84

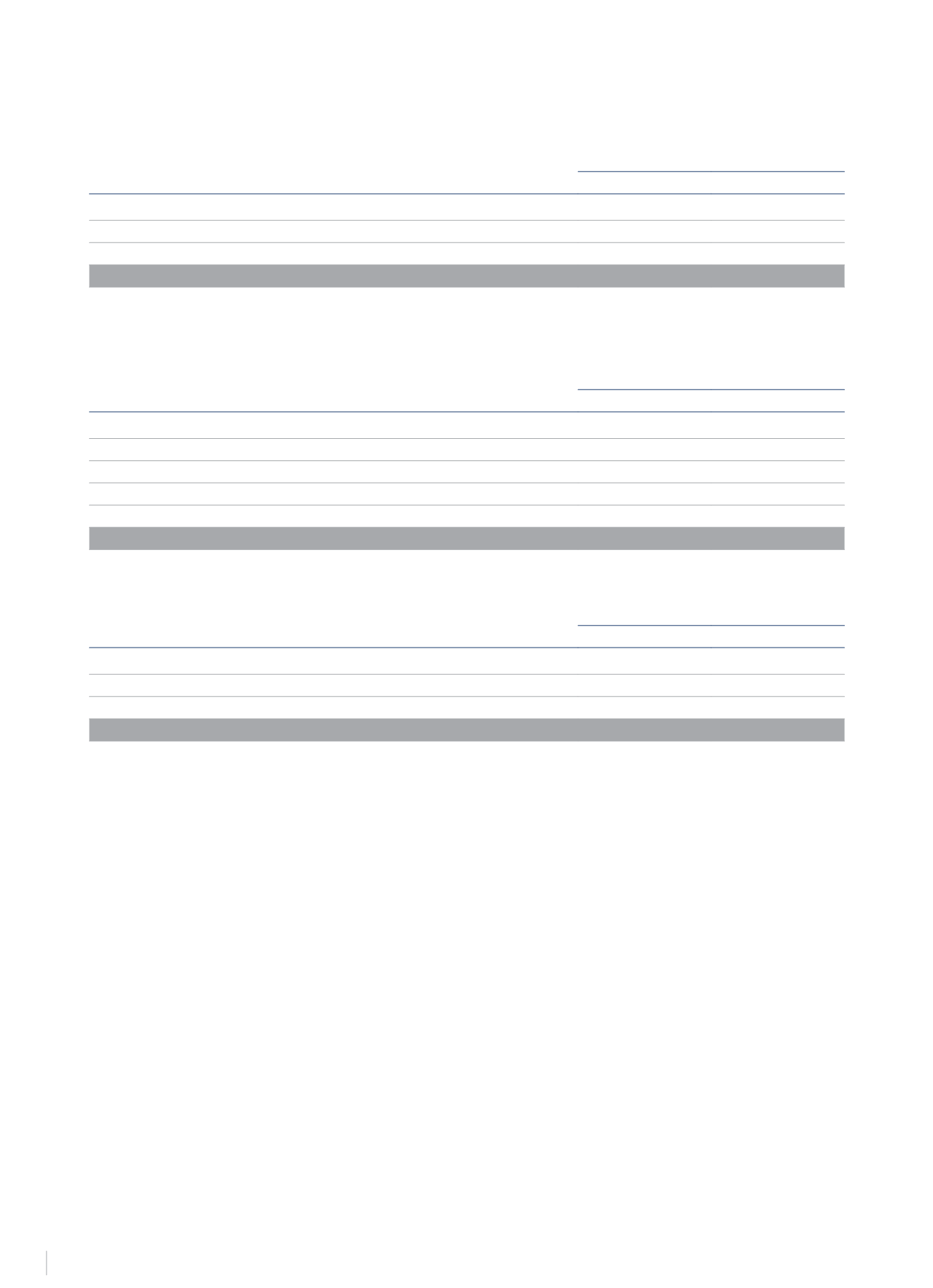

13.- TRADE RECEIVABLES

This item reflects different accounts receivable from the Group’s operations. The breakdown at 31 December 2014 and 2013 is as follows:

€Thousands

2014

2013

Trade receivables for services provided

149,054

127,190

Trade receivables for real-estate product sales

-

7,654

Provision for bad debts

(13,042)

(15,649)

Total

136,012

119,195

As a general rule, these receivables do not accrue interest and are due at less than 90 days with no restrictions on how they may be availed.

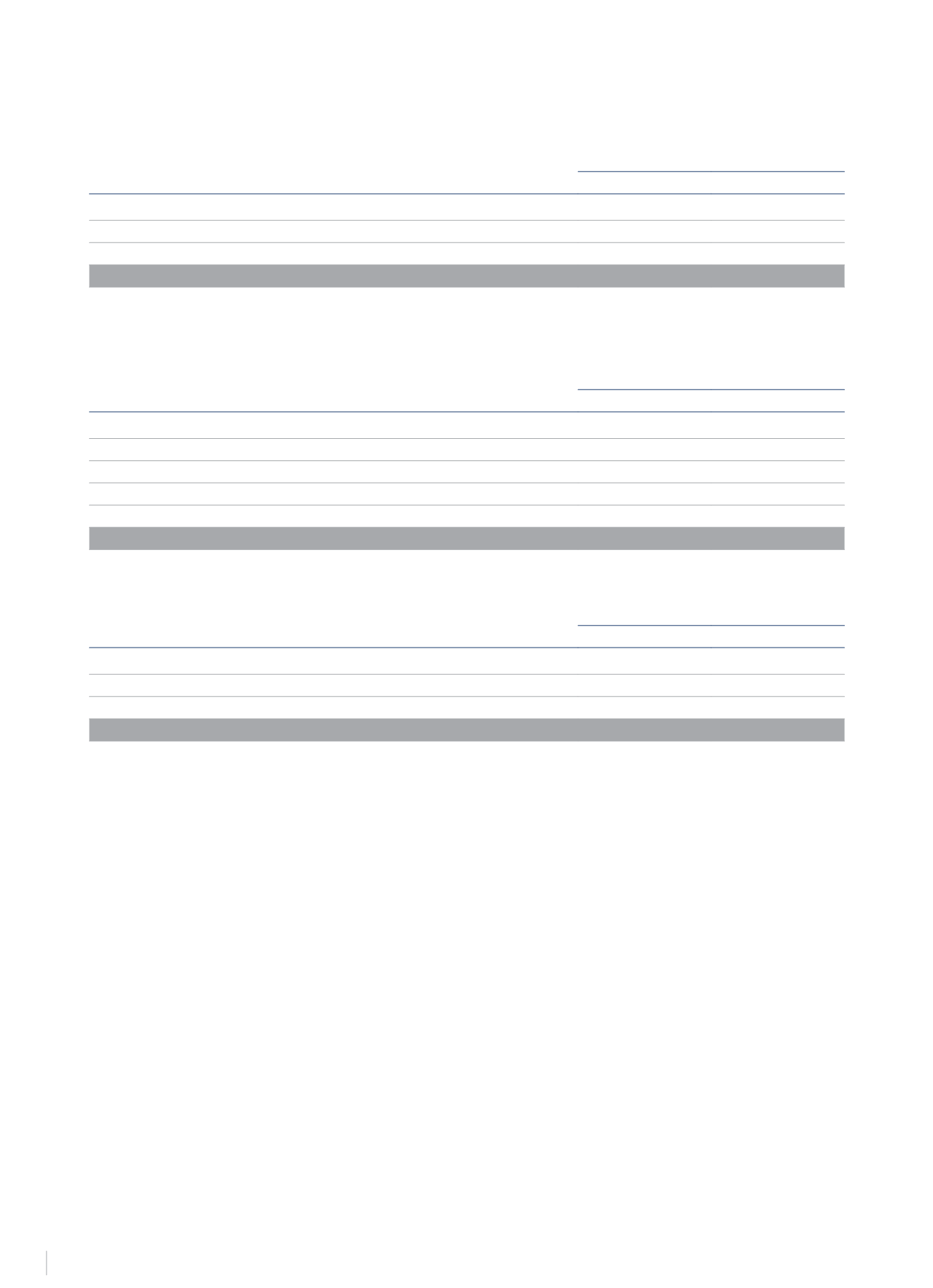

Movements in the provision for bad debts during the years ending 31 December 2014 and 2013 were as follows:

€Thousands

2014

2013

Balance at 1 January

15,649

15,144

Changes in scope

(4,271)

-

Exchange differences

(19)

(132)

Additions

2,852

2,798

Applications

(1,169)

(2,161)

Balance at 31 December

13,042

15,649

The analysis of the ageing of financial assets in arrears but not considered impaired at 31 December 2014 and 2013 is as follows:

€Thousands

2014

2013

Less than 30 days

23,117

22,565

From 31 to 60 days

13,060

12,568

More than 60 days

25,054

14,377

Total

61,231

49,510

14.- CASH AND CASH EQUIVALENTS

This item essentially includes the Group’s cash position, along with any loans granted and bank deposits that mature at no more than three months.

The average interest rate obtained by the Group for its cash and cash equivalents balances during 2014 and 2013 was a variable Euribor-indexed

rate. These assets are recognised at their fair value.

There are no restrictions on cash withdrawals, except an escrow deposit agreement of US$7 million for the purchase of Hoteles Royal.

As a result of the enactment of Royal Decree 1558/2012 of 15 November, of Article 42 bis of Royal Decree 1065/2007 of 27 July, approving the

General Regulations on tax management, inspection and procedures, and implementing the common rules of the procedures for applying taxes,

which establishes certain reporting obligations with regard to overseas assets and rights, among others, it is disclosed that some members of the NH

Hotel Group S.A. Board of Directors have the right, as representatives or authorised officials, to dispose of bank accounts located abroad, which are

in the name of Group companies. The reason certain Board members have the right to dispose of overseas bank accounts is that they are directors

or board members of said subsidiaries.

NH Hotel Group S.A. holds other accounting documents, namely the consolidated annual accounts, from which sufficient data can be extracted in

relation to the aforementioned accounts.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS