103

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

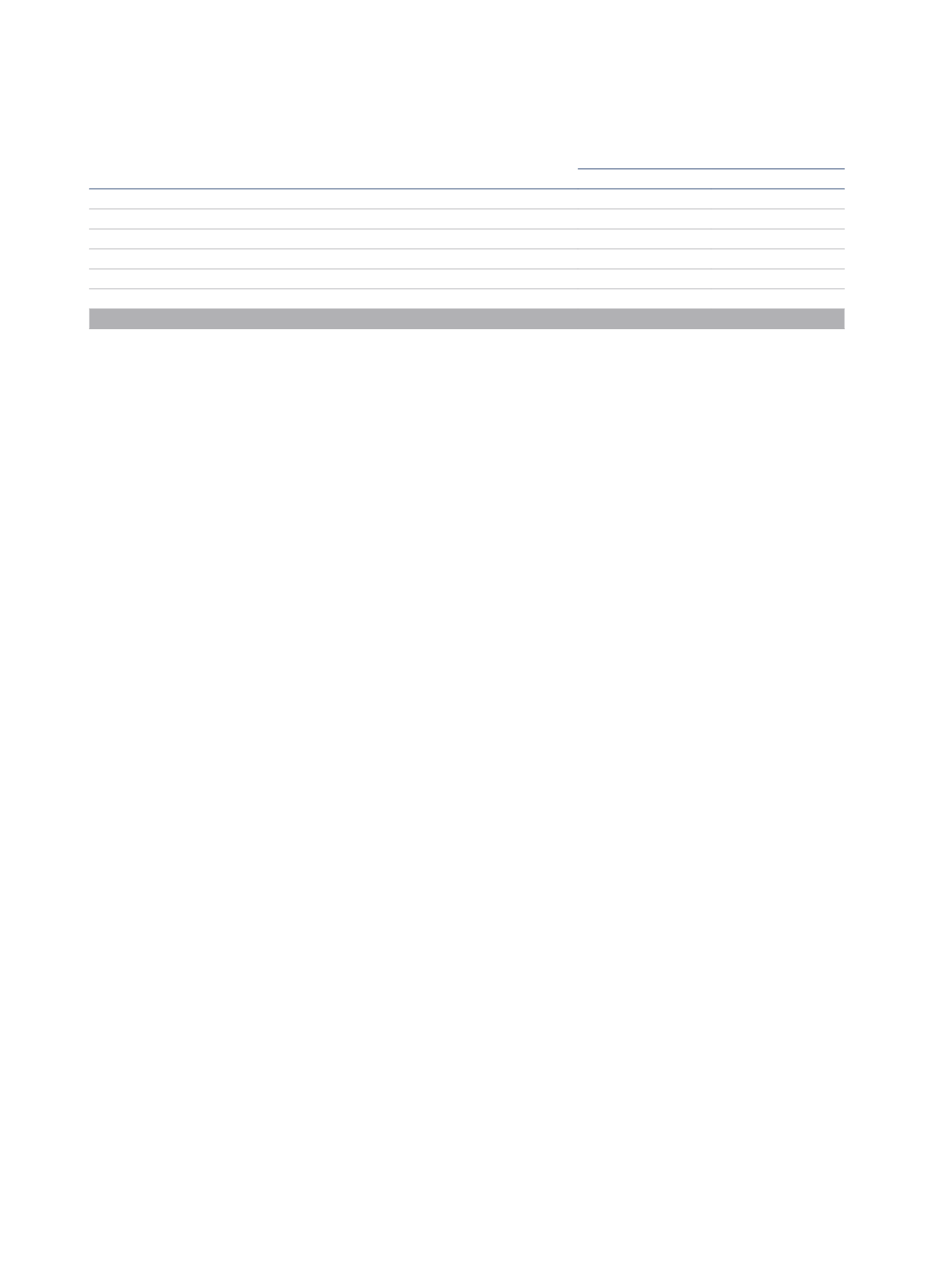

21.- OTHER CURRENT LIABILITIES

At 31 December 2015 and 2014, this item is broken down as follows:

Thousands of euros

2015

2014

Outstanding remuneration

27,928

30,555

Compensation for termination of Hotel NH Buhlerhöhe lease

-

3,915

Linearisation of revenue

1,371

3,159

Liabilities from contract termination

667

-

Put option for Donnafugata Resort, S.r.l. (Note 16)

10,335

-

Other creditors

2,138

7,935

Total

42,439

45,564

22.- THIRD-PARTY GUARANTEES AND CONTINGENT ASSETS AND LIABILITIES

Financial institutions had granted surety to the Group for an amount totalling 21.01 million euros (22.05 million euros at 31 December 2014) which, in

general terms, guarantee the fulfilment of certain obligations taken on by the consolidated companies in the performance of their activities.

At 31 December 2015, the Group had taken out insurance policies to cover risks arising from damage to material goods, loss of profits and third party

liability. The capital insured sufficiently covers the assets and risks mentioned above.

Commitments to third parties

- A Group company currently acts as co-guarantor for a syndicated loan granted by two banks to the associate Sotocaribe, S.L. which at 31

December 2015 had an outstanding principal of 21,755 thousand euros (23,685 in thousand US dollars as per as 31 December 2015) and final

maturity on 23 December 2016.

- On 10 March 2006, NH Europa, S.A. and Losan Hoteles, S.L. (now Carey Property, S.L.) signed a shareholders’ agreement on Losan Investments

Ltd. (the owner of the Kensington Hotel), by means of which, should Losan Investments Ltd. receive an offer to purchase 100% of its shares at

a price deemed to be a market price, Losan Hoteles, S.L. (now Carey Property, S.L.) may require NH Europa, S.A. to transfer its shares to the

third party who made the offer and the latter will be obliged to accept. However, NH Europa, S.A. will have preferential acquisition rights over

shares held by Losan Hoteles, S.L. (now Carey Property, S.L.) in Losan Investments Ltd.

- Under the agreements reached between the NH Group and HNA Group regarding the joint venture, a right of “Tag-along” is recognised, in

the sense that if one of the partners receives a takeover bid by a third party for 100% of the shares in the company, the other partner has

the option to exercise their right of first refusal or may communicate its irrevocable offer to sell the shares it holds the aforementioned joint

venture, and under the conditions of sale supplied by the third party; if the third party does not accept the offer of the other partner to sell

the rest of the shares in the company, the other partner is not allowed to sell its shares to the third party.

- Within the framework of new development projects in the normal course of business, in which the NH Group subsidiaries act as lessees or

operators, the Group’s parent company gives personal guarantees in favour of third parties to secure its contractual obligations.

- Within the framework of the Group’s financing, personal and real guarantees have been granted to fulfil the obligations guaranteed under the

financing agreements (see Note 15).

Contingent assets and liabilities

The Group’s main contingent assets and liabilities on the date these consolidated financial statements were drawn up, are set out below:

- NH Group has appeared in the insolvency proceedings of Viajes Marsans, S.A. and Tiempo Libre, S.A., from the unsettled estate of Gonzalo

Pascual Arias and Gerardo Díaz Ferrán, and in the voluntary insolvency proceedings against María Angeles de la Riva Zorrilla, in order to

claim outstanding amounts. The Group also appears in the voluntary bankruptcy proceedings of Transhotel and Orizonia. Said balances were

provisioned in consolidated financial statements in the amounts deemed not recoverable.

- The owner of four hotels in the Netherlands has claimed in court the payment of 2,723 thousand euros plus interest and costs to a Dutch

subsidiary because there was allegedly a change of the control situation in the year 2014, which supposedly entitles him to claim a fine,

according to the lease. The Court has fully rejected the lawsuit filed by the owner, notwithstanding that the owner still has time to appeal the

court decision.

- The owner of a hotel has filed a suit against a Group company, demanding compliance with certain contractual obligations. After rejecting the

appeal judgement, it was appealed to the Supreme Court in October 2015. No negative or significant material consequences are expected.