90 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

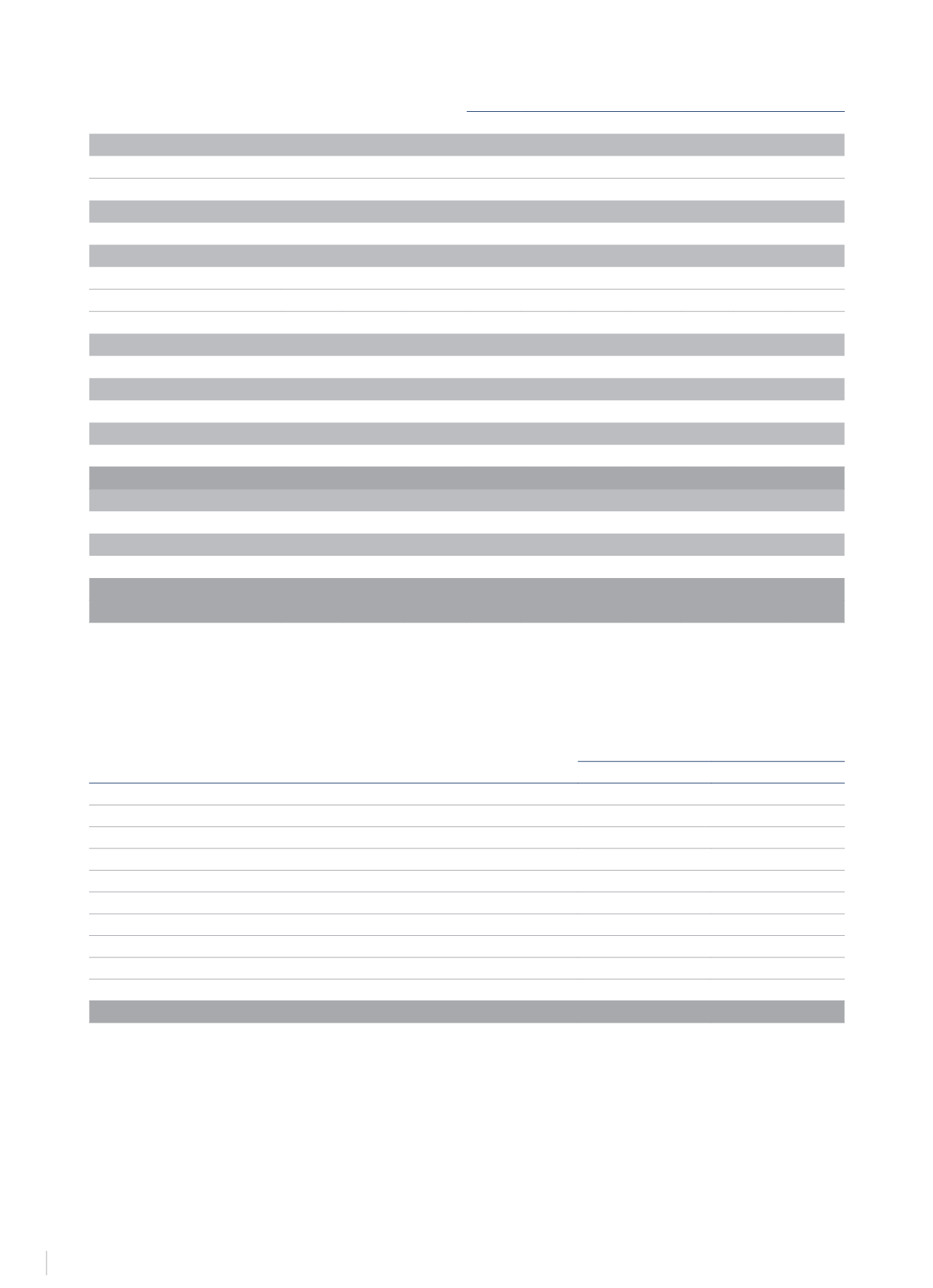

Maturity

Instrument

Limit

Available Disposed 2014 2015

2016

2017

2018

2019 Remainder

Mortgages

105,222

-

105,222

-

18,807 48,076 25,463 5,981

743

6,152

Fixed rate

40,042

-

40,042

-

2,823 32,893

84

82

83

4,077

Variable interest

65,180

-

65,180

-

15,984 15,183 25,379 5,899

660 2,075

Subordinated loans

75,000

-

75,000

-

-

-

-

-

-

75,000

Variable interest

75,000

-

75,000

-

-

-

-

-

-

75,000

Syndicated loans

188,000 56,667

131,333

-

19,700 19,700 87,033 700

700 3,500

Tranche A (floating rate)

114,333

-

114,333

-

19,000 19,000 76,333

-

-

-

Tranche B (floating rate)

66,667

56,667

10,000

-

-

-

10,000

-

-

-

Syndicated NH Europa (floating rate)

7,000

-

7,000

-

700

700

700

700

700 3,500

Guaranteed line of credit

14,000

2,537

11,463

-

11,463

-

-

-

-

-

Variable interest

14,000

2,537

11,463

-

11,463

-

-

-

-

-

Convertible notes

228,156

-

228,156

-

-

-

-

228,156

-

-

Fixed rate

228,156

-

228,156

-

-

-

-

228,156

-

-

Guaranteed senior notes

250,000

-

250,000

-

-

-

-

-

250,000 -

Fixed rate

250,000

-

250,000

-

-

-

-

-

250,000 -

SUBTOTAL

860,378 59,204 801,174

49,970 67,776 112,496 234,837 251,443 84,652

Credit lines

27,550

6,396

21,154

-

21,154

-

-

-

-

-

Variable interest

27,550

6,396

21,154

-

21,154

-

-

-

-

-

Arrangement expenses

-

-

(19,643)

-

(1,365)

(307)

(2,310)

(5,358)

(8,817)

(1,487)

Borrowing costs

-

-

4,669

-

4,669

Borrowing situation at 31/12/2014

887,928 65,600 807,354

-

74,428 67,469 110,186 229,479 242,626 83,165

Borrowing situation at 31/12/2013

974,989 80,779 879,288 99,705 44,583 37,486 122,769 242,850 250,743 81,152

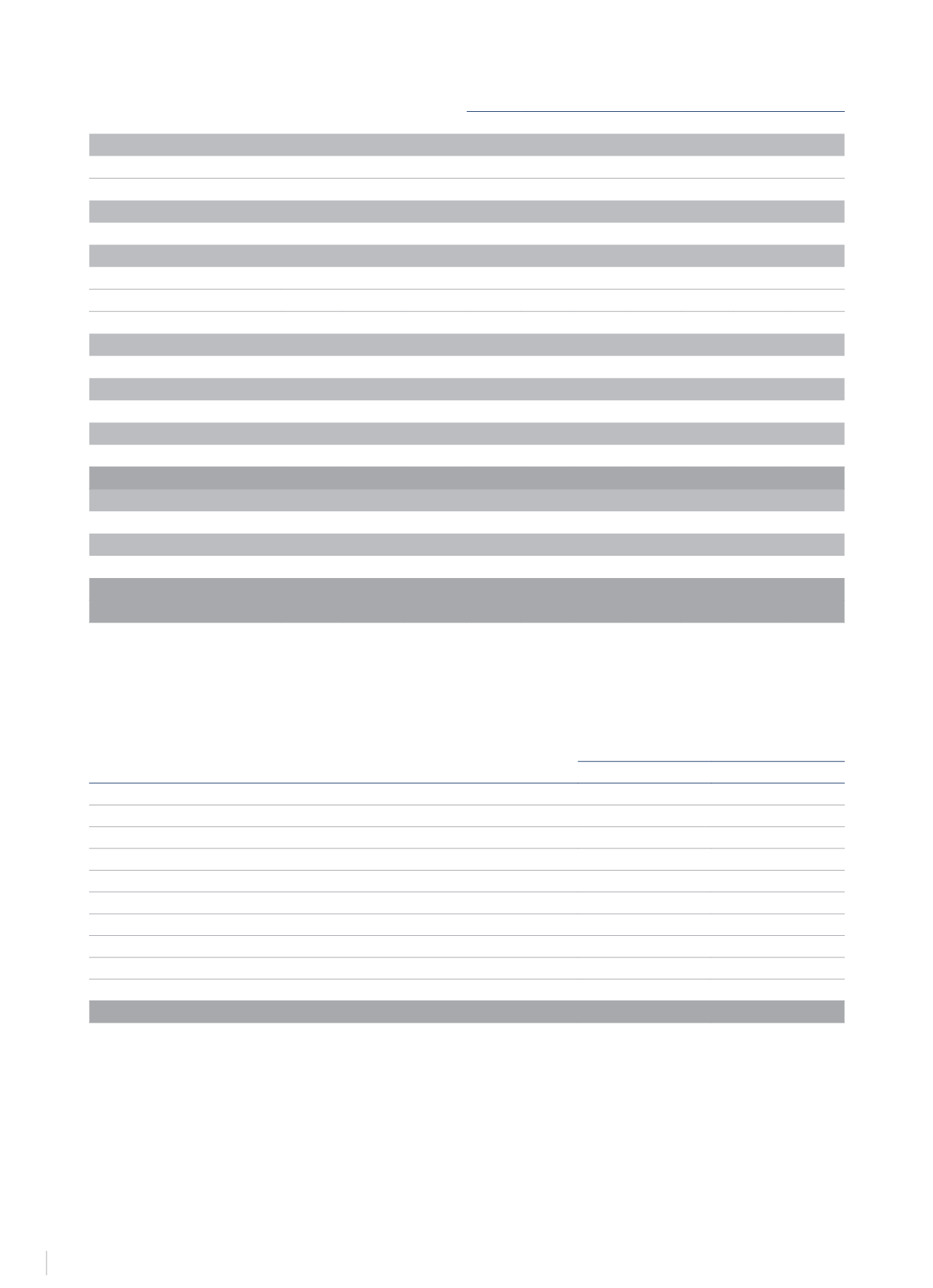

17.- OTHER NON-CURRENT LIABILITIES

The breakdown of the “Other non-current liabilities” item in the accompanying consolidated balance sheets, at 31 December 2014 and 2013, is as

follows:

€Thousand

2014

2013

At fair value:

Put option for Donnafugata Resort, S.r.l.

10,670

9,900

At amortised cost:

Linearisation of revenue

15,895

14,441

Issue of promissory notes

1,810

1,810

Capital subsidies (Note 9)

-

18,086

Indemnity for termination of the Hotel Bühlerhöhe lease (Note 23)

-

3,593

Loans from shareholders

533

818

Other liabilities

1,326

1,658

Purchase option on Sotocaribe, S.L. (see note 2.5.4)

58,250

-

88,484

50,306

On 26 October 2012 the arbitration tribunal ratified the valuation of Donnafugata Resort, S.r.l. made by an independent valuer in response to the

communication made by the non-controlling interests of said company in 2010 of their intention to exercise the put option (at 31 December 2012

they represented 8.81% of the share capital). As a result of this decision, the Parent recognised the put option of the non-controlling interests in

accordance with said valuation, which amounted to €9,900 thousand. In December 2014, an arbitration ruling set the costs and financial expenses

payable by the Group at €770 thousand. The change in the fair value of this option was recognised under the heading “Change in fair value of

financial instruments” in the accompanying comprehensive consolidated profit and loss statement for 2014. (See Note 25.6).

The financial liability resulting from recognising the Donnafugata Resort, S.r.l. put option at fair value was classified as level 2 in accordance with the

calculation hierarchy established in IFRS 7.