85

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

15.-EQUITY

15.1 Subscribed Share Capital

On 26 June, the increase in the share capital of NH Hotel Group, S.A. was executed and completed. The capital increase involved the issue of

42,000,000 new ordinary shares, each with a par value of €2, with an issue premium of €2.70 per share which were fully subscribed and paid up by

Intesa San Paolo, S.p.A. through the contribution of 445,000 shares representing 44.5% of the share capital of NH Italia, S.p.A.

At 31 December 2014 the Parent Company’s share capital after the capital increase was represented by 350,271,788 fully subscribed and paid up

bearer shares, each with a par value of €2.

All these shares are entitled to identical voting and economic rights and are traded on the Continuous Market of the Madrid, Barcelona, Bilbao and

Valencia Stock Exchanges.

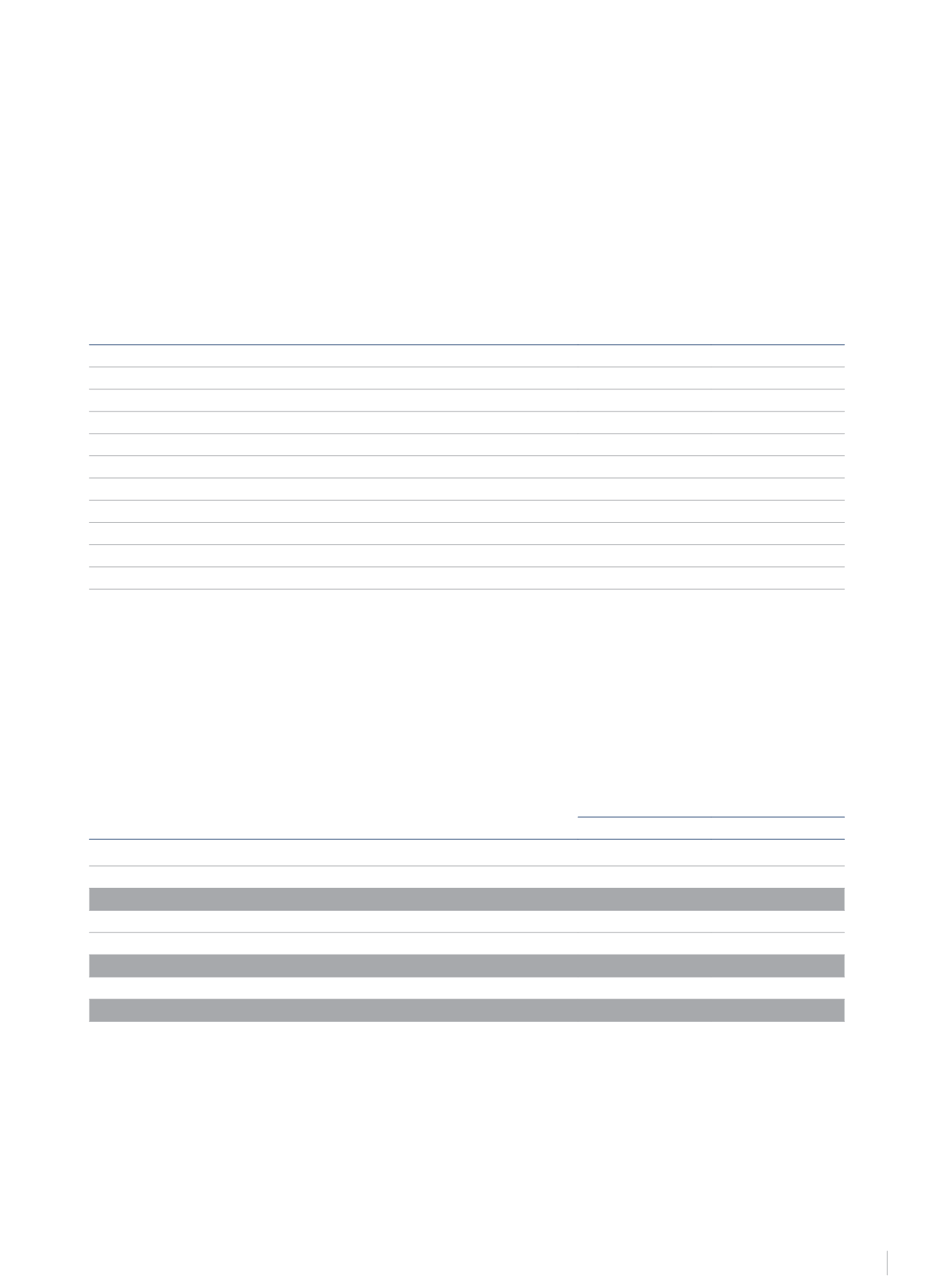

According to the latest notifications received by the Parent Company and the notices given to the National Securities Market Commission before the

end of every financial year, the most significant shareholdings at 31 December 2014 and 2013 were as follows:

2014

2013

HNA Group Co Limited

29.50%

20.00%

Grupo Inversor Hesperia, S.A.

9.24%

20.07%

Banco Santander, S.A.

8.57%

-

Intesa Sanpaolo, S.p.A*

7.64%

4.52%

UBS Group AG

2.01%

-

Blackrock Inc.

2.31%

5.62%

Fidelity International Limited

0.96%

1.47%

Banco Financiero y de Ahorros, S.A.

-

12.60%

Pontegadea Inversiones, S.L.

-

4.06%

Shares allocated to Employee Remuneration Schemes

0.10%

-

Shares owned by NH employees

0.07%

0.12%

*In January 2015, Intesa San Paolo through UBS Limited transferred 100% of its shares in NH Hotel Group, S.A. to a group of accredited investors, and therefore at the date of drafting these

Annual Accounts, Intesa San Paolo is no longer a Company shareholder.

At year-end 2014 and 2013, members of the Board of Directors were the holders or stable proxies of shareholdings representing approximately

46.43% and 61.43% of the share capital, respectively.

The main aims of the Group’s capital management are to ensure short-term and long-term financial stability, a positive trend for NH Hotel Group,

S.A. share prices, and suitable funding for investments while maintaining the level of indebtedness. All the above is geared towards ensuring that

the Group maintains its financial strength and the strength of its financial ratios, enabling it to maintain its businesses and maximise value for its

shareholders.

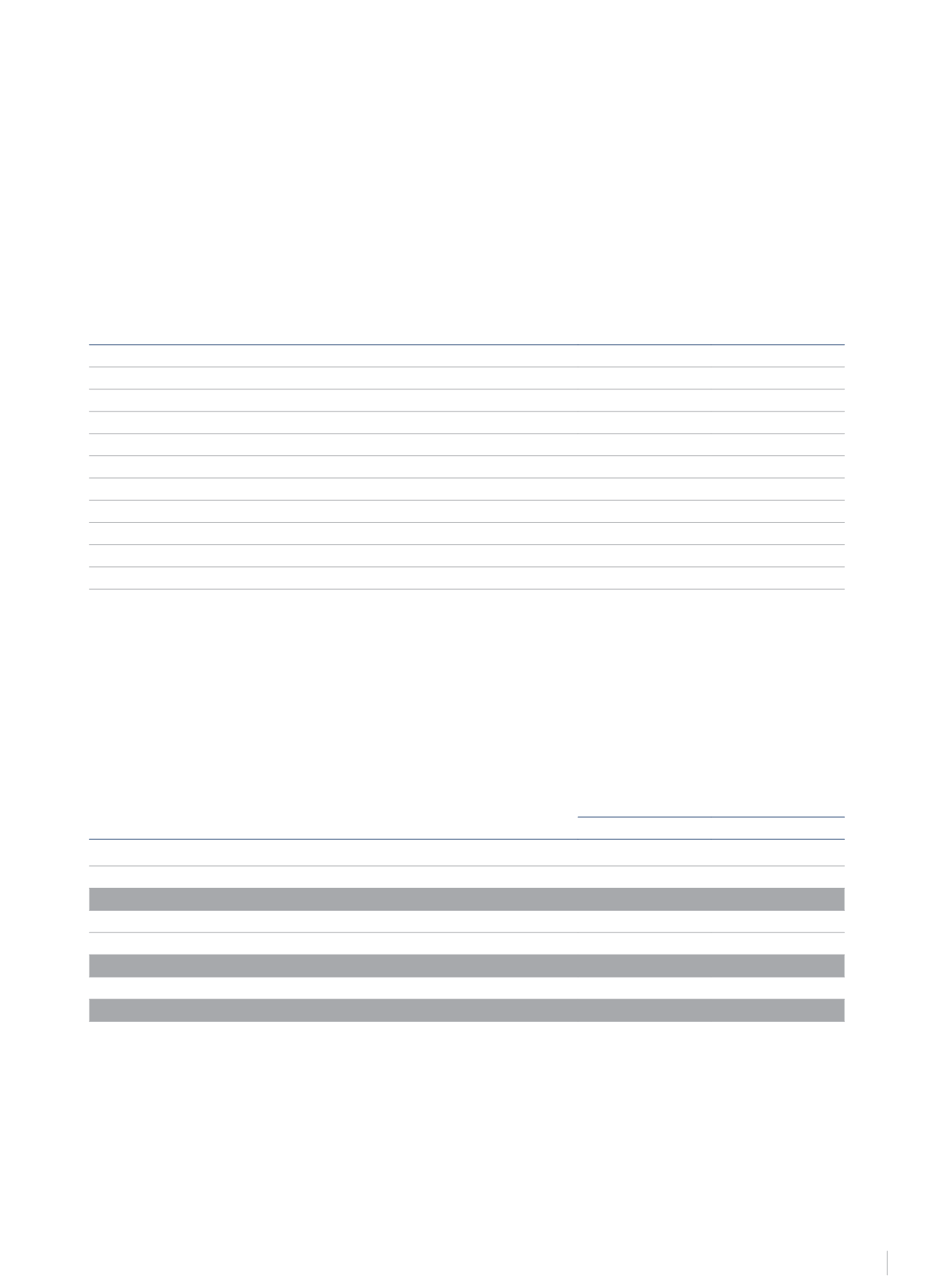

In recent years, the Group’s strategy has not varied, maintaining a financial leverage ratio of 0.53x. The leverage ratios at 31 December 2014 and

2013 were as follows:

€Thousand

2014

2013

Bonds and other marketable securities (Note 16)

467,499

461,949

Bank borrowings and other financial liabilities (Note 16)

339,855

417,339

Gross debt

807,354

879,288

Cash and cash equivalents (Note 14)

200,103

133,869

Liquid assets

200,103

133,869

Total Net Debt

607,251

745,419

Total Equity

1,136,668

1,153,471

Financial leverage

0.53

0.64