83

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

The “Subordinated loans to companies owning hotels operated by the Group through leases” item includes a series of loans granted by the Group

to companies which own hotels in countries such as Germany, Austria, Luxembourg, the Netherlands, Italy and Spain, and which are operated by the

Group under a leasing agreement.

The main features of these agreements are as follows:

- Hotel rentals are not subject to evolution of the inflation rate or to that of any other index.

- The above-mentioned subordinated loans accrue interest at a fixed rate of 3% per year (€2.36 million in 2014 and €2.23 million in the preceding

year).

- New lease agreements establish a purchase right on properties subject to agreements that, as a general rule, may be executed in the fifth, tenth

and fifteenth year from the entry into force of the agreement.

- The model used for these lease agreements has been analysed and independent experts consider them to be operating leases.

The “Other collection rights” item reflects the claim filed against the insurance company that underwrote the ten-year construction insurance. The

amount claimed corresponds to the repairs made and pending in a housing development. This claim was left out of the 2014 sale agreement for

Sotogrande, S.A., the company which first presented the claim (see note 2.5.4).

“Other Loans” includes the loan granted to the owner of the Nhow Rotterdam hotel, operated on a management basis, which accrues a fixed annual

interest rate of 3%.

The “Lease advance payments” item consists of advance payments made to the owners of certain hotels operated under a lease arrangement for

the purchase of decoration and furniture; these are discounted from future rental payments.

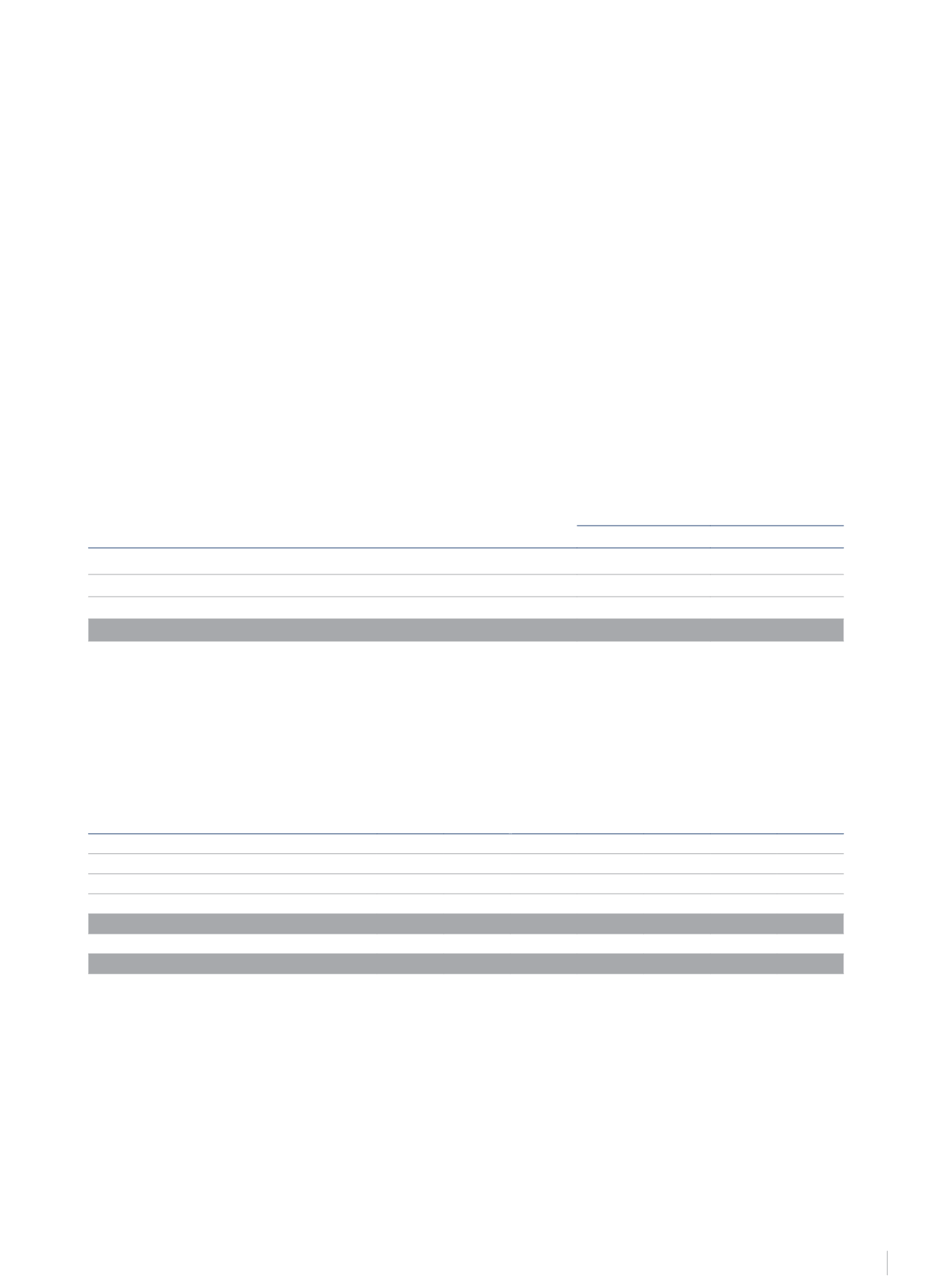

11.2 Other Non-Current Financial Investments

This heading of the consolidated balance sheet comprised, at 31 December 2014 and 2013, the following equity interests, valued at cost:

€Thousand

2014

2013

NH Panamá

3,767

3,767

Other investments

4,525

6,072

Other provisions

(1,587)

(2,107)

Total

6,705

7,732

These companies were not consolidated at 31 December 2014, since they were inactive on said date.

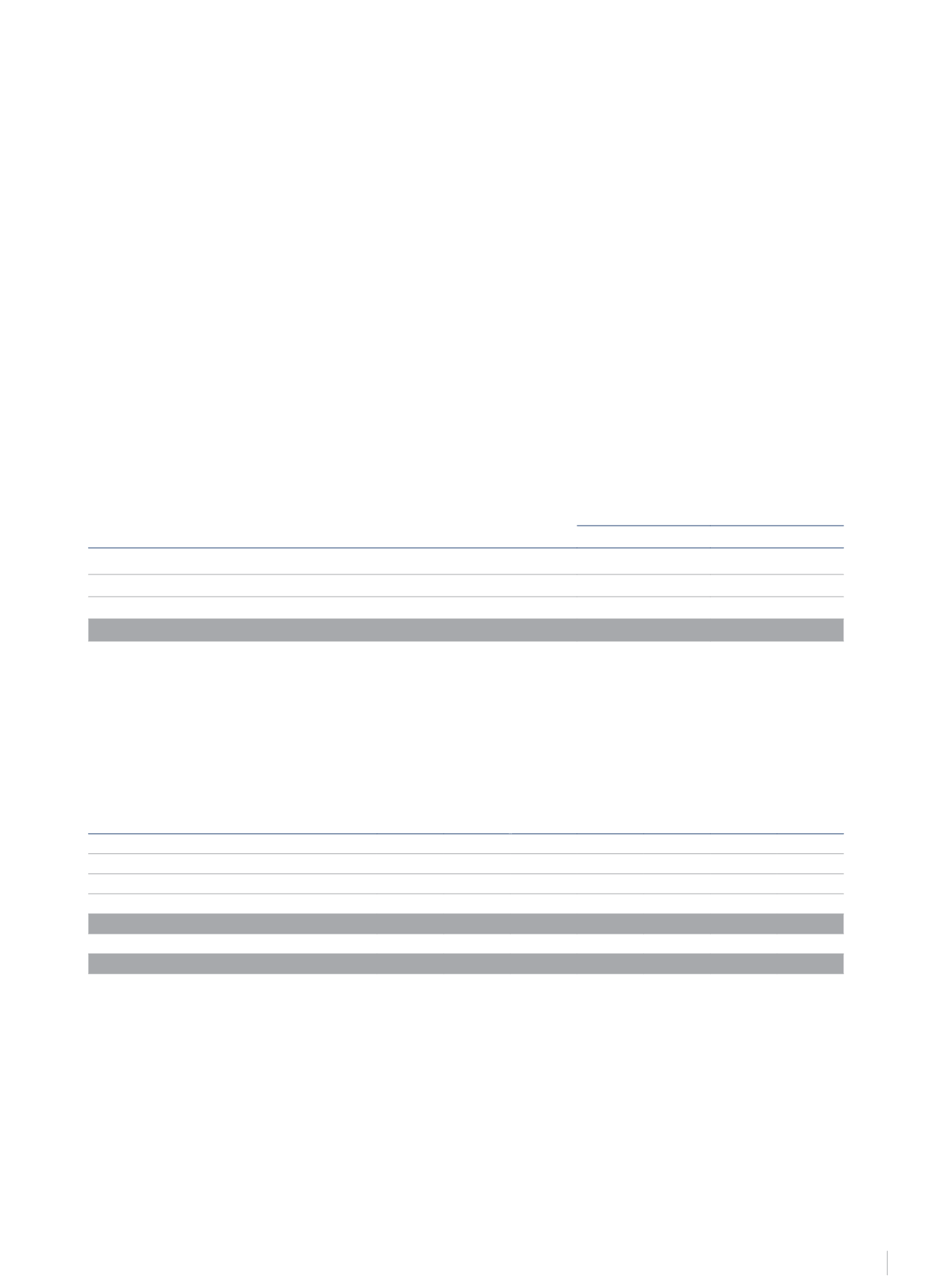

12.- INVENTORY

This item of the consolidated balance sheet was as follows at 31 December 2014 and 2013, including movements during both years:

Balance at

31/12/2012 Additions Net Changes

in Inventories

Balance at

31/12/2013

Transfers

(Note 9)

Net Changes

in Inventories

Balance at

31/12/2014

Developed land

46,558

38

-

46,596

(46,596)

-

-

Undeveloped land

10,697

-

(157)

10,540

(10,540)

-

-

Finished works

26,579

-

(59)

26,520

(26,520)

-

-

Ancillary materials and others

9,016

-

(53)

8,963

(362)

(375)

8,226

92,850

38

(269)

92,619

(84,018)

(375)

8,226

Impairment

(6,735)

(6,249)

-

(12,984)

12,984

-

-

Net value

86,115

(6,211)

(269)

79,635

(71,034)

(375)

8,226

The transfers record the inventory of the companies classified as assets available for sale and then disposed of in the contract removing Sotogrande,

S.A. from the scope of consolidation (see note 9).