86

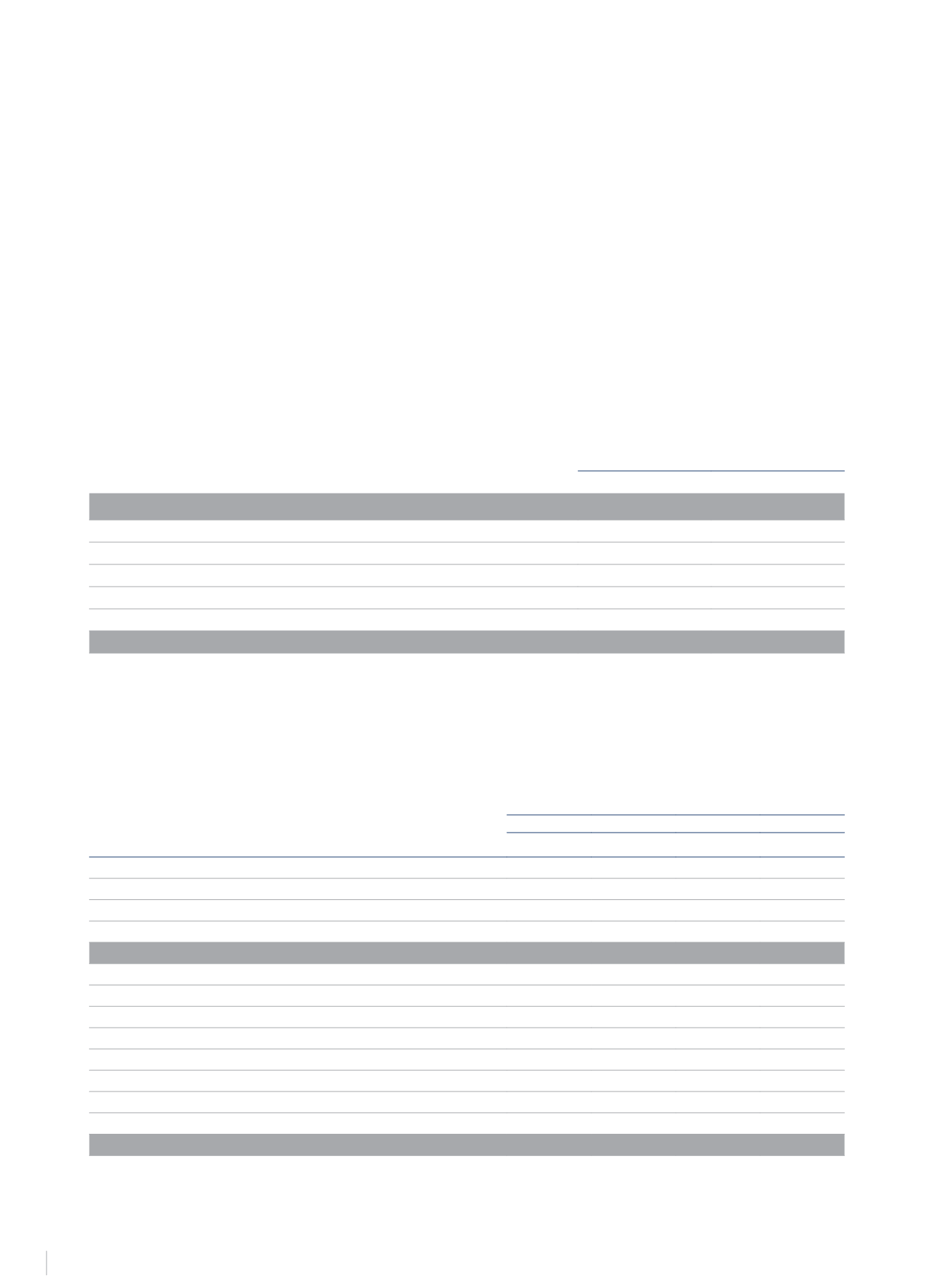

15.2 Parent Company Reserves

i) Legal reserve

In accordance with the Consolidated Text of the Corporate Enterprises Act, 10% of the net profit for each year must be allocated to the legal

reserve until it reaches at least 20% of share capital. The legal reserve may be used to increase capital provided its remaining balance does not

fall below 10% of the increased capital amount. With the exception of the aforementioned purpose, and when it does not exceed 20% of share

capital, this reserve may be used only to offset losses, provided no other reserves are available for this purpose.

ii) Share premium

The Consolidated Text of the Corporate Enterprises Act expressly allows the balance of this reserve to be used to increase capital and imposes

no restrictions on its availability.

15.3 Treasury Shares

At year-end, NH Hotel Group held 9,359,003 treasury shares representing 2.67% of its share capital at a total cost of €38,805 thousand. On 4

November 2013, the Spanish Securities Market Commission was informed of the loan of 9,000,000 shares from the total number of treasury shares

to three financial entities that were involved in the placement of bonds convertible or exchangeable into the shares of NH Hotel Group, S.A., worth

€250 million. The purpose of this loan was to allow those financial entities to offer the shares to subscribers of the bonds requesting them (see note

16).

15.4 Non-Controlling Interests

The movements in this heading in 2014 and 2013 are summarised below:

€Thousand

2014

2013

Opening balance

153,001

159,158

Capital increases (Note 2.5.4)

(123,055)

-

Comprehensive profit (loss) attributed to non-controlling interests

(558)

(289)

Percentage changes in shares and sales (Note 2.5.4)

(4,626)

(3,875)

Dividends paid to non-controlling interests

(765)

(1,466)

Other movements

(816)

(527)

Closing balance

23,181

153,001

The “Dividends paid to non-controlling interests” item basically reflects the dividends paid out in 2014 to the following companies: NH Marín, S.A.,

for €250 thousand, and Latinoamericana de Gestión Hotelera, S.A., for €515 thousand.

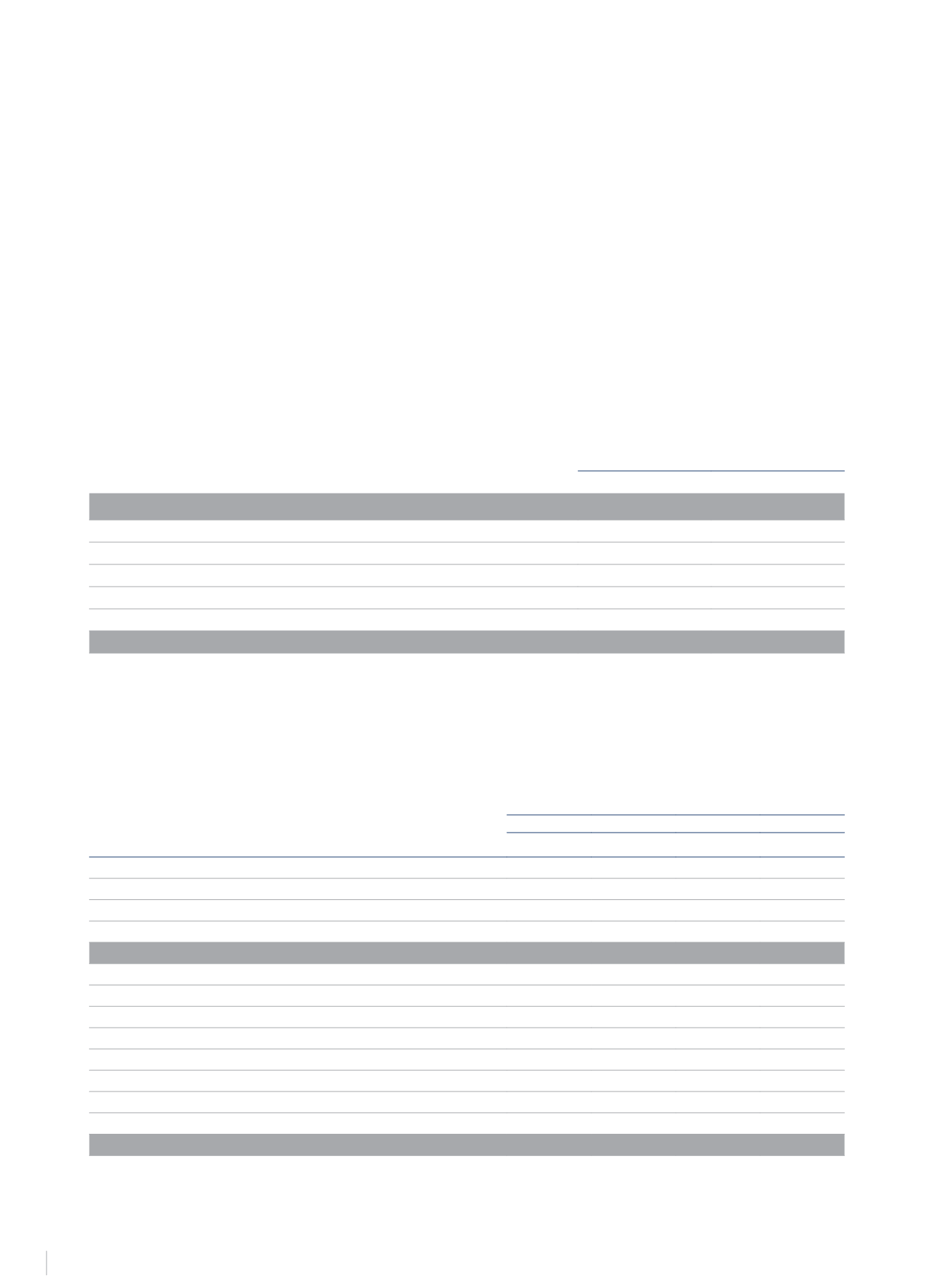

16.-DEBT IN RESPECT OF BOND ISSUES AND BANK BORROWINGS

The balances of the “Bonds and other negotiable securities” and “Debts with credit institutions” items at 31 December 2014 and 2013 were as follows:

€Thousand

2014

2015

Long-term Short-term Long-term Short-term

Convertible notes

228,156

-

223,417

-

Guaranteed senior notes

250,000

-

250,000

-

Borrowing costs

-

3,517

-

3,661

Arrangement expenses

(14,174)

-

(15,129)

-

Obligations and other negotiable securities

463,982

3,517

458,288

3,661

Syndicated loans

111,633

19,700

114,333

19,000

Mortgages

86,415

18,807

131,124

55,855

Equity loans

-

-

-

6,493

Subordinated loans

75,000

-

75,000

-

Credit lines

-

32,617

6,506

12,482

Arrangement expenses

(4,104)

(1,365)

(5,668)

(716)

Borrowing costs

-

1,152

-

2,930

Debts with credit institutions

268,944

70,911

321,295

96,044

Total

732,926

74,428

779,583

99,705

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS