92 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

Equity loans

On 2015 NH Hotel Group, S.A was authorized by financial entities participating in the syndicated loans described above and in the syndicated loan

granted to the Group Company NH FINANCE, S.A., amounting to 200,000 thousand euros, to formalize an additional debt though an equity loan in

order to improve the financial liquidity of the Group. The outstanding amount of the equity loans at 31 December 2015 amounted to 15,332 thousand

euros.

Mortgages loans

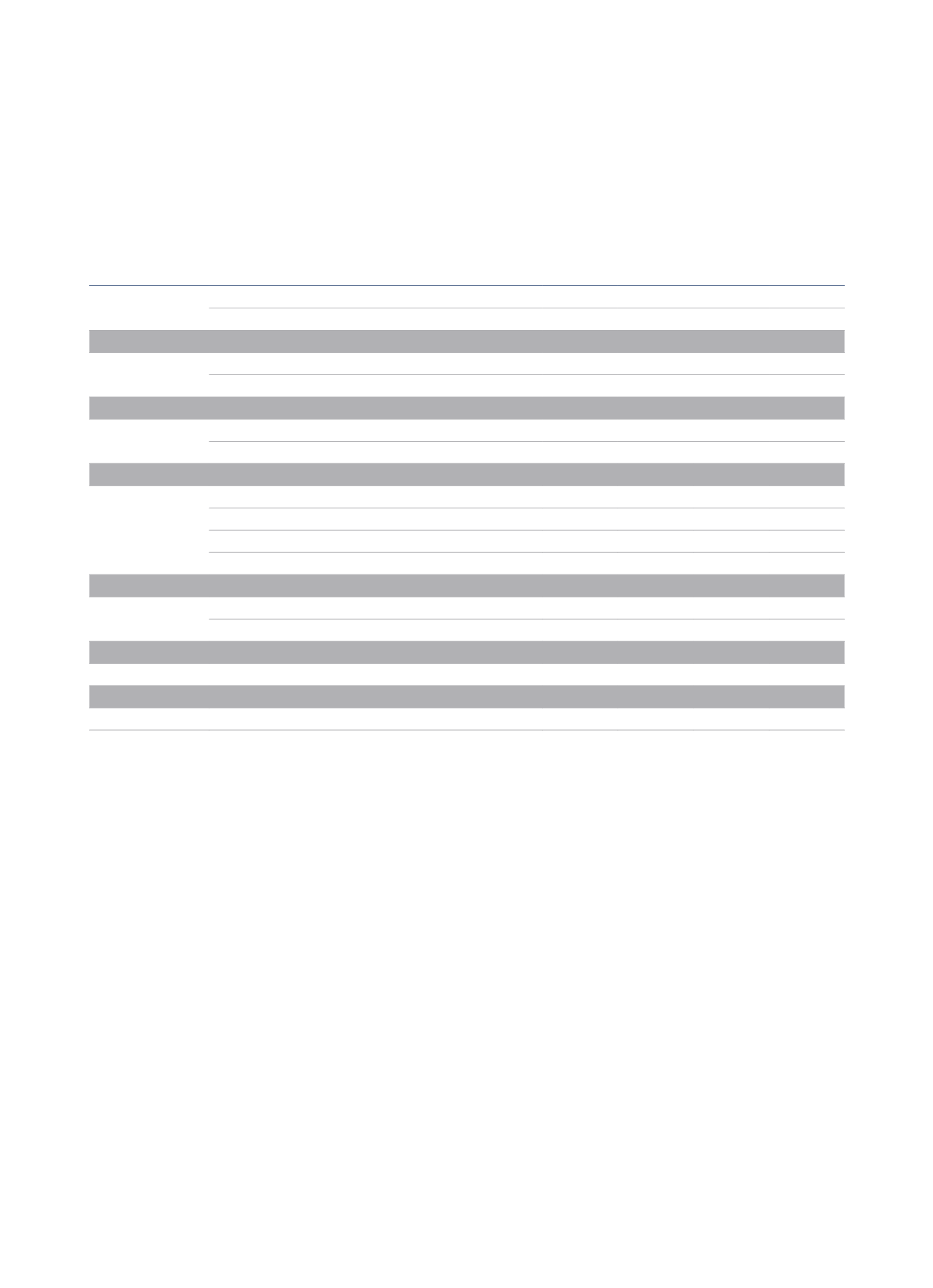

The detail of the mortgage loans and credit lines is as follows (in thousands of euros):

Mortgaged asset

Fixed rate

Variable

Interest

Total

Net value

value

mortgaged

asset

Spain

NH Lagasca

-

6,400

6,400

17,128

NH Príncipe de La Paz

-

1,997

1,997

7,035

Total Spain

-

8,397

8,397

24,163

Mexico

NH Qerétaro

-

2,035

2,035

5,397

NH Santa Fe

-

2,020

2,020

8,348

Total Mexico

-

4,055

4,055

13,745

The Netherlands

NH Groningen

-

1,548

1,548

6,096

NH Rotterdam

-

1,856

1,856

13,795

Total The Netherlands

-

3,404

3,404

19,891

Italy

NH Milanofiori and convention centre

-

4,050

4,050

53,044

NH Bellini

-

278

278

8,368

NH Genova

-

1,798

1,798

24,178

NH Villa San Mauro

-

2,580

2,580

4,043

Total Italy

-

8,706

8,706

89,633

Chile

NH Antofagasta and NH Iquique

8,385

-

8,385

15,874

NH Collection Plaza de Santiago

7,607

-

7,607

16,653

Total Chile

15,992

-

15,992

32,527

Switzerland

NH Fribourg

4,892

-

4,892

11,700

Total Switzerland

4,892

-

4,892

11,700

Total

20,884

24,562

45,445

191,660

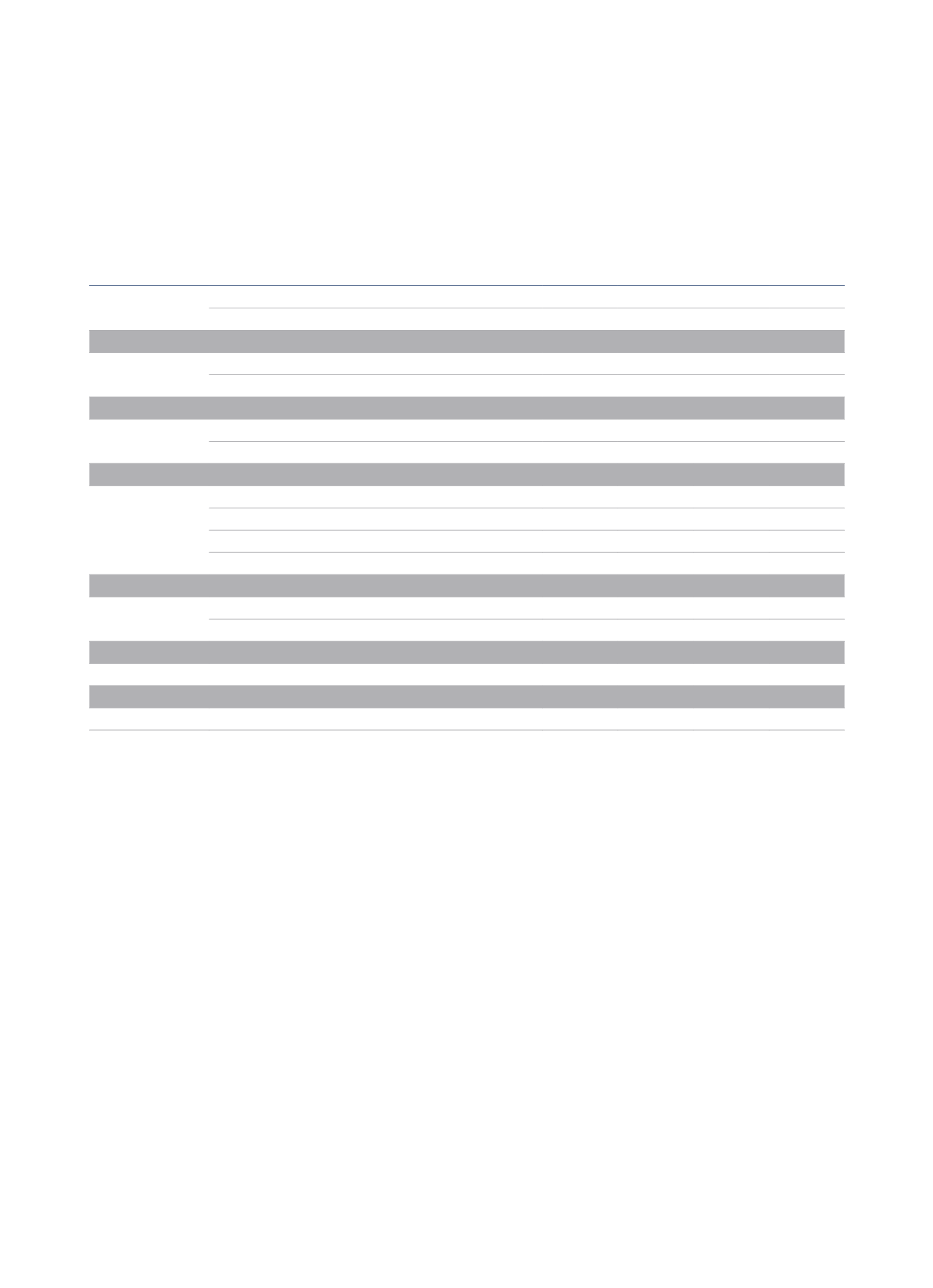

The mortgage loans in Chile for a total of 15,992 thousand euros corresponds to Hoteles Royal, S.A. (see Note 2.5.4). The decrease in mortgage

loan and credit balances at 31 December 2015 compared with the figure reported at 31 December 2014 (116,685 thousand euros) is largely due to

refinancing through syndicated loans made in 2015.

Assets granted as mortgage security against the syndicated loan of 200,000 thousand euros and guaranteed senior notes of 250,000 thousand

euros, can be broken down as follows (Thousands of euros):