65

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

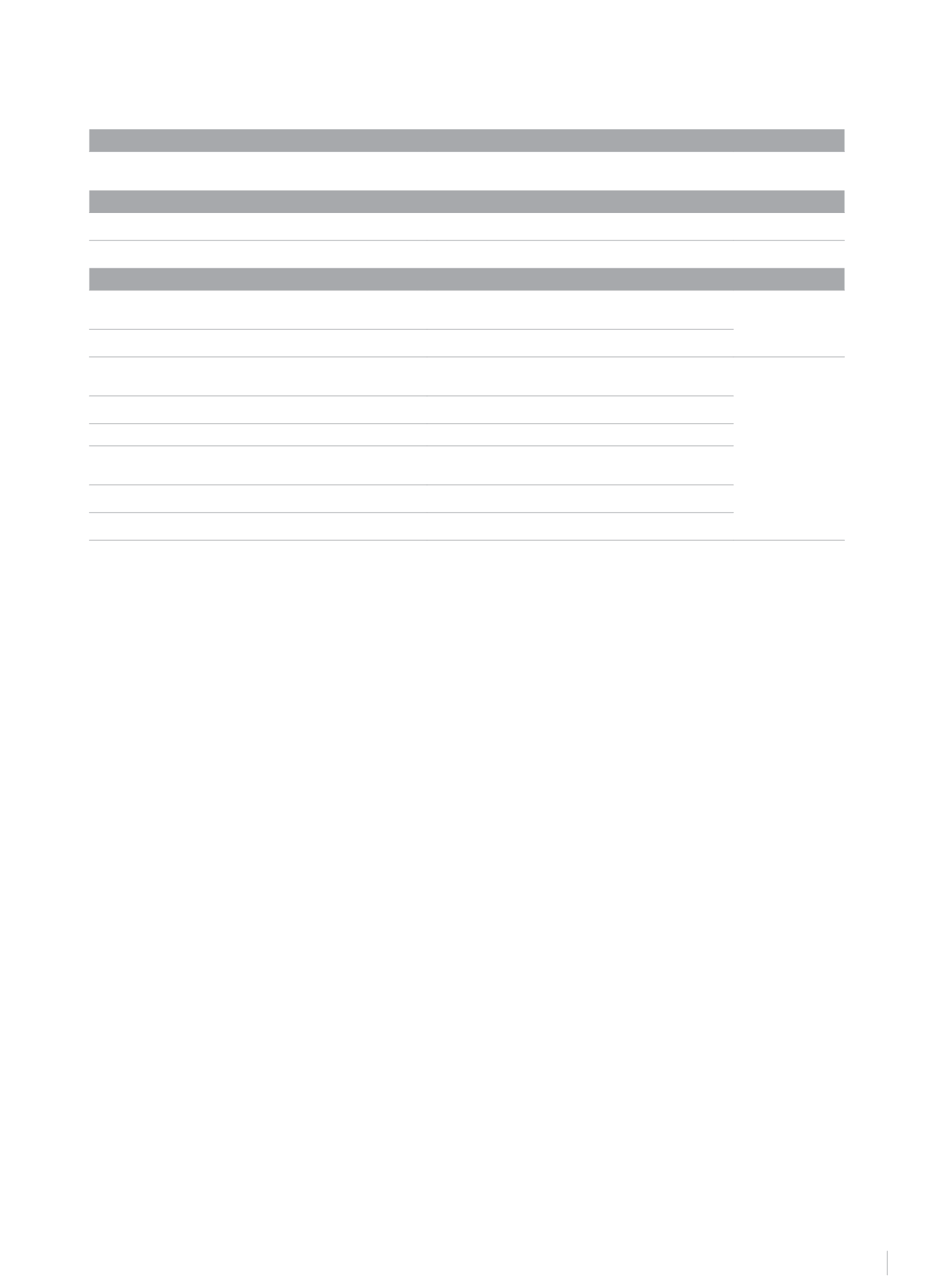

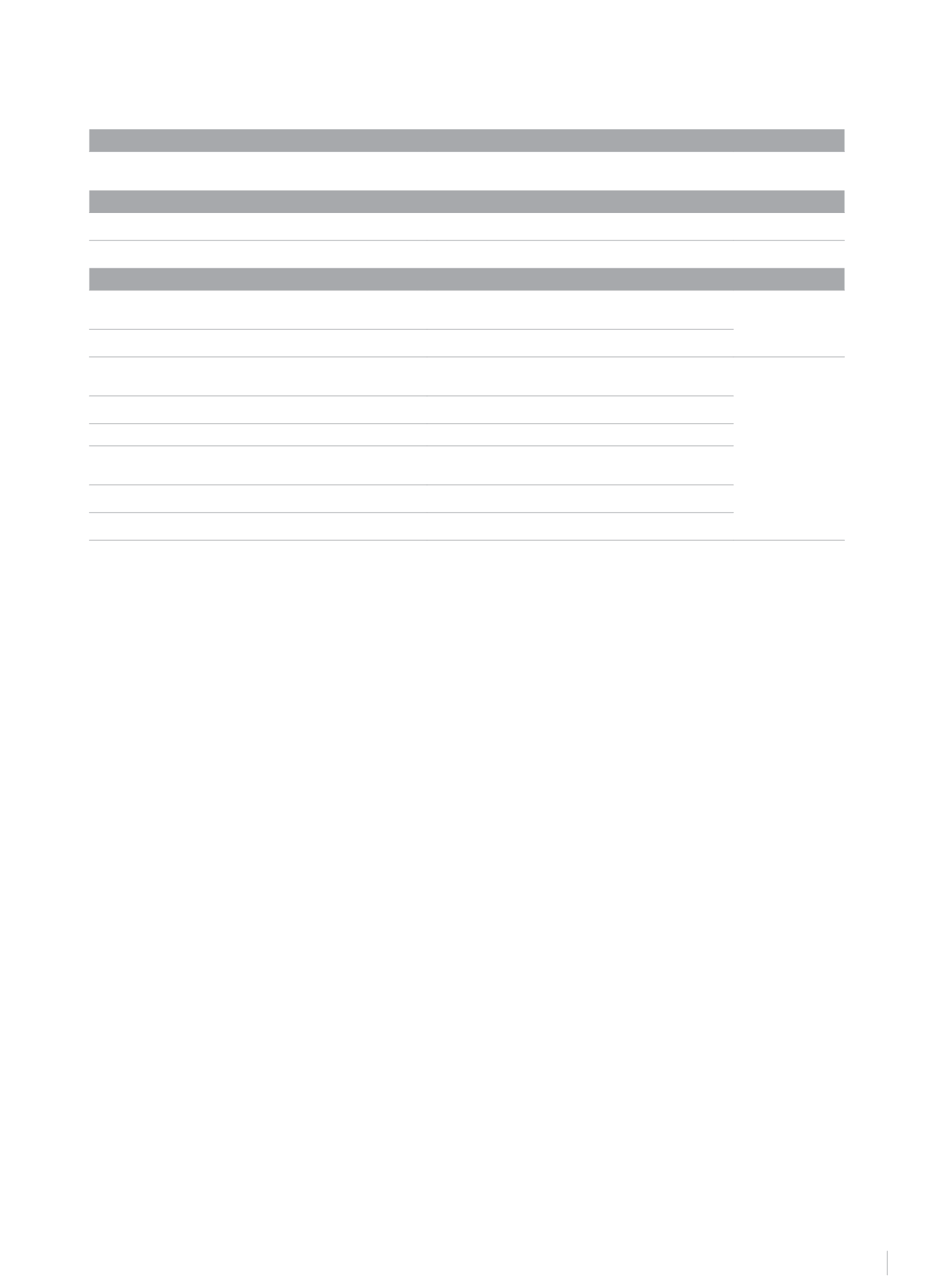

New standards, amendments and interpretations

Mandatory application

starting from:

Approved for use in the European Union

IFRIC 21 Levies (published in May 2013)

Interpretation of when to recognise a liability for levies that

are dependent on the entity's participation in an activity on a

given date

17 June 2014

Awaiting approval for use in the European Union as of the date of publication of this document (2)

IFRS 9 Financial Instruments (final phase published in July 2014)

It replaces the classification and measurement, impairment and

hedge accounting requirements in IAS 39

01 January 2018

IFRS 15 - Revenue from Contracts with Customers (published in

May 2014)

New standard on revenue recognition (replaces IAS 11, IAS 18,

IFRIC 13, IFRIC 15, IFRIC 18 and SIC-31)

01 January 2017

Amendments and/or interpretations

Amendment to IAS 19 Defined Benefit Plans: Employee Contributions

(published in November 2013)

The amendment was issued to make it possible to deduct these

costs from the service cost in the same period in which they are

paid when certain requirements are met

01 July 2014

Improvements to the 2010-2012 and 2011-2013 IFRS Cycles (published

in December 2013)

Minor amendments to a number of standards

Amendment to IAS 16 and IAS 38 - Acceptable Methods of

Depreciation and Amortisation (published in May 2014)

Clarifies the methods acceptable for depreciating and

amortising property, plant and equipment and intangible

assets

1 January 2016

Amendment to IFRS 11 Accounting for Acquisitions of Interests in

Joint Ventures (published in May 2014)

Specifies how to account for the acquisition of an interest in a

joint venture whose activity constitutes a business

Improvement to IFRS 2012 -2014 Cycle (published in May 2014)

Minor amendments to a number of standards

Amendment to IFRS 10 and IAS 28 Sale or Contribution of Assets

between an Investor and its Associate or Joint Venture (published in

September 2014)

Clarification on the result of these operations if dealing with

businesses or assets

Amendment to IAS 27 Equity Method in Separate Financial

Statements (published in August 2014)

This will allow the equity method to be applied to the individual

statements of an investor

Amendments to IAS 16 and IAS 41: bearer plants (published in

June 2014)

Bearer plants will be measured at cost instead of fair value

The directors have assessed the potential impact of applying these standards in the future and estimate that their entry into force will not have a

material impact on the consolidated financial statements.

2.2. Information on 2013

As required by IAS 1, the information from 2013 contained in this consolidated annual report is presented solely for comparison with the information

from 2014, and consequently does not in itself constitute the Group’s consolidated annual accounts for 2013.

In accordance with IFRS 5 - Non-Current Assets Held for Sale and Discontinued Operations, as indicated in Note 4.7.2, non-strategic assets

and liabilities undergoing divestment were reclassified as “Non-Current Assets and Liabilities Classified as Held for Sale” in the accompanying

consolidated balance sheet and as “Profits (Loss) for the Year from Discontinued Operations Net of Tax” in the accompanying comprehensive

consolidated income statement. Likewise, in accordance with this regulation, for comparison purposes the relevant uniformity adjustments were

made to the consolidated comprehensive income statement and statement of cash flows for 2013.

The accompanying Consolidated Statements of Changes in Equity include, under “Record of Audit Adjustments”, adjustments identified in previous

years relating to calculating rental linearisation. The adjustments for 2012 and before come to €2,795 thousand and those for 2013 are €1,744

thousand.

2.3. Currency of Presentation

These consolidated financial statements are presented in euros. Any foreign currency transactions have been recognised in accordance with the

criteria described in Note 4.11.

2.4. Responsibility for the Information, Estimates Made and Sources of Uncertainty

The Directors of the Parent Company are responsible for the information contained in these consolidated financial statements.

Estimates made by the management of the Group and of the consolidated entities (subsequently ratified by their Directors) have been used in the

Group’s consolidated financial statements to quantify some of the assets, liabilities, revenue, expenses and undertakings recognised. These estimates

essentially refer to:

- Losses arising from asset impairment.

- The assumptions used in the actuarial calculation of liabilities for pensions and other undertakings made to the personnel.

- The useful life of the tangible and intangible assets.

- The valuation of consolidation goodwill.

- The market value of specific assets.

- The estimation of onerous agreements.

- Calculation of provisions and evaluation of contingencies.

These estimates were made on the basis of the best available information on the facts analysed. Nonetheless, it is possible that future events may

take place that make it necessary to modify them, which would be done in accordance with IAS 8.