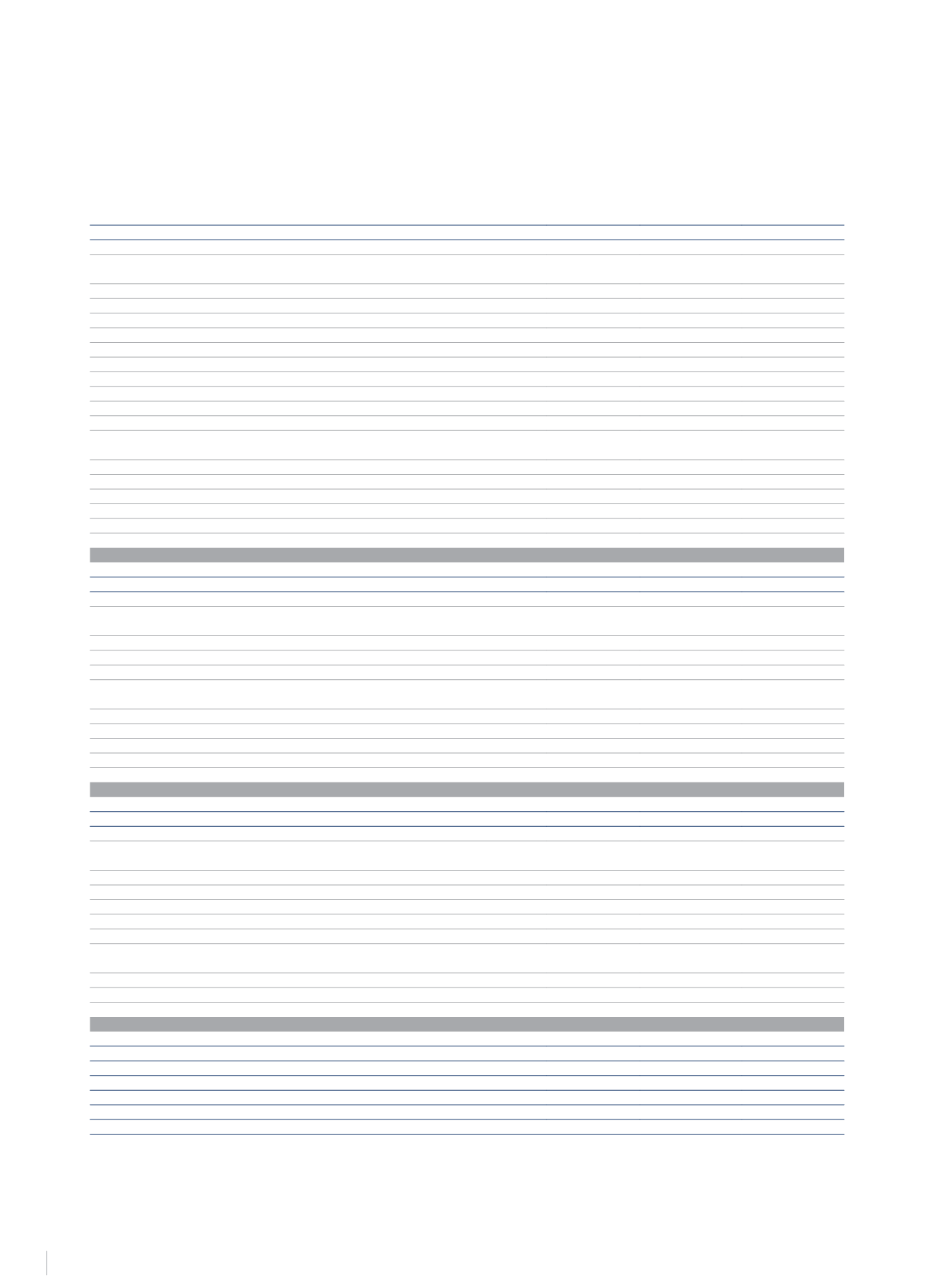

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

62

CONSOLIDATED

CASH FLOW STATEMENTS

For the twelve months ending 31 December 2014 and 2013 (€Thousand)

Note

31/12/13

31/12/12*

1. OPERATING ACTIVITIES

Consolidated profit (loss) before tax

(26,338)

(22,512)

Adjustments:

Amortisation of tangible and intangible assets (+)

7 and 8

98,516

101,322

Impairment losses (net) (+/-)

6, 7 and 8

(12,810)

(28,103)

Allocations for provisions (net) (+/-)

19

(14,721)

(6,642)

Gains/Losses on the sale of tangible and intangible assets (+/-)

25.1

1,005

(2,120)

Gains/Losses on investments valued using the equity method (+/-)

10

1,341

1,521

Financial income (-)

25.2

(7,368)

(4,099)

Financial expenses and variation in fair value of financial instruments (+)

25.6

66,813

67,287

Net exchange differences (Income/(Expense))

(38)

7,483

Profit (loss) on disposal of financial investments

(17,278)

(40,851)

Other non-monetary items (+/-)

4,108

(14,995)

Adjusted profit (loss)

93,230

58,291

Net variation in assets / liabilities:

(Increase)/Decrease in inventories

361

(29)

(Increase)/Decrease in trade debtors and other accounts receivable

(44,383)

(5,486)

(Increase)/Decrease in other current assets

(6,014)

8,330

Increase/(Decrease) in trade payables

3,674

358

Increase/(Decrease) in other current liabilities

(3,847)

(13,172)

Increase/(Decrease) in provisions for contingencies and expenses

(7,158)

(959)

Income tax paid

(3,750)

(7,082)

Total net cash flow from operating activities (I)

32,113

40,251

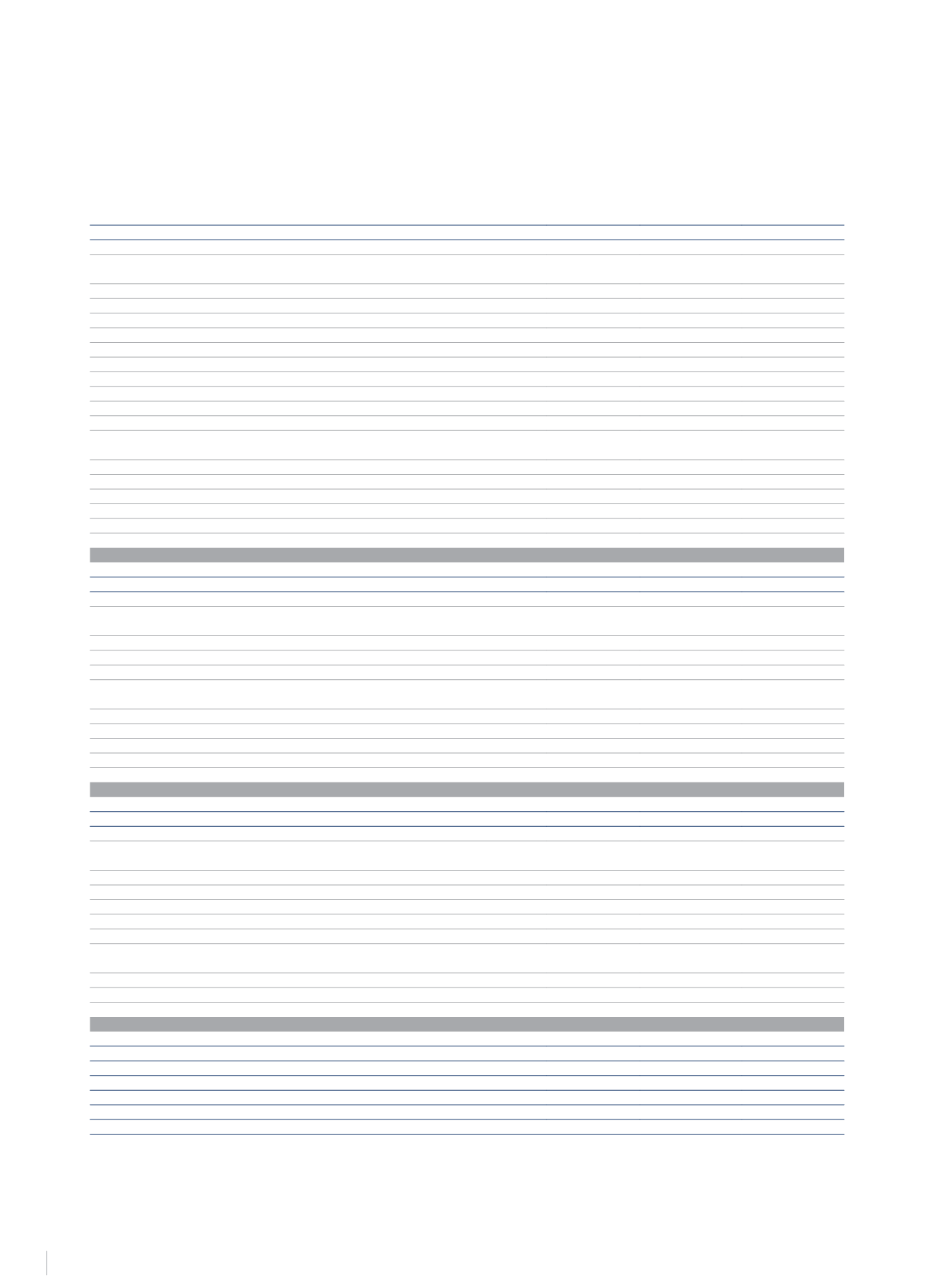

2. INVESTMENT ACTIVITIES

Financial income

7,289

3,753

Investments (-):

-

Tangible and intangible assets and investments in property

(109,892)

(38,768)

Non-current assets classified as held for sale

(4,256)

-

Non-current financial investments

(370)

(17,560)

(114.518)

(56,328)

Disinvestment (+):

Group companies, joint ventures and associates

2

58,278

141,388

Tangible and intangible assets and investments in property

6,449

1,962

Non-current assets classified as held for sale

-

5,150

Non-current financial investments

4,247

-

Other assets

-

287

68,974

148,787

Total net cash flow from investment activities (II)

(38,255)

96,212

3. FINANCING ACTIVITIES

Interest paid on debts (-)

(59,952)

(68,055)

Variations in (+/-):

Equity instruments:

- Capital

-

123,309

- Reserves

-

107,512

- Non-controlling interests

-

-

- Treasury shares

(692)

(23,634)

- Equity components of convertible bonds

-

27,230

Debt instruments:

- Bonds and other tradable securities (+)

-

457,641

- Loans from credit institutions (+)

10,000

137,575

- Loans from credit institutions (-)

(37,227)

(765,684)

- Other financial liabilities (+/-)

(15,911)

(37,585)

Total net cash flow from financing activities (III)

(103,782)

(41,691)

4. GROSS INCREASE/DECREASE IN CASH AND CASH EQUIVALENTS (I+II+III)

(109,924)

94,772

5. Effect of exchange rate variations on cash and cash equivalents (IV)

254

1,210

6. Effect of variations in the scope of consolidation (V)

176,412

-

7. NET INCREASE/DECREASE IN CASH AND CASH EQUIVALENTS (I+II+III-IV+VI)

66,234

93,562

8. Cash and cash equivalents at the start of the financial year

133,869

40,307

9. Cash and cash equivalents at the end of the financial year (7+8)

200,103

133,869

* Audited balances adjusted for IFRS 5.

Notes 1 to 31 in the Consolidated Annual Report and Annexes I/II are an integral part of the Consolidated Comprehensive Income for 2014.

The Consolidated Comprehensive Income Statement for 2013 is presented solely for the purposes of comparison.