71

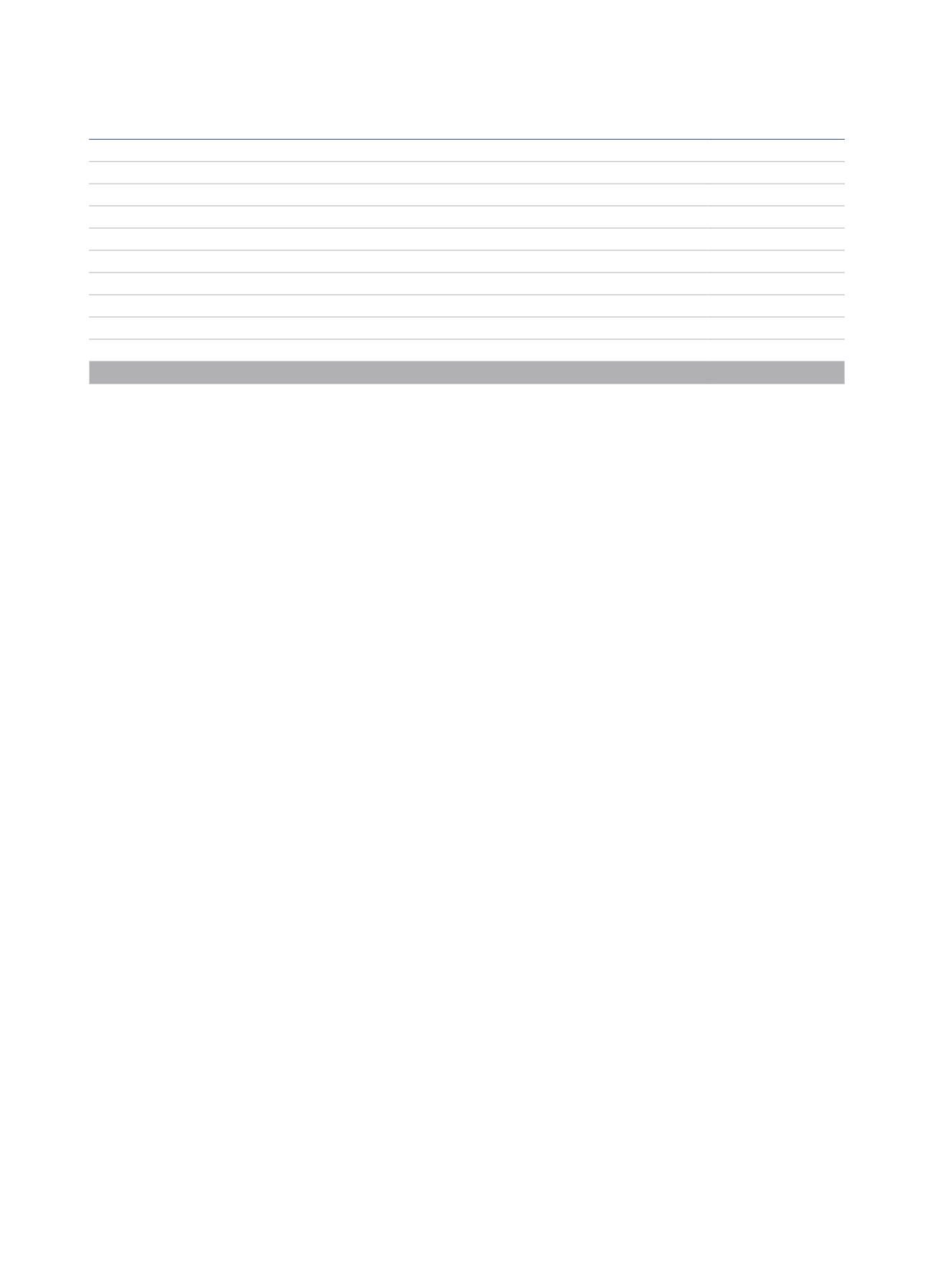

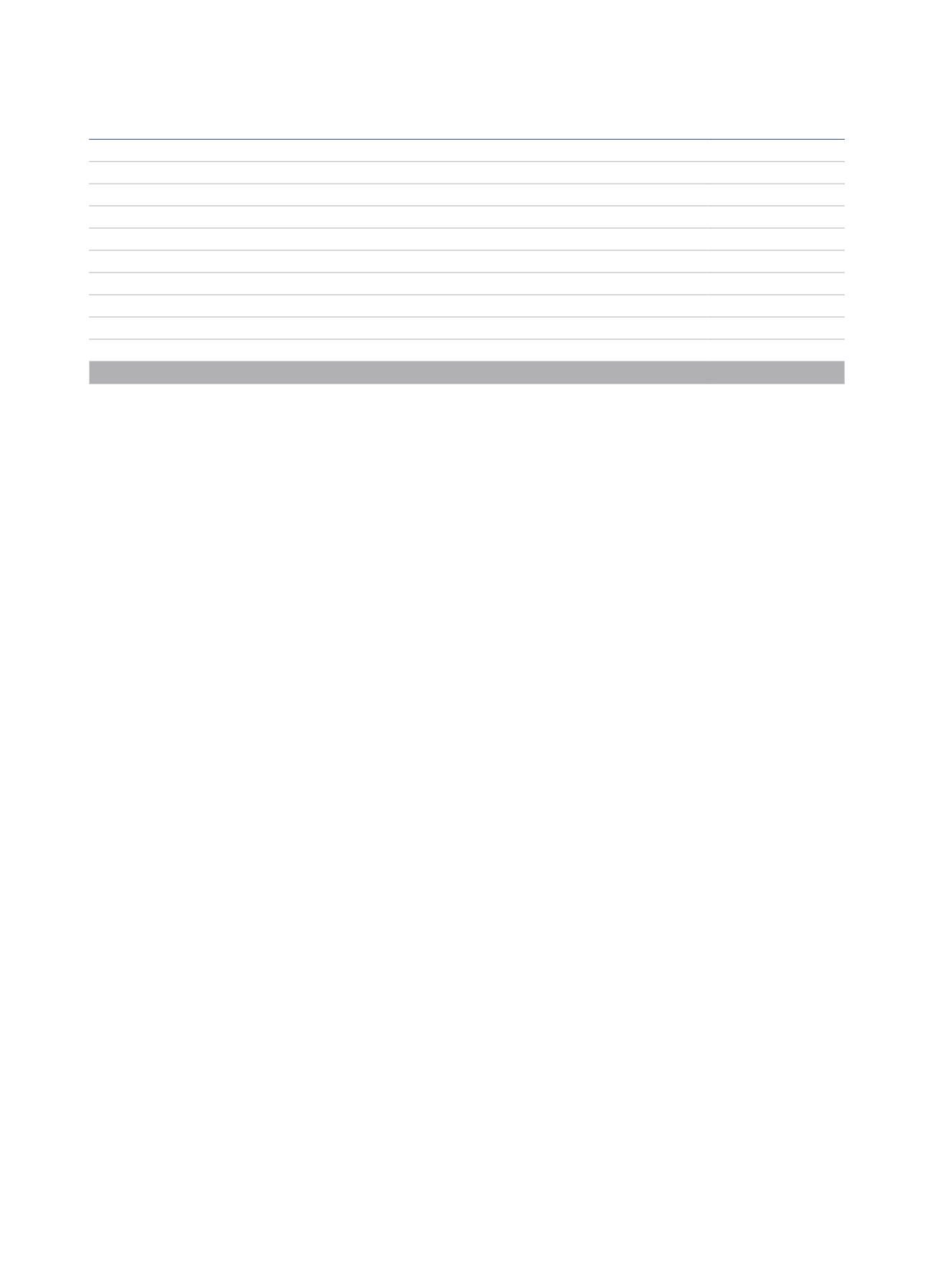

The effect of the business combination on the consolidated statement of financial position at 31 December 2015 is as follows:

Thousands of euros

Property, plant and equipment (Note 8)

63,923

Intangible fixed assets (Note 7)

43,295

Deferred tax assets

8,518

Other current assets

24,980

Bank borrowings

(24,965)

Deferred tax liabilities

(26,077)

Other current and non-current liabilities

(16,634)

Non-controlling interests

(14,646)

Net assets acquired

58,394

Net Consideration

(94,824)

First consolidation difference (Note 6)

(36,430)

On 9 September 2015, the Joint Venture with the shareholding group HNA Hospitality Group CO, LTD was formalised, creating a Chinese company

in which the Group is a 49% shareholder. The company’s capital increased to 20,000 thousand US dollars and each part will make an initial payment

corresponding to 50% of its shares, with the remaining amount to be paid over the following two years. At the end of December the Group

contributed 300 thousand US dollars.

On 15 April 2015, the contract for the Joint Venture between the Group and the company MDH Hologram, S.A. was formalised, in virtue of which 25%

of the company Hotel & Congress Technology, S.L. was sold, resulting in a 50% shareholding for the NH Hotel Group. The company was incorporated

into the consolidation upon commencing activity in 2015, having been previously inactive, with shares accounted for under the heading “Other non-

current financial assets” in the year 2014.

a.2 Changes in the scope of consolidation in 2014

a.2.1 Disposals

On 14 November 2014, the Parent Company’s stake in Sotogrande, S.A., representing 96.997% of its share capital, was sold for 224,947 thousand

euros. The net amount received after deducting municipal taxes, transaction costs, net debt and financial effects was 181,110 thousand euros, of which

129,312 thousand euros corresponded to shares in Sotogrande, S.A. and 51,798 thousand euros to the liquidation of the inter-company account which

the Parent Company maintained with Sotogrande, S.A.

This transaction involved the transfer of the entire property business segment of Sotogrande, S.A., based in Cádiz (Spain). The transaction excluded

ownership of shares in the international assets (Capredo Investments GmbH, Sotocaribe, S.L., and Donnafugata Resort, S.r.l., see note 11), and the

rights to receivables arising from the claim against the insurance agency which provided the ten-year policy covering building work in a housing

development by Sotogrande (see Note 10.1) and the deferred payment of the sale of 15 business premises in another property development.

Before the sale, Sotogrande, S.A. acquired 504,089 and 46,865 shares in Residencial Marlin, S.L. and Los Alcornoques de Sotogrande, S.L.,

respectively, representing 50% of the share capital of both companies, for a total of 16,650 thousand euros. Thus, the Group acquired control of both

companies, which it later sold in the context of the sale of its shares in Sotogrande, S.A.

At the same time as the transfer of shares in Sotogrande, S.A., the stakes in the excluded international assets listed above were transferred to NH

at market prices, maintaining their value for accounting purposes according to the consolidated financial statements of NH Hotel Group, S.A. and

Subsidiaries. A period of five years was established for transferring the stake in Sotocaribe, S.L. through reciprocal sales and purchase options, to

be exercised within the indicated period. The strike price of the option, 58,250 thousand euros, is equivalent to the part of the price of the stake in

Sotogrande, S.A. which the purchaser left deferred, with both items to be offset when the option is exercised (see Notes 11 and 15).

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS