96 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

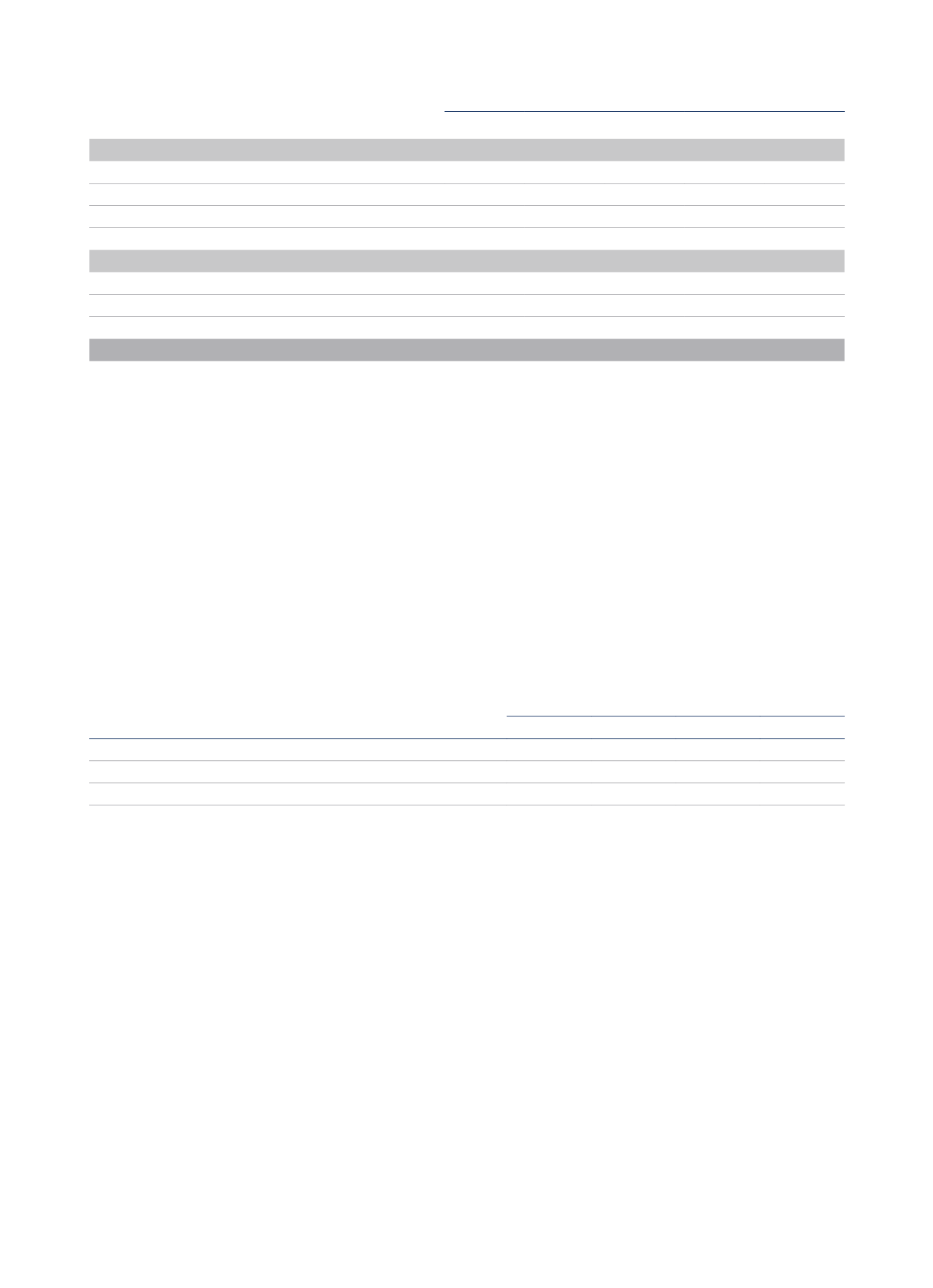

Thousands of euros

Balance at

31/12/2013

Additions

Applications/

Reductions

Transfers

Balance at

31/12/2014

Provisions for contingenciesand extraordinary costs:

Onerous contracts

27,241

14,809

(4,950)

(10,114)

26,986

Provisions for pensions and similar obligations

17,951

209

(4,131)

(232)

13,797

Other claims

21,543

3,390

(7,607)

(1,179)

16,147

66,735

18,408

(16,688)

(11,525)

56,930

Provisions for contingencies and current expenses:

Onerous contracts

21,406

-

(21,406)

10,114

10,114

Restructuring provisions

4,864

4,740

(4,883)

-

4,721

26,270

4,740

(26,289)

10,114

14,835

Total

93,005

23,148

(42,977)

(1,411)

71,765

Onerous contracts

The Group has classified a number of hotel lease agreements, to which it is committed between 2015 and 2041 and on which the Group makes a

loss, as onerous. Cancellation of these agreements could force the Group to make full payment of rent for the outstanding years of the lease or

compensation, where applicable.

Resources for the year include an amount of 2,609 thousand euros relating to the updating of the provision for onerous contracts (see Note 24.6)

and a negative exchange rate effect amounting to 25.6 thousand euros. Applications for the year include 9,967 thousand euros in automatic

reversion due to the evolution of the maturity of the contracts and 9,046 thousand euros that correspond to the lower provisions required by the

improved performance of the hotels with onerous contracts.

Provision for pensions and similar obligations

The “Provisions for pensions and similar obligations” account includes the pension fund of a certain number of employees of the Netherlands

business unit, and the T.F.R. (Trattamento di fine rapporto), an amount paid to all workers in Italy at the moment they leave the company for any

reason. This is another remuneration element, whose payment is deferred and annually allocated in proportion to fixed and variable remuneration

both in kind and in cash, which is valued on a regular basis. The annual amount to be reserved is equivalent to the remuneration amount divided by

13.5. The annual cumulative fund is reviewed at a fixed interest rate of 1.5% plus 75% of the increase in the consumer price index (CPI).

At the end of 2015, the liabilities entered against this item were of 14,202 thousand euros (13,797 thousand euros at 31 December 2014).

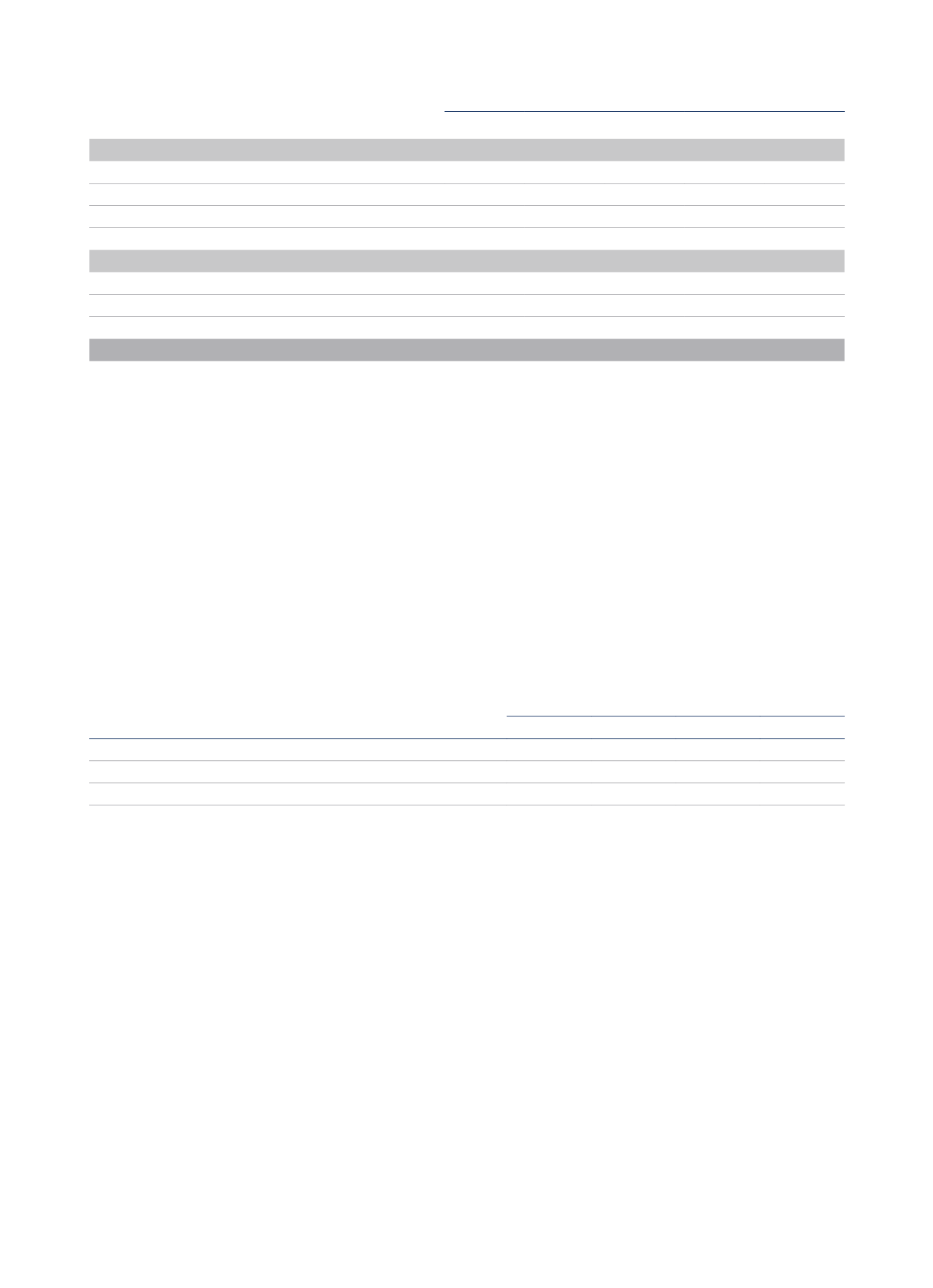

The breakdown of the main assumptions used to calculate actuarial liabilities is as follows:

2015

2014

The Netherlands

Italy

The Netherlands

Italy

Discount rates

2.70%

0.15%

2.10%

0.18%

Expected annual rate of salary rise

2.50%

1.90%

2.50%

1.90%

Expected return from assets allocated to the plan

2.70%

2.18%

2.10%

2.50%

Restructuring provision

The restructuring provision corresponds to the restructuring plan approved by the Group in connection with the reorganisation of the Group in

previous years. At the end of 2015, the Group’s provisions amounted to 1,002 thousand euros.