96

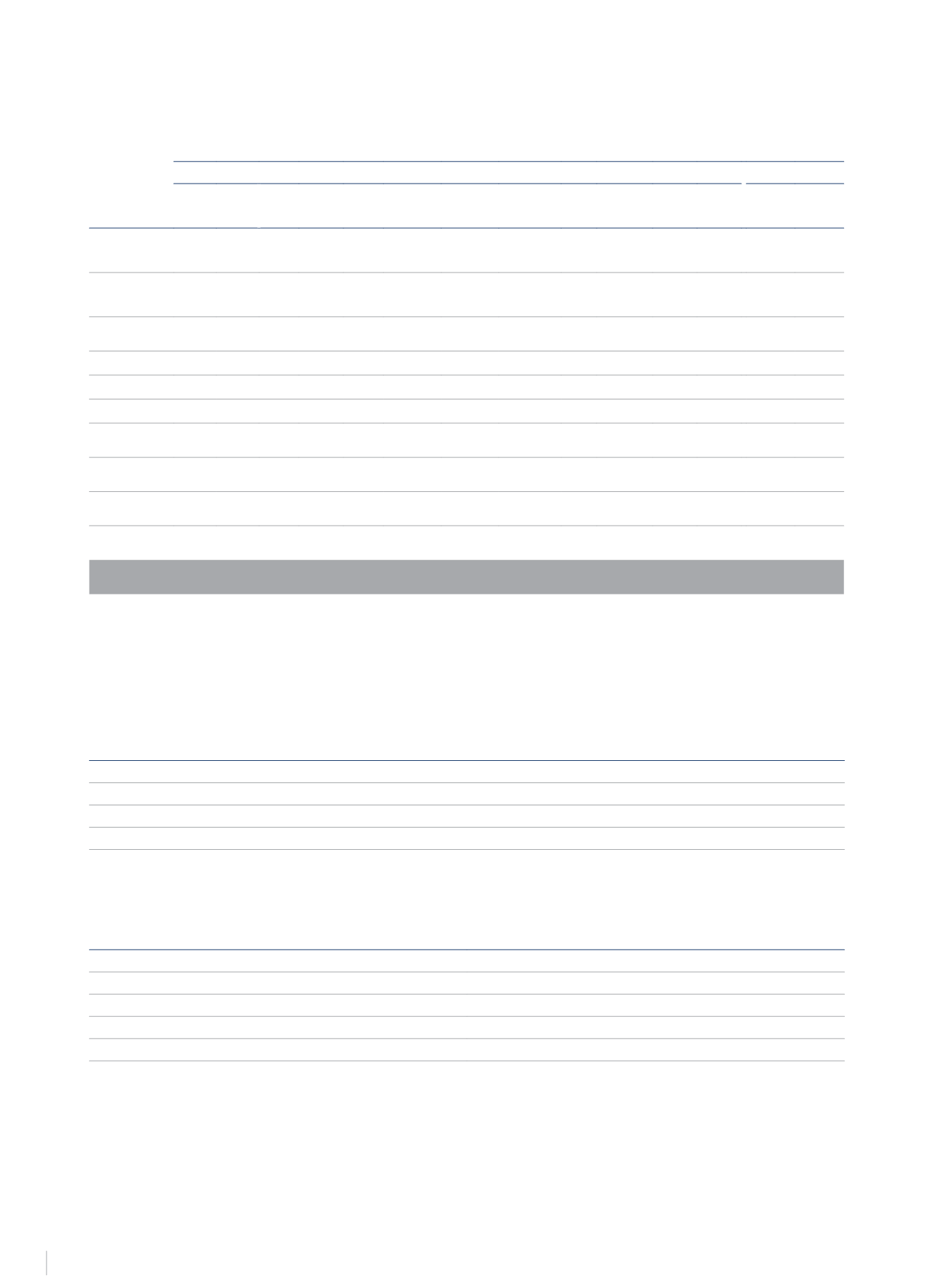

The reconciliation between the consolidated comprehensive profit or loss statements, the corporation tax base, current and deferred tax for the

year, is as follows:

€Thousand

2014

2013

Spain Germany Czech R. Romania Poland Switzerland Luxembourg Latin America

(1)

Italy Netherlands

(2)

Portugal TOTAL Spanish

Companies

Other

Companies

Consolidated

comprehensive

profit and loss

statements

(75,876) 9,339 194

28

49

(701)

1,060

10,044

22

29,559 (56) (26,338) (125,754) 92,917

Adjustments to

consolidated

comprehensive

profit and loss:

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Accounting

consolidation

adjustments

(25,339) 4,765

-

-

-

-

-

-

4,680

-

-

(15,894) 22,770.00 9,974

Due to permanent

differences

35,823 (12,621)

-

196

-

1,460

(1,060)

(1,435) (10,572) 3,416

56 15,263 40,433 (2,069)

Due to temporary

differences

17,225 (188)

-

-

-

-

-

2,857

1,124 (7,956)

-

13,062 22,618 14,806

Tax base (Taxable

profit or loss)

(48,167) 1,293 194 224 49

759

-

11,465 (4,746) 25,018

-

(13,911) (39,935) 115,628

Current taxes to

be refunded / (to

pay)

(1,088)

179

-

1

-

(27)

2

(604)

4,183 1,751

(54)

4,343

(194)

2,761

Total current

tax income /

(expense)

11,275 (388)

-

(36)

(9)

(59)

-

(3,153)

(4,645) (6,254)

-

(3,269)

387 (26,266)

Total deferred

tax income /

(expense)

3,914 (57)

-

-

-

-

-

786

356 (1,989)

-

3,010 (7,827)

28,238

Total income /

(expense) due to

tax rate changes

(14,562)

-

-

-

-

-

-

(789)

-

-

-

(15,351)

-

-

Total Corporation

Tax income /

(expense)

626 (444)

-

(36)

(9)

(59)

-

(3,157) (4,289) (8,243)

-

(15,611) (7,440)

1,972

(1) The Latin America business area includes the profits and losses obtained by the Group in Argentina, Mexico, Uruguay, the Dominican Republic, Colombia, Chile, Panama and Brazil.

(2) The Netherlands business area includes Belgium and France.

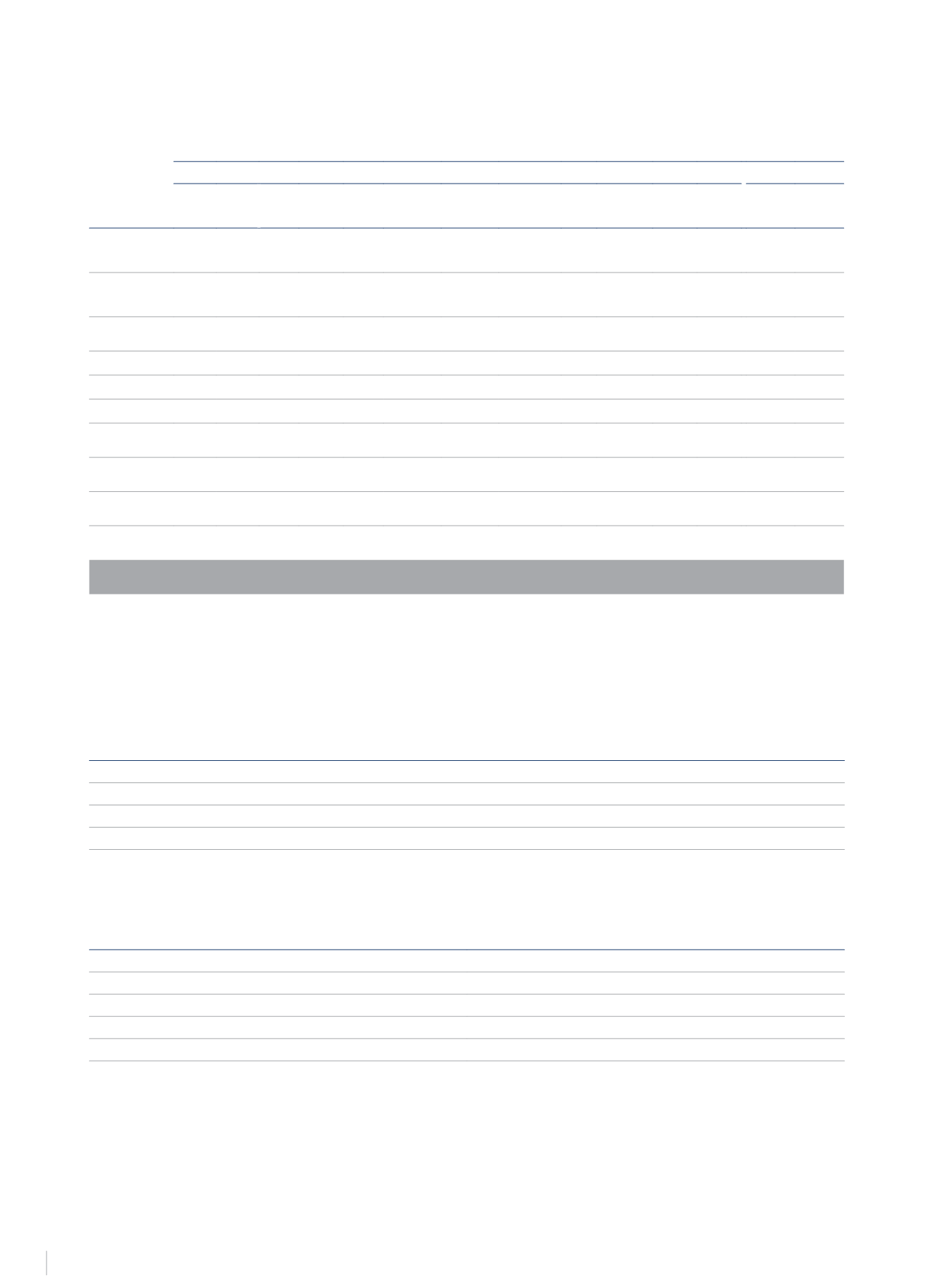

Financial years subject to tax inspection

In accordance with Spanish tax legislation, the years open for review to the Consolidated Tax Group are:

Tax

Pending Periods

Corporation

2010 to 2013

VAT

2011 to 2014

IRPF (personal income tax)

2011 to 2014

Others

2011 to 2014

On 30 January and 3 February 2015, NH Hotel Group, S.A. and NH Hoteles España, S.A. received separate notifications from the Spanish Tax Agency

of audit and investigation inspections, with the following scope:

Item

Period

Corporate Income Tax

2010 to 2014

Value Added Tax

2011 to 2013

Withholdings on earnings

2011 to 2013

Withholdings on property income

2011 to 2013

Withholdings on non-resident income (NH Hotel Group)

2011 to 2013

The notification of the start of audit and investigation inspections was sent to NH Hotel Group, S.A. in its role as the parent company of Grupo 23/92,

regarding Corporate Income Tax, and of Group 161/09, regarding VAT.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS