69

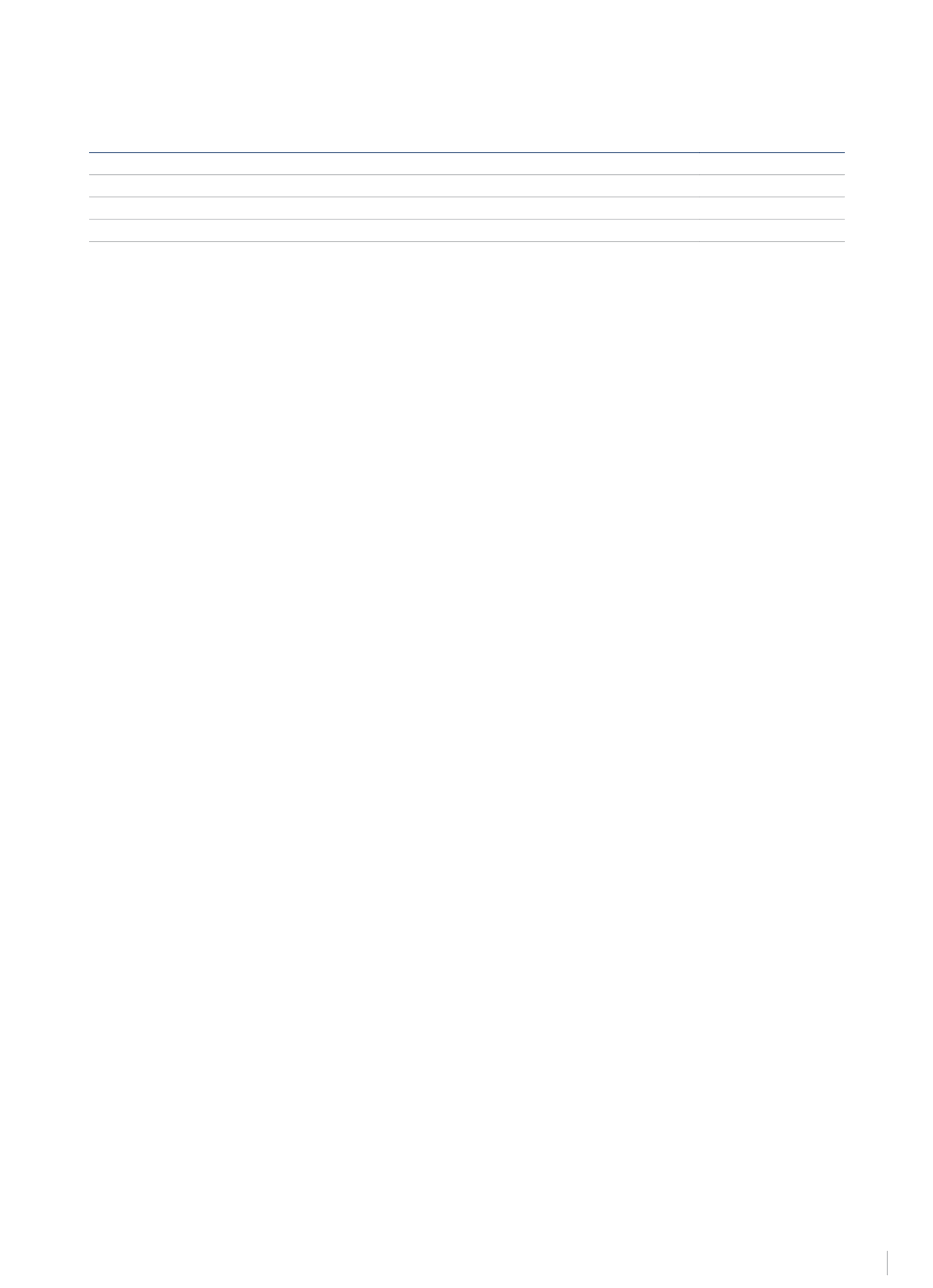

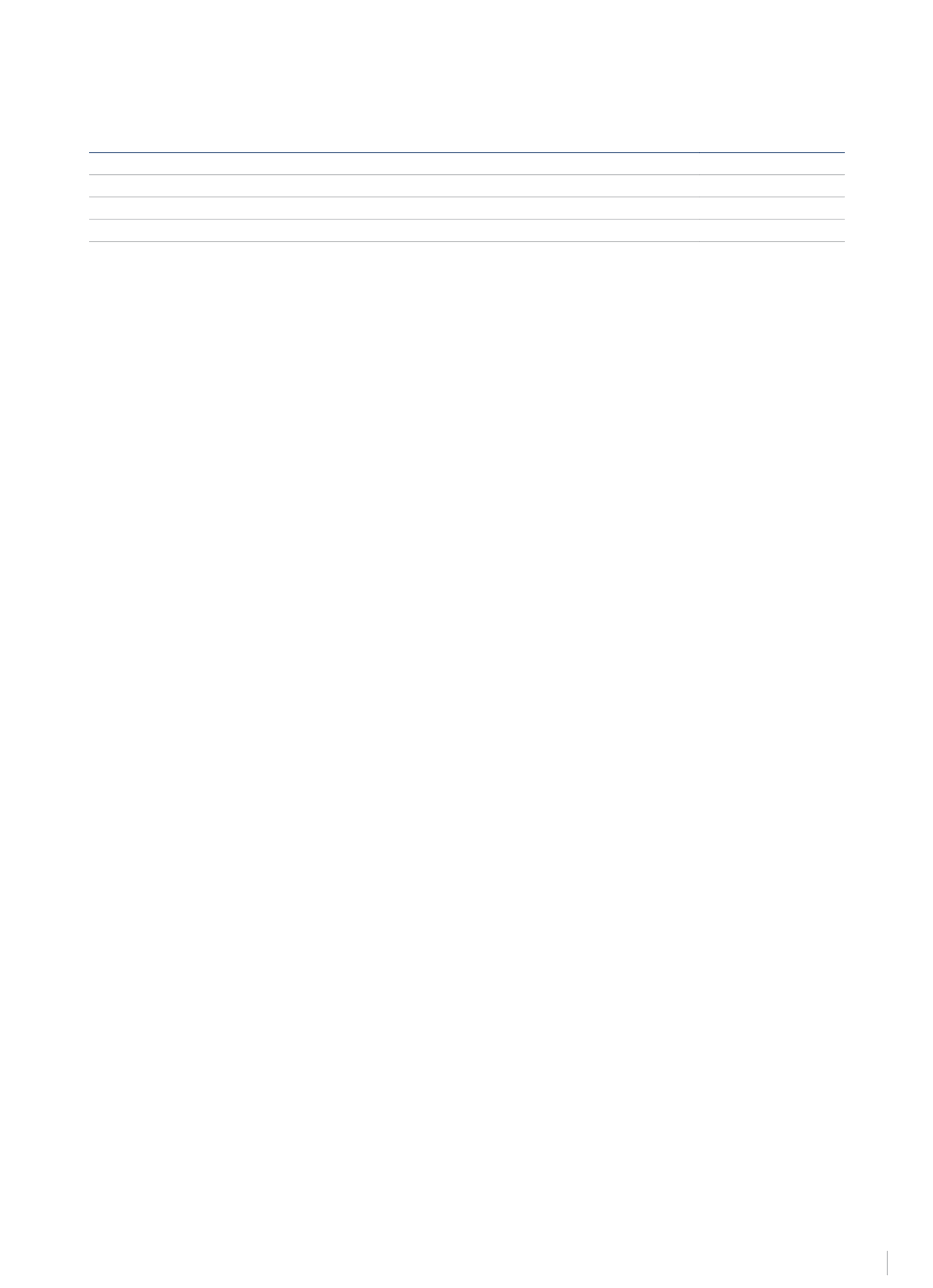

The Group depreciates its property, plant and equipment following the straight line method, distributing the cost of the assets over their estimated

useful lives, in accordance with the following table:

Estimated years of useful life

Buildings

33-50

Plant and machinery

10-30

Other plant, fixtures and furniture

5-10

Other fixed assets

4-5

4.2 Consolidation Goodwill

The goodwill generated on consolidation represents the excess of the cost of acquisition over the Group’s share in the market value of the identifiable

assets and liabilities of a subsidiary.

Any positive differences between the cost of interests in the capital of consolidated and associated entities and the corresponding theoretical

carrying amounts acquired, adjusted on the date of the first consolidation, are recognised as follows:

1.If they are assignable to specific equity elements of the companies acquired, by increasing the value of any assets the market value of which

is above their carrying amount appearing in the balance statements.

2.If they are assignable to specific intangible assets, by explicitly recognising them in the consolidated balance sheet, provided their market

value on the date of acquisition can be reliably determined.

3.Any remaining differences are recognised as goodwill, which is assigned to one or more specific cash-generating units (in general hotels)

which are expected to make a profit.

Goodwill is recognised only when it has been acquired for valuable consideration.

Any goodwill generated through acquisitions prior to the IFRS transition date, 1 January 2004, is kept at its net value recognised at 31 December

2003 in accordance with Spanish accounting standards.

Goodwill is not amortised. In this regard, at the end of every year, or whenever there are indications of a loss of value, the Group estimates, using the

so-called “Impairment Test”, the possible existence of permanent losses of value that would reduce the recoverable amount of goodwill to less than

the net cost recognised. Should this be the case, it is written down in the consolidated comprehensive profit and loss statement. Any write-downs

recognised cannot subsequently be reversed.

All goodwill is assigned to one or more cash-generating units in order to conduct the impairment test. The recoverable amount of each cash-

generating unit is determined either as the value in use or as the net sale price that would be obtained for the assets assigned to the cash-generating

unit, whichever is higher. The value in use is calculated on the basis of estimated future cash flows discounted at an after-tax rate that reflects the

current market valuation with respect to the cost of money and the specific risks associated with the asset.

4.3 Intangible Assets

Intangible assets are considered to be any specifically identifiable non-monetary assets which have been acquired from third parties or developed

by the Group. Only those whose cost can be estimated in an objective way and from which future economic profits are expected are recognised.

Any assets deemed to contribute indefinitely to the generation of profits are considered to have an indefinite useful life. The remaining intangible

assets are considered to have a “finite useful life”.

Intangible assets with an indefinite useful life are not amortised and are hence subjected to the “impairment test” at least once a year (see Note 4.4).

Intangible assets with a finite useful life are amortised according to the straight-line method on the basis of the estimated years of useful life of the

asset in question.

The following are the main items recognised under the “Intangible assets” heading:

i) Usufruct Rights: this item reflects the right to operate Hotel NH Plaza de Armas in Seville, acquired in 1994, amortisation of which is recognised

in the consolidated comprehensive profit/loss over the 30-year term of the agreement at a rate which increases by 4% each year.

ii)“Rental agreement premiums” reflect the amounts paid as a condition to obtain certain hotel lease agreements. They are amortised on a

straight-line basis depending on the term of the lease.

iii)“Concessions, patents and trademarks” basically reflect the disbursements made by Gran Círculo de Madrid, S.A. for the refurbishment and

remodelling of the building where the Casino de Madrid is located. The amortisation of such works is calculated on a straight-line basis by

taking into account the term of the concession for operating and managing the services provided in the building where the Casino de Madrid

is located, which finalises on 1 January 2037.

iv)“Software applications” include various computer programs acquired by the different consolidated companies. These programs are measured

at acquisition cost and amortised at a rate of between 20%-25% per year on a straight-line basis.

4.4 Impairment in the Value of Tangible and Intangible Assets Excluding Goodwill

The Group evaluates the possible existence of a loss of value each year that would oblige it to reduce the carrying amounts of its tangible and

intangible assets. A loss is deemed to exist when the recoverable value is less than the carrying amount.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS