68 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

The consolidated financial statements for 2015 of the Group and the entities that it comprises have not yet been approved by the shareholders at

the respective Annual General Meetings or by the respective shareholders or sole shareholders. Nonetheless, the Directors of the Parent Company

believe that said financial statements will be approved without any significant changes. The consolidated financial statements for 2014 were approved

by the shareholders at the Annual General Meeting held on 29 June 2015 and filed with the Companies Registry of Madrid.

Since the accounting standards and valuation criteria applied in the preparation of the Group’s consolidated financial statements for 2015 may differ

from those used by some of its member companies, adjustments and reclassifications were used to standardise them and adapt them to IFRS as

adopted by the European Union.

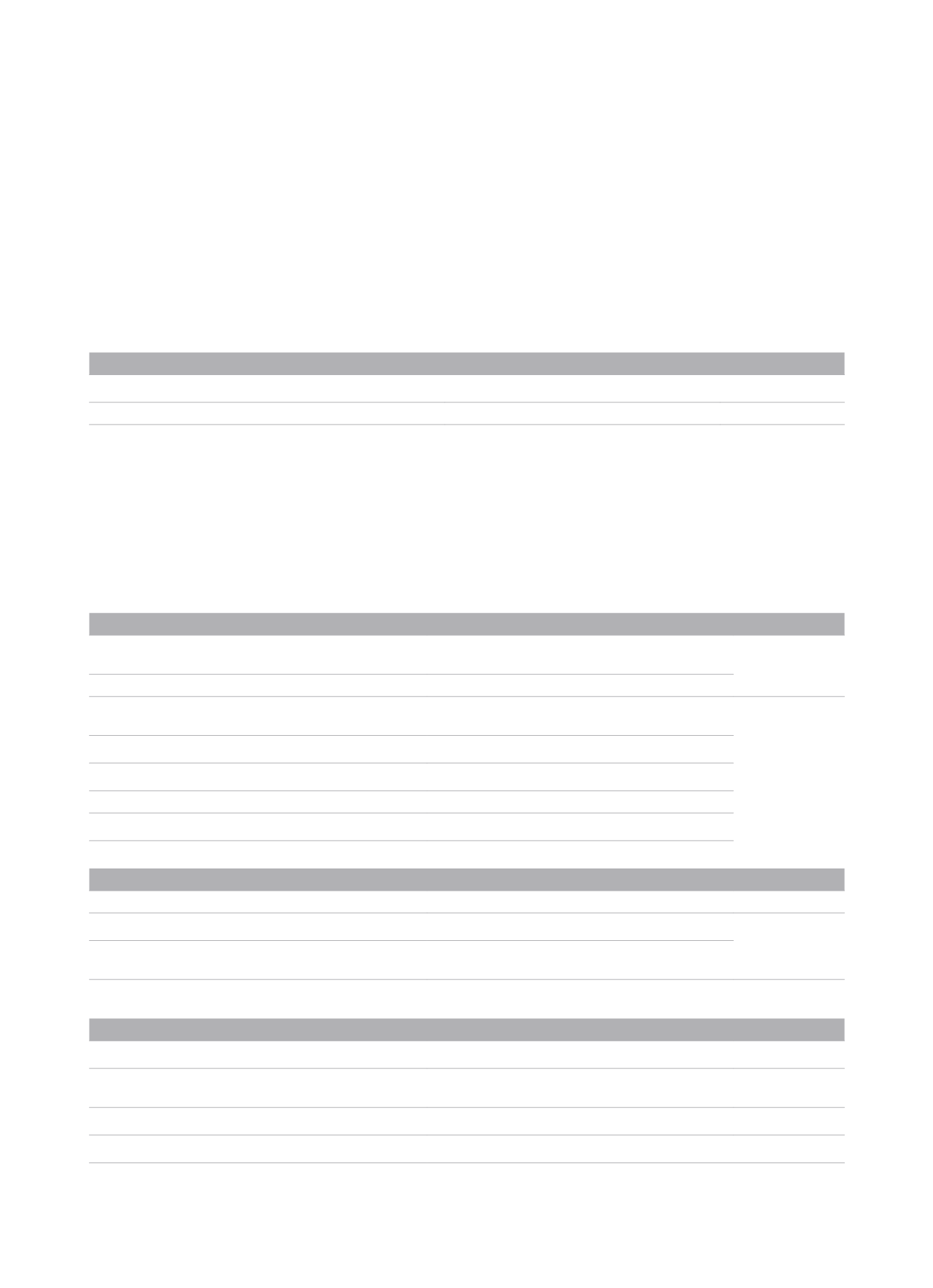

2.1.1 Standards and interpretations effective in this period

In 2015 new accounting standards came into force and were therefore taken into account when preparing the accompanying consolidated financial

statements, but which did not give rise to a change in the Group’s accounting policies:

A) New obligatory regulations, amendments and interpretations for the year commencing 1 January 2015.

New standards, amendments and interpretations

Obligatory application in

the years beginning on

or after:

Approved for use in the European Union

IFRIC 21 Levies (published in May 2013)

Interpretation on when to recognise a liability to pay a

levy.

17 June 2014

(1)

Improvement to IFRS 2011 -2013 Cycle (published in December 2013)

Minor amendments to a series of standards.

01 January 2015

(2)

(1) The European Union endorsed IFRIC 21 (EU Gazette, 14 June 2014), amending the original commencement date set out by the IASB (1 January 2014) to 17 June 2014.

(2) The IASB commencement date for these regulations was from 1 July 2014.

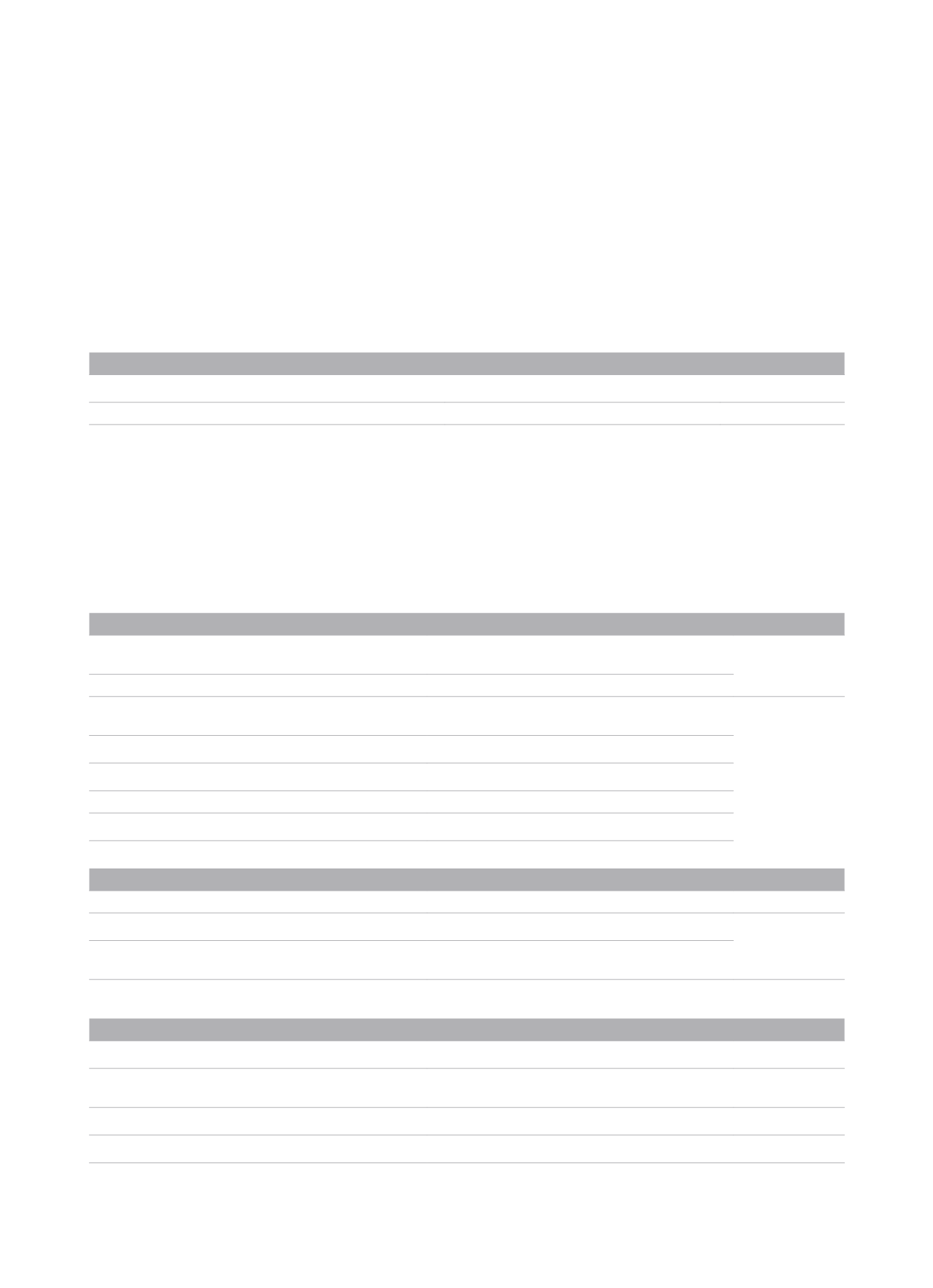

B) New obligatory regulations, amendments and interpretations in years subsequent to the calendar year which commenced on 1 January 2015

(applicable from 2015 onwards)

The following standards and interpretations had been published by the IASB on the date the consolidated financial statements were drawn up

but had not yet entered into force, either because the date of their entry into force was subsequent to the date of these consolidated financial

statements or because they had not yet been adopted by the European Union:

New standards, amendments and interpretations

Obligatory application

in the years beginning

on or after:

Approved for use in the European Union

Amendment to IAS 19 Employee contributions to defined benefit

plans (published in November 2013)

The amendment is issued to facilitate the possibility of

deducting these contributions from the service cost in the

same period they are paid if certain requirements are met.

01 February 2015

(1)

Improvements to IFRS 2010-2012 Cycle (published in December 2013)

Minor amendments to a number of standards.

Amendment to IAS 16 and IAS 38 Acceptable methods of depreciation

and amortisation (published in May 2014)

Clarifies the methods acceptable for depreciating and

amortising property, plant and equipment and intangible

assets, which do not include those based on income.

01 January 2016

Amendments to IFRS 11 Accounting for acquisitions of shares in joint

ventures (published in May 2014)

Specifies how to account for the acquisition of an interest in a

joint venture whose activity constitutes a business.

Amendments to IAS 16 and IAS 41: Bearer plants (published in June

2014)

Bearer plants will be measured at cost instead of fair value.

Improvements to IFRS 2012-2014 Cycle (published in September 2014)

Minor amendments to a number of standards.

Amendment to IAS 27 Equity Method in Separate Financial

Statements (published in August 2014)

The equity method in individual financial statements of an

investor will be allowed.

Amendment to IAS 1: Disclosures initiative (December 2014)

Various clarifications regarding the itemisations (materiality,

aggregation, order of the notes, etc.).

Not yet approved for use in the European Union at the date of this communication (2)

New standards

IFRS 15 - Revenue from Contracts with Customers (published in May

2014)

New income recognition standard (replaces IAS 11, IAS 18, IFRIC

13, IFRIC 15, IFRIC 18 and SIC-31).

01 January 2018

IFRS 9 Financial Instruments (last phase published in July 2014)

It replaces the requirements for classification, valuation,

recognition and derecognition of financial assets and liabilities

in accounts, hedge accounting and impairment of IAS 39.

IFRS 16 Leases (published in January 2016)

New standard on leases that replaces IAS 17. Lessees will

include all leases on the balance sheet as if they were financial

purchases.

01 January 2019

Amendments and/or interpretations

Amendments to IFRS 10, IFRS 12 and IAS 28: Investment Entities

(December 2014)

Clarifications on the exception for consolidation of investment

companies.

01 January 2016

Amendments to IFRS 10 and IAS 28 Sale or transfer of assets between

an investor and their associate/joint venture (published in September

2014)

Clarification on the result of these operations if dealing with

businesses or assets.

No date set

Amendment to IAS 12 Recognition of deferred asset taxes for

unrealised losses (published in January 19, 2016)

It refers to the DTA of available items for the sale of debt with

fair value less than the cost.

01 January 2017

Amendment to IAS 7 Initiative of itemisations (published in January

29, 2016)

Reconciliation of changes in liabilities in the balance sheet with

flows from financing activities.

01 January 2017

*(1) The IASB commencement date for these regulations was from 1 July 2014.

(2) It is recommended to update the approval status of the standards by the European Union through the EFRAG website