93

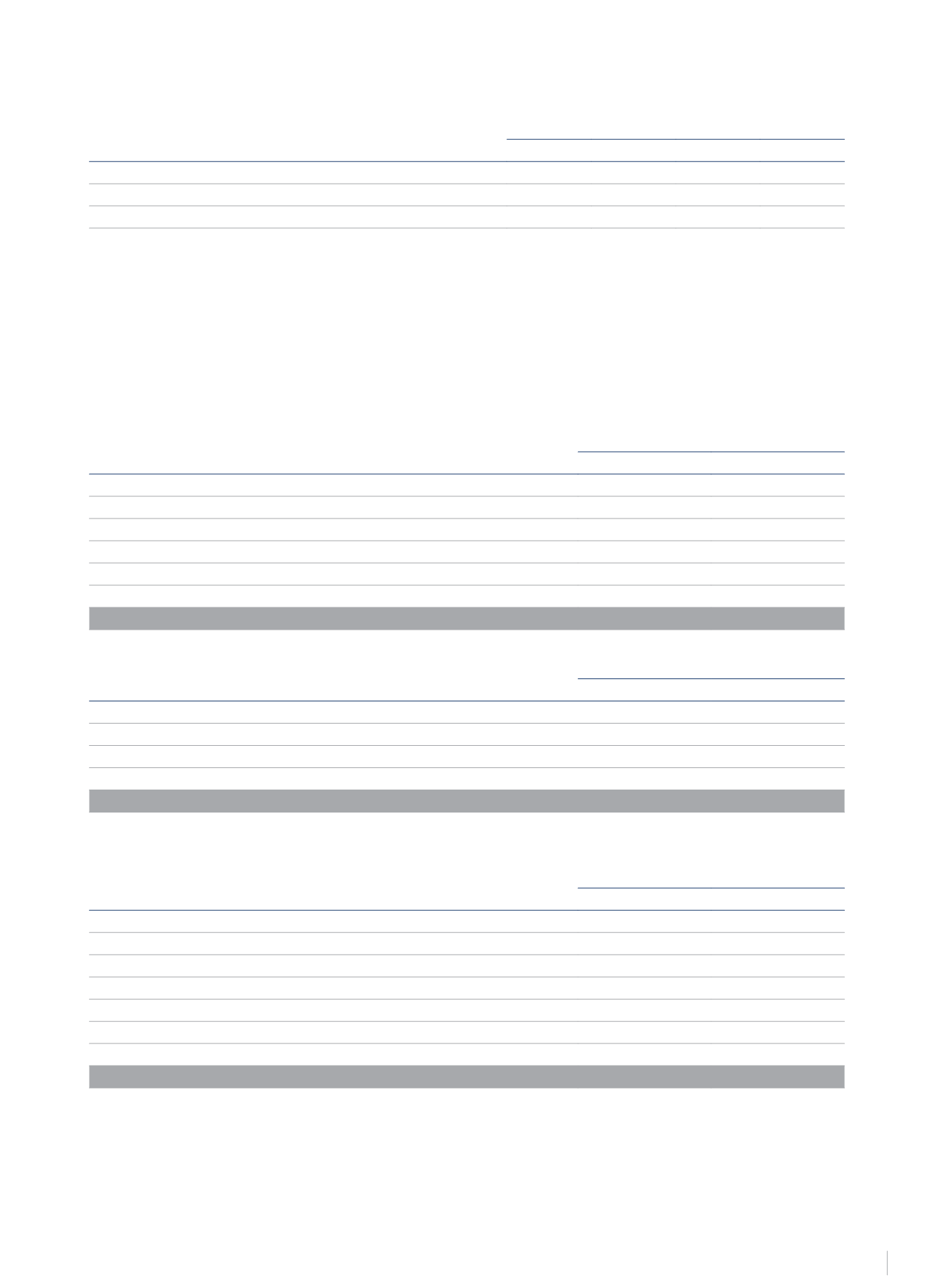

The breakdown of the main assumptions used to calculate actuarial liabilities is as follows:

2014

2013

Netherlands

Italy

Netherlands

Italy

Discount rates

2.10%

0.18%

2.10%

0.18%

Expected annual rate of salary rise

2.50%

1.90%

2.50%

1.90%

Expected return from assets allocated to the plan

2.10%

2.50%

2.10%

2.50%

Restructuring provision

The lower restructuring provision is due to the restructuring plan that the Group approved for reorganisation in Italy and Spain, which was executed

in 2014 and 2013. At the end of 2014, the Group’s provisions amounted to €4,721 thousand.

20.- TAX NOTE

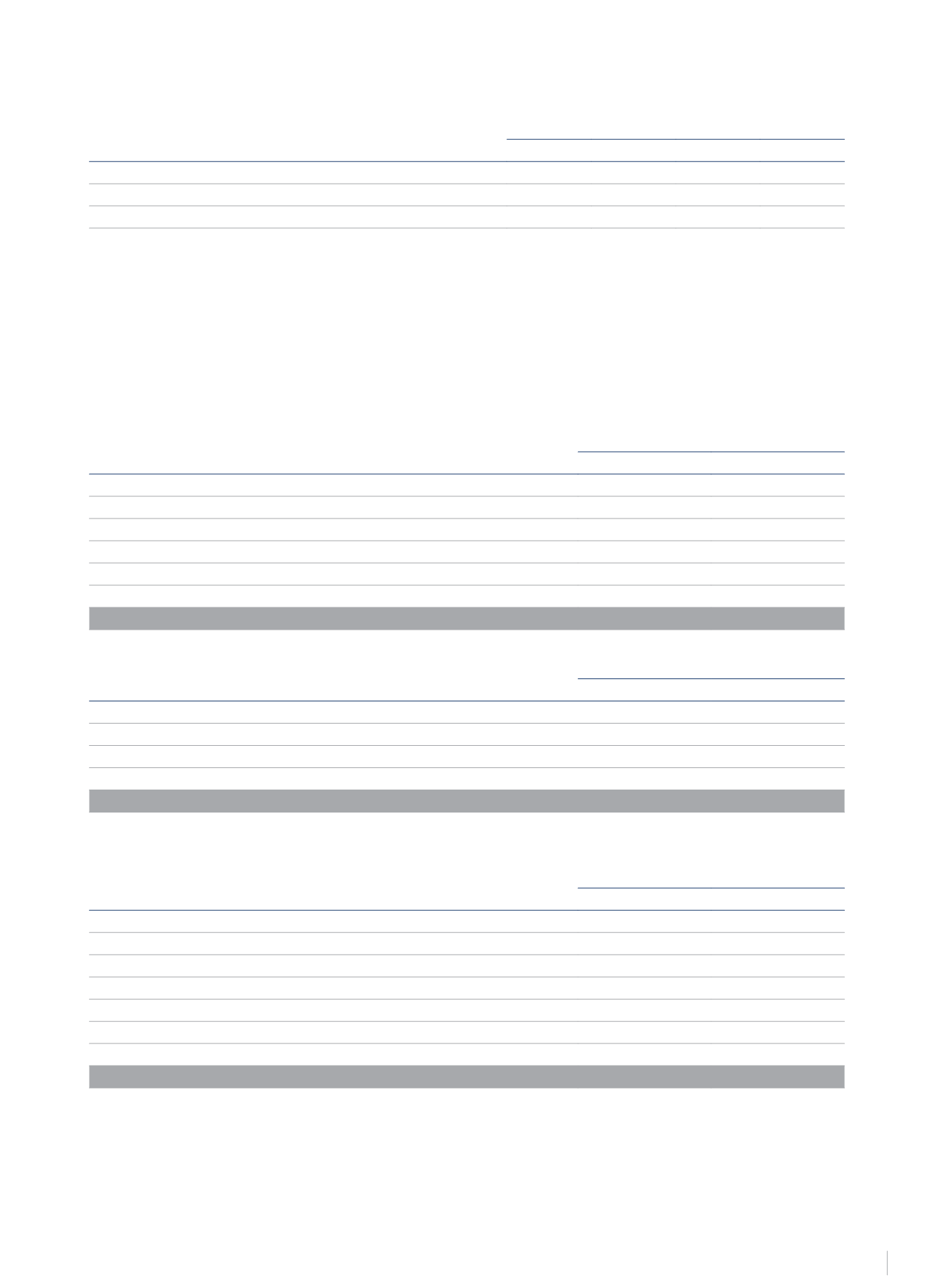

Balances with Public Administrations

The balance of tax receivables at 31 December 2014 and 2013 were as follows:

€Thousand

2014

2013

Deferred tax assets

Tax credits

105,449

140,048

Tax assets due to asset impairment

35,353

38,735

Withholdings on personal income tax

1,703

1,437

Derivative financial instruments

-

-

Other prepaid taxes

15,353

18,562

157,858

198,782

€Thousand

2014

2013

Short-term taxes receivable

Income tax

11,068

4,746

Value Added Tax

18,405

29,196

Other tax receivables

5,650

5,750

Total

35,123

39,692

The movements of the “Deferred tax assets” item in 2014 and 2013 were as follows:

€Thousand

2014

2013

Opening balance

198,782

210,939

Asset impairment

(3,382)

(1,856)

Disposals due to derivative instruments

-

(10,932)

Cancellation of assets due to changes in scope

(28,708)

-

Cancellation of assets due to change in tax rate

(21,861)

-

Tax loss carry-forward for the year

12,056

(761)

Others

971

1,392

Total

157,858

198,782

Asset cancellations due to change in scope correspond to the derecognition of the tax losses contributed by Sotogrande and its subsidiaries,

worth €20,440 thousand, which are now lost due to the exit of these entities from the Spanish tax consolidation group (see note 2.5.4.) and to

the derecognition of the deferred tax assets these companies contributed to the consolidated balance sheet, worth €8,268 thousand (see note 9).

Asset disposals due to tax rate changes have arisen due to the change in the rate of Spanish Corporate Income Tax introduced by Law 27/2014, of

27 November. As the rate has been reduced, the Group has adjusted its deferred tax assets and liabilities and its tax loss assets, using the rate which

is likely to be applicable in the period when it estimates the asset will be realised or the liability will be settled.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS