99

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

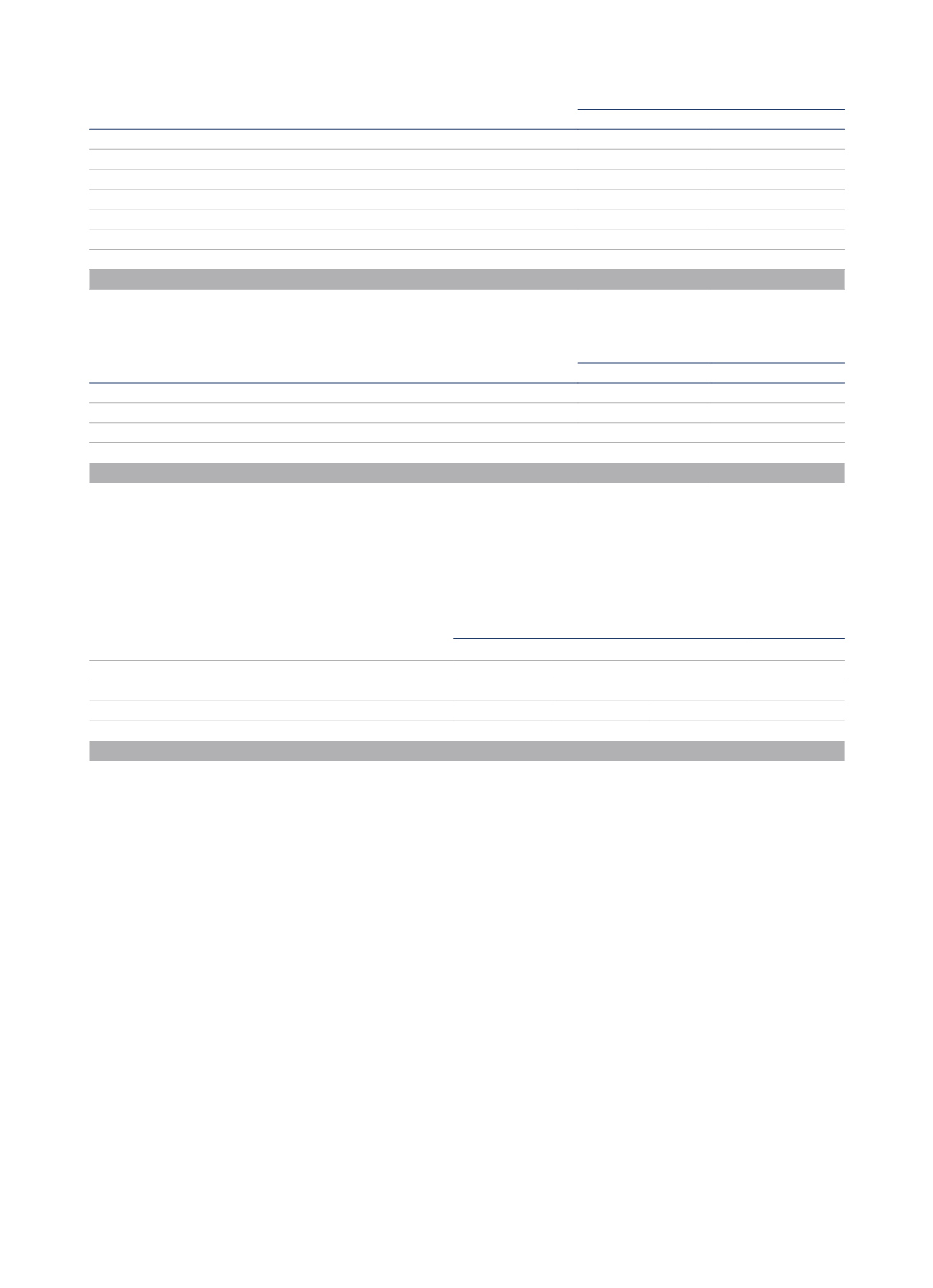

Thousands of euros

2015

2014

Short term taxes payable

Income tax

15,545

15,412

Value Added Tax

8,509

1,763

Personal Income Tax

7,010

8,321

Tax on Income from Capital

217

90

Social Security

7,568

8,196

Others

11,986

6,312

Total

50,835

40,094

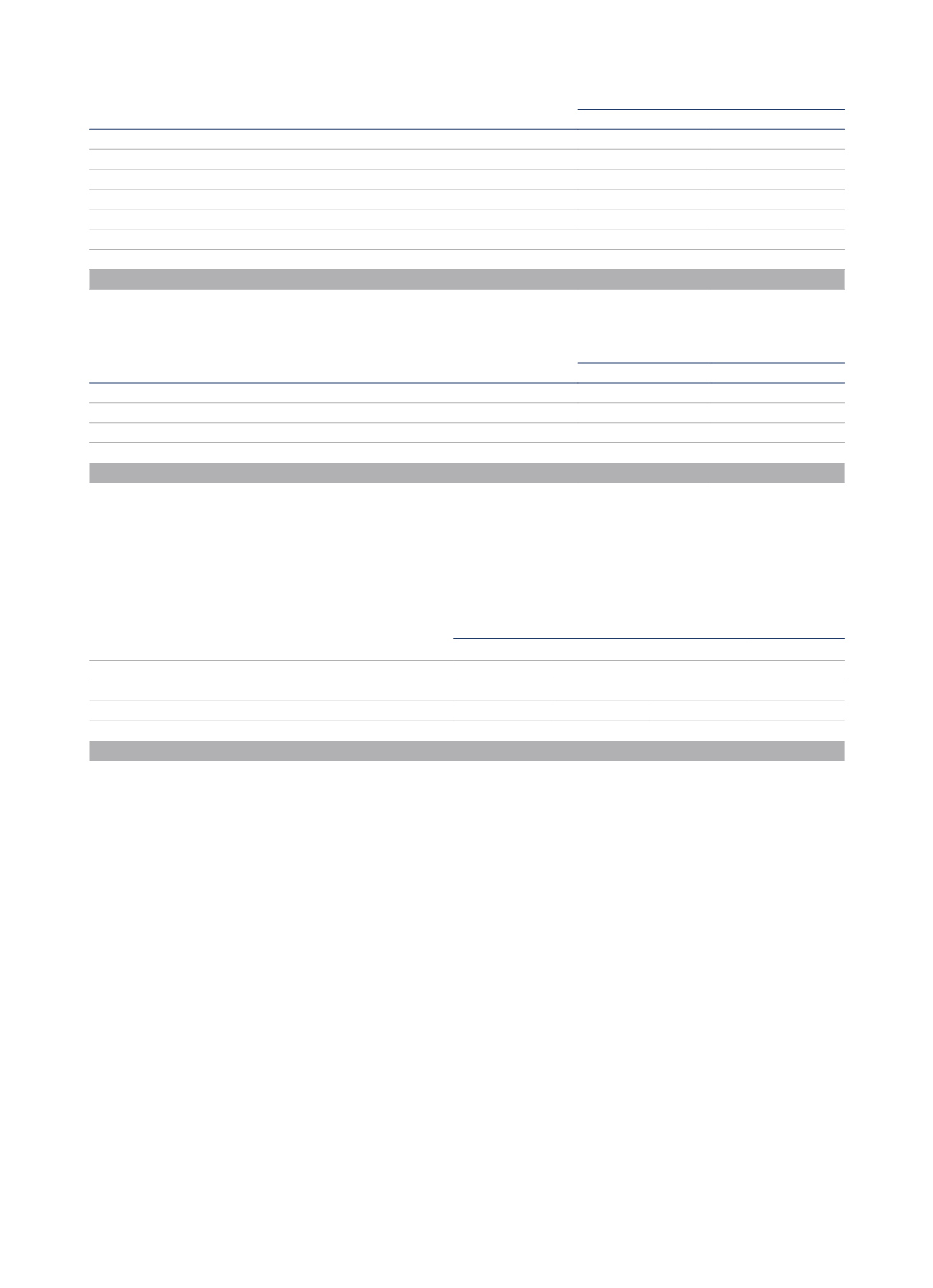

The movements in deferred tax liabilities during 2015 are as follows:

Thousands of euros

2015

2014

Opening balance

179,730

201,225

Derecognition of liabilities due to change in tax rate

(10,309)

(6,510)

Addition of liabilities due to entry into scope (Note 2.5.4)

26,077

(9,461)

Others

1,213

(5,524)

Closing balance

196,711

179,730

The settlement is mainly to the adaptation of tax liabilities related to Italian companies (IRES) associated with accounting revaluations at the

expected effective tax rate (see deferred tax assets movement).

The net increase in deferred tax liabilities is mainly due to the combined effect of the entry in the consolidation scope of the Grupo Royal and the

reversal of impairment of revalued assets.

The detail, by country and item, of these deferred taxes is as follows:

Thousands of euros

Tax credits

Prepaid Taxes

Total Assets

Liabilities

Spain

109,202

22,932

132,134

50,286

Italy

3,303

11,837

15,140

114,040

Germany

-

2,146

2,146

494

Others

1,880

14,496

16,377

31,891

TOTAL

114,385

51,411

165,797

196,711

Corporate Income Tax expense

The Group operates in many countries and is therefore subject to the regulations of different tax jurisdictions regarding taxation and corporate

income tax.

NH Hotel Group, S.A. and the companies with tax domicile in Spain in which it held a direct or indirect stake of at least 75% during the 2015 tax period

are subject to the tax consolidation scheme governed by Title VII, Chapter VI of Law 27/2014 on Corporate Income Tax.

The companies belonging to the tax group have signed an agreement to share the tax burden. Hence, the Parent Company settles any credits and

debts which arise with subsidiary companies due to the negative and positive tax bases these contribute to the tax group.

During 2015, Hotel & Congress Technology, S.L. (previously Hotel & Travel Business, S.L.) were excluded from the Spanish tax consolidation group.

Corporation tax is calculated on the financial or accounting profit or loss resulting from the application of generally accepted accounted standards

in each country, and does not necessarily coincide with the tax result, this being construed as the tax base.

In 2015, Spanish companies pay taxes at the general tax rate of 28% irrespective of whether they apply the consolidated or separate taxation

schemes. Following the approval of tax reform in Spain, the tax rates applicable to resident entities will be 28% in 2015 and 25% in 2016 and the

following years. However, tax credits of Spanish tax group activated in the balance sheet are valued at 25%. The foreign companies are subject to

the prevailing tax rate in the countries where they are domiciled. In addition, taxes are recognised in some countries at the estimated minimum profit

on a complementary basis to Corporation Tax.