98

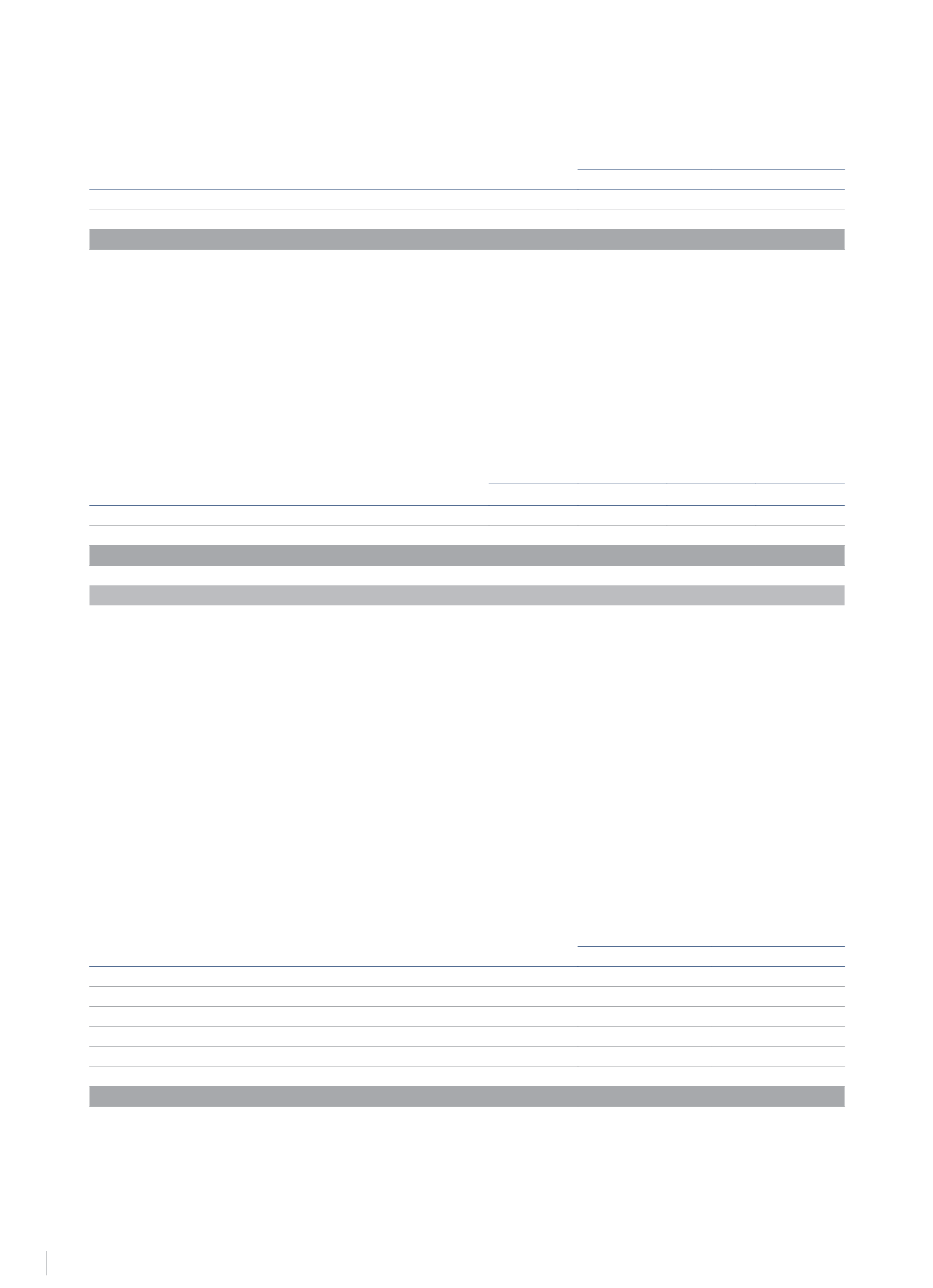

21.- TRADE PAYABLES

The breakdown of this item in the consolidated balance sheet at 31 December 2014 and 2013 is as follows (€thousand):

€Thousand

2014

2013

Trade payables

206,288

208,160

Advance payments from customers

25,139

21,428

231,427

229,588

The “Trade payables” item reflects the accounts payable arising from the Group’s regular trading activities.

The “Advance payments from customers” item mainly includes customer deposits arising from the Group’s hotel businesses.

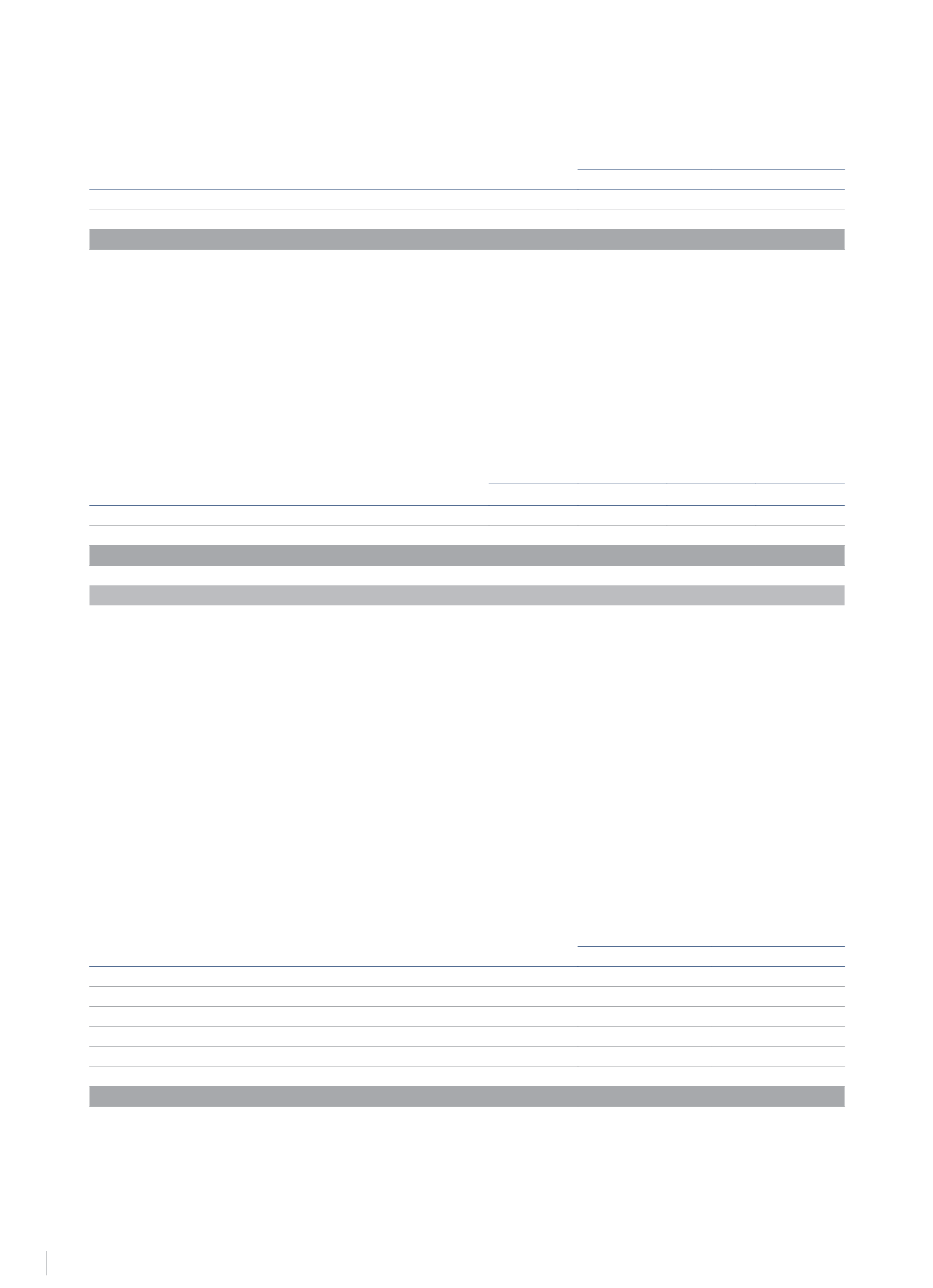

22.- INFORMATION ON DEFERRED PAYMENTS TO SUPPLIERS. THIRD ADDITIONAL

PROVISION. “DUTY TO REPORT” OF ACT 11/2013 OF 26 JULY

A breakdown of the information required by the Third Additional Provision of Act 15/2010 of 5 July on agreements executed under Spanish legislation

appears below:

2014

2013

€Thousand

%

€Thousand

%

Payments made within the maximum legal term

93,882

35%

186,466

70%

Remainder

171,783

65%

81,102

30%

Total payments in the financial year

265,665

100%

267,568

100%

Weighted average exceeded payment period (days)

65

38

Deferrals which exceeded the maximum legal deadline at year-end

19,833

18,418

The above information on payments to suppliers refer to those which by their nature are trade creditors due to debts with suppliers of goods and

services. The table includes, therefore, the “Trade creditors” item in current liabilities of the attached consolidated balance sheet at 31 December

2014.

The weighted average exceeded payment period (PMPE) has been calculated as the sum of the product of each of the supplier payments made

in the year with a delay exceeding the legal payment deadline and the number of days by which the relevant deadline has been exceeded in the

numerator, and the total amount of the payments made in the year with a delay exceeding the legal payment deadline in the denominator.

The maximum legal payment period applicable to the Group’s Spanish companies in 2014 and 2013 is 30 days, unless there is an agreement between

the parties with a maximum period of 60 days, in accordance with Law 4/2013 of 26 July, amending Law 3/2004, establishing measures to combat

delinquency in commercial transactions.

The weighted average exceeded payment period (PMPE) for payments due in 2014 is higher because after the migration of the accounting system

in January 2014, payments were delayed in the first half of 2014 until the system was stabilised.

23.- OTHER CURRENT LIABILITIES

The composition of this item at 31 December 2014 and 2013 is as follows:

€Thousand

2014

2013

Outstanding remuneration

30,555

28,687

Compensation for termination of the Hotel Bühlerhöhe lease (Note 17)

3,915

2,936

Linearisation of revenue

3,l59

1,970

Corporate restructuring provision in Mexico

-

2,500

Provision for Los Cortijos refurbishment expenses

-

682

Other creditors

7,935

2,224

45,564

38,999

In 2014 the corporate restructuring provision was applied in Mexico due to a company divestment operation there in April.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS