recognised in some countries at the estimated minimum profit on a complementary basis to Corporation Tax.

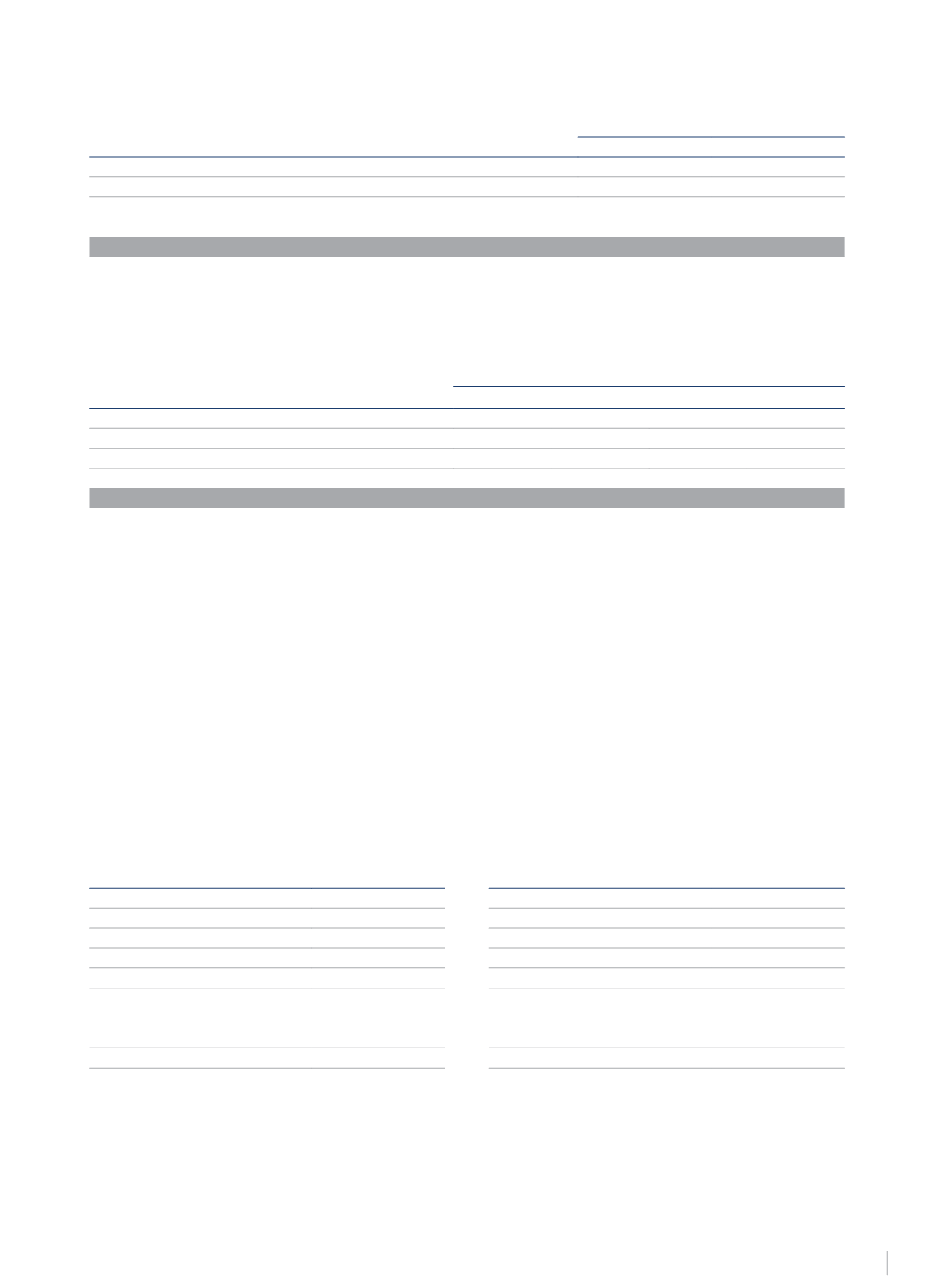

The prevailing income tax rates in the different jurisdictions where the Group has significant operations are as follows:

Country

Nominal Rate

Country

Nominal Rate

Argentina (1)

35%

Romania

16%

Colombia (2)

-

Poland

19%

Chile

20%

Switzerland

7.80%

Panama

25%

Dominican Rep.

19%

Brazil

34%

Luxembourg

29.20%

Mexico

30%

Italy

31.70%

Uruguay

25%

Netherlands

25%

Dominican Republic

28%

France

33%

Germany

30%

Portugal

31.50%

(1) Jurisdictions in which there is a minimum taxable income.

(2) NH Parque de la 93, S.A.S., the Colombian company which operates a hotel in Bogotá, is exempt from Income Tax.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS