82

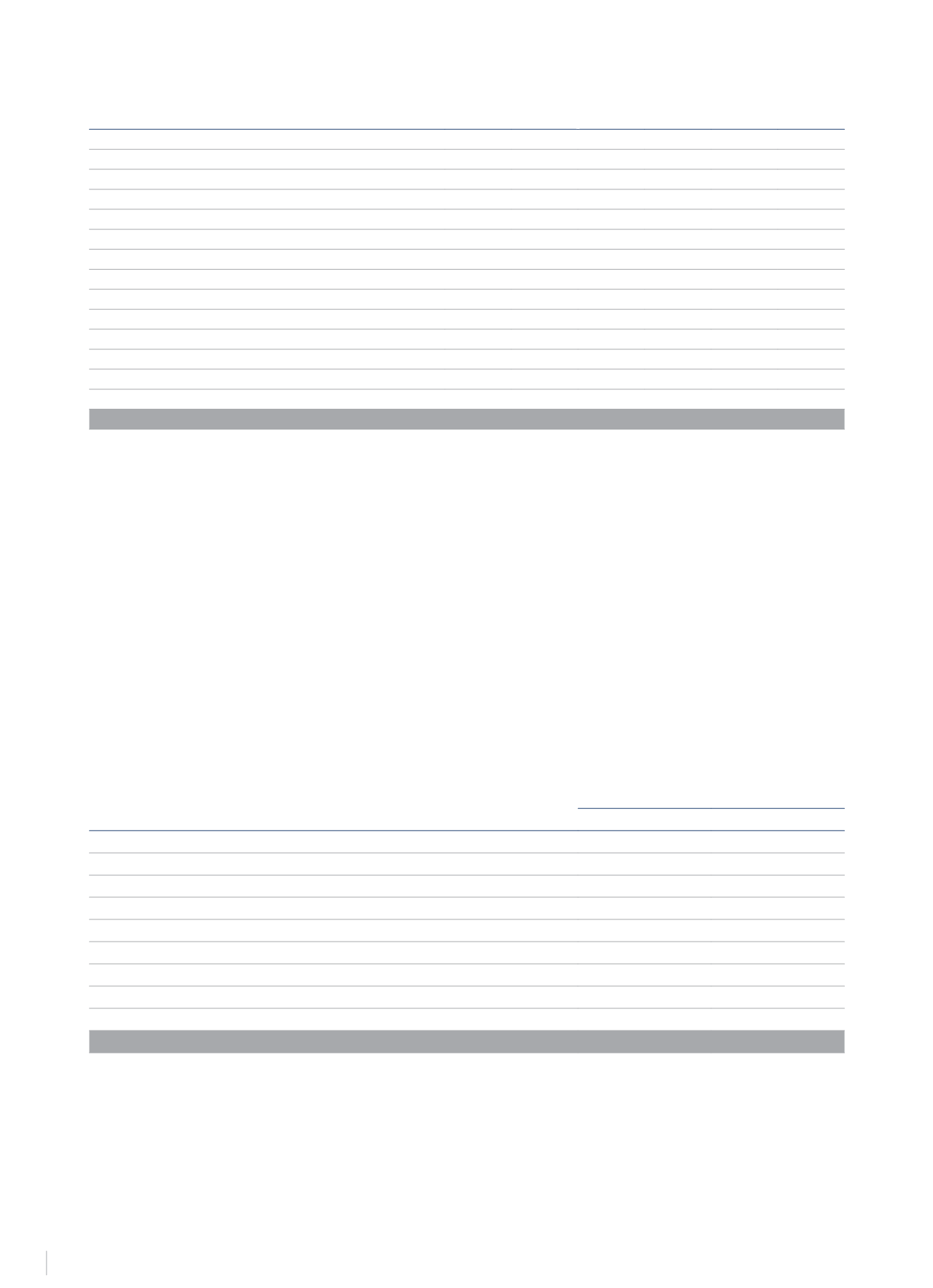

Company

Net

balance at

31/12/13

Retirements Assignments

(Note 9)

Profit (Loss)

2013

Currency

translation

Net

balance at

31/12/14

Sotocaribe, S.L.

41,941

-

(41,941)

-

-

-

Capredo Investments GmbH

6,348

-

(6,348)

-

-

-

Varallo Comercial, S.A.

9,693

-

-

(1,717)

(564)

7,412

Inmobiliaria 3 Poniente, S.A. de C.V.

1,542

-

-

218

419

2,179

Palacio de la Merced, S.A.

1,396

-

-

52

-

1,448

Mil Novecientos Doce, S.A. de C.V.

1,787

-

-

87

208

2,082

Consorcio Grupo Hotelero T2, S.A. de C.V.

374

-

-

121

382

877

Hotelera del Mar, S.A.

214

-

-

-

2,170

2,384

Fonfir1, S.L.

20

(20)

-

-

-

-

Residencial Marlin, S.L.

19,328

-

(19,328)

-

-

-

Borokay Beach, S.L.

1,536

-

-

(102)

-

1,434

Los Alcornoques de Sotogrande, S.L.

-

-

-

-

-

-

Losan Investment, Ltd.

-

-

-

-

-

-

Harrington Hall, Ltd.

-

-

-

-

-

-

Total

84,179

(20)

(67,617)

(1,341)

2,615

17,816

Once Hotelera del Mar, S.A. commenced its activity, the NH Group consolidated it, reclassifying the balance from “Other non-current financial

investments” with effect from 1 January 2013.

Although the NH Group has an ownership interest of only 22.33%, it exercises significant influence, since it participates in the determination of the

distribution/allocation of its profit/loss.

NH Hotel Group’s policy on interests in associates consists in the Group ceasing to recognise losses in these companies if the associate’s consolidated

losses attributable to the Group are equivalent to or exceed the cost of its interest in them, provided there are no additional contingencies or

guarantees connected with already incurred losses. This is the situation of the stake in Losan Investment, Ltd.

On 12 August 2014 the NH Group sold its shares in Harrington Hall, Ltd. for €13,291 thousand generating a net gain of €13,662 thousand (see Note

2.5.4).

The most significant financial information related to the main ownership interests in joint ventures is detailed in Appendix II to this consolidated

annual report.

11.- NON-CURRENT FINANCIAL INVESTMENTS

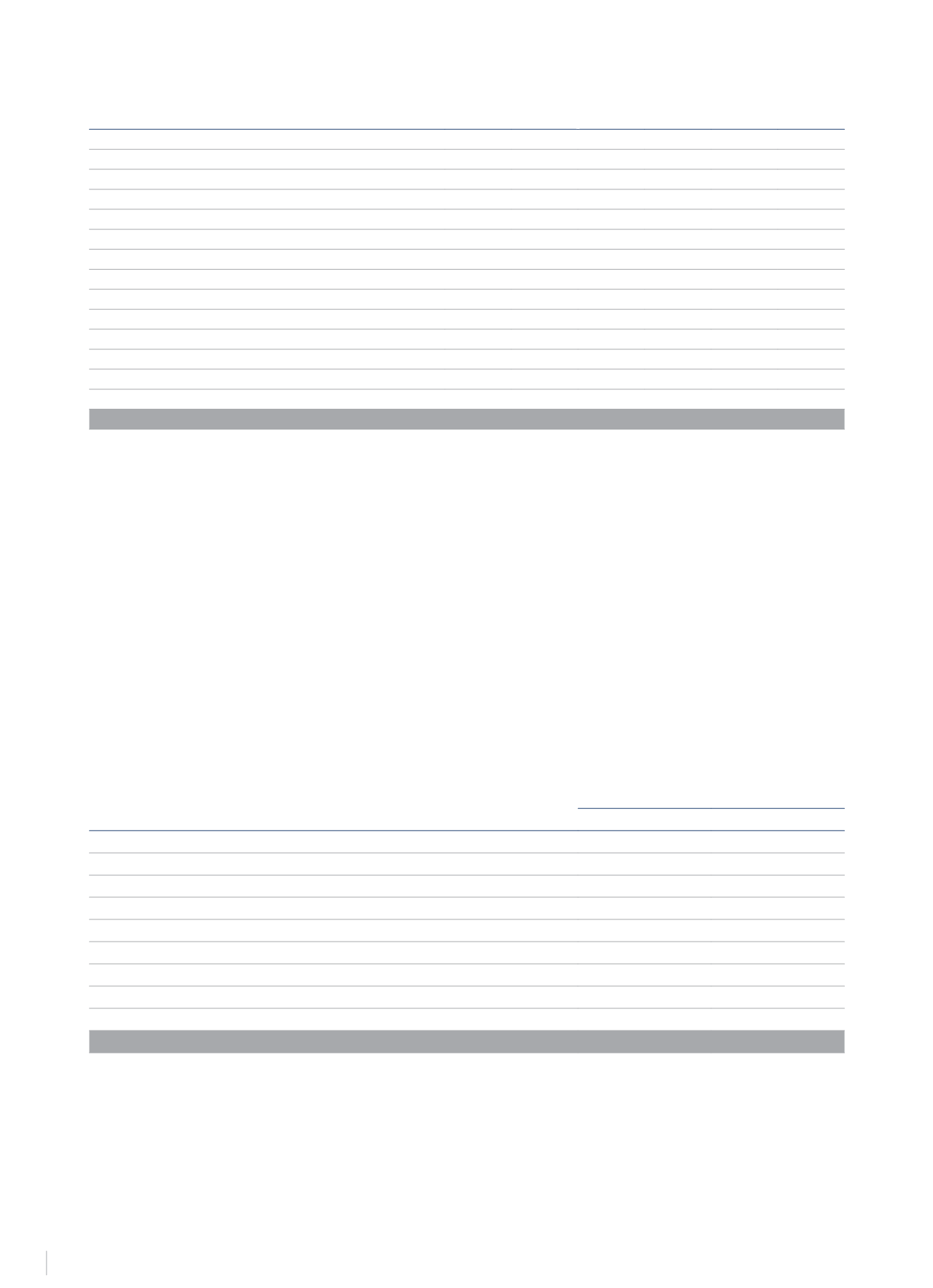

11.1 Loans and Accounts Receivable Not Available for Trading

The breakdown of this item at 31 December 2014 and 2013 is as follows:

€Thousand

2014

2013

Subordinated loans to companies owning hotels operated by the Group through leases (*)

46,740

45,885

Accounts receivable in respect of put option for Sotocaribe (Note 2.5.4)

58,250

-

Other collection rights

10,116

10,116

Other loans

17,230

16,722

Lease advance payments

3,535

3,660

Accounts receivable from joint ventures (Note 26)

6,279

5,576

Loans to associates (Note 26) (*)

-

2,250

Long-term deposits and sureties

12,789

15,172

Others

3,930

4,486

Total

158,859

103,867

*These loans accrue an average rate of interest of 3% to 4.89%.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS