76

2014

2013

NH Hoteles Deutschland GmbH and NH Hoteles Austria GmbH

89,945

94,710

Others

3,978

2,511

Total

93,923

97,221

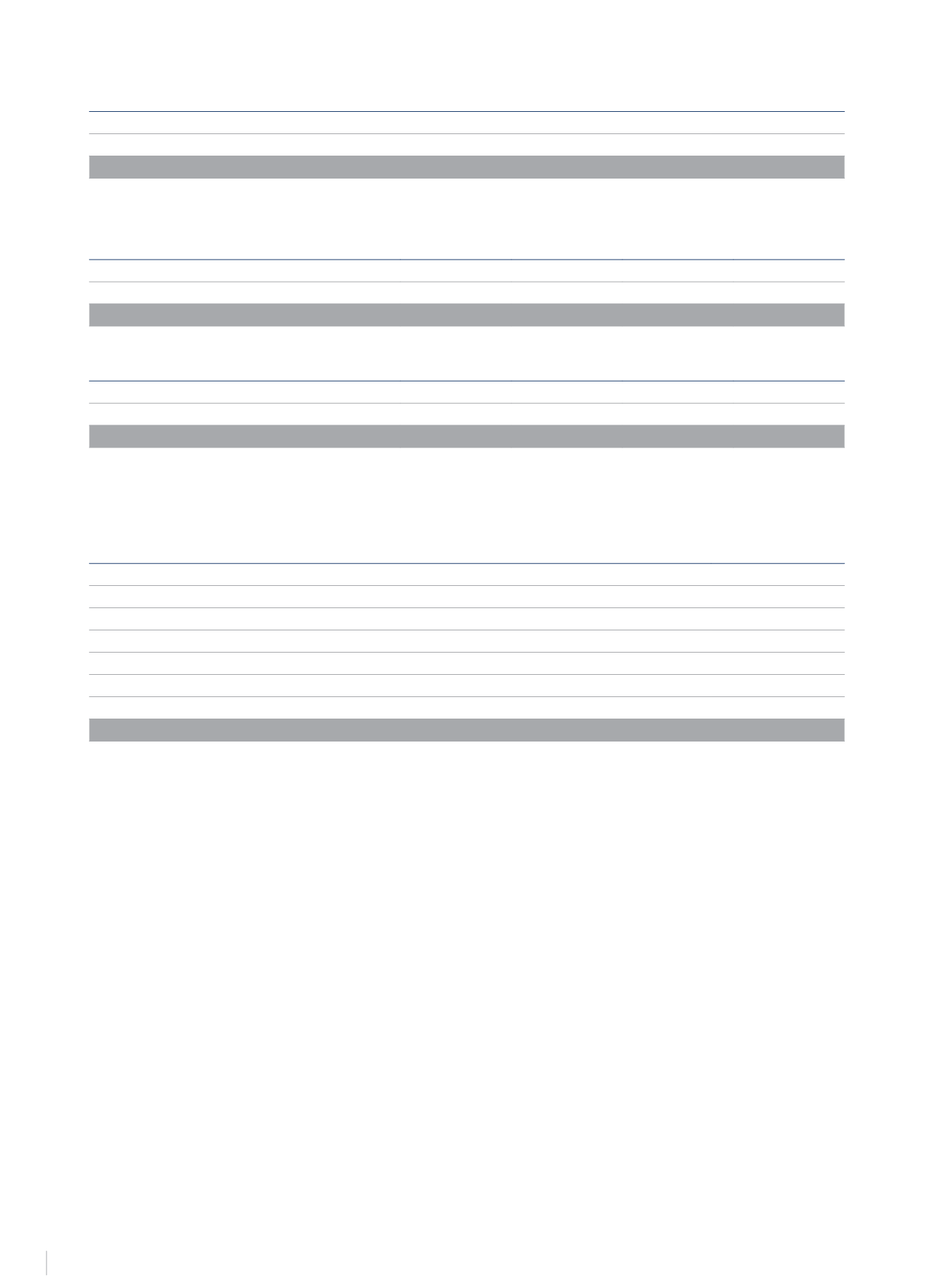

The movements in this heading of the consolidated balance sheet in 2014 and 2013 were as follows (€Thousand):

Company

Goodwill

31.12.12

Currency

translation

Impairment

Goodwill

31.12.13

NH Hoteles Deutschland GmbH and NH Hoteles Austria GmbH

97,467

-

(2,757)

94,710

Others

4,347

(1,836)

-

2,511

Total

101,814

(1,836)

(2,757)

97,221

Company

Goodwill

31.12.13

Currency

translation

Impairment

Goodwill

31.12.14

NH Hoteles Deutschland GmbH and NH Hoteles Austria GmbH

94,710

-

(4,765)

89,945

Others

2,511

1,467

-

3,978

Total

97,221

1,467

(4,765)

93,923

Recoverable goodwill values have been allocated to each cash-generating unit, mainly rental agreements, by using five-year projections on results,

investments and working capital.

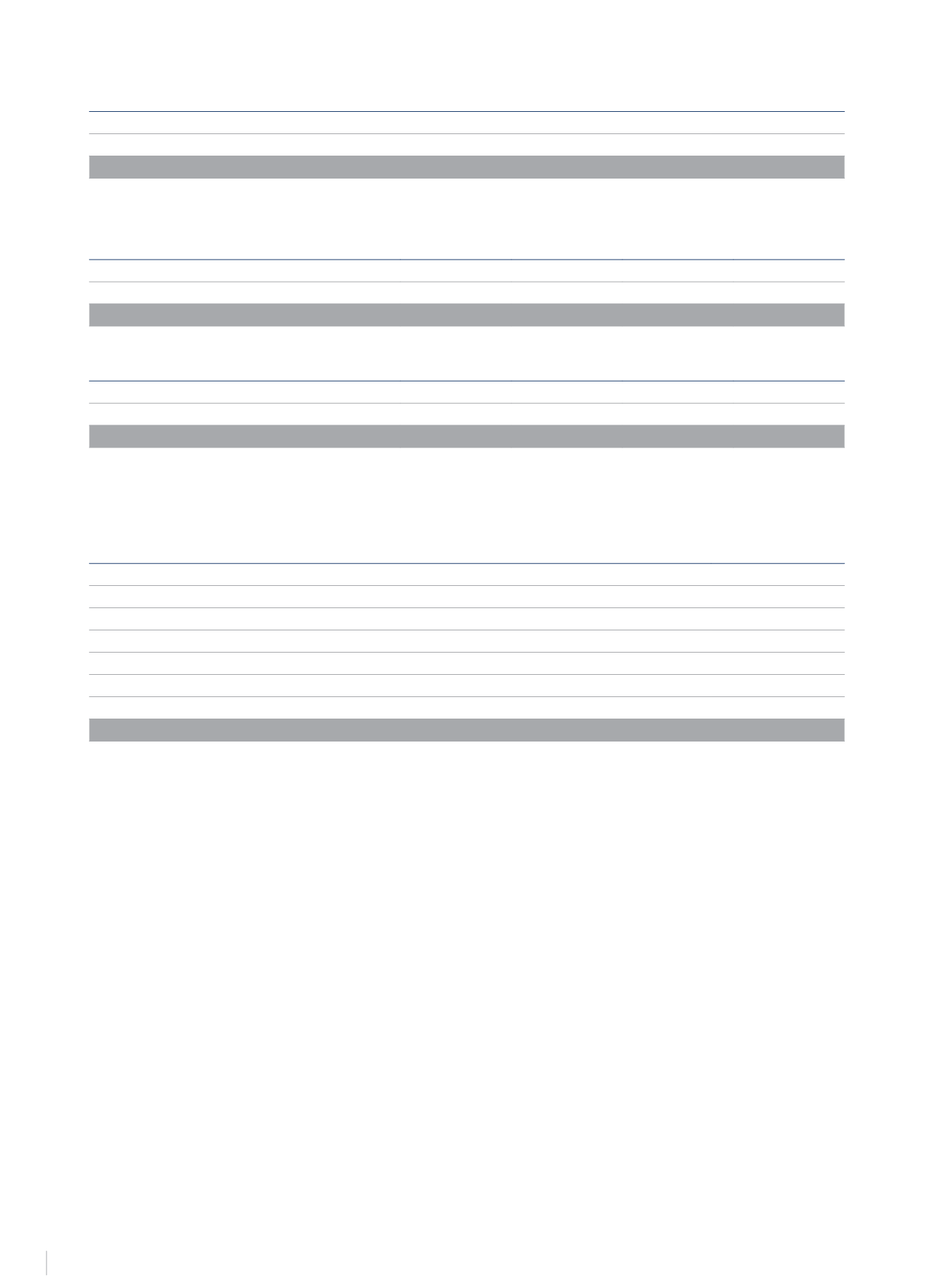

A breakdown of the cash generating units to which goodwill on consolidation has been allocated is shown below:

€Thousand

CGU 6

16,754

CGU 21

10,856

CGU 22

8,243

CGU 12

7,758

CGU 13

6,208

CGU 2

5,525

CGUs with individually allocated goodwill < €4 million

38,579

93,923

The basic assumptions used to estimate future cash flows of these CGUs are detailed below:

• Discount rate: 6.52% and 6.85%, since these are CGUs subject to the same risk (German and Austrian market).

• Terminal value growth rate (g): 2%.

As a result of the impairment analysis carried out by the Group at the end of 2014, an impairment of €4,765 thousand was recognised.

The Group has also run a sensitivity analysis on the result of the impairment test, with variations on the following assumptions:

Scenario 1:

- An increase of 100 basis points in the discount rate.

- Use of a perpetuity growth rate of 0%.

Scenario 2:

- A 1% reduction in the occupancy level.

- A 1% reduction in the average daily rate (ADR).

These sensitivity analyses do not reveal the existence of any impairment in either scenario.

The impairment provision for the year was produced as a consequence of not considering perpetuities in the case of cash-generating units where

there is no guarantee of renewal of rental contracts. Thus the projections are for the term of these contracts.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS