100

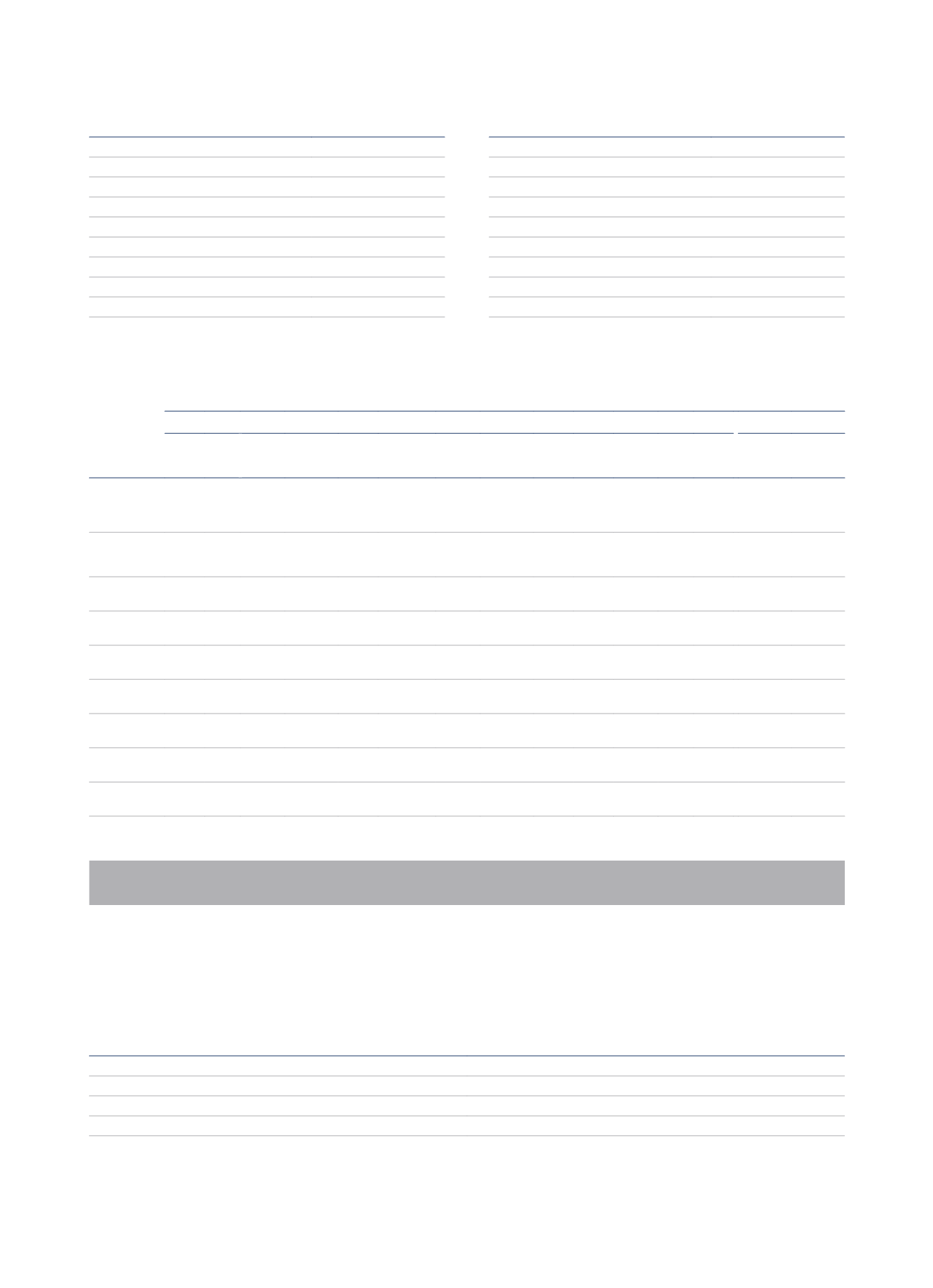

The prevailing income tax rates in the different jurisdictions where the Group has significant operations are as follows:

Country

Nominal Rate

Country

Nominal Rate

Argentina

(1)

35.0%

Romania

16.0%

Colombia

(1)

34.0%

Poland

19.0%

Chile

22.5%

Switzerland

7.8%

Panama

25.0%

Dominican Rep.

19.0%

Brazil

34.0%

Luxembourg

29.2%

Mexico

30.0%

Italy

31.7%

Uruguay

25.0%

The Netherlands

25.0%

Dominican Republic

28.0%

France

33.3%

Germany

30.0%

Portugal

31.5%

(1) Jurisdictions in which there is a minimum taxable income.

The reconciliation between the consolidated comprehensive profit or loss statements, the corporation tax base, current and deferred tax for the

year, is as follows:

Thousands of euros

2015

2014

Spain Italy Germany

The

Netherlands

(1)

Latin

America

(2)

Luxembourg Romania Switzerland Czech R. Poland Portugal Others TOTAL Spanish

Companies

Other

Companies

Consolidated

comprehensive

profit and loss

statements

before taxes

(65,136) 45,527 (4,433)

21,182 23,824 1,762

454 (6,715)

284 63

20 (444) 16,388 (75,876)

49,538

Adjustments to

consolidated

comprehensive

profit and loss:

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Accounting

consolidation

adjustments

(14,378)

-

4,765

-

-

-

-

-

-

-

-

-

(9,613)

(25,339)

9,445

Due to

permanent

differences

45,163 (12,766) 4,403 7,862 2,327 (1,575)

10

-

-

-

(16)

-

45,408 35,823 (20,560)

Due to

temporary

differences

(16,116) (16,245) (3,016)

1,276

572

-

-

34

-

-

-

-

(33,495)

17,225 (4,163)

Tax base

(Taxable profit

or loss)

(50,467) 16,516 1,720 30,321

26,723

186

464 (6,681)

284 64

4 (444) 18,690 (48,167)

34,256

Current taxes

to be refunded

/ (to pay)

1,004 512

13

2,060 7,705

-

-

-

-

-

1

-

11,295 (1,088)

5,431

Total current

tax income /

(expense)

11,455 (7,607) (516)

(7,580) (7,830)

(54)

(74)

(58)

-

(12)

(1)

(41) (12,318)

11,275 (14,544)

Total deferred

tax income /

(expense)

(4,029) (5,523) (905)

319

167

-

-

3

-

-

-

-

(9,968)

3,914

(904)

Total income

/ (expense)

due to tax rate

changes

-

9,204 -

-

-

-

-

-

-

-

-

-

9,204 (14,562)

(789)

:

Total

Corporation

Tax income /

(expense)

7,426 (3,926) (1,421)

(7,261) (7,663)

(54)

(74)

(55)

-

(12)

(1)

(41) (13,082)

626 (16,237)

(1) The Netherlands business area includes Belgium and France.

(2) The Latin America business area includes the profits and losses obtained by the Group in Argentina, Mexico, Uruguay, the Dominican Republic, Colombia, Chile, Panama and Brazil.

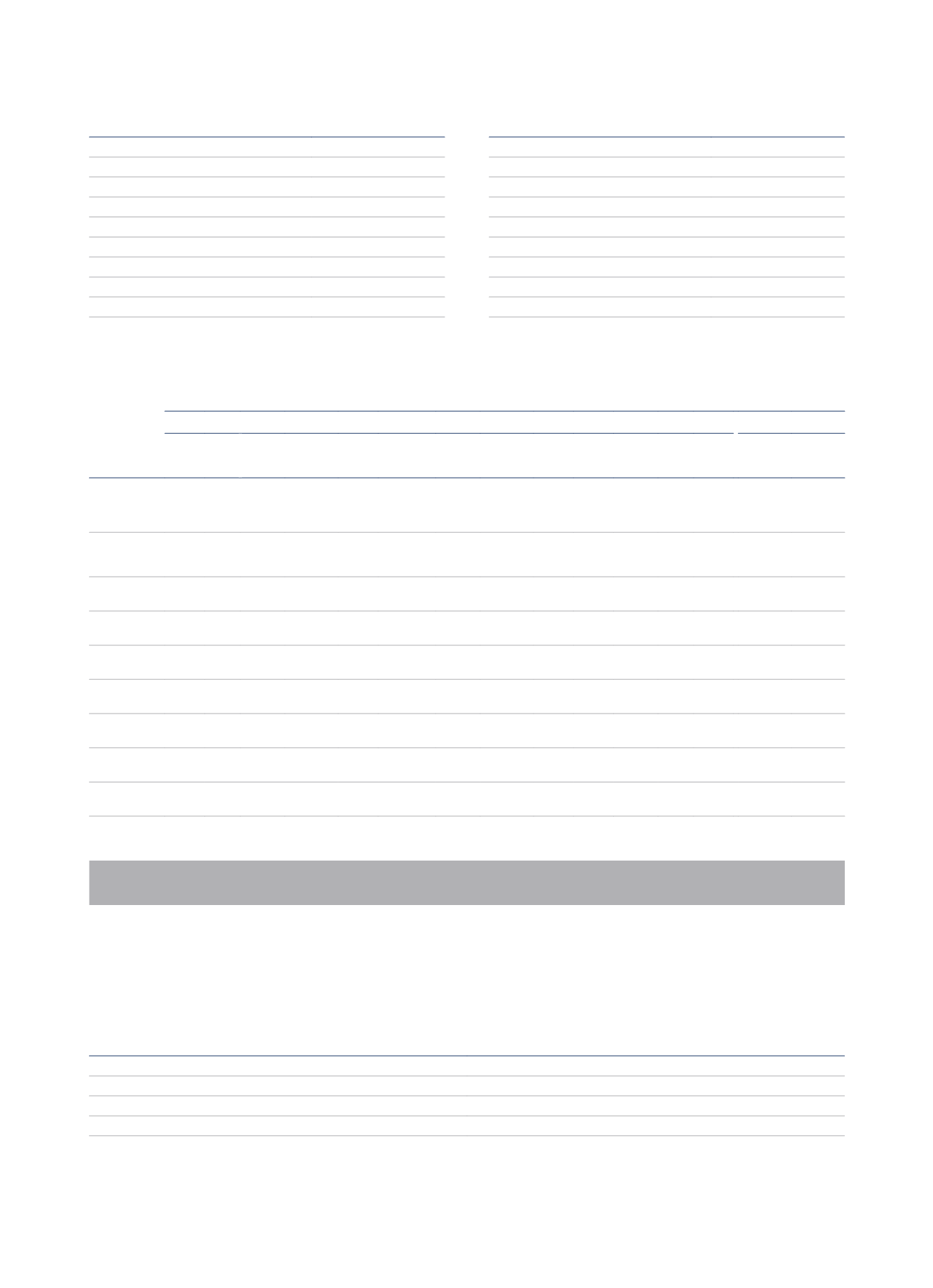

Financial years subject to tax inspection

In accordance with Spanish tax legislation, the years open for review to the Consolidated Tax Group are:

Tax

Pending Periods

Corporation

2014

VAT

2014 and 2015

IRPF (personal income tax)

2014 and 2015

Non-resident Income Tax

2014 and 2015

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS