97

Deductions applied by the consolidated tax group of the Parent Company

The deductions generated during the year are essentially due to double taxation. 2014 marked the end of the compensation period of the €9 million

deduction to avoid double taxation generated in 2006.

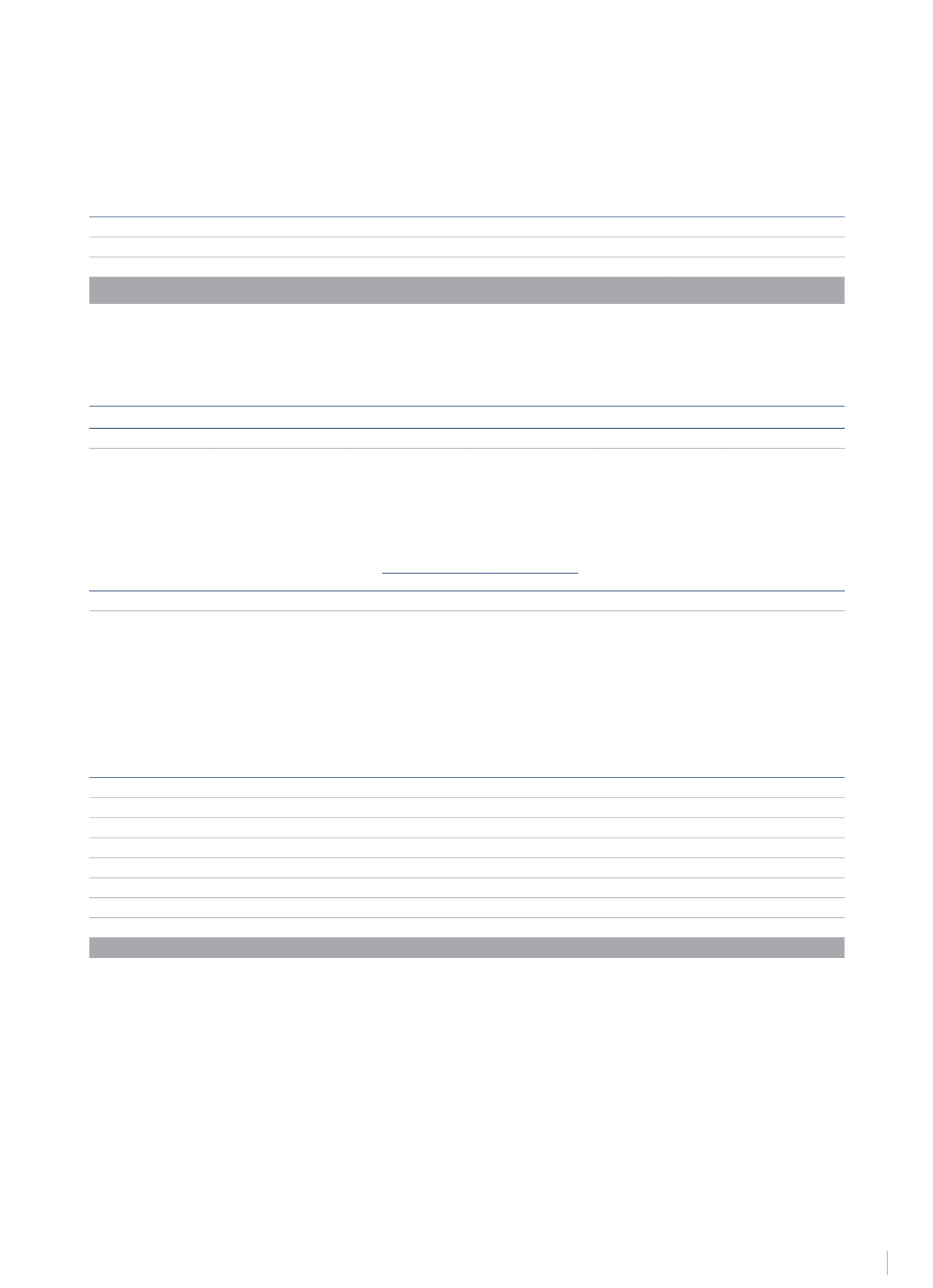

At 31 December 2014, the Tax Group held the following tax credit carry-forward (€thousand):

Year Origin

Deduction pending application

Amount

2002 to 2010

Investment in export activity

29,047

2007 to 2013

Tax deduction to avoid double taxation

12,222

2002 to 2013

Other

1,279

42,548

Similarly, the consolidated tax group of the Parent Company took advantage in prior years of the “Deferral of extraordinary profits for reinvestment”

scheme. The essential characteristics of such reinvestment are as follows (€thousand):

Amount offset

Year of origin

Revenue Qualifying

for deferral

Previous years

Year 2014

Amount Outstanding Last year of deferral

1999

75,145

50,757

682

23,706

2049

This income was reinvested in the acquisition of buildings.

Revenue from previous year written off for the reinvestment of extraordinary profits in accordance with the provisions set forth in Section 42 of the

Consolidated Text of the Corporation Tax Act is shown below (€thousand).

Financial year

Date of transmission Revenue deferred

Deduction

Company generating the

capital gain

Company reinvesting

Applied

Outstanding

2008

June

1,583

-

190

Gran Círculo de Madrid, S.A.

NH Europa, S.L.

The capital gains obtained in 2008 were re-invested in 2009 through the Group’s acquisition of new shares in the Italian subsidiary through NH

Europa, S.L., formerly “NH Hotel Rallye, S.A.”. These shares were issued as a result of a capital increase of €73 million, allocated to acquiring new

hotels and refurbishing existing ones, with an obligation to maintain the investment during a three-year period.

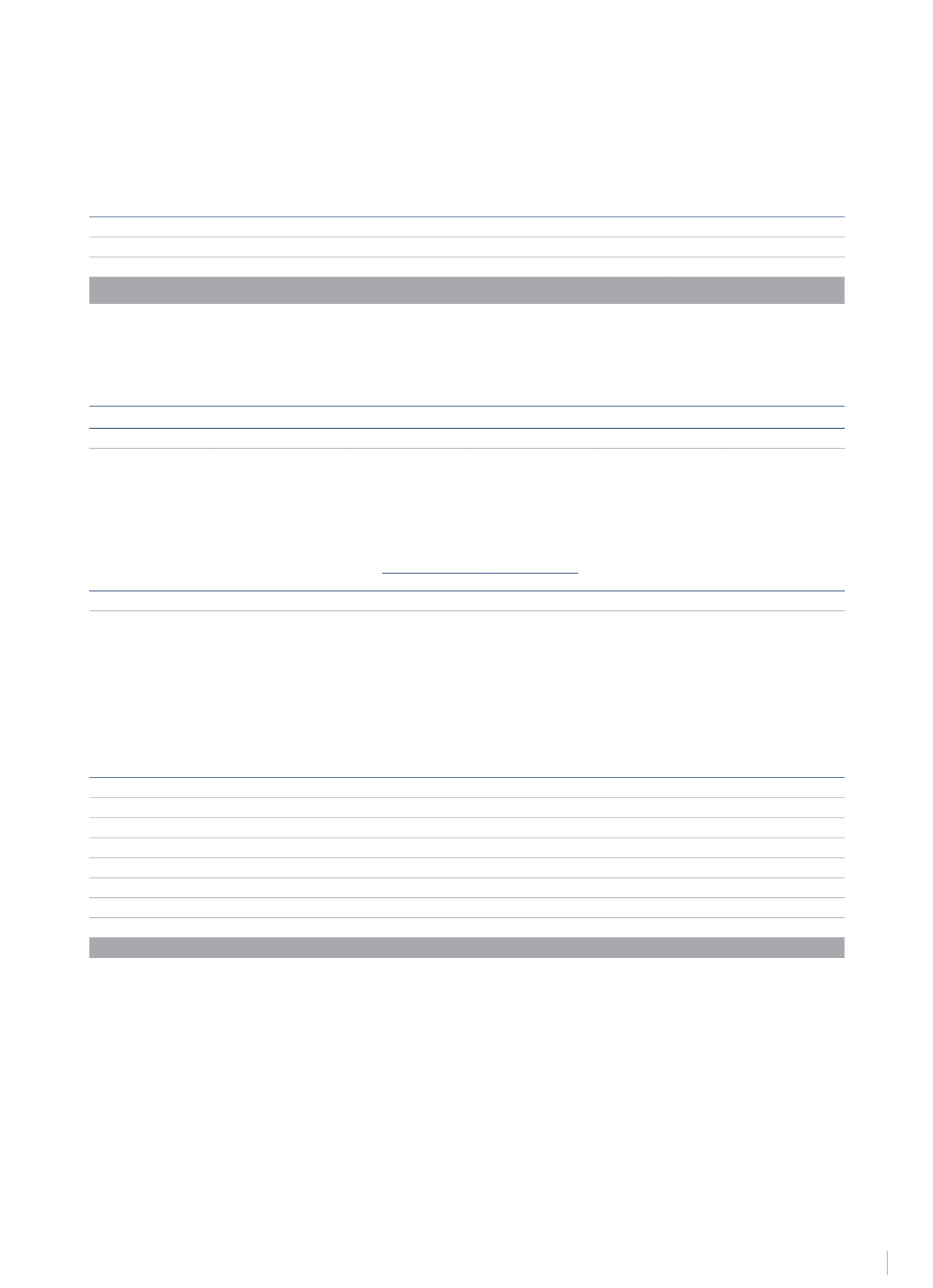

Negative tax bases

At 31 December 2014, the Consolidated Tax Group headed by NH Hotel Group, S.A. has the following tax loss carry-forwards:

Financial year

Amount

2007

8,992

2008

17,711

2009

91,223

2010

50,107

2011

23,706

2012

156,689

2013

31,213

2014

49,316

Total

428,958

The exit of Sotogrande, S.A., Resco Sotogrande, S.L. and Club Deportivo Sotogrande, S.A. from the Tax Group means an estimated reduction in tax

loss carry-forwards of €68 million.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS