NH HOTEL GROUP

Key figures

10

RESULTS AND EVOLUTION

EBITDA increased and positive net profit for the first time

since 2011

After two years of investments in assets repositioning and reinforcing its

organisational, management and communication capabilities, NH Hotel

Group has delivered its guidance for 2015 and expects to top guidance

going forward, with a larger revenue base, a better-positioned and

optimized portfolio, as well as a significant improvement in quality.

In 2015 total revenue rises 10.3% to €1,395M, while EBITDA before

onerous provision reversal rose 35.8% to €149.5M; consolidated net

profit comes in at €0.9M, compared to the €9.6M loss reported in the

same period the previous year.

Momentum in the hotel business gathered traction throughout the

year, fuelled by the pricing strategy rolled out, resulting in a growth

in revenue per available room (RevPAR) of 11%, topping the upper end

of its guidance range for the year. Price growth (+10.4%, from €78.9 to

€87.1) represents 95% of RevPAR growth in the year. Two years into

the implementation of the Strategic Plan, the price strategy is validated

by greater Group growth in top cities (+12.4%) vs direct competitors

(+7.0%), the finalization of repositioning investments in Spain and Italy,

and the start of repositioning investments in Benelux and Germany in

the second half of the year. EBITDA before onerous provision reversal

rose 11% vs 9% in 2014, with conversion ratios of 41%.

The healthy performances posted by Business Unit Spain and Business

Unit Italy in this period are worth noting, whose asset repositioning

strategy was executed in the initial years of the Strategic Plan. Meanwhile,

BU Benelux and BU Central Europe are expected to perform better in

2016 and 2017, as the repositioning works began in these markets during

the second half of 2015.

Implementation of the Group’s five-year Strategic Plan is tracking ahead

of schedule and the scope for outperformance of the initial guidance

has increased. At year-end 2015, hotels representing 64% of the Group’s

EBITDA are in perfect shape and once the €237M repositioning plan has

been fully implemented, this figure will rise to 81%.

KEY FIGURES

12M 2014

12M 2015

2014/2015

TOTAL REVENUES

1,265.1

1,395.5

10.3%

EBITDA BEFORE ONEROUS

110.1

149.5

35.8%

NET RECURRING INCOME

(18.0)

(2.7)

85.0%

NET INCOME including non-recurrent

(9.6)

0.9

109.9%

NH HOTEL GROUP PROFIT AND LOSS STATEMENT IN 2015

(€ million)

*Includes Hoteles Royal since 4 March 2015

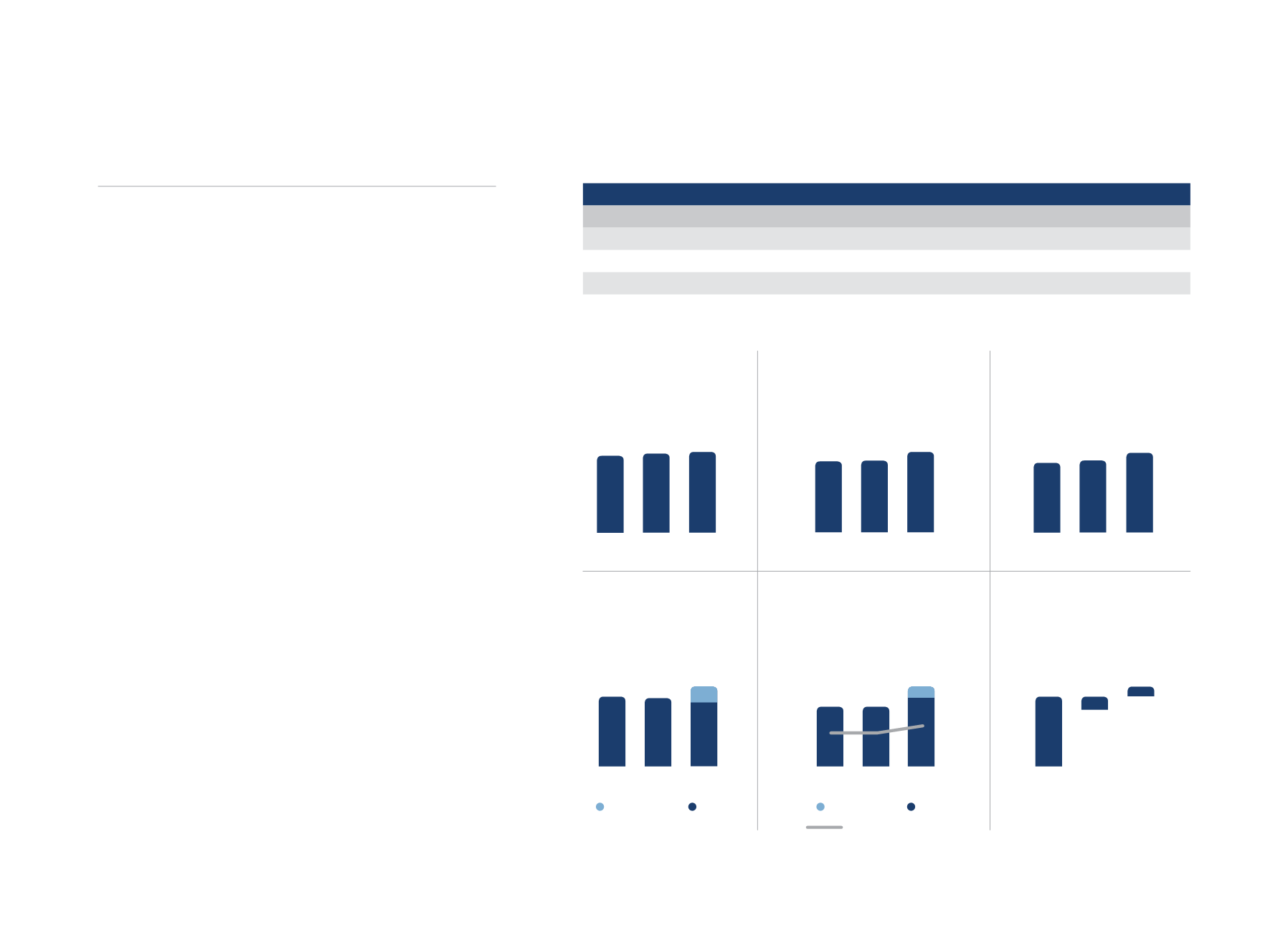

occupancy

Higher activitity

levels

2013

2014

2015

68.1%

67.7%

66.1%

revenue (€M)

€130M revenue

growth (+10.3%)

2013

1.281

2014

1.265

2015

1.395

1,345

51

H. Royal

NH

adr (€)

10.4% increase

in 2015

2013

2014

2015

87.1

78.9

77.5

ebitda before onerous

reversal (€M)

€40M EBITDA increase

(+36%)

2013

111

2014

110

2015

150

11%

142

9%

9%

7

H. Royal

NH

EBITDA Margin

revpar (€)

95% growth

through ADR

2013

2014

2015

59.3

53.4

51.2

net income

(€M)

First positive

Net income since 2011

2013

2014

2015

1.345

-39.8

-9.6

0.9