78

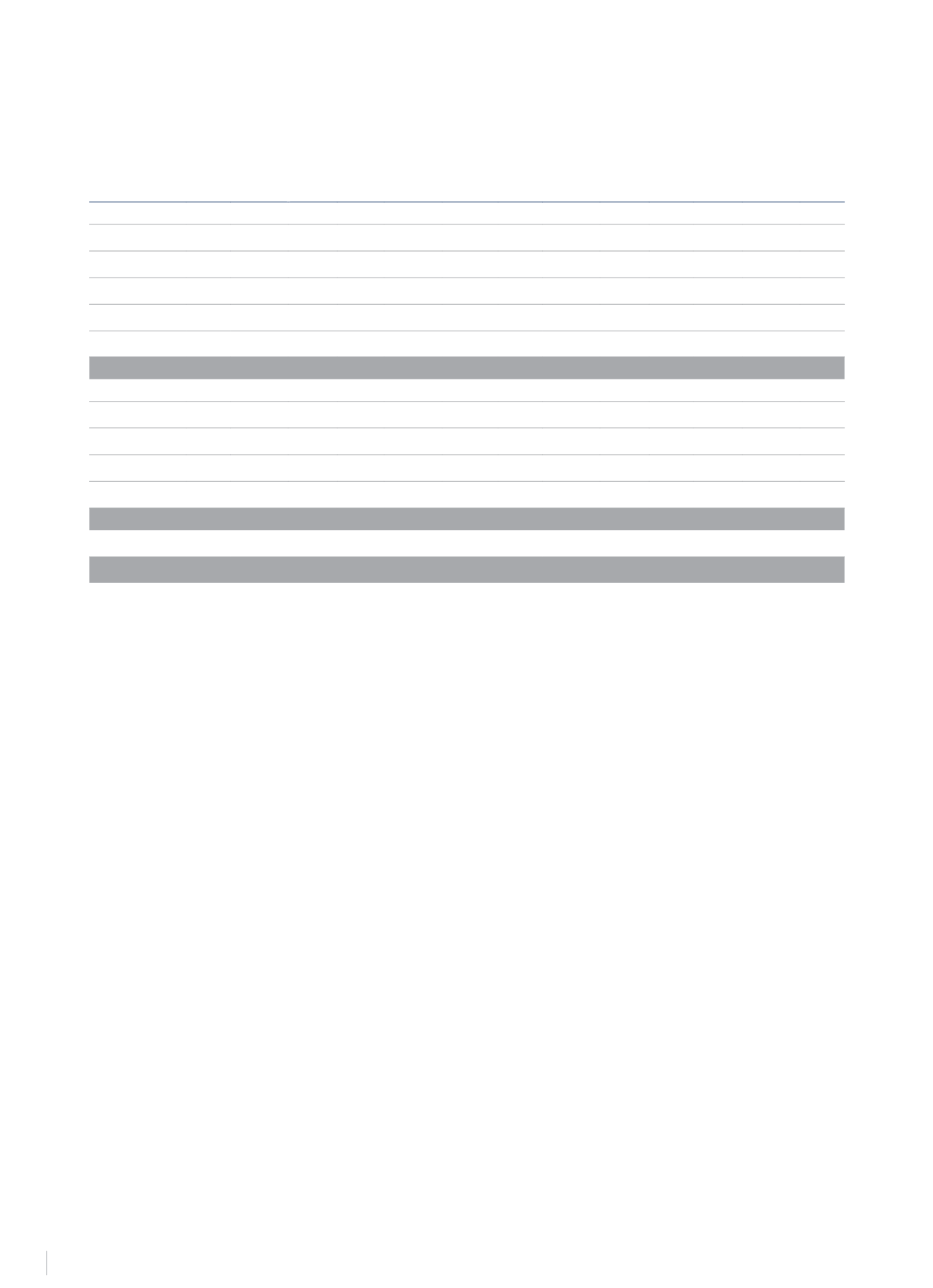

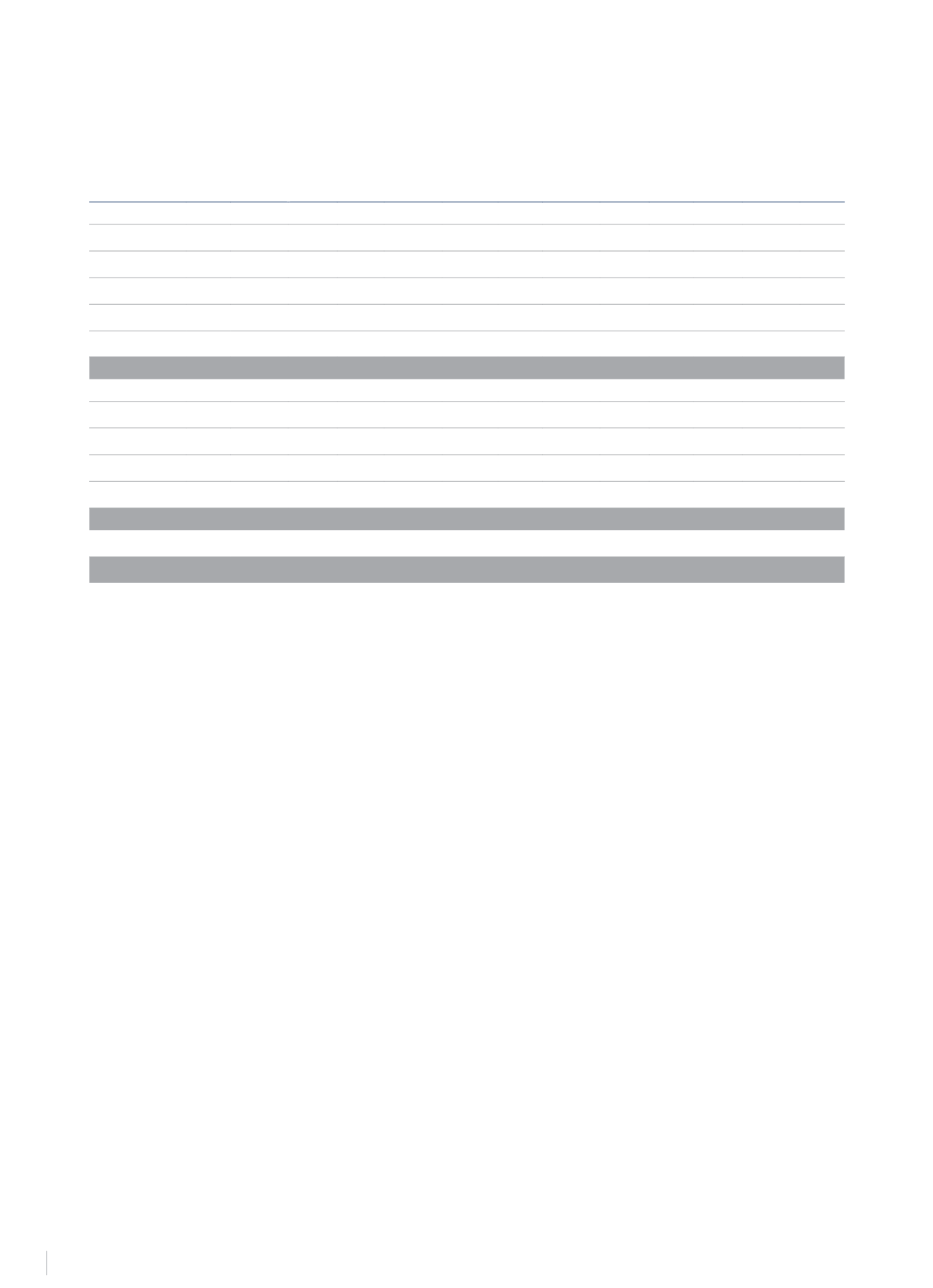

8.- PROPERTY, PLANT & EQUIPMENT

The breakdown and movements under this heading during 2014 and 2013 were as follows (€Thousand):

Balance

at

31/12/2012

Change in

scope of

consolidation

Currency

translation Additions Retirements Assignments

Balance

at

12/31/13

Change in

scope of

consolidation

(see note

2.5.4)

Currency

translation Additions Retirements

Assignments

Balance

at

31/12/2014

COST

Land and buildings 1,947,279 (109,072) (23,137)

5,479

(907)

(3)

1,819,639 (50,333)

(3,749) 14,206 (2,913)

(118,175) 1,658,675

Plant and machinery 796,859 (12,072)

(9,288)

3,313 (15,269)

(3)

763,540 (4,116)

776 38,136 (24,707)

(15,221) 758,408

Other fixtures, tools

and furniture

522,953 (26,982)

(4,362) 15,704 (25,004)

2,477 484,786 (214)

595

41,156 (28,742)

(27,061) 470,520

Other fixed assets

1,651

-

(41)

246

(598)

-

1,258

-

3

268

(44)

(1,143)

342

Assets under

construction

26,498 (234)

(161)

5,657

(88)

-

31,672

-

(129)

11,618 (133)

(25,016)

18,012

3,295,240 (148,360) (36,989) 30,399 (41,866)

2,471 3,100,895 (54,663) (2,504) 105,384 (56,539) (186,616) 2,905,957

CUMULATIVE DEPRECIATION

Buildings

(295,529)

9,791

4,109 (25,139)

438

-

(306,330) 7,668

(3,146) (22,354)

848

24,362 (298,952)

Plant and machinery (494,974)

5,160 4,808 (39,232)

15,221

2

(509,015)

3,623

1,162 (39,342) 19,806 12,755 (511,011)

Other fixtures, tools

and furniture

(425,384) 24,417

3,201

(25,169)

24,474

(434) (398,896)

196

101

(25,960) 23,293 15,588 (385,678)

Other fixed assets

(1,591)

-

-

(61)

600

-

(1,014)

-

(3)

(126)

42

761

(340)

(1,217,478) 39,368 12,157 (89,539)

40,731

(434) (1,215,255) 11,487 (1,886) (87,782) 43,989 53,466 (1,195,981)

Provisions

(220,067)

-

237

(2,261)

41,071

10,360 (170,660)

-

(13)

(7,939) 25,978 49,019 (103,616)

NET BOOK

VALUE

1,857,695

1,714,980

1,606,360

The “Translation differences” column reflects the effect of changes in the exchange rate used in the conversion of the different tangible fixed asset

items.

The most significant movements in this heading during the 2014 and 2013 were as follows:

i) The most significant additions under this heading, broken down by business units, were:

In Spain, the most significant additions in 2014 were related to the renovation of the hotels NH Collection Eurobuilding (€17.4 million), NH

Aránzazu (€3.79 million), NH Collection Abascal (€3.31 million), NH Iruña Park (€1.66 million), NH Gran Hotel (€0.86 million), NH Collection

Constanza (€0.82 million), NH Plaza de Armas (€0.72 million), NH Calderón (€0.60 million), and others.

In Benelux, the most significant additions in 2014 correspond to central services (€2.65 million), and renovations in the hotels NH Conference

Centre Koningshof (€1.81 million), NH Conference Centre Leeuwenhorst (€1.67 million), NH Schiphol Airport (€0.54 million) and NH Luxembourg

(€0.46 million).

In Germany, the renovation of the hotels NH Berlin Mitte (€2.4 million) and NH München am Ring (€1.8 million).

In Italy, the renovation of the hotels NH Milano Fiori (€2.43 million), NH Touring (€1.77 million), NH Madison (€1.56 million), NH Firenze (€1.23

million), NH Laguna Palace (€0.83 million), NH President Milano (€0.6 million), NH Vittorio Veneto Roma (€0.53 million), NH Ambasciatori

Torino (€0.49 million), NH Leonardo da Vinci Roma (€0.48 million), Nhow Milano (€0.46 million), NH Carlton Amsterdam (€0.41 million), and

others.

ii)The most significant asset retirements in 2014 were:

In Spain, abandonment of the hotels NH Palacio de Oriol (€2.11 million), NH Inglaterra (€1.49 million), NH Santander Parayas (€1.12 million) and

NH Orus (€0.51 million) and renovation of the hotels NH Collection Eurobuilding (€9.15 million), NH Aránzazu (€2.47 million), NH Collection

Abascal (€1.40 million), NH Iruña Park (€0.67 million), and others.

In Italy, renovation of the hotels NH Manin (€1.21 million), NH President Milano (€0.17 million), NH Vittorio Veneto Roma (€0.17 million), NH

Leonardo da Vinci Roma (€0.17 million), NH Ambasciatori Torino (€0.16 million), and others.

And, in Germany, mainly building work on the NH Berlin Potzdamer Platz (€0.74 million).

iii) Transfers mainly record the reclassification of all the assets of Sotogrande as available for sale (Note 9), for a net amount of €82.89 million.

At 31 December 2014, there were tangible fixed asset elements with a carrying amount of €686 million (€807.3 million in 2013) to guarantee several

mortgage loans (see Note 16).

The applied provisions include, on one hand, a balance of €0.14 million corresponding to the impairment balance associated with the hotels

abandoned over the year, and on the other, the impairment write-offs include €4,887 thousand due to the Group continuing to depreciate fixed

assets with allocated impairment.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS