81

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

Additionally, and considering the assumption implied in the preceding paragraph, the Group has conducted a sensitivity analysis of the result of the

impairment test to changes in the following situations:

Scenario 1:

- An increase of 100 basis points in the discount rate.

- Use of a perpetuity growth rate of 0%.

Scenario 2:

- A 1% reduction in the occupancy level.

- A 1% reduction in the average daily rate (ADR).

These sensitivity analysis do not reveal the existence of any impairment in either scenario.

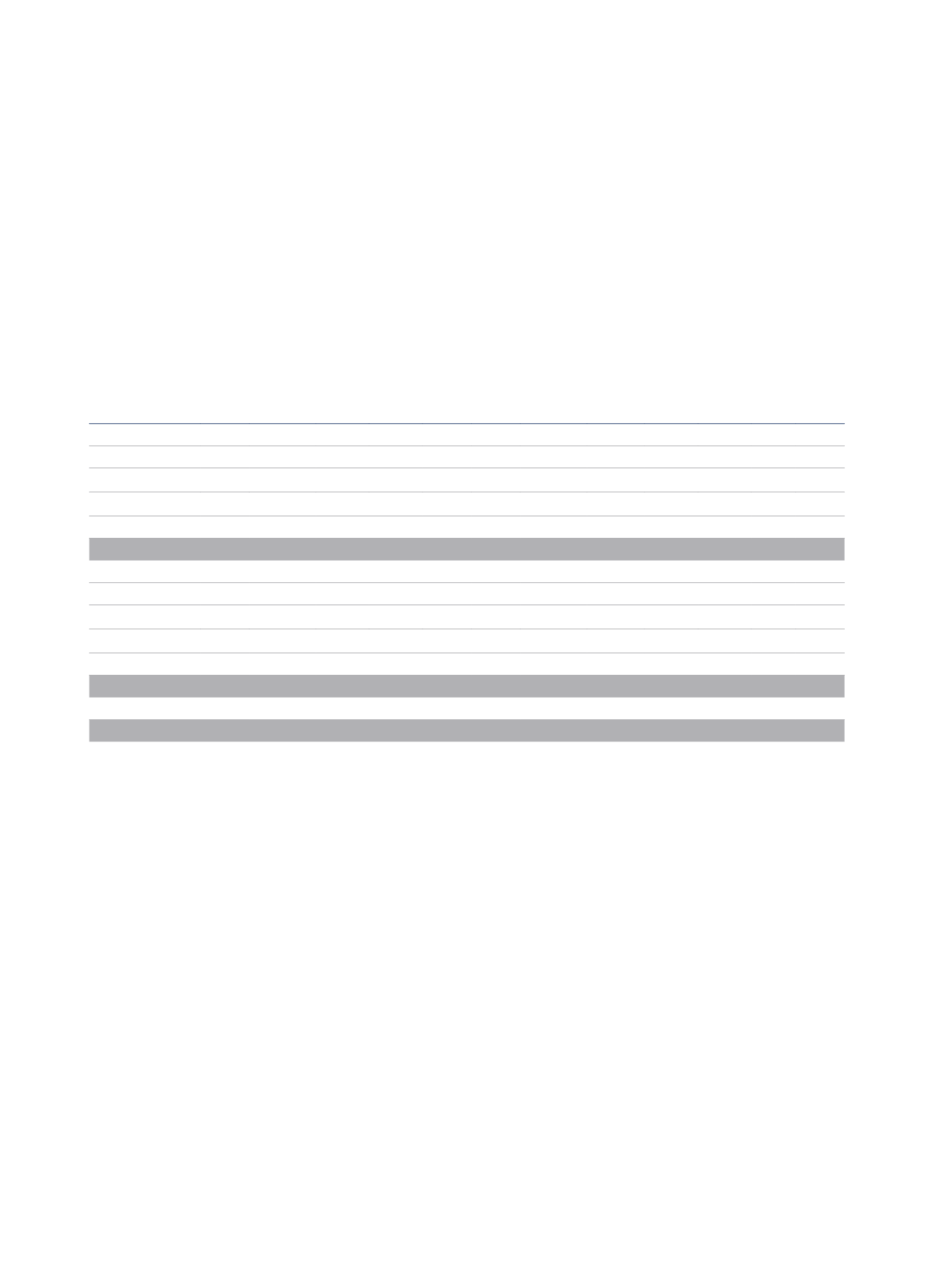

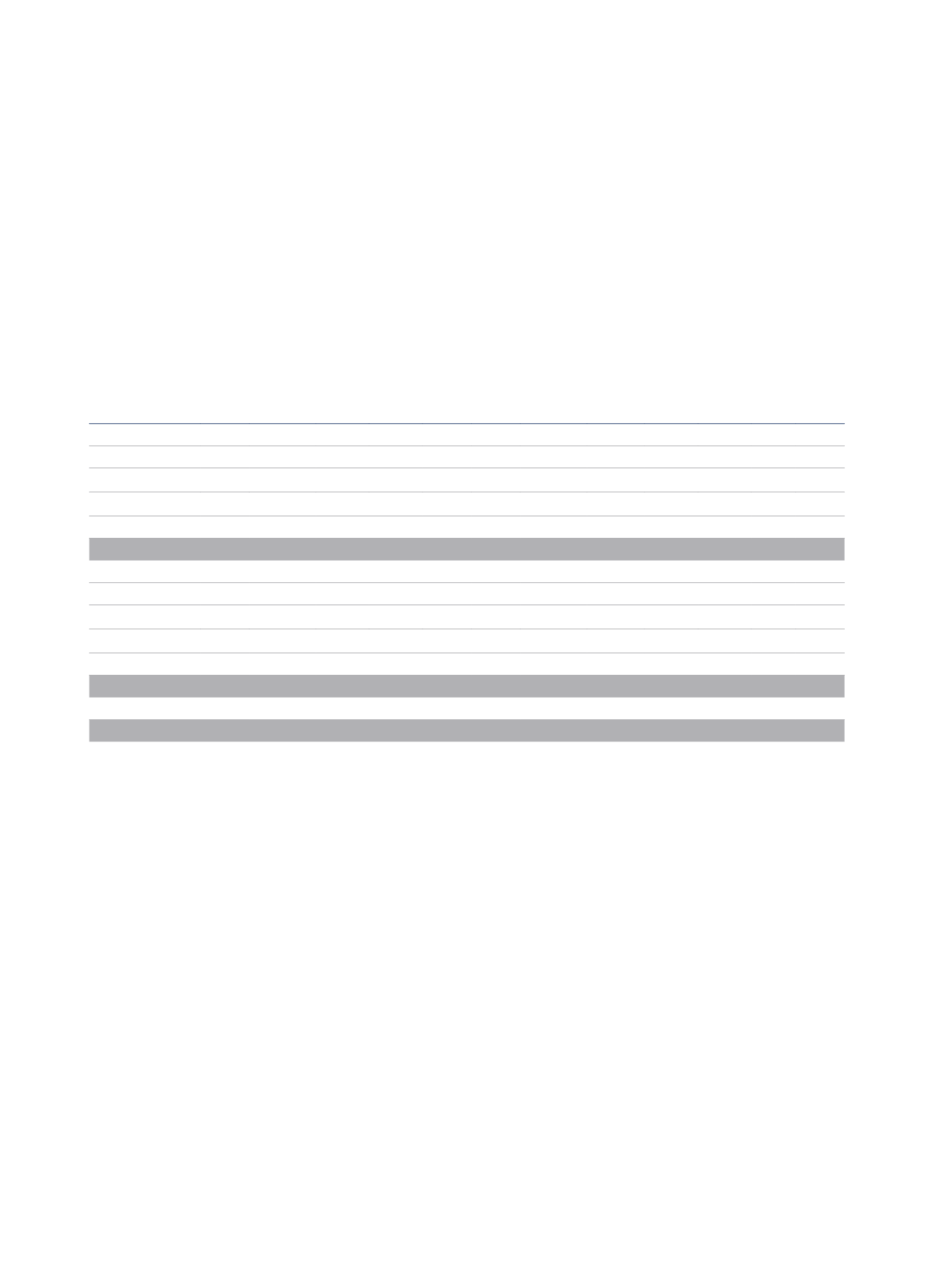

7.- INTANGIBLE ASSETS

The breakdown and movements under this heading during 2015 and 2014 were as follows (in thousands of euros):

Balance at

31/12/2013

Currency

translation

differences

Inclusions/

Allowances Retirements Transfers

(Note 8)

Balance at

31/12/2014

Change in

scope of

consolidation

(see Note

2.5.4)

Currency

translation

differences

Inclusions/

Allowances Retirements Transfers Balance at

31/12/2015

COST

Hotel operating rights

30,548

-

99

-

(38)

30,610 36,660

(6,826)

99

(150)

-

60,393

Rental agreement

premiums

68,430

(4)

-

(757)

-

67,669

-

-

627

-

-

68,296

Concessions, patents

and trademarks

34,662

-

87

(503)

(1,646)

32,600 6,635

(1,110)

106

(129)

-

38,102

Software applications

69,873

(7)

21,592 (4,106)

(383)

86,969

-

(13)

18,481

(243)

-

105,194

203,514

(11)

21,778 (5,366) (2,067) 217,848 43,295

(7,949)

19,313

(522)

-

271,985

CUMULATIVE DEPRECIATION

Hotel operating rights (17,686)

-

(1,221)

(10)

3

(18,914)

-

134

(2,340)

149

13,903 (7,068)

Rental agreement

premiums

(14,019)

4

(924)

260 6,034 (8,645)

-

113

(2,012)

-

(728)

(11,272)

Concessions, patents

and trademarks

(10,215)

-

(556)

483

(5,440) (15,728)

-

36

(794)

28

-

(16,458)

Software applications (65,996)

7

(8,033)

788

(41)

(73,275)

-

105

(9,646)

223 (13,175) (95,768)

(107,916)

11

(10,734)

1,521

556 (116,562)

-

388

(14,792)

400

-

(130,566)

Impairment

(22,982)

-

(464)

141

861

(22,444)

-

-

-

307

-

(22,137)

NET BOOK VALUE

72,616

78,842

119,282

7.1 Hotel operating rights

Additions to the rights of use in the current year in the column of changes in the scope of consolidation amounting to 36.7 million euros from the

purchase of Hoteles Royal.

On 28 July 1994, NH Hoteles, S.A. was granted a right of use on Hotel NH Plaza de Armas in Seville, which is owned by Red Nacional de los

Ferrocarriles Españoles (RENFE), for a thirty-year period commencing on the date the agreement was executed. NH Hoteles, S.A. paid RENFE the

amount of 30.2 million euros in accordance with a payment schedule which concluded in 2014.

The Group has reflected the entire amount agreed upon as the transaction’s price in the “Hotel operating rights” item. In order to correctly accrue

this price, the result of spreading out the cost over the thirty-year term of the agreement was assigned to the consolidated comprehensive profit

and loss statement in accordance with an increasing instalment with a percentage annual growth of 4%.

7.2 Concessions, patents and trademarks

As a result of the entry into the scope of consolidation of Grupo Hoteles Royal, brands operated by the Royal Hotel Group with a useful life of 20

years have been recognised under this heading.

7.3 Software applications

The most significant inclusions in 2015 were in Spain, as a result of the investments made to develop the new website and implement front office

systems of the hotels.