64 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

The consolidated financial statements for 2014 of the Group and the entities that it comprises have not yet been approved by the shareholders at the

respective Annual General Meetings or by the respective shareholders or sole shareholders. Nonetheless, the directors of the Parent Company believe

that said financial statements will be approved without any significant changes. The consolidated financial statements for 2013 were approved by the

shareholders at the Annual General Meeting held on 26 June 2014 and filed with the Mercantile Registry of Madrid.

Since the accounting standards and valuation criteria applied in the preparation of the Group’s consolidated financial statements for 2014 may differ

from those used by some of its member companies, adjustments and reclassifications were used to standardise them and adapt them to IFRS as

adopted by the European Union.

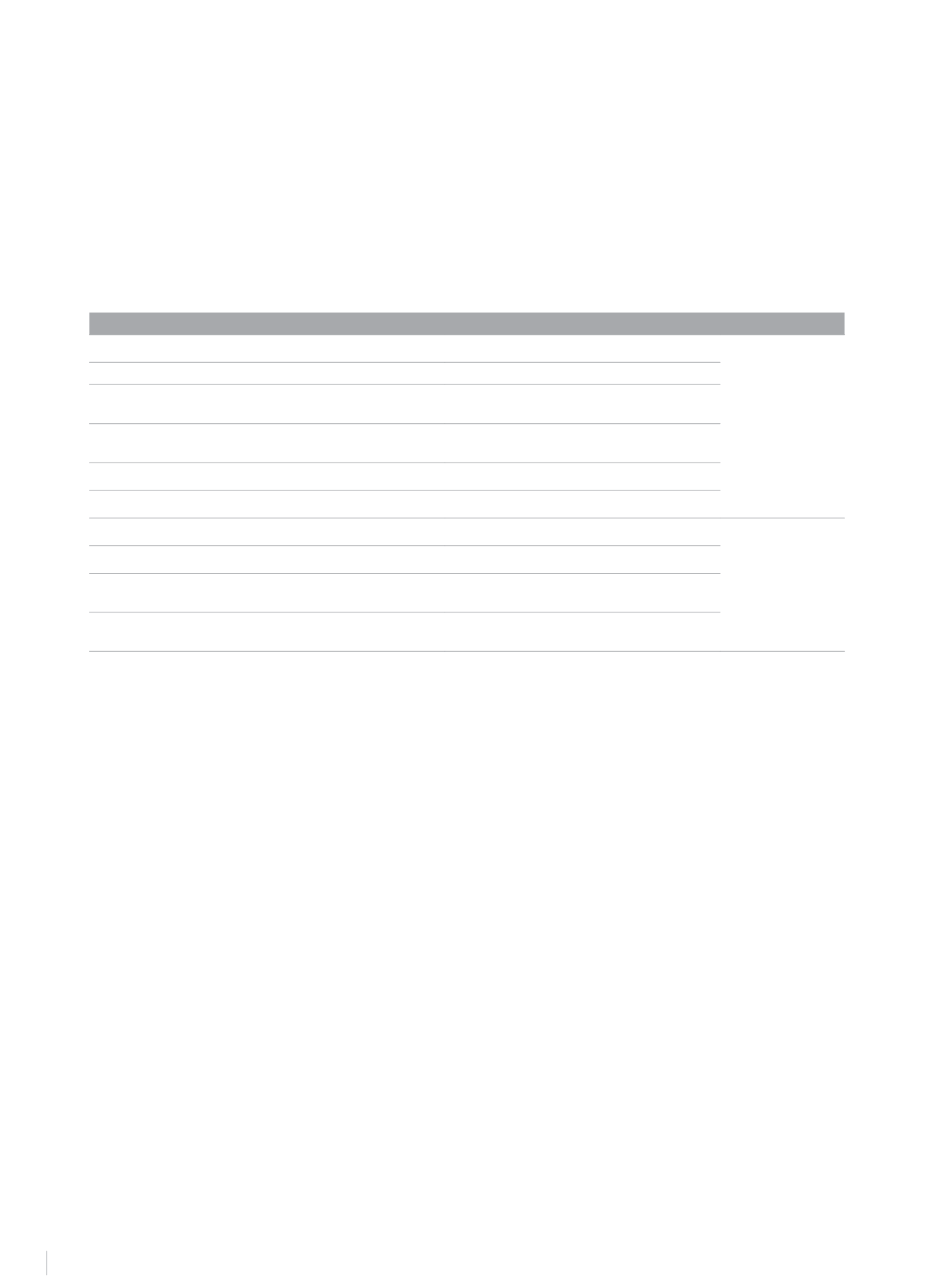

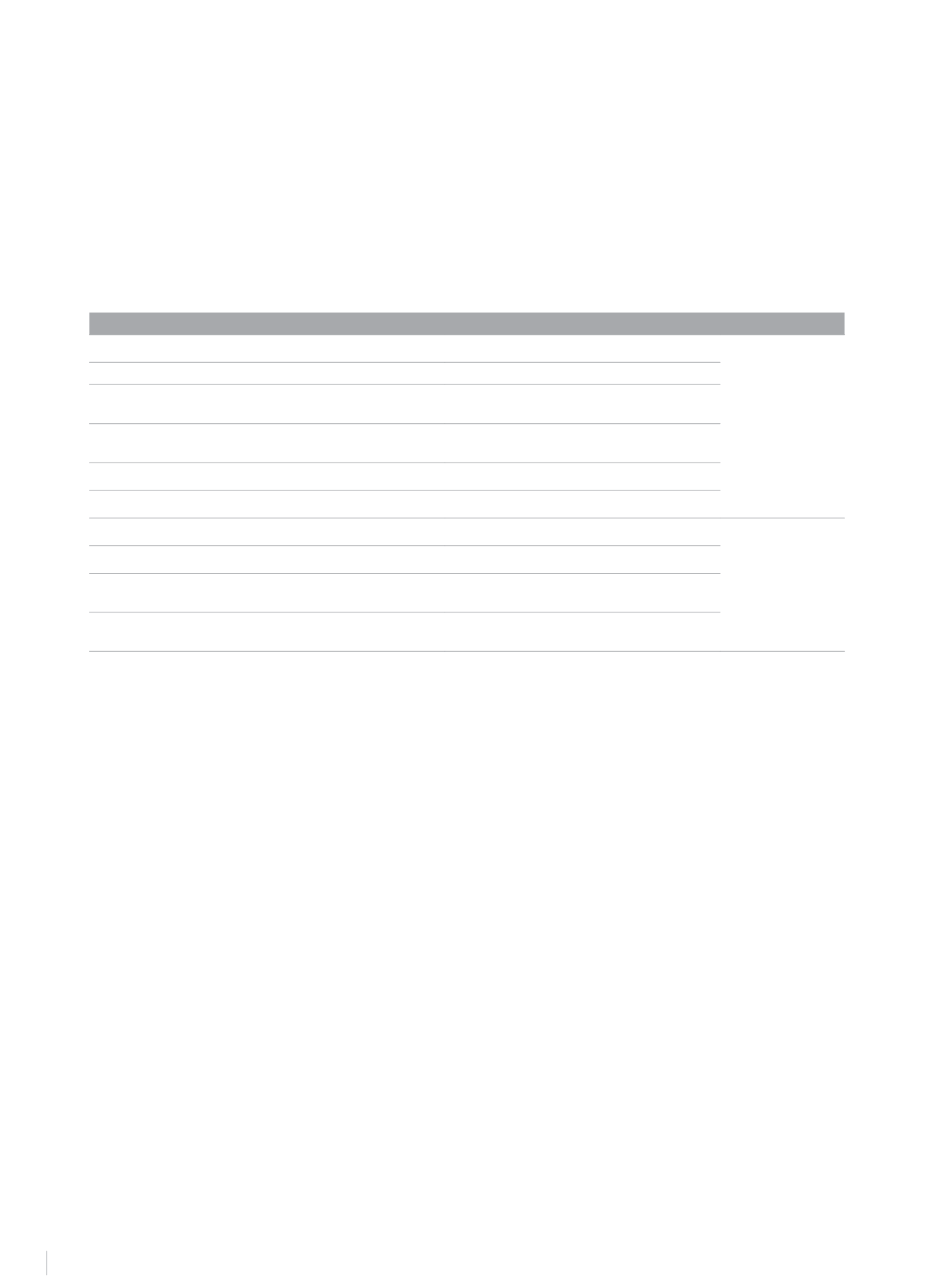

2.1.1 Standards and interpretations effective in this period

In 2014 new accounting standards came into force and were therefore taken into account when preparing the accompanying consolidated financial

statements, but which did not give rise to a change in the Group’s accounting policies:

New standards, amendments and interpretations

Mandatory application

starting from:

Approved for use in the European Union

IFRS 10 Consolidated Financial Statements (published in May 2011)

Replaces the current consolidation requirements set by

IAS 27

01 January 2014

(1)

IFRS 11 - Joint Arrangements (published in May 2011)

Replaces the current IAS 31 on joint ventures

IFRS 12 - Disclosure of Interests in Other Entities (published in May 2011)

Single standard which establishes the disclosure of

interests in subsidiaries, associates, joint ventures and

unconsolidated entities

IAS 27 (Revised) - Separate Financial Statements (published in May 2011)

The standard has been reviewed, given that since the

issuance of IFRS 10 now only the separate financial

statements of an entity are included

IAS 28 (Reviewed) - Investments in Associates and Joint Ventures

(published in May 2011)

Parallel review relating to the issue of IFRS 11 Joint

Arrangements

Transitional rules: Amendment to IFRS 10, 11 and 12 (published in June

2012)

Clarification of the transitional rules for these standards

Investment companies: Amendment to IFRS 10, IFRS 12 and IAS 27

(published in October 2012)

Exception from consolidation for parent companies that

meet the definition of investment companies

01 January 2014

Amendment to IAS 32 Financial Instruments: Presentation - Offsetting

Financial Assets and Financial Liabilities (published in December 2011)

Further clarifications regarding the rules for offsetting

financial assets and liabilities under IAS 32

Amendment to IAS 36 - Recoverable amount disclosures for non-financial

assets (published in May 2013)

Clarifies when certain disclosures are required and

extends the requirements when the recoverable amount

is based on the fair value less selling costs

Amendments to IAS 39 - Novation of derivatives and continuation of

hedge accounting (published in June 2013)

The amendments establish the cases and criteria in

which the novation of derivatives does not necessarily

entail discontinuing hedge accounting

*(1) The European Union postponed the date of mandatory application by a year. The original date for application of the IASB was 1 January 2013.

The Group had opted for voluntary early adoption, beginning in 2013, of the following standards and interpretations, in force as of 2014:

IFRS 10 Consolidated Financial Statements

New regulations for consolidation, replacing the consolidation provisions of IAS 27 and interpretation SIC-12 on the consolidation of special purpose

entities. The main new feature is the change to the definition of control: power over an investee, exposure or rights to variable returns on investment,

and the ability to affect those returns.

This new definition and the entire new regulatory framework do not require changes to the consolidated companies.

IFRS 11 Joint Arrangements

Replaces IAS 31. The essential change brought about is the elimination of the proportional consolidation option for entities subject to joint control,

which shall be accounted for using the equity method.

This standard was applied early, from 1 January 2013. The impact of its application is detailed in the consolidated annual accounts for 2013.

2.1.2 Standards and interpretations issued and not in force

The most significant standards and interpretations published by the IASB on the date these consolidated annual accounts were drawn up but had

not yet entered into force either because the date of their entry into force was subsequent to the date of these consolidated annual accounts or

because they had not been endorsed by the European Union, were the following: