90 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

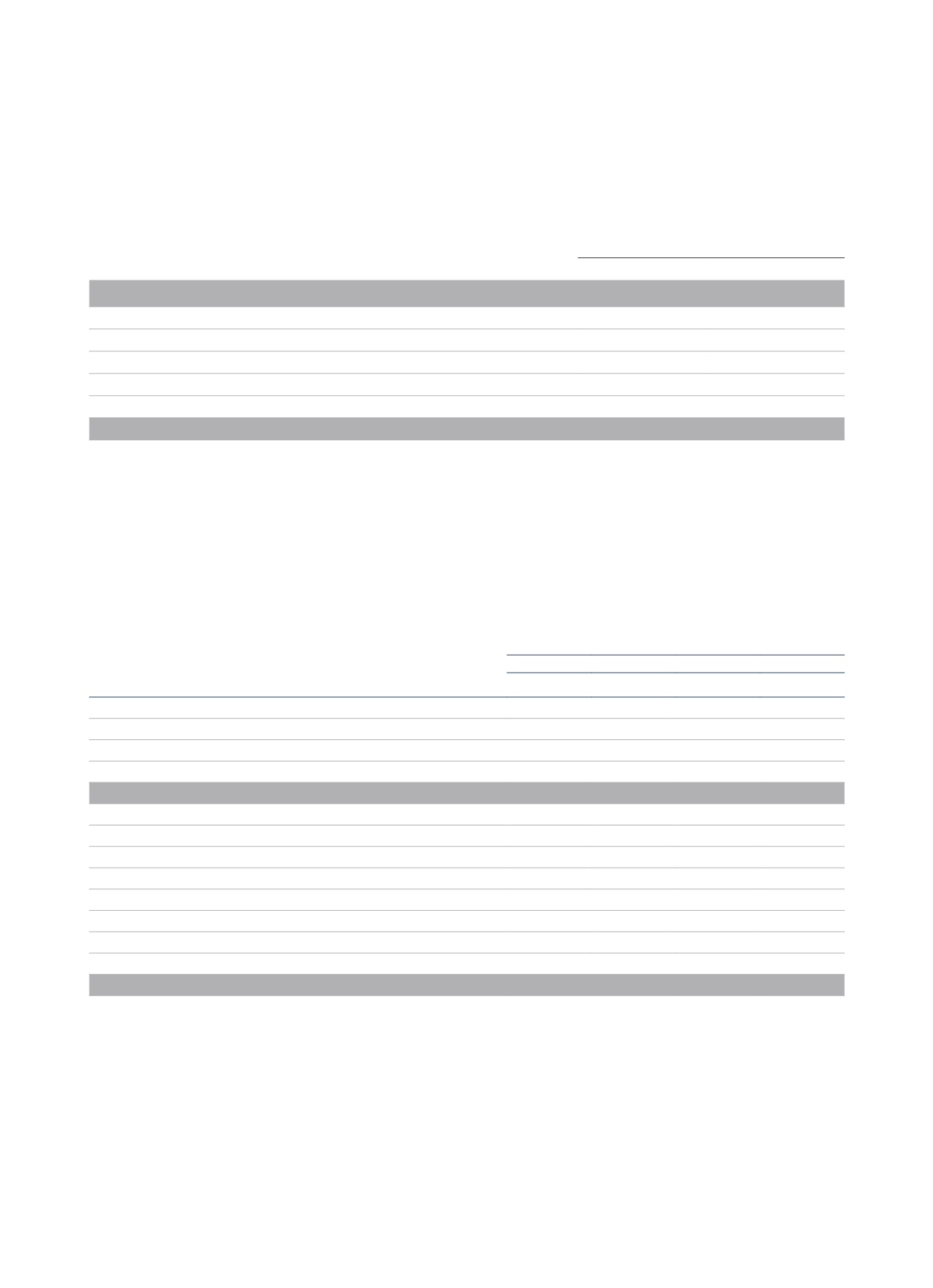

14.3 Treasury shares

At year-end, NH Hotel Group, S.A. held 9,000,000 treasury shares representing 2.57% of its share capital at a total cost of 37,561 thousand euros. On

4 November 2013, the Spanish National Securities Market Commission (CNMV) was notified of the loan of 9,000,000 of shares to the three financial

institutions involved in the placement of the bonds convertible or exchangeable for shares of NH Hoteles, S.A. amounting to 250 million euros. The

purpose of this loan was to allow said financial entities to offer the shares to subscribers to the bonds requesting them (Note 15).

14.4 Non-controlling interests

The movements in this heading in 2015 and 2014 are summarised below:

Thousands of euros

2015

2014

Opening balance

24,201

153,588

Capital increases/reductions (Note 2.5.4)

-

(123,055)

Comprehensive profit (loss) attributable to non-controlling interests

(1,383)

(125)

Changes in percentage shareholdings and purchase/sales

16,461

(4,626)

Dividends paid to non-controlling interests

(1,374)

(765)

Other movements

58

(816)

Closing balance

37,963

24,201

The “Changes in percentage shareholdings and purchase/sales” ítem mainly includes the entry in the consolidation scope of the hotel management

group Hoteles Royal.

The “Dividends paid to non-controlling interests” item basically reflects the dividends paid out in 2015 to the following companies: NH Marín, S.A., for

331 thousand euros, Hoteles Royal, S.A. for 346 thousand euros and Latinoamericana de Gestión Hotelera, S.A. for 697 thousand euros.

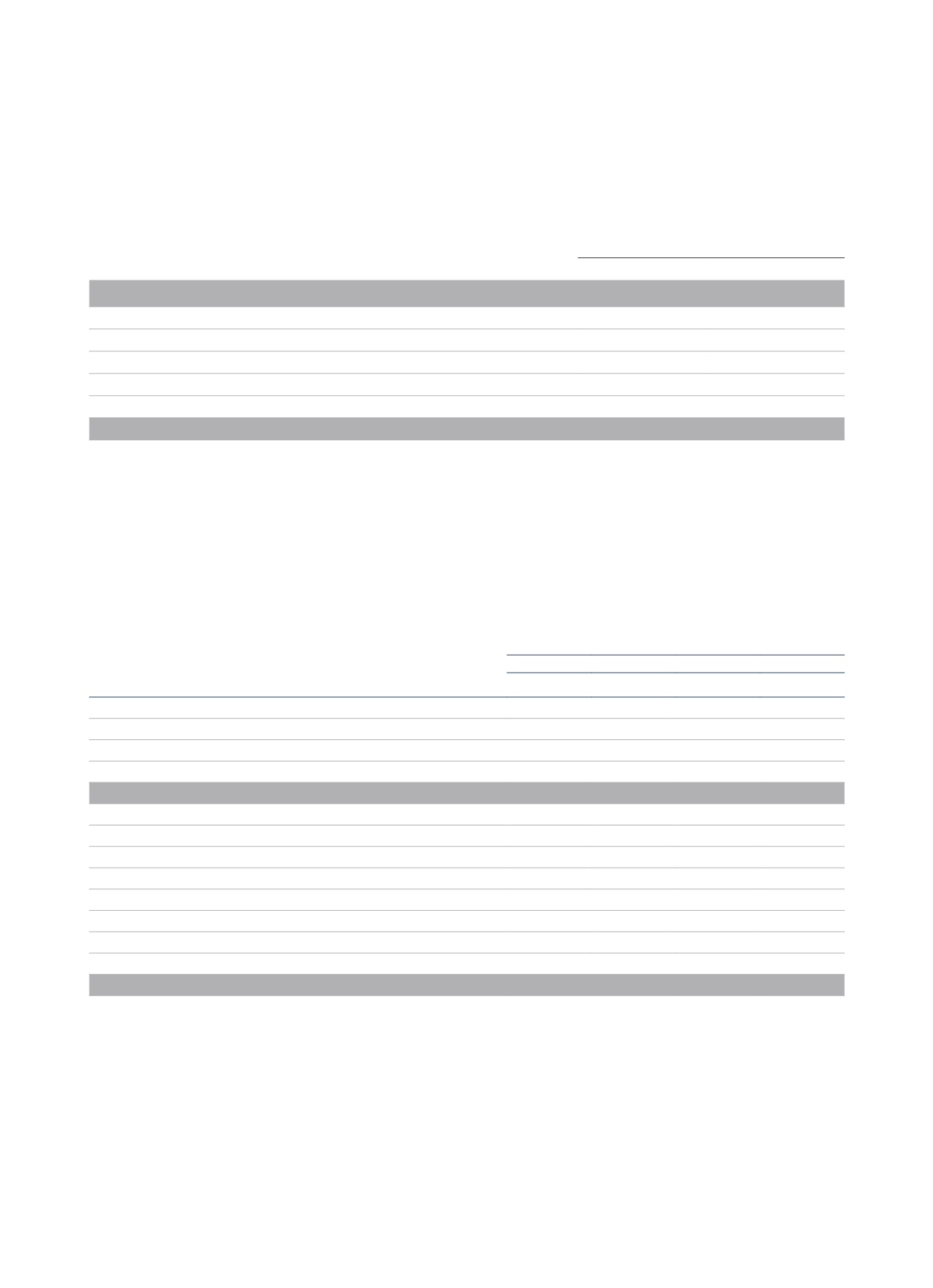

15.-DEBT IN RESPECT OF BOND ISSUES AND BANK BORROWINGS

The balances of the “Bonds and other negotiable securities” and “Debts with credit institutions” items at 31 December 2015 and 2014 were as follows:

Thousands of euros

2015

2014

Long term Short term Long term Short term

Convertible bonds

233,251

-

228,156

-

Guaranteed senior notes

250,000

-

250,000

-

Borrowing costs

-

3,613

-

3,517

Arrangement expenses

(11,380)

-

(14,175)

-

Debt instruments and other marketable securities

471,871

3,613

463,981

3,517

Syndicated loans

221,600

21,200

111,633

19,700

Mortgages

32,262

13,183

86,415

18,807

Equity loans

11,736

3,596

-

-

Subordinated loans

75,000

-

75,000

-

Credit lines

-

36,861

-

32,617

Arrangement expenses

(4,433)

(1,060)

(4,104)

(1,365)

Borrowing costs

-

1,492

-

1,152

Bank borrowings

336,165

75,272

268,944

70,911

Total

808,036

78,885

732,925

74,428