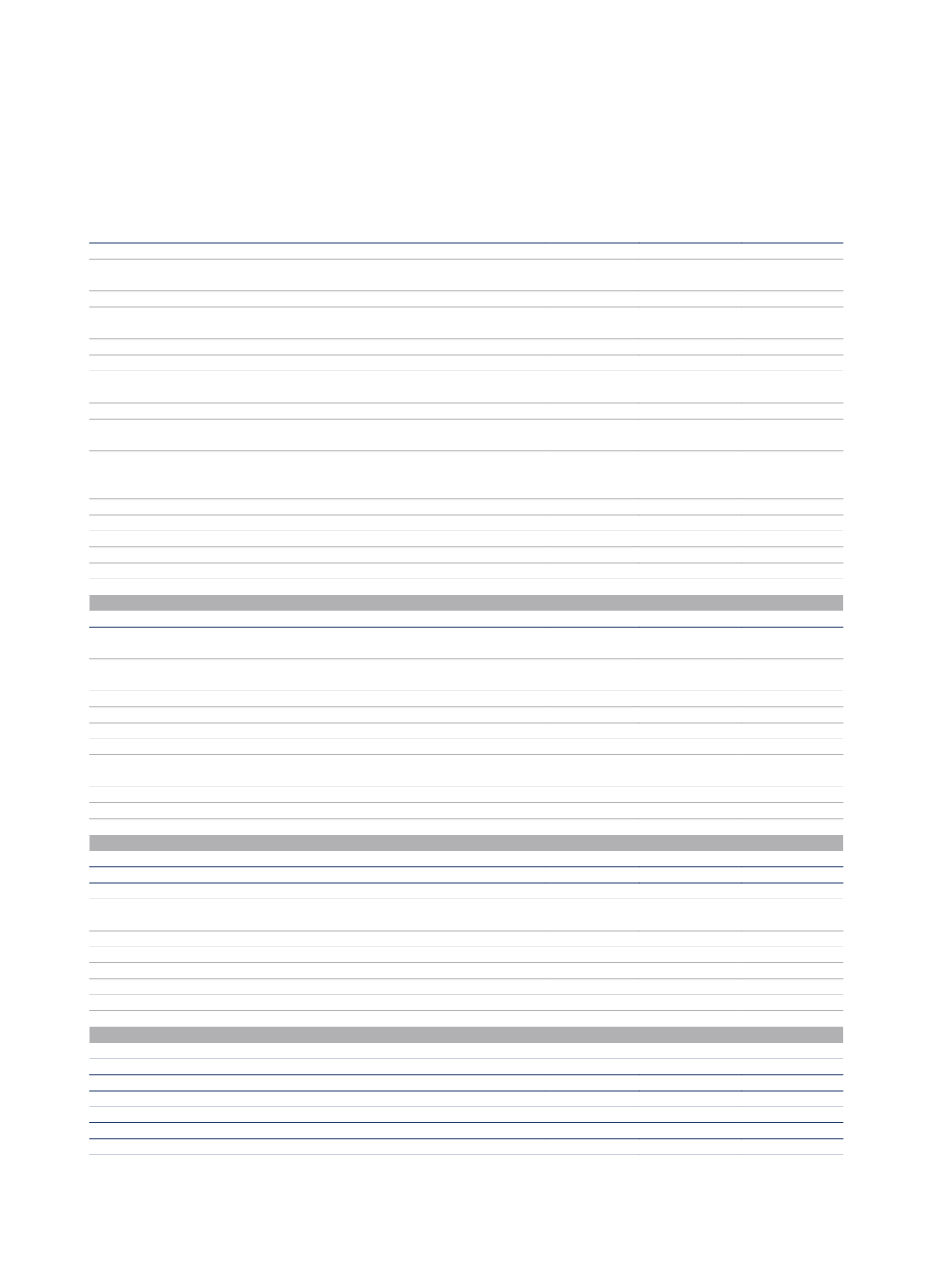

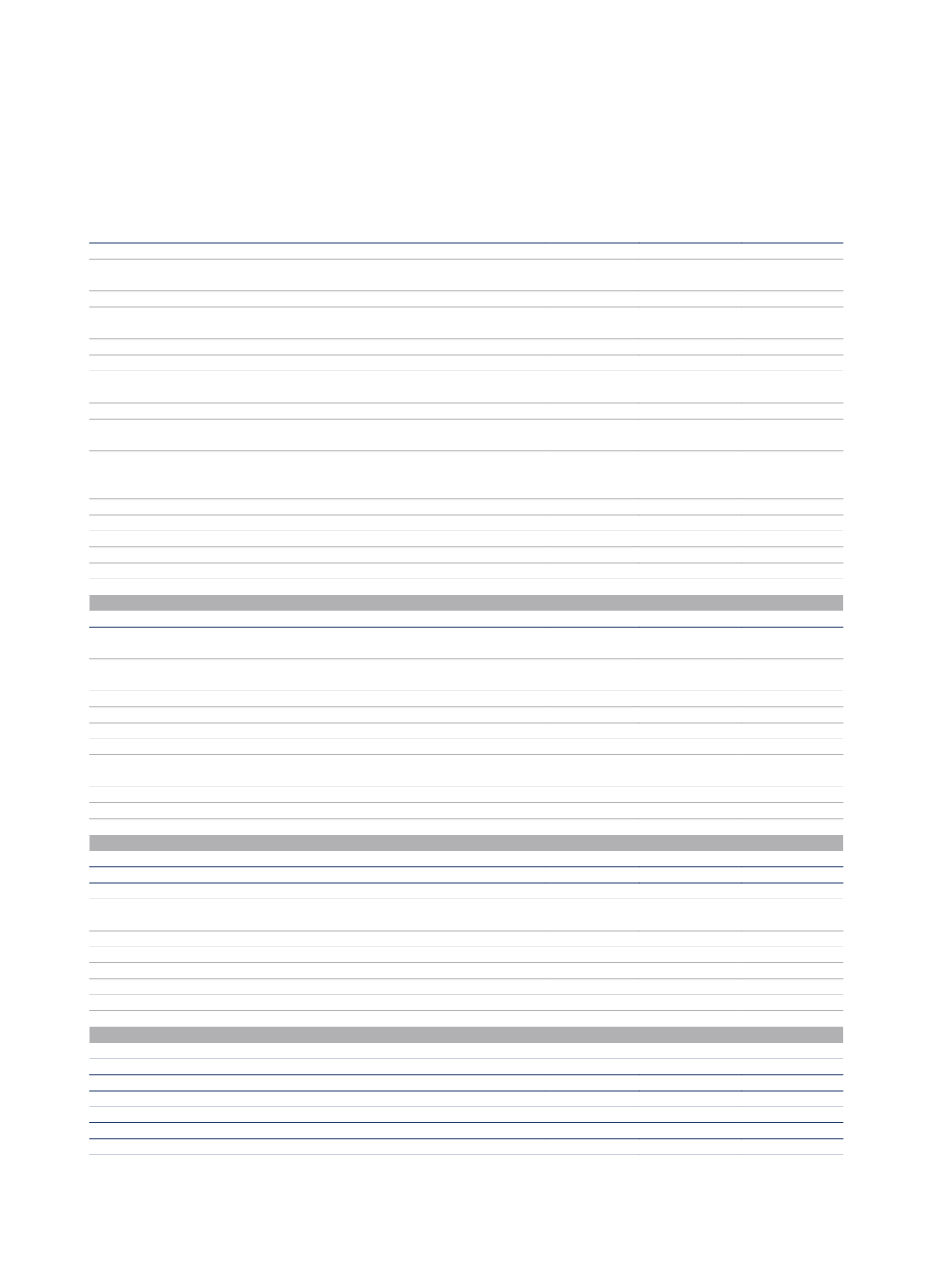

CONSOLIDATED CASH FLOW STATEMENTS

66

CONSOLIDATED

CASH FLOW STATEMENTS

Produced in the twleve-month periods ending 31 december 2015 (Thousands of euros)

Note

31/12/2015

31/12/2014

1. OPERATING ACTIVITIES

Consolidated profit (loss) before tax:

10,320

(26,338)

Adjustments:

Depreciation of tangible and amortisation of intangible assets (+)

7 and 8

106,159

98,516

Impairment losses (net) (+/-)

6, 7 and 8

(30,859)

(12,810)

Allocations for provisions (net) (+/-)

17

(19,014)

(14,721)

Gains/Losses on the sale of tangible and intangible assets (+/-)

843

1,005

Gains/Losses on investments valued using the equity method (+/-)

10

663

1,341

Financial income (-)

24.2

(5,154)

(7,368)

Financial expenses and variation in fair value of financial instruments (+)

24.2 and 24.6

69,020

66,813

Net exchange differences (Income/(Expense))

(2,135)

(38)

Profit (loss) on disposal of financial investments

(4,828)

(17,278)

Other non-monetary items (+/-)

1,141

4,108

Adjusted profit (loss)

126,156

93,230

Net variation in assets / liabilities:

(Increase)/Decrease in inventories

(801)

361

(Increase)/Decrease in trade debtors and other accounts receivable

(17,937)

(41,500)

(Increase)/Decrease in other current assets

6,353

(8,897)

Increase/(Decrease) in trade payables

10,352

3,674

Increase/(Decrease) in other current liabilities

(17,809)

(3,847)

Increase/(Decrease) in provisions for contingencies and expenses

(470)

(7,158)

Increase/(Decrease) in other non-current assets and liabilities

(5,839)

-

Income tax paid

(9,707)

(3,750)

Total net cash flow from operating activities (I)

90,298

32,113

2. INVESTMENT ACTIVITIES

Finance income

4,806

7,289

Investments (-):

-

Group companies, joint ventures and associates

(273)

-

Tangible and intangible assets and investments in property

(176,083)

(109,892)

Non-current assets classified as held for sale

-

(4,256)

Non-current financial investments

(77,725)

(370)

(254,081)

(114,518)

Disinvestment (+):

Group companies, joint ventures and associates

19,643

58,278

Tangible and intangible assets and investments in property

12,804

6,449

Non-current financial investments

-

4,247

32,447

68,974

Total net cash flow from investment activities (II)

(216,828)

(38,255)

3. FINANCING ACTIVITIES

Dividends paid out (-)

-

-

Interest paid on debts (-)

(56,750)

(59,952)

Variations in (+/-):

- Treasury shares

1,244

(692)

Debt instruments:

- Loans from credit institutions (+)

177,111

10,000

- Loans from credit institutions (-)

(125,617)

(37,227)

- Finance leases

(275)

-

- Other financial liabilities (+/-)

(2,509)

(15,911)

Total net cash flow from financing activities (III)

(6,796)

(103,782)

4. GROSS INCREASE/DECREASE IN CASH AND CASH EQUIVALENTS (I+II+III)

(133,326)

(109,924)

5. Effect of exchange rate variations on cash and cash equivalents (IV)

3,064

(254)

6. Effect of variations in the scope of consolidation (V)

7,858

176,412

7. NET INCREASE/DECREASE IN CASH AND CASH EQUIVALENTS (I+II+III-IV+VI)

(122,404)

66,234

8. Cash and cash equivalents at the start of the financial year

200,103

133,869

9. Cash and cash equivalents at the end of the financial year (7+8)

77,699

200,103