79

The Group has taken out insurance policies to cover any possible risks to which the different elements of its tangible fixed assets are subject, and

to cover any possible claims that may be filed against it in the course of its activities. It is understood that such policies sufficiently cover the risks

to which the Group is exposed.

Firm purchase undertakings amounted to €17.8 million at 31 December 2014. These investments will be made in 2015, 2016 and 2017.

9.- NON-CURRENT ASSETS HELD FOR SALE, LIABILITIES LINKED TO NON-CURRENT

ASSETS HELD FOR SALE AND DISCONTINUED OPERATIONS

In accordance with IFRS 5, Non-current assets classified as held for sale and discontinued operations (see Note 4.8), non-strategic assets which,

pursuant to the Strategic Plan, are undergoing divestment with committed sales plans, were reclassified.

We classified as discontinued operations Sotogrande, S.A., Donnafugata Resort, S.R.L., Resco Sotogrande, S.L., Sotocaribe, S.L., Los Alcornoques de

Sotogrande S.L., Residencial Marlin, S.L. and Capredo Investments, GmbH, the last four accounted for using the equity method. These companies

represent NH Hotel Group’s entire property business and include the operation of businesses associated with the hospitality and leisure sectors,

including two golf courses and three hotels.

The assets classified as held for sale, after deducting their liabilities, were measured at the lower of their carrying amount and the expected sales

price minus costs.

Also, in accordance with these regulations, the balances in the 2013 consolidated comprehensive income statement corresponding to operations

considered to have been discontinued that year were standardised.

On 14 November 2014, the sale was formalised of the Parent Company’s stake in Sotogrande, S.A., representing 96.997% of its share capital (see

note 2.5.4).

The sections below detail, by type, the various income and balance sheet items relating to assets and liabilities classified as held for sale and

discontinued operations.

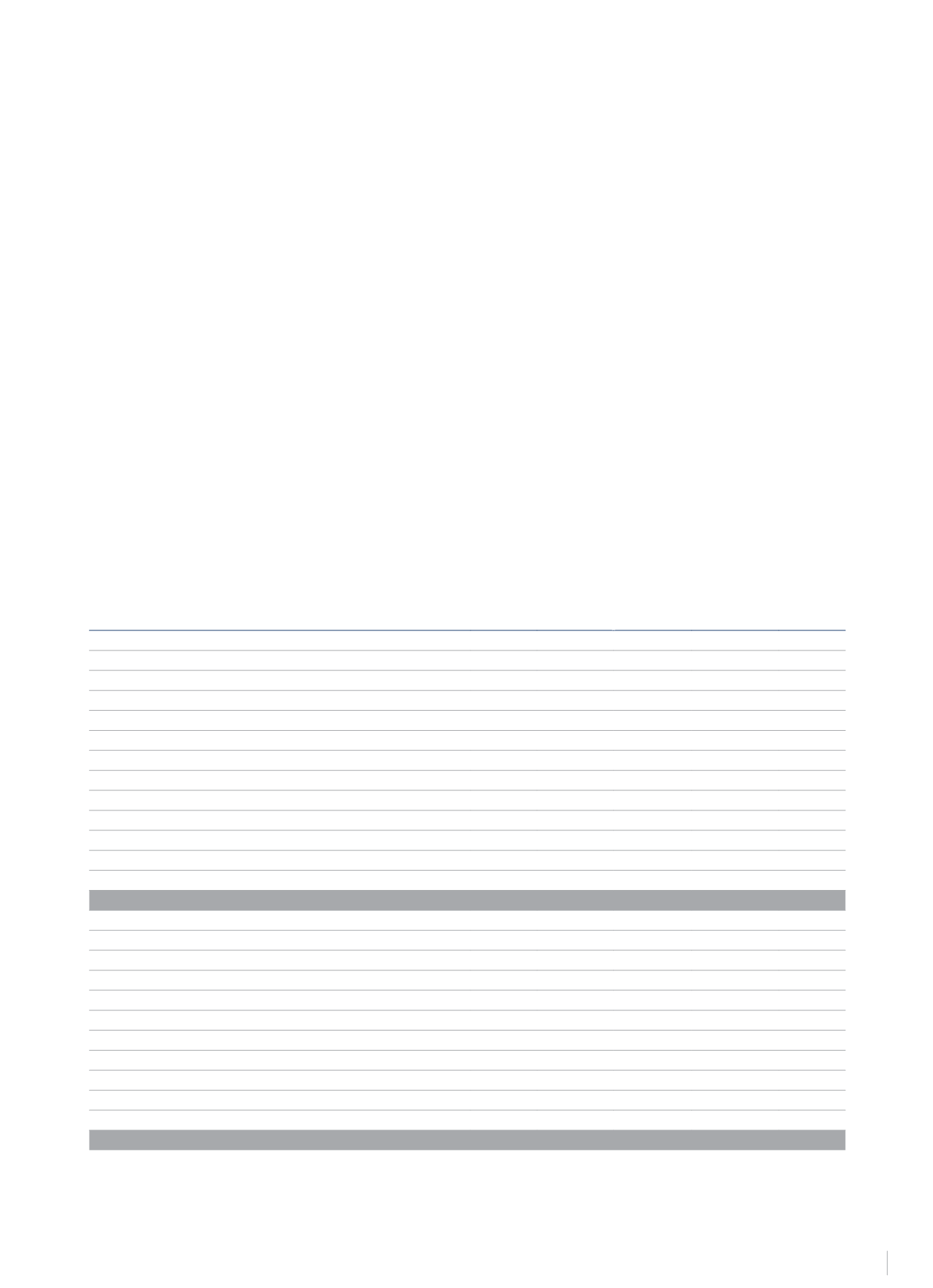

Consolidated balance sheets. Headings of Non-current assets and liabilities classified as Held for Sale

A movement by balance headings of the assets and liabilities presented under the corresponding Held for Sale headings at 31 December 2014 is

shown below:

31.12.2013 Assignments

Net Variation

Changes in scope

of consolidation

(see Note 2)

31.12.2014

Property, plant and equipment

-

82,891

(3,440)

(40,668)

38,783

Intangible assets

-

1,920

(68)

(1,837)

15

Investment property

-

957

(61)

(896)

-

Financial assets

-

73,941

(1,259)

(25,694)

46,988

Investments accounted for using the equity method

-

67,617

(1,251)

(19,410)

46,956

Other non-current financial investments

-

6,324

(8)

(6,284)

32

Deferred tax assets

-

8,268

251

(8,226)

293

Inventories

-

71,034

(2,926)

(67,439)

669

Accounts receivable for sales and services and trade receivables

-

12,473

(3,070)

(7,654)

1,749

Tax receivables

-

9,030

(7,687)

(808)

535

Other current financial assets

-

93

68

(161)

-

Cash

-

5,150

2,740

(1,868)

6,022

Other current assets

-

212

57

(130)

139

Non-current assets classified as held for sale

-

265,969

(15,395)

(155,381)

95,193

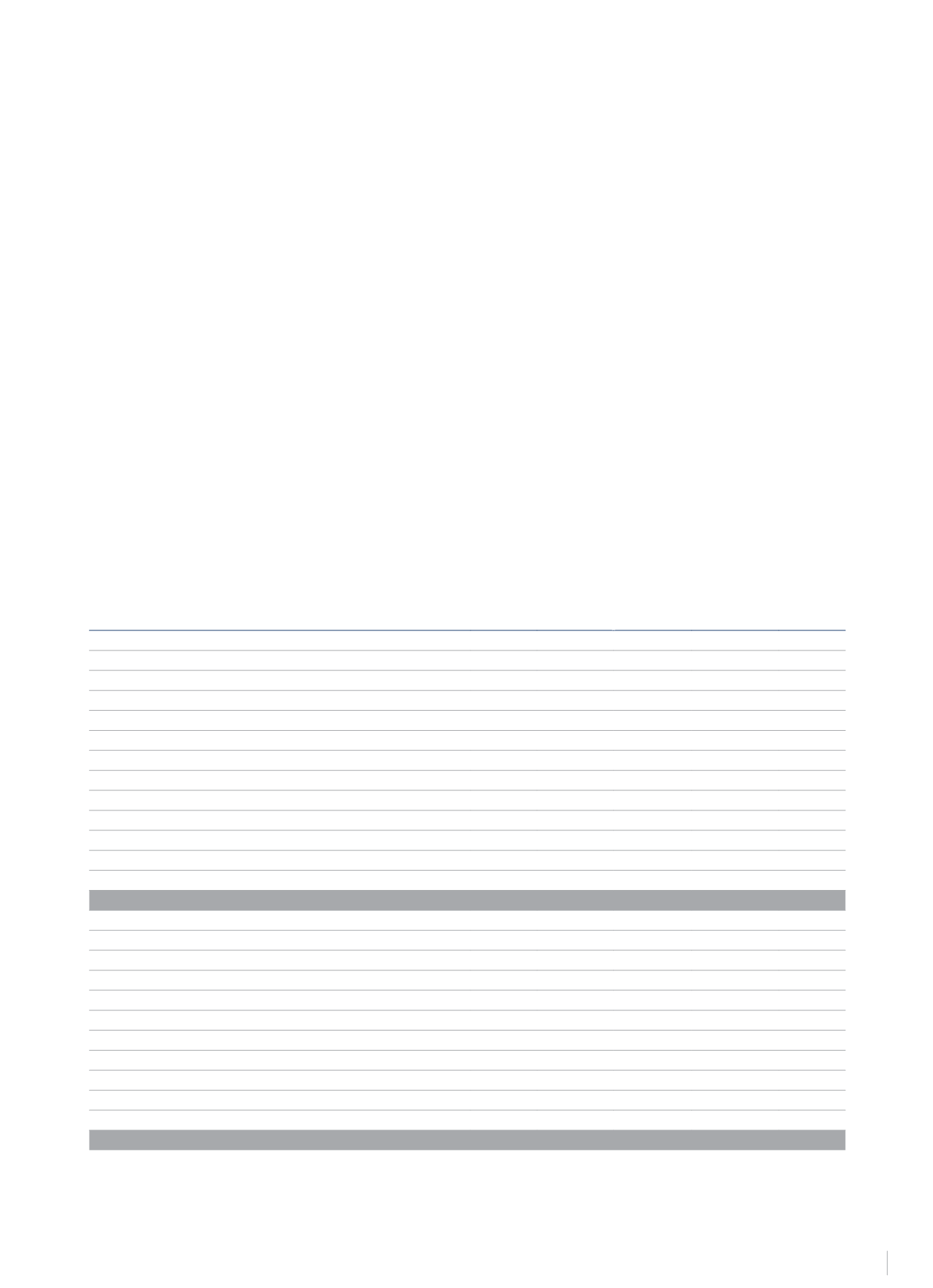

Bank borrowings (non-current)

-

6,494

(2,672)

(3,822)

-

Obligations under finance lease

-

132

(29)

(103)

-

Other non-current liabilities

-

18,538

(720)

(2,037)

15,781

Capital subsidies

-

18,086

(737)

(1,568)

15,781

Other liabilities

-

452

17

(469)

-

Provisions for contingencies and charges

-

1,411

53

(995)

469

Deferred tax liabilities

-

9,461

(4,717)

(4,458)

286

Bank borrowings (current)

-

41,985

(7,129)

(6,644)

28,212

Trade payables

-

11,704

(2,971)

(5,091)

3,642

Tax receivables

-

804

575

(1,073)

306

Other current liabilities

-

7,031

2,298

(1,950)

7,379

Liabilities associated with assets classified as held for sale

-

97,560

(15,312)

(26,173)

56,075

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS