94

At 31 December 2014, the Group had updated the tax credit recovery plan based on the Group’s business plan, considering an annual increase in the

tax base of 2% starting in 2020, in which extraordinary transactions are not taken into account. In accordance with the results of said recovery plan,

the tax credits will be fully offset in 2024. For this reason, the directors of the Parent Company have decided to capitalise the tax losses registered

for the year.

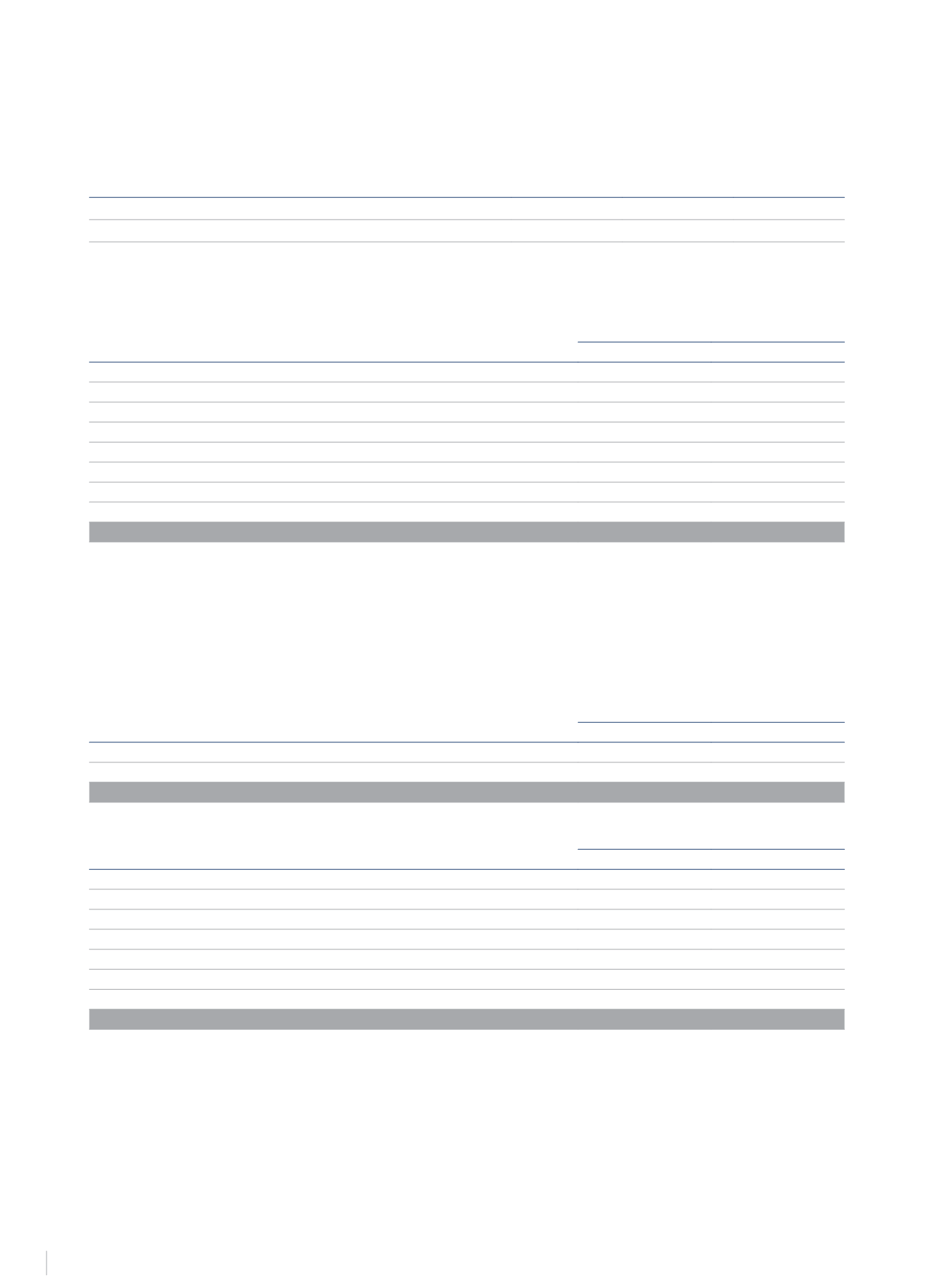

Below is a sensitivity analysis based on the tax base used in the estimate:

Annual Tax Base Variation

(10%)

(20%)

(30%)

Year of Recovery

2025

2026

2028

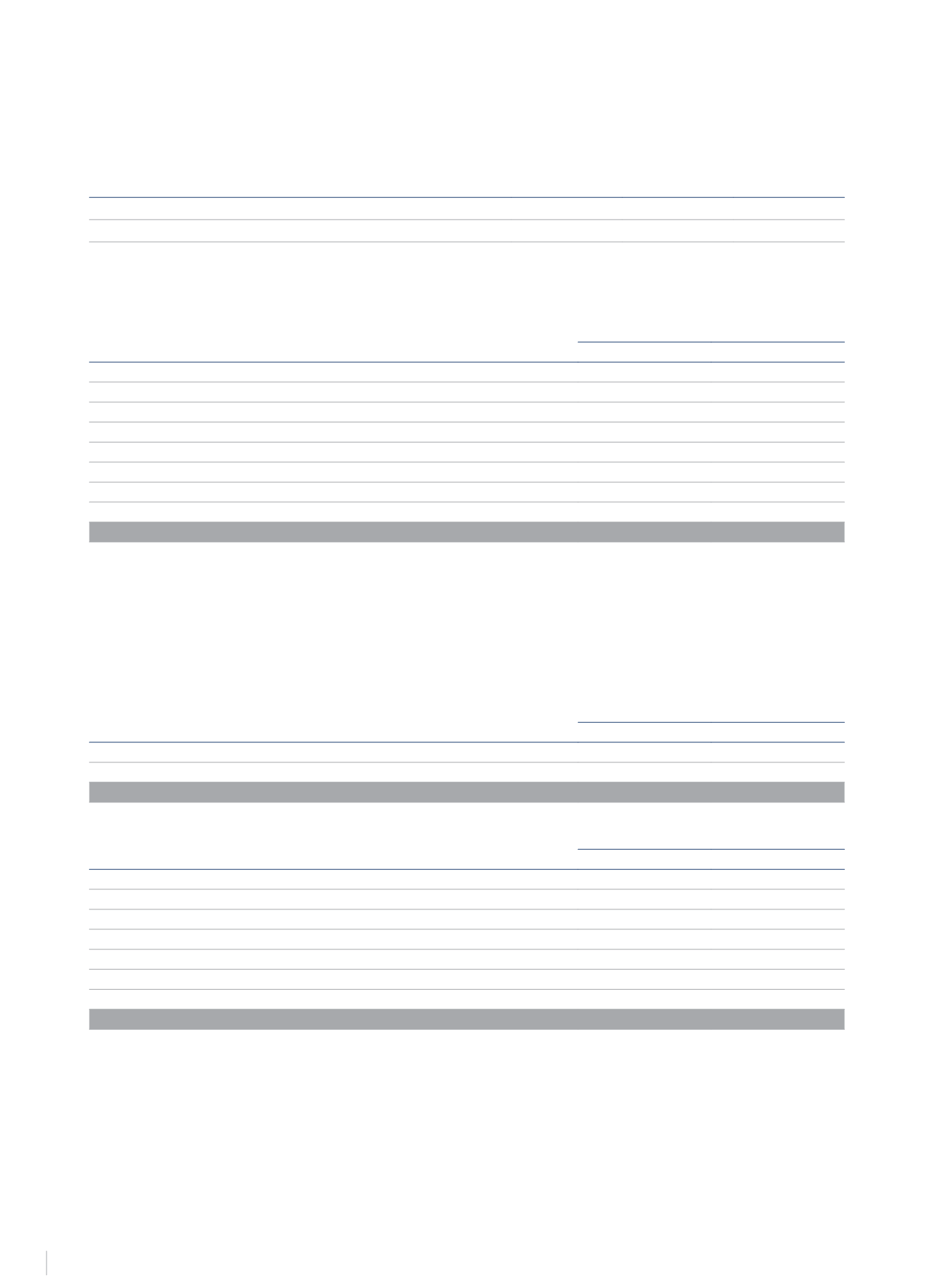

At 31 December 2014 and 2013 the Group had tax credits worth €574,544,000 that had not been entered in the accompanying balance statement

because the Directors considered they did not meet accounting standard requirements. These assets are grouped as follows:

€Thousand

2014

2013

Non-deductible financial expenses in Spain

138,113

96,575

Non-deductible financial expenses in Italy

28,519

30,298

Non-deductible financial expenses in Germany

12,900

11,400

Tax bases generated by the Spanish entities before consolidation

108,790

11,976

Tax bases generated in Spain

31,213

31,213

Tax bases generated in Italy

43,762

39,016

Tax bases generated in Germany

168,700

192,000

Deductions generated in Spain

42,548

45,463

Total

574,544

557,940

Financial expenses that cannot be deducted from Spanish Corporate Income Tax, due to exceeding 30% of the operating income of the tax group,

calculated according to Article 20 of the Redrafted Text of the Corporate Income Tax Act, approved by Legislative Royal Decree 4/2004, of 5

March, were €41,538 thousand in 2014 (€54,074 thousand in 2013). In accordance with the new stipulations of Law 27/2014, there is no deadline

for offsetting non-deductible finance costs. Regarding Italian and German Corporate Income Tax, tax regulations in those countries are similar to

those of Spain on the deductibility limit of financial expenses. In accordance with Italian and German legislation, there is no deadline for offsetting

non-deductible finance costs.

The composition of the credit balances with Public Administrations at 31 December 2014 and 2013 is as follows:

€Thousand

2014

2013

Deferred tax liabilities

Revaluation of assets and other valuation differences

179,730

201,225

Total

179,730

201,225

€Thousand

2014

2013

Short-term taxes payable

Corporate Income Tax

15,412

7,314

Value Added Tax

1,763

12,009

Personal Income Tax

8,321

5,124

Tax on Income from Capital

90

1,196

Social Security

8,196

6,695

Others

6,312

5,157

Total

40,094

37,495

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS